XRP Trademark Powers Financial Revolution: Why This USPTO Registration Changes Everything

XRP's verified USPTO trademark under Class 36 Financial Services provides the legal foundation for its role in global finance. With SEC clarity achieved and ETFs launching, this intellectual property protection distinguishes XRP as institutional infrastructure, not speculative cryptocurrency

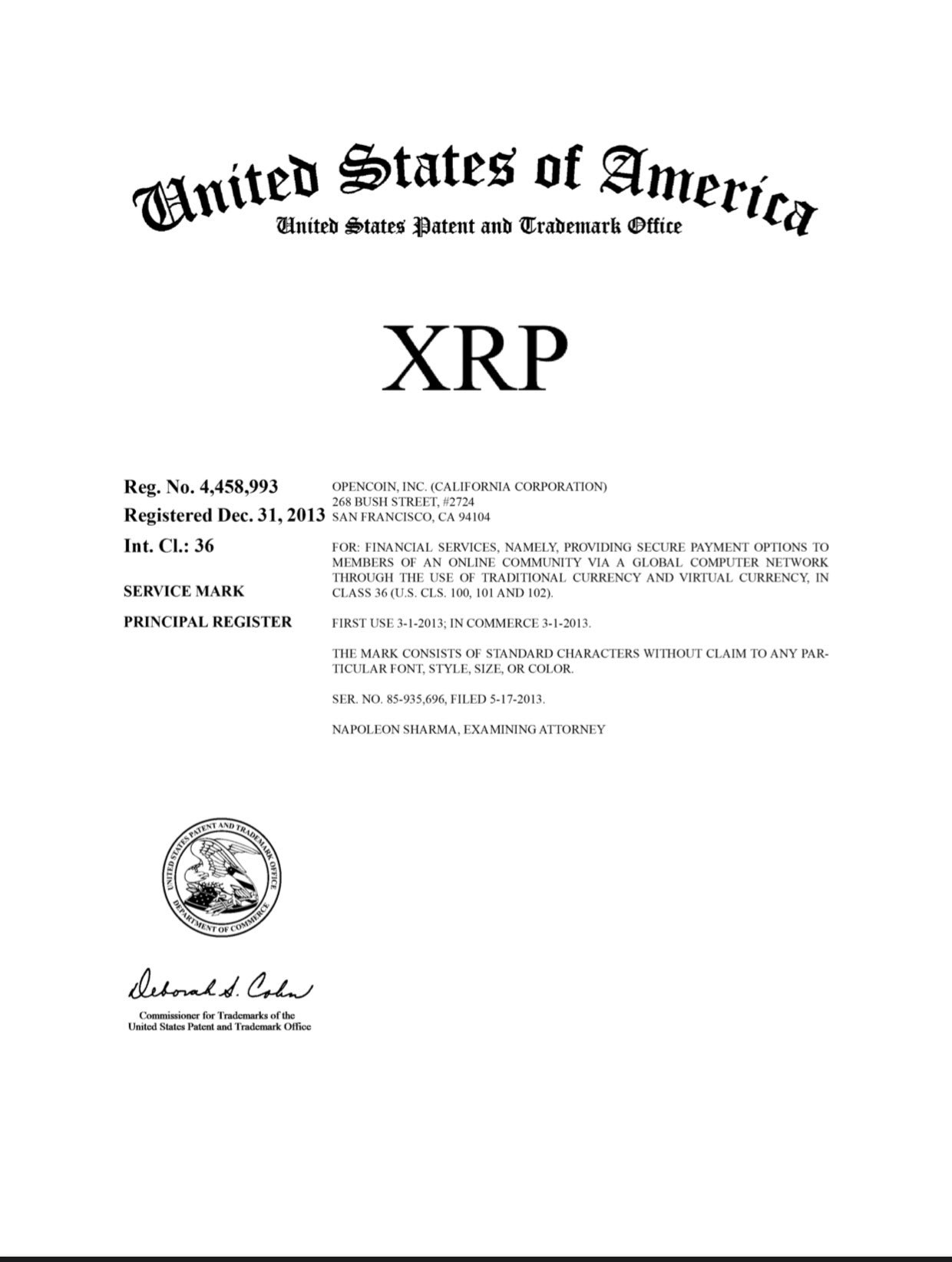

The XRP trademark registration, officially verified as authentic by the USPTO under registration number 4,458,993, represents far more than intellectual property protection—it establishes XRP's legal foundation as a cornerstone of the emerging digital financial system. With the SEC's enforcement case now officially dismissed and regulatory clarity achieved, this trademark's specific classification for "financial services" under Class 36 has become the bedrock for institutional adoption.

Legal Foundation Meets Market Reality

The significance of this trademark has crystallized following the official end of the SEC vs. Ripple lawsuit in August 2025, with both parties dismissing their appeals and settling for a reduced $50 million penalty. The trademark's precise language—"providing secure payment options to members of an online community via a global computer network through the use of traditional currency and virtual currency"—now serves as the legal blueprint for XRP's expanding role in global finance.

This isn't a mere coincidence. The trademark was registered on December 31, 2013, by OpenCoin Inc. (now Ripple Labs), with a filing date of May 17, 2013, just months after the XRP Ledger's public launch on January 1, 2013. This early intellectual property protection demonstrates Ripple's strategic vision for XRP as institutional financial infrastructure from day one.

Why Class 36 Classification is Game-Changing

The trademark's classification under Class 36 for Financial Services (specifically US Classes 100, 101, and 102) provides crucial regulatory clarity that distinguishes XRP from speculative digital assets. This classification covers:

- Class 100: Insurance and financial affairs

- Class 101: Real estate affairs

- Class 102: Monetary affairs and real estate

This alignment ensures XRP can seamlessly interface with existing banking infrastructure, accelerating its adoption in regulated environments. The trademark essentially serves as legal recognition that XRP was designed specifically for financial institutions—not as a speculative investment vehicle.

ETF Catalyst: From Legal Clarity to Institutional Access

The trademark's significance has become amplified with the SEC's July 2025 approval of the ProShares Ultra XRP ETF (UXRP), marking the first regulated XRP investment product in the United States. This 2x leveraged futures-based ETF, trading on NYSE Arca, provides institutional investors with regulated exposure to XRP without custody requirements.

Currently, ten major asset managers including Grayscale, Bitwise, and Franklin Templeton have filed spot XRP ETF applications, with final SEC decisions expected by October 2025. The trademark's Class 36 financial services designation provides crucial legal support for these applications, differentiating XRP from other cryptocurrencies lacking similar intellectual property protection.

Analysts estimate an 85% approval probability for spot XRP ETFs, citing favorable regulatory shifts and the precedent set by Bitcoin and Ethereum ETFs.

Institutional Adoption Accelerates

The SEC's legal clarity has unlocked $1.1 billion in institutional investment in XRP in 2025 alone, while strategic partnerships with SBI, Gemini, and others have embedded XRP into global payment networks. The trademark provides legal certainty for these partnerships, enabling banks and financial institutions to integrate XRP without regulatory ambiguity.

Ripple's On-Demand Liquidity (ODL) service, adopted by 300+ institutions, leverages XRP to cut cross-border payment costs by 70% while aligning with ISO 20022 standards. The trademark's "global computer network" language directly supports this infrastructure, providing legal foundation for international financial rails.

Market Impact and Future Implications

XRP reached a new all-time high above $3.40 in July 2025, finally surpassing its 2018 peak for the first time in seven years, representing a 480% gain in just one month. This surge coincides directly with regulatory clarity and the recognition of the trademark's importance for institutional adoption.

If additional spot ETFs are approved, they could catalyze a surge in institutional inflows—potentially exceeding $5 billion in the first month. The trademark provides the legal foundation ensuring these products can operate within existing financial regulations.

XRP/Ripple Analysis: The Strategic Advantage

The XRP trademark offers Ripple several critical advantages:

Legal Certainty: The Class 36 designation provides clear regulatory guidance for financial institutions integrating XRP, reducing compliance risks.

Competitive Moat: Ripple maintains an aggressive IP strategy with 53+ trademark applications filed, 48 currently active, showing the commercial value of comprehensive trademark portfolios in digital asset markets.

Partnership Facilitation: The trademark's specific language enables banks to justify XRP integration as using established "financial services" rather than experimental cryptocurrency.

ETF Foundation: The intellectual property protection supports regulatory approval for investment products, as demonstrated by the ProShares ETF launch.

Global Financial System Integration

XRP's alignment with the ISO 20022 standard and its role in CBDC pilots position it to benefit from the global shift toward digital finance. The trademark's "virtual currency and traditional currency" language provides legal framework for these emerging use cases.

Japan's SBI Holdings has recently filed to launch the country's first-ever Bitcoin/XRP ETF, signaling strong institutional interest in the token. International recognition of the USPTO trademark supports these global initiatives.

Legal Foundation for Financial Revolution

The XRP trademark represents more than intellectual property—it's the legal cornerstone enabling XRP's evolution from cryptocurrency to financial infrastructure. The ruling largely upholds Judge Torres' 2023 decision by confirming that XRP sales made programmatically (i.e., retail transactions) are non-securities, while institutional sales remain classified as securities.

With the SEC case resolved, ETF approvals pending, and institutional adoption accelerating, the trademark's Class 36 financial services designation provides the regulatory certainty needed for XRP to fulfill its role as a bridge asset in the global financial system. For investors and institutions, this trademark isn't just legal protection—it's the foundation for XRP's integration into the rails of modern finance.

DISCLAIMER: This newsletter is for informational purposes only and does not constitute investment advice or a recommendation to buy, sell, or hold any securities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.