Western Union Ditches SWIFT for Stablecoin Settlement

Western Union pilots stablecoin settlement to move away from SWIFT and modernize remittances following GENIUS Act passage. The 173-year-old giant aims to cut costs, speed transfers, and reduce reliance on correspondent banks. What does this mean for XRP?

In a significant shift for the 173-year-old remittance giant, Western Union has announced it is actively piloting stablecoin-based settlement systems to modernize its global payment infrastructure and move away from the traditional SWIFT correspondent banking system. CEO Devin McGranahan confirmed during the company's Q3 2025 earnings call on October 24 that Western Union is testing blockchain settlement rails to reduce dependency on legacy banking networks, dramatically speed up settlements, and cut customer costs.

Regulatory Clarity Paves the Way

Western Union's move comes after years of hesitation regarding cryptocurrencies due to volatility concerns and regulatory uncertainty. The turning point arrived with the passage of the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins) in July 2025, signed into law by President Donald Trump. This landmark legislation established the first comprehensive federal regulatory framework for payment stablecoins, requiring 100% reserve backing with liquid assets and mandatory monthly public disclosures.

"We see stablecoins as an opportunity, not a threat," McGranahan stated earlier this year. With the GENIUS Act now providing clear guardrails, Western Union joins a growing wave of traditional financial institutions embracing digital asset integration. The regulatory clarity has enabled the company to move forward with confidence, knowing that stablecoin issuers must comply with strict anti-money laundering requirements and Bank Secrecy Act provisions.

Breaking Free from SWIFT's Limitations

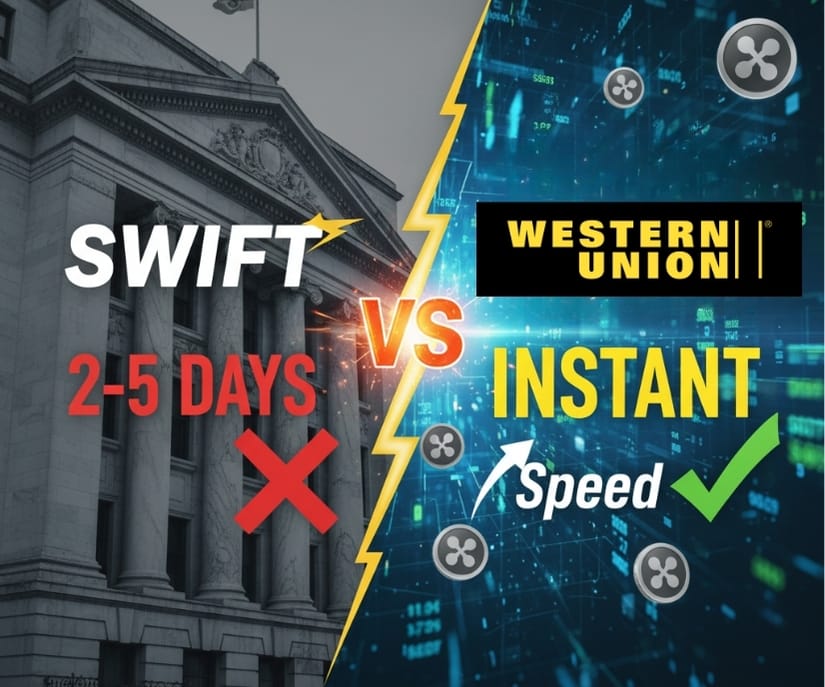

At the heart of Western Union's stablecoin initiative is a strategic push away from the SWIFT network, the decades-old messaging system that facilitates an estimated $5 trillion in daily transactions globally. While SWIFT has been the backbone of international finance since 1973, its reliance on multiple intermediaries creates significant operational friction, high processing fees, and settlement delays that can span 2-5 days.

McGranahan explicitly framed the stablecoin pilot as a way to "reduce dependency on legacy correspondent banking systems." Traditional cross-border transfers require funds to hop through multiple correspondent banks, each taking a cut and adding time to the process. In contrast, blockchain-based stablecoin settlements offer near-instant finality with transparent, predictable costs.

Western Union isn't alone in this pivot. Major financial institutions worldwide are exploring alternatives to SWIFT. SWIFT itself is building its own blockchain platform, while Visa and Mastercard are racing to integrate crypto payment capabilities. The message is clear: the era of multi-day settlement times and opaque correspondent banking is ending.

Business Imperative Behind the Shift

The decision to pilot stablecoins is not merely innovative—it's existential. Western Union processes approximately 70 million transfers each quarter across more than 200 countries, serving over 150 million customers. However, the company faces mounting competitive pressure from stablecoin issuers like Tether (USDT) and Circle (USDC), which collectively command over $312 billion in market capitalization.

Moreover, Western Union's direct competitors have already moved ahead. MoneyGram and WorldRemit-owner Zepz now offer crypto wallets enabling customers to send and receive USDC directly. Remitly has announced similar plans. Average global remittance fees remain around 6.6%, but stablecoins could reduce this by as much as 50%, presenting enormous value for families sending money internationally.

Implementation and Market Impact

McGranahan emphasized that Western Union's stablecoin pilots will initially focus on treasury operations and backend settlement processes. The goal is to "move money faster with greater transparency and at lower cost without compromising compliance or customer trust." By leveraging blockchain settlement rails, Western Union can achieve near-instant finality—settling transactions in seconds rather than the 2-5 days typical of SWIFT-based transfers. This represents a fundamental reimagining of how money moves across borders.

The company is also expanding partnerships to allow customers to move and hold stablecoin assets directly. This capability will be particularly valuable in high-inflation economies where holding U.S. dollar-denominated assets helps preserve purchasing power. McGranahan noted that "in many parts of the world, being able to hold a U.S. dollar-denominated asset has real value as inflation and currency devaluation can rapidly erode an individual's purchasing power."

According to the U.S. Treasury Department, the stablecoin market surpassed $300 billion in April 2025 and could reach $2 trillion by 2028, signaling massive institutional interest. Western Union's entry into this space represents a critical validation of stablecoins as legitimate payment infrastructure.

XRP and Ripple: Competitive Landscape Analysis

Western Union's stablecoin embrace has significant implications for Ripple and its native cryptocurrency XRP, which has long positioned itself as a direct alternative to SWIFT for cross-border payments. Ripple's business model centers on its On-Demand Liquidity (ODL) service, which leverages XRP to facilitate international transfers while bypassing traditional correspondent banking networks—exactly the same problem Western Union is now addressing with stablecoins.

The irony is striking: both Ripple and Western Union are pursuing the same goal—replacing SWIFT-based settlement—but with different technological approaches. Ripple introduced XRP as a bridge currency precisely to help banks and payment providers settle transfers in seconds rather than days, and institutions like Morgan Stanley have highlighted Ripple's technology as a superior alternative to SWIFT. Now Western Union is validating the broader thesis while choosing stablecoins as its preferred vehicle.

Competitive Pressures and Opportunities

The rise of stablecoin adoption by major payment processors creates both challenges and opportunities for XRP. On one hand, stablecoins like USDC and USDT currently dominate on-chain remittance volumes due to their price stability and regulatory legitimacy. Western Union's decision to use stablecoins rather than XRP for settlement suggests that institutional players may prefer the predictability of dollar-pegged assets over cryptocurrencies with price volatility.

However, XRP maintains distinct advantages. With settlement times of 3-5 seconds compared to Bitcoin's 10 minutes or SWIFT's 2-5 days, XRP offers superior speed. Additionally, Ripple has established partnerships with over 300 financial institutions across 45+ countries, with over 40% utilizing XRP for ODL services. Ripple's ODL transaction volume reached an astounding $1.3 trillion in Q2 2025.

Ripple's Strategic Response: RLUSD Stablecoin

Recognizing the competitive threat from stablecoins, Ripple launched its own institutional-grade stablecoin, Ripple USD (RLUSD), in December 2024. Available on both the XRP Ledger and Ethereum, RLUSD has already grown to exceed $700 million in market capitalization. This strategic move positions Ripple to compete directly in the stablecoin settlement space while leveraging XRP as a bridge asset between different stablecoin networks across various regulatory jurisdictions.

The RLUSD Opportunity: A Win-Win Scenario

Here's where the story gets particularly interesting for XRP holders: Western Union doesn't necessarily have to choose between stablecoins and XRP. RLUSD could be the stablecoin Western Union adopts, which would indirectly benefit the entire XRP ecosystem.

Many RLUSD transactions settle on the XRP Ledger, which means increased RLUSD adoption drives network activity, liquidity, and utility for the underlying XRPL infrastructure. Every RLUSD transaction that settles on the XRP Ledger creates network effects that strengthen the ecosystem. The XRPL's 3-5 second settlement times and minimal fees make it an ideal platform for stablecoin settlements at scale.

Additionally, as industry analysts note, numerous RLUSD transactions are settled via the XRP Ledger. This creates a complementary relationship: Western Union gets the price stability and regulatory clarity of a dollar-pegged stablecoin, while XRP benefits from increased network usage, higher transaction volumes, and greater institutional validation of the XRPL as payment infrastructure.

For complex, multi-jurisdictional payment flows, RLUSD and XRP could work in tandem. RLUSD could handle the dollar-denominated settlements where price stability is paramount, while XRP serves as the bridge asset connecting different currency corridors and stablecoin networks across regulatory boundaries. This "best of both worlds" approach would allow Western Union to leverage stablecoin predictability while tapping into XRP's superior liquidity provisioning in emerging markets where dollar stablecoins face regulatory restrictions.

The key insight is that XRP and stablecoins are not necessarily competitors—they can be complementary. XRP's capacity to function as a borderless bridge asset allows it to link disparate stablecoin networks across regulatory boundaries that stablecoins alone cannot easily navigate. This positions both RLUSD and XRP as essential components in complex payment flows.

Impact on XRP Price and Adoption

The SEC's reclassification of XRP as a commodity in August 2025 provided crucial regulatory clarity, ending the five-year legal battle that had clouded XRP's prospects. This resolution, combined with growing institutional adoption of blockchain payment rails, has created a more favorable environment for XRP. Current price predictions for 2025 range from $3.80 to $4.50, with some analysts forecasting potential peaks near $5 if Bitcoin maintains its bullish trajectory and the Federal Reserve implements expected rate cuts.

Western Union's stablecoin pilot validates the broader thesis that blockchain-based settlement is the future of cross-border payments. While Western Union may not directly adopt XRP, the company's move legitimizes the entire digital asset payment infrastructure category, potentially opening doors for Ripple's technology to gain traction with other financial institutions observing Western Union's results.

Beyond Competition: The Hybrid Future

Western Union doesn't have to choose between stablecoins and XRP—and as we'll see, they may already be positioning for both. Ripple's technology has been highlighted by institutions like Morgan Stanley as a superior alternative to SWIFT. The question is whether Western Union will leverage Ripple's full technology suite, including both XRP and RLUSD, or chart a different path entirely.

As it turns out, Western Union's relationship with Ripple runs deeper than most observers realize, which makes the RLUSD opportunity particularly compelling.

The Intermex Factor: Western Union Already Embracing XRP

Here's the bombshell that makes the RLUSD opportunity even more compelling: Western Union is already acquiring a company that uses Ripple's XRP technology.

In August 2025, Western Union announced a $500 million all-cash acquisition of International Money Express (Intermex), a remittance company that has been using Ripple's On-Demand Liquidity (ODL) services since 2020. The deal, which values Intermex at $16 per share—a 50% premium over its 90-day volume-weighted average—is expected to close in mid-2026 pending regulatory approval.

Inheriting Ripple-Powered Infrastructure

By acquiring Intermex, Western Union isn't just gaining a well-established remittance business with 6 million customers and strong Latin American operations—it's inheriting Ripple-powered payment infrastructure that actively uses XRP for cross-border settlements. Intermex has been leveraging Ripple's ODL technology for years, particularly across Latin America, one of the world's highest-volume remittance corridors.

This acquisition dramatically shifts the Western Union-Ripple relationship from theoretical to operational. Western Union's stablecoin pilot isn't happening in a vacuum—the company is simultaneously bringing proven XRP-based payment flows into its network through Intermex. The deal is expected to boost Western Union's adjusted earnings by over $0.10 per share in the first full year, with $30 million in annual cost savings anticipated within two years.

The RLUSD Integration Path

This is where RLUSD becomes the perfect bridge solution. Western Union will inherit XRP infrastructure through Intermex while piloting stablecoin settlement in its legacy operations. RLUSD represents the ideal convergence point:

- Existing XRP relationships: Western Union will already have operational XRP flows through Intermex, making Ripple a known, trusted partner

- Infrastructure compatibility: RLUSD settling on the XRP Ledger seamlessly integrates with Intermex's existing ODL infrastructure

- Stablecoin benefits: Western Union gets the price stability and regulatory clarity it seeks with stablecoins

- XRP ecosystem growth: Every RLUSD transaction on XRPL drives network activity, liquidity, and utility for the entire ecosystem

- Hybrid model: XRP ODL for high-liquidity corridors, RLUSD for markets requiring dollar-pegged stability

Rather than Western Union choosing between "stablecoins or XRP," the company could leverage both: continuing Intermex's XRP ODL operations while expanding RLUSD adoption for additional corridors where stablecoin characteristics provide advantages. This "best of both worlds" approach maximizes flexibility while strengthening the entire Ripple ecosystem.

Market Impact and Strategic Implications

Crypto analyst Xaif Crypto noted on social media that this acquisition positions Western Union "to dominate money flows across all of America" while marking "a significant step toward XRP's broader objective of achieving global market dominance." The combination of Western Union's vast global network with Intermex's proven Ripple ODL usage could enhance the speed, reliability, and cost-efficiency of transactions across multiple geographies.

With Western Union processing 70 million transfers quarterly and Intermex adding 6 million customers with established Latin American corridors, the potential volume flowing through Ripple's infrastructure—whether XRP ODL or RLUSD settlement—could be substantial. This aligns with the growing trend of financial giants tapping blockchain technology to remain competitive in the evolving global payments market.

Looking Ahead

Western Union plans to share additional details about its digital asset strategy at its Investor Day on November 6. The company's stablecoin pilot represents a watershed moment for the remittance industry, signaling that even the most established players recognize the need to adapt to blockchain-based payment infrastructure.

However, the bigger story may be unfolding behind the scenes. With Western Union's pending acquisition of Intermex—an active Ripple ODL user since 2020—the company is already embracing XRP-powered settlement infrastructure. The stablecoin pilot and Intermex acquisition together suggest Western Union may be positioning for a hybrid approach: XRP ODL for certain corridors and RLUSD stablecoin settlement for others, creating a comprehensive blockchain payment strategy that leverages the strengths of both technologies.

If RLUSD emerges as Western Union's preferred stablecoin—settling transactions on the XRP Ledger—it would create a powerful synergy: Western Union gets the stability and regulatory clarity of dollar-pegged stablecoins while simultaneously driving massive transaction volume through the XRPL ecosystem. With 70 million quarterly transfers from Western Union plus Intermex's 6 million customers, even a fraction of this volume flowing through Ripple's infrastructure would represent unprecedented institutional validation.

As McGranahan emphasized, "This is not about speculation. It is about giving our customers more choice and control in how they manage and move their money." With regulatory clarity now established through the GENIUS Act and operational XRP infrastructure coming through Intermex, Western Union may be uniquely positioned to lead the industry's transition from SWIFT-based settlement to blockchain-powered payments—potentially with Ripple's technology at the center of that transformation.

DISCLAIMER: This newsletter is for informational purposes only and does not constitute investment advice, advertising, or a recommendation to buy, sell, or hold any securities. This content is not sponsored by or affiliated with any of the mentioned entities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.

Sources

- TradingView/NewsBTC: How Western Union's Acquisition Of Intermex Is A Win For Ripple And XRP

- Blockhead: Western Union CEO Unveils Stablecoin Plans for Treasury and Customer Payments

- Yahoo Finance: Western Union to Pilot Stablecoin Settlement System for Global Remittances

- BanklessTimes: Western Union to Launch Stablecoin Settlement Pilot

- 99Bitcoins: Western Union Pilots Stablecoins, Fed "Skinny" Accounts

- CCN: Western Union Follows Banