Why XRP's Liquidity Solution Outpaces Chainlink

Software engineer Vincent Van Code reveals why XRP's instant liquidity solution fundamentally outpaces Chainlink's oracle network—and why comparing them represents a category mistake that misses crypto's real transformation.

The Liquidity Problem Nobody Talks About

Software engineer Vincent Van Code recently explained what most cryptocurrency investors fundamentally misunderstand about global finance. According to Van Code's analysis, the biggest roadblock to true globalization isn't technology or regulation—it's the lack of liquidity. While everyone discusses Bitcoin's scarcity or Ethereum's smart contracts, few grasp why XRP exists and what problem it actually solves.

As Van Code explains in his viral social media post, liquidity is how easily value can move when needed—without friction, delay, or price impact. Think of it as water flowing through the pipes of global finance. Without liquidity, everything slows down: trade, payments, and even supply chains. The current banking system struggles with this fundamental challenge, with over twenty trillion dollars trapped globally in nostro-vostro accounts—pre-funded pools of money sitting idle in foreign banks just to facilitate cross-border payments.

🚨 Let’s talk about liquidity 👇

— Vincent Van Code (@vincent_vancode) October 22, 2025

Everyone throws the word around, but few actually understand what it means - or why XRP exists.

The biggest roadblock to true globalisation is the LACK OF LIQUIDITY. Nothing else comes even close. We need "limitless liquidity", so how can…

Why XRP's Liquidity Solution Outpaces Chainlink

Understanding Vincent Van Code's liquidity framework and why XRP is designed for global finance while Chainlink serves a different purpose

The Liquidity Problem Nobody Talks About

Software engineer Vincent Van Code recently explained what most cryptocurrency investors fundamentally misunderstand about global finance. According to Van Code's analysis, the biggest roadblock to true globalization isn't technology or regulation—it's the lack of liquidity. While everyone discusses Bitcoin's scarcity or Ethereum's smart contracts, few grasp why XRP exists and what problem it actually solves.

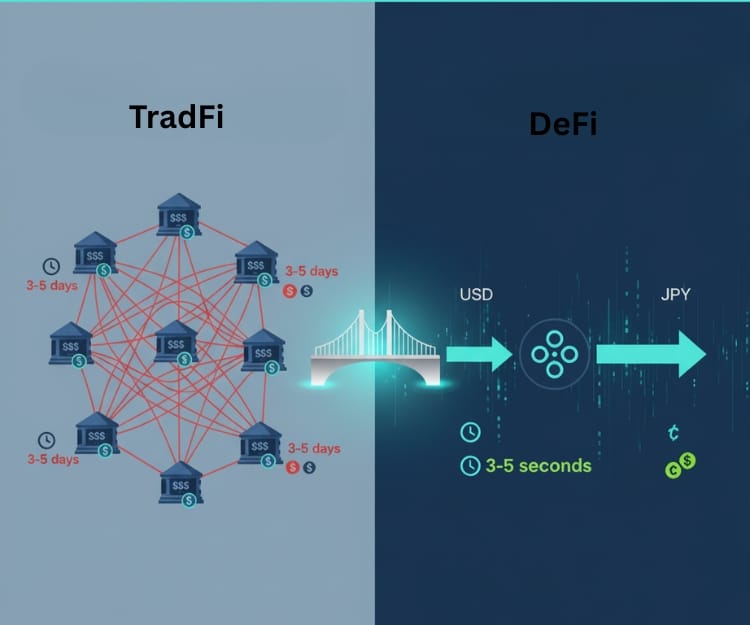

As Van Code explains in his viral social media post, liquidity is how easily value can move when needed—without friction, delay, or price impact. Think of it as water flowing through the pipes of global finance. Without liquidity, everything slows down: trade, payments, and even supply chains. The current banking system struggles with this fundamental challenge, with over twenty trillion dollars trapped globally in nostro-vostro accounts—pre-funded pools of money sitting idle in foreign banks just to facilitate cross-border payments.

Enter XRP: The Real-Time Liquidity Bridge

XRP's Core Design Principles

Van Code clarifies that XRP wasn't designed as a speculative asset or store of value like Bitcoin. Instead, it's engineered as a bridge asset—a real-time liquidity layer for global settlement. The technology enables value to move between any two currencies in seconds, without pre-funded accounts, waiting periods, or intermediaries. Learn more about XRP's technical architecture on the official XRP Ledger documentation.

Here's how XRP fundamentally differs from traditional systems and other cryptocurrencies:

- Settlement Speed: Three to five second transaction finality compared to days for traditional wire transfers

- Minimal Costs: Transaction fees typically under one cent, compared to percentage-based fees from banks

- No Middlemen: Direct settlement without correspondent banking networks

- Currency Agnostic: Can bridge any currency pair, including fiat and digital assets

- Scalability: Handles approximately fifteen hundred transactions per second

As Van Code emphasizes, XRP is neutral and decentralized, built specifically for value mobility rather than ecosystem building. It doesn't compete with Bitcoin's store of value proposition or Ethereum's smart contract platform—it serves an entirely different purpose in the digital finance architecture.

