XRP ETF Decision Deadline Collides with Coinbase Downtime: Coincidence or Strategic Timing?

SEC's XRP ETF deadlines meet Coinbase's 4-hour downtime on Oct 25—coincidence or timing? US govt shutdown complicates everything. Billions at stake as crypto community questions the overlap.

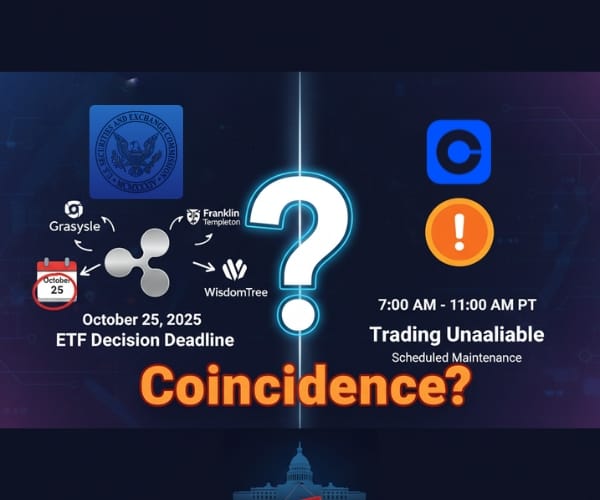

As the cryptocurrency community watches October 25th approach, an unusual convergence of events has sparked widespread speculation. The SEC's crucial XRP ETF decision deadline falls on the exact same day that Coinbase, America's largest crypto exchange, has scheduled a four-hour maintenance window. This timing has crypto analysts questioning whether it's mere coincidence or something more calculated.

The October 25 Deadline Cluster

The U.S. Securities and Exchange Commission faces multiple critical deadlines for XRP exchange-traded fund applications between October 18-25, 2025. Major financial institutions including Grayscale, Franklin Templeton, WisdomTree, 21Shares, Bitwise, Canary Capital, and CoinShares have all submitted applications for spot XRP ETFs, with final review dates concentrated in a single week.

The October 25th deadline specifically applies to three major applications: WisdomTree, Franklin Templeton, and CoinShares. If approved, these ETFs would provide institutional and retail investors with regulated access to XRP, potentially triggering billions in inflows and fundamentally reshaping the market for Ripple's native token.

Market observers have placed approval odds at 87-95% based on regulatory readiness and the dismissal of the SEC's lawsuit against Ripple. Analysts predict $5-8 billion in potential ETF inflows within the first month, which could create a supply shock in the XRP market.

Coinbase's Scheduled Maintenance: The Timing Raises Eyebrows

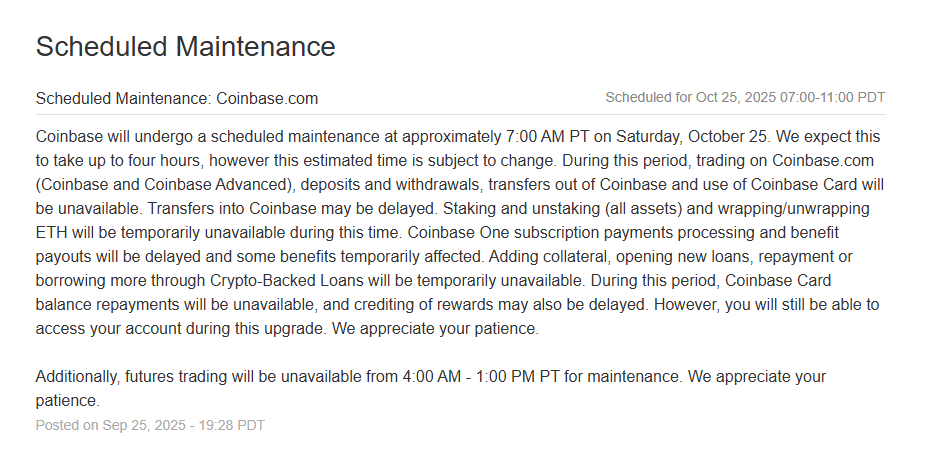

Adding intrigue to this situation, Coinbase announced via its official status page and social media that it will undergo scheduled maintenance on October 25 at 7:00 AM PT, estimated to last approximately four hours. The maintenance window was first announced on September 25, 2025, giving users several weeks' notice.

During this maintenance period, all trading on Coinbase.com will be unavailable, along with deposits, withdrawals, transfers out of Coinbase, and use of Coinbase Card. Additionally, futures trading will be unavailable from 4:00 AM to 1:00 PM PT, extending the downtime for derivatives traders.

The crypto community quickly noticed the overlap. Analyst ChartNerd (@ChartNerdTA) highlighted the coincidence in a viral post, questioning whether Coinbase being down for four hours during daylight hours on the same day as XRP ETF decisions was truly random. The observation resonated with many in the XRP community who have long suspected coordination between major exchanges and institutional players.

The Government Shutdown Complicates Everything

However, there's a critical development that overshadows both the ETF deadlines and Coinbase's maintenance schedule: the U.S. government shut down at 12:01 AM on October 1, 2025, after Congress failed to reach an agreement on federal spending.

The shutdown has forced the SEC to operate with extremely limited capacity, with only 393 of its 4,289 employees remaining active. The SEC Division of Corporation Finance announced that it cannot declare registration statements effective, review filings, issue no-action letters, or provide interpretive advice during the shutdown.

With the SEC focused only on "essential" market functions, approvals during the shutdown appear unlikely. The October 25 target now looks fragile, caught between market readiness and government paralysis. Any approvals would likely come only after the government reopens.

XRP and Ripple: The Regulatory Breakthrough That Set the Stage

The current wave of XRP ETF applications follows a pivotal August 2025 ruling where a federal appeals court dismissed the SEC's lawsuit against Ripple, confirming that XRP does not qualify as a security under U.S. law when sold on secondary markets. This decision removed the primary regulatory obstacle that had prevented XRP ETF approvals for years.

The SEC now requires at least six months of active XRP futures trading for ETF eligibility, a threshold that XRP has met through CME XRP futures, which reached $1 billion in open interest in just over three months. Additionally, Coinbase launched CFTC-regulated XRP futures in April 2025, providing the necessary regulated derivatives infrastructure.

One XRP ETF has already launched in the U.S.: the Rex-Osprey XRPR, which went live on September 18, 2025, using a combination of spot exposure and derivatives. The product's approval demonstrates that spot XRP ETFs can be listed under current SEC rules.

Market Implications and Price Dynamics

XRP has traded in a consolidation range between $2.75 and $2.88 in recent weeks, with the market seemingly waiting for clarity on ETF approvals. Despite recent volatility, institutional wallets have quietly accumulated nearly $928 million worth of XRP, signaling confidence among large players.

Analysts have projected various price targets if ETF approvals materialize. Technical patterns suggest a potential 35% rally toward $4, mirroring a July breakout that generated a 66% surge. More optimistic forecasts point to $10-$20 by year-end if multiple ETFs receive approval and institutional FOMO accelerates.

ETF analyst Nate Geraci argues that skeptics are severely underestimating investor demand for spot XRP ETFs, noting how doubts about Bitcoin and Ethereum ETFs were quickly invalidated once billions flowed in. Forecasts suggest XRP ETFs could attract $5-8 billion in the first year, though these projections depend on market conditions and the number of approved products.

Coinbase's Mysterious XRP Activity

Adding another layer to the October 25 timing question, Coinbase's XRP holdings have declined dramatically in recent months. Public data shows that Coinbase held nearly 970 million XRP in cold storage in June 2025, but by September, those holdings had fallen by over 60%.

Analysts believe the XRP was transferred to institutional investors and OTC desks preparing for ETF launches, not sold on the open market. This pattern mirrors what occurred before Bitcoin ETF approvals, where major asset managers secured tokens well ahead of product launches. Firms like Franklin Templeton, Grayscale, and Bitwise could be using Coinbase Prime to acquire XRP without public disclosure.

What October 25 Actually Means Now

Despite the coordinated appearance of multiple events on October 25, the government shutdown means the October deadlines may pass without any SEC action. Any approvals would likely come only after normal government operations resume.

According to SEC guidance, registration statements can become effective 20 days after filing without staff action pursuant to Section 8(a) of the Securities Act if filed without a delaying amendment, though this is not a typical path for ETF approvals. The SEC staff will not declare registration statements effective during the shutdown.

As for Coinbase's maintenance, the exchange has a history of scheduled upgrades and the timing may indeed be coincidental. The maintenance was announced weeks in advance and follows standard practice for major infrastructure updates. However, the overlap with multiple major crypto catalysts has fueled speculation in XRP communities about coordination.

Looking Ahead: What Comes Next for XRP ETFs

The next six weeks represent the clearest runway XRP has ever had toward full U.S. ETF legitimacy. If the government shutdown ends soon, the SEC could move quickly on pending applications. If approvals come in clusters, XRP could see billions in inflows similar to Bitcoin ETF approvals. Conversely, if denials pile up, XRP sentiment could collapse.

Beyond ETFs, Ripple has submitted an application for a U.S. national bank charter with a decision expected in October 2025. Approval would allow Ripple to operate as a federally supervised banking institution, adding significant credibility to XRP's role in payments and custody.

The combination of ETF approval and a bank charter would cement XRP as both investable and operationally essential in the financial system. For now, the crypto community watches and waits, knowing that October's outcomes—whenever they arrive—will likely define XRP's trajectory for years to come.

Key Takeaways

- Multiple XRP ETF decisions are scheduled for October 18-25, with major applications from Grayscale, Franklin Templeton, WisdomTree, and others

- Coinbase maintenance is scheduled for October 25 at 7AM PT for approximately 4 hours, temporarily halting all trading

- U.S. government shutdown has paralyzed SEC operations since October 1, making it unlikely that ETF approvals will occur on the scheduled deadlines

- XRP regulatory clarity improved significantly after the August 2025 appeals court dismissal of the SEC lawsuit against Ripple

- Institutional accumulation continues with nearly $928 million in XRP held in institutional wallets

- Supply dynamics have shifted as Coinbase's XRP reserves declined by over 60% from June to September 2025, likely moving to institutional custody

DISCLAIMER: This newsletter is for informational purposes only and does not constitute investment advice, advertising, or a recommendation to buy, sell, or hold any securities. This content is not sponsored by or affiliated with any of the mentioned entities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.

Sources

- Coinbase Status Page

- Full List of XRP Spot ETFs Filings - CoinPedia

- XRP News Today: SEC's XRP ETF Deadlines Clash with Shutdown - AI Invest

- SEC Operations During Government Shutdown - McGuireWoods

- Division of Corporation Finance Actions - SEC.gov

- XRP ETF Countdown - CryptoDnes

- XRP ETFs Tracker - CCN

- How High Will XRP Rise on October's ETF Approval - Daily Forex

- Coinbase Research: XRP Is Next In Line - DailyCoin

- Do Coinbase Wallets Have 'ZERO' XRP - CoinPedia

- XRP Price Prediction After SEC ETF Decisions - CoinGape