XRP Ledger Sets New Sustainability Standard with Minimal Energy Use

Fresh data reveals XRP Ledger's entire network consumes dramatically less energy than major competitors—with metrics showing 57,000x more efficiency than Bitcoin and annual energy usage equivalent to just 50 U.S. households.

Fresh data reveals that XRP Ledger's entire network consumes dramatically less energy than major competitors, with environmental metrics that challenge industry assumptions about blockchain sustainability.

Fresh Data on XRP Ledger electricity consumption and carbon emissions.

— Vet 🏴☠️ (@Vet_X0) September 2, 2025

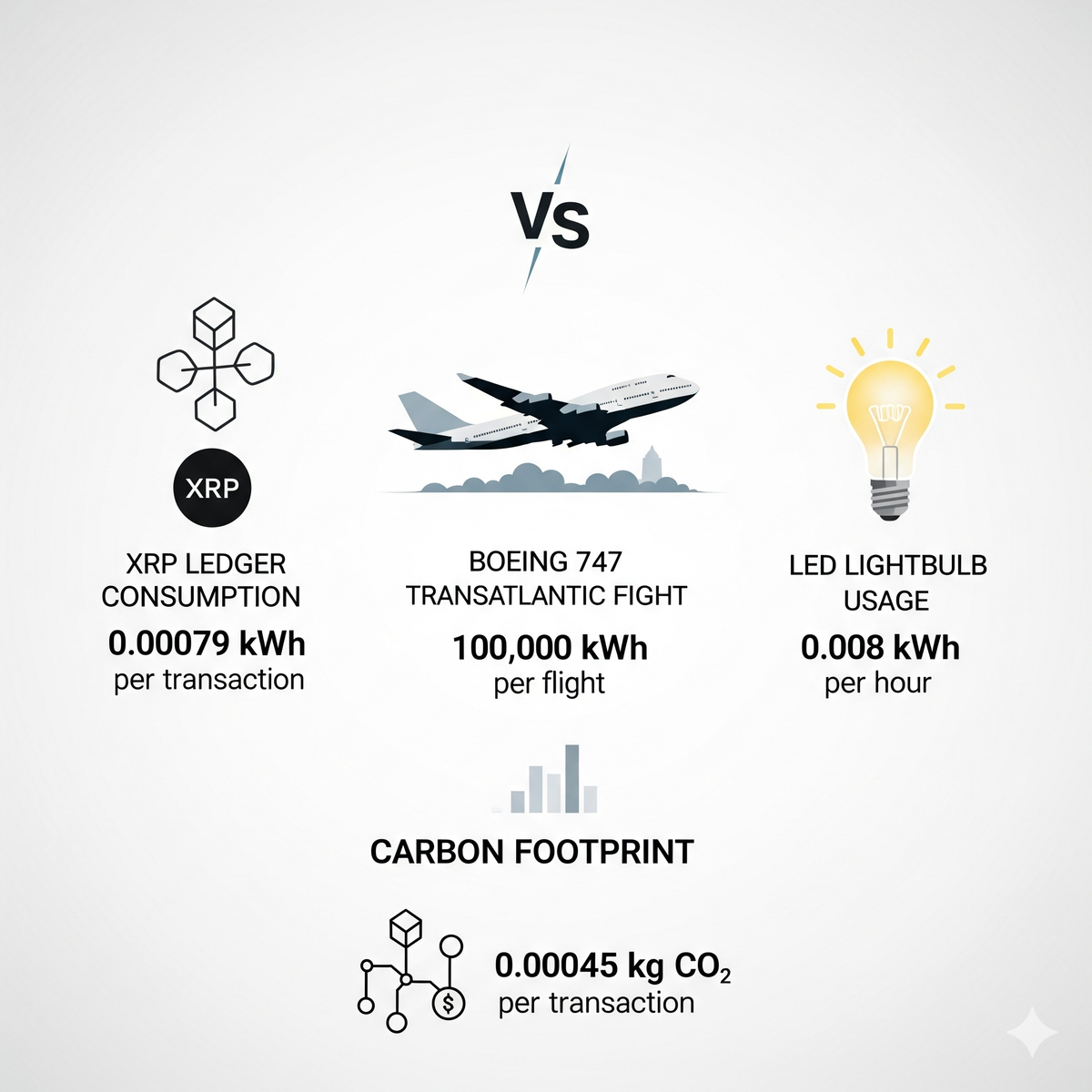

Whole network has a carbon footprint of one transatlantic flight with a Boeing 747.

One XRPL transaction consumes electricity equal to running a LED light for 1 milisecond. pic.twitter.com/FG3PRbZMyA

Revolutionary Energy Efficiency Numbers

New metrics from the XRP Ledger demonstrate extraordinary environmental efficiency compared to traditional blockchain networks. For every 1 million transactions, XRP could power 79,000 lightbulb hours. In contrast, for every 1M transactions, Bitcoin could power 4.51 billion lightbulb hours. This represents a 57,000x energy efficiency advantage over Bitcoin.

Recent data shows the XRPL network's annual energy consumption is equivalent to powering approximately 50 U.S. households, compared to Bitcoin's estimated 13 million households worth of energy usage. XRP's energy usage per transaction is estimated at 0.0079 kWh, far below Bitcoin's 707 kWh and Ethereum's 62 kWh (pre-merge).

The remarkable efficiency stems from XRP Ledger's unique consensus mechanism. XRPL's unique consensus mechanism doesn't require mining to settle transactions. The negligible amount of energy it does consume is then offset with carbon credits through EW Zero, an open-source tool that allows any blockchain to decarbonize by purchasing renewable energy from local carbon markets across the world.

Scientific Validation Behind the Claims

Independent academic research supports these efficiency claims. A study predicted that a transaction would consume just 0.01133 Wh, which is far less than the prediction made by Ripple in their study. The University of Waterloo conducted a comprehensive energy consumption analysis of XRP validators, measuring both wall socket energy and CPU package energy across controlled intervals.

The XRP ledger's energy use is under 0.001% of Bitcoin's. This extraordinary efficiency is achieved through the Ripple Protocol Consensus Algorithm (RPCA), which eliminates energy-intensive mining while maintaining security through validator consensus.

How XRP Compares to Web3 Competitors

When comparing XRP to other major blockchain networks, the energy differences are striking:

Bitcoin: In May 2023, a single Bitcoin transaction used 703.25 kilowatt-hours of electricity. Bitcoin's proof-of-work mining consumes approximately 121 terawatt-hours annually.

Ethereum: Post-merge Ethereum transactions use between 0.0008 and 0.0147 kilowatt-hours per transaction, representing a 99.95% reduction from its previous proof-of-work system.

Chainlink (LINK): While Chainlink operates on Ethereum and uses proof-of-stake consensus, it faces gas consumption challenges. Chainlink uses an Ethereum-based ERC-20 token to secure the oracle network. However, Chainlink is a step ahead of Ethereum, as it already has a proof-of-stake (PoS) consensus mechanism already in place. Individual Chainlink operations require gas fees that can vary significantly based on network congestion.

Other Efficient Blockchains: Ripple has established itself as one of the most energy-efficient cryptocurrency projects in the competitive financial sector, with an energy consumption of just 0.0079 kWh per transaction.

XRP/Ripple Analysis: Leading Green Finance Innovation

XRP's environmental advantages directly impact Ripple's business operations and market positioning:

Business Operations Enhancement: XRP's speed, low transaction costs, and energy efficiency provide a solid foundation for facilitating green investments. This positions Ripple favorably with environmentally conscious financial institutions.

Regulatory Advantages: With increasing regulatory focus on ESG compliance, XRP's carbon-neutral status provides significant competitive advantages. Ripple is striving to achieve carbon net-zero by 2030.

Partnership Opportunities: RippleNet now partners with over 300 financial institutions across 45+ countries, including heavyweights like Santander and SBI Holdings. The sustainability angle opens new partnership avenues with green-focused organizations.

Adoption Prospects: XRP can be used to facilitate carbon credit transactions in a transparent, traceable, and efficient manner. This positions XRP for growth in the expanding carbon credit market.

Price Implications: Environmental advantages could drive institutional adoption, particularly as ESG investing continues to growcommitted. XRP rallied nearly 500% last November after many years of underperformance relative to other cryptocurrencies, boosted by a changing political climate and greater regulatory clarity.

Blockchain Infrastructure Comparison

XRP's technical architecture enables superior efficiency:

Transactions are validated by a network of independent validators who reach consensus every 3 to 5 seconds, enabling rapid transaction settlement. Unlike proof-of-work systems requiring massive computational power, XRP validators achieve consensus through agreement rather than competition.

XRP handles 1,500 transactions per second, whereas SWIFT averages 5–7 TPS, revealing a vast speed gap. This efficiency extends beyond energy to processing capacity, making XRP suitable for large-scale adoption without proportional energy increases.

Market Context and Implications

The cryptocurrency industry faces increasing pressure regarding environmental impact. Headlines and deep dives on the staggering levels of crypto energy consumption — among some blockchains in particular — have put the industry under a spotlight.

XRP's positioning as a carbon-neutral blockchain provides strategic advantages as governments and institutions prioritize sustainability. Governments around the world are realizing how massive the carbon footprint is for those cryptocurrencies on energy-intensive blockchains. In March, President Biden signed an Executive Order outlining the responsible development of digital assets, including a call to "reduce negative climate impacts."

The environmental efficiency represents more than just good optics—it's fundamental to XRP's value proposition in the evolving financial landscape where sustainability increasingly drives adoption decisions.

Sources:

- XRP Learning Portal - XRPL and Sustainability

- Ripple Official Press Release - Carbon Neutrality Commitment

- University of Waterloo Research - Energy Consumption Analysis of XRP Validator

- Technology Innovators - XRP and Green Finance Case Study

- CoinLaw - XRP Statistics 2025

- Ripple Insights - Environmental Impact Analysis

- Ripple Insights - A Greener Future for Crypto and Blockchain

- Ledger Insights - XRP Ledger Carbon Free Blockchain

- IEEE Conference Publication - Energy Consumption Analysis of XRP Validator

- ResearchGate - Energy Consumption Analysis of XRP Validator

- CoinLaw - XRP vs SWIFT Statistics 2025

- CME Group - How XRP Relates to the Crypto Universe

- Digiconomist - Bitcoin Energy Consumption Index

- Integrity Energy - Pursuing Energy-Efficient Cryptocurrency

- CoinMarketCap - What Is Chainlink

- Chainlink Documentation - Various Billing and Cost Pages

- Wikipedia - XRP Ledger

DISCLAIMER: This newsletter is for informational purposes only and does not constitute investment advice, advertising, or a recommendation to buy, sell, or hold any securities. This content is not sponsored by or affiliated with Uphold, XRP, or any mentioned entities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.