The Bigger Picture: Global Financial Transformation

Van Code's framework reveals something crucial that many investors miss. The next global transformation isn't about replacing money—it's about making money move like data. Traditional currency movement relies on pre-funded accounts and batch processing, creating massive inefficiencies. XRP solves this by enabling instant, on-demand liquidity sourcing.

Vincent Van Code projects that at higher price points, XRP could theoretically unlock over eight hundred trillion dollars in liquidity. His argument centers on XRP functioning as a swap mechanism rather than requiring full cash conversion. This logarithmic liquidity expansion means that market cap limitations don't constrain XRP's utility the way they would for traditional assets.

XRP versus Chainlink: Understanding the Fundamental Differences

Comparing XRP to Chainlink reveals why these projects exist in entirely different categories, despite both serving critical infrastructure roles in the evolving financial system.

What Chainlink Actually Does

Chainlink operates as a decentralized oracle network, providing secure data feeds to blockchain smart contracts. Founded in twenty seventeen by Sergey Nazarov and Steve Ellis, Chainlink solves what's called the oracle problem—how blockchains can securely access real-world information without relying on centralized data providers.

Chainlink's primary use cases include:

- Price Feeds: Supplying real-time market data to DeFi protocols for lending, derivatives, and trading

- Cross-Chain Messaging: Enabling interoperability between different blockchain networks via CCIP

- Off-Chain Computation: Processing complex calculations outside the blockchain

- IoT Integration: Connecting smart contracts to Internet of Things devices and sensors

- Verification Services: Confirming real-world events for automated contract execution

Chainlink has achieved significant institutional adoption, with partnerships including Swift, Deutsche Telekom, and major financial institutions. As of August twenty twenty-five, Chainlink's infrastructure enabled over fifty-seven billion dollars in total value secured across decentralized finance applications. The protocol's LINK token serves as the payment mechanism for oracle services and network security through staking.

The Category Mistake: Why XRP and Chainlink Aren't Competitors

Industry analysts at Messari recently published a comprehensive comparison highlighting why treating XRP and Chainlink as competitive alternatives represents a fundamental misunderstanding. These technologies operate in completely different layers of the financial technology stack.

XRP: Settlement Infrastructure

The XRP Ledger functions as payments and settlement rails. It's designed to be the plumbing that moves value between accounts, currencies, and financial institutions. Ripple's On-Demand Liquidity service uses XRP to enable instant cross-border payments without pre-funding. Financial institutions can source liquidity on-the-fly by converting fiat to XRP to destination currency in seconds.

Recent institutional developments underscore this positioning. Ripple's billion-dollar acquisition of GTreasury in October twenty twenty-five provides direct access to the hundred-twenty trillion dollar corporate treasury market. The integration of Ripple's blockchain technology with GTreasury's platform allows businesses to manage both traditional assets and emerging digital assets like stablecoins through unified infrastructure.

Chainlink: Data and Interoperability Middleware

Chainlink operates as middleware—the data and messaging layer that enables smart contracts to function. It doesn't move value itself but provides the information infrastructure that allows decentralized applications to operate securely. Think of Chainlink as the information highway, while XRP is the value highway.

The Motley Fool's crypto analyst Alex Carchidi captured this distinction perfectly, noting that expecting Chainlink to cannibalize XRP or vice versa represents a category mistake. These coins solve different problems for different customers and operate at different points in the adoption curve.

Why XRP's Architecture is Head and Shoulders Above

Real-Time Settlement versus Data Delivery

The fundamental advantage XRP holds for global finance comes down to what Van Code identified: limitless liquidity creation through instant settlement. Chainlink can tell you the price of an asset or verify an event occurred, but it can't move that value between parties. XRP does exactly that—it IS the bridge that makes value interoperable across the global financial system. See our detailed comparison analysis for more technical details.

While Chainlink nodes stake LINK tokens to provide accurate data, XRP's consensus mechanism enables thousands of validators worldwide to achieve transaction finality in seconds without proof-of-work mining or high energy consumption. The XRP Ledger's unique consensus protocol allows it to maintain decentralization while achieving the transaction throughput necessary for enterprise-grade payment systems.

Market Scale and Institutional Focus

XRP operates at a dramatically larger scale than Chainlink, with a market capitalization near one hundred eighty billion dollars compared to Chainlink's seventeen billion dollars as of October twenty twenty-five. This ten-fold difference reflects their different target markets and maturity levels. XRP targets the multi-trillion dollar cross-border payments market, while Chainlink serves the growing but comparatively smaller decentralized finance and oracle services sectors.

Ripple's institutional partnerships demonstrate XRP's positioning. The company has secured relationships with over three hundred financial institutions globally, including major banks in Japan, South Korea, and the Middle East. Recent collaborations include South Korea's BDACS for custody services and Clear Junction for GBP and Euro payment rails.

Chainlink has also achieved impressive institutional traction, with BNY Mellon, Citibank, and Euroclear adopting its data infrastructure. However, these use cases remain focused on specific applications—tokenized asset transfers, smart contract automation, and data verification—rather than the fundamental settlement layer that XRP provides.

Regulatory Clarity and Compliance Architecture

The XRP Ledger increasingly emphasizes compliance features essential for institutional adoption. Ripple's development of the Multi-Purpose Token standard enables embedded compliance rules and control features at the protocol level. The company acknowledges that privacy features and KYC controls remain priorities for broader bank adoption, with ongoing development of credentials systems and enhanced privacy capabilities.

Chainlink's compliance focus centers on its Cross-Chain Identity protocol and Automated Compliance Engine, which help verify institutional identities and maintain transaction transparency. While valuable for smart contract applications, these tools don't address the core settlement and payment compliance requirements that financial institutions face—the exact problem XRP was designed to solve.

The Complementary Future: Why Both Matter

Messari's analysis concludes with a crucial insight that investors should remember: the future of crypto infrastructure is collaborative, not competitive. Ripple's recent integration of Chainlink's oracle network to provide real-time price feeds for the RLUSD stablecoin on both XRP Ledger and Ethereum demonstrates this principle perfectly.

By supplying oracles for Ripple's stablecoin, Chainlink implicitly endorses XRPL's settlement layer. By leaning on Chainlink's feeds, Ripple acknowledges that institutional DeFi requires best-in-class middleware rather than closed-loop solutions. This symbiotic relationship reveals how different blockchain infrastructure projects can work together rather than compete.

XRP's Unique Value Proposition

Vincent Van Code's framework helps clarify why XRP occupies a unique position:

- Purpose-Built for Payments: Designed from inception for cross-border settlement and liquidity provision

- Institutional Grade: Enterprise partnerships and regulatory engagement from day one

- Real Liquidity Solution: Solves actual capital inefficiency problems that banks face today

- Proven Technology: Over a decade of operation with consistent sub-second settlement

- Neutral Bridge Asset: Not trying to replace currencies but making them interoperable

As Van Code emphasizes, once you understand XRP's role in enabling frictionless, scalable liquidity, you begin to see its true value. It's not about being better than Bitcoin or Ethereum—those serve different purposes. XRP addresses a specific problem in global finance that no other digital asset tackles as directly: instant, low-cost value movement across borders and currencies. Read more in our comprehensive sources reference.

XRP's Impact on Ripple and the Broader Ecosystem

Industry observers increasingly recognize that Ripple's business model fundamentally depends on XRP's eventual price appreciation. Despite regulatory caution around direct price discussion, Ripple holds approximately thirty-five billion XRP in escrow and another five billion in spendable wallets. Every dollar increase in XRP's price adds approximately forty billion dollars to Ripple's balance sheet.

This alignment creates a virtuous cycle. As XRP's utility expands through mechanisms like On-Demand Liquidity, Central Bank Digital Currency bridges, and tokenized asset transactions, demand for XRP increases. Higher prices strengthen Ripple's financial position, enabling more ecosystem development and institutional partnerships, which further drives adoption and utility.

Van Code's analysis of XRP's realistic liquid supply reveals another important factor. While XRP's total supply reaches one hundred billion tokens, only twelve to fifteen billion are realistically available for active market use. The remaining supply sits in escrow, institutional holdings, strategic reserves, or DeFi liquidity pools. This supply constraint means that significant expansion in XRP usage could have substantial price impacts.

Key Takeaways

For investors and observers of the cryptocurrency space, several conclusions emerge from comparing XRP and Chainlink:

- Different Problems, Different Solutions: XRP provides settlement infrastructure while Chainlink supplies data middleware

- Collaborative Future: These technologies work together rather than compete, as demonstrated by Chainlink providing oracles for Ripple's stablecoin

- Liquidity is Key: Van Code's framework reveals why instant value movement matters more than data feeds for transforming global finance

- Institutional Adoption Matters: XRP's focus on financial institutions and regulatory compliance positions it for mass adoption

- Scale Differences: XRP operates at roughly ten times Chainlink's market scale, reflecting its target market size

As Vincent Van Code's analysis makes clear, the true transformation in global finance won't come from replacing money but from making money move like data. XRP isn't the currency of the future—it's the bridge that makes future currencies interoperable. Understanding this distinction separates those who grasp cryptocurrency's real potential from those chasing speculative narratives.

Sources & Additional Resources

- Vincent Van Code's XRP Analysis and Social Media Posts

- Messari: Chainlink vs XRP Ledger Comparison

- The Crypto Basic: Ripple Endgame Analysis

- The Motley Fool: Is Chainlink Going to Be the Next XRP?

- XRP News: Realistic Liquid Supply Analysis

- XRP Role in Global Finance: $100 Trillion Liquidity

- TradingView: XRP at $10K Analysis

- Chainlink Official Website and Documentation

- XRP Ledger Official Resources

- Ripple Official Website

- Gemini: What is Chainlink?

- BingX: Chainlink Oracle Protocol Explained

- CoinPaper: XRP vs LINK Key Differences

- Bitcoinist: Chainlink vs XRP Ledger Report

- The Crypto Basic: World is Sleeping on XRP

DISCLAIMER

This newsletter is for informational purposes only and does not constitute investment advice, advertising, or a recommendation to buy, sell, or hold any securities. This content is not sponsored by or affiliated with any of the mentioned entities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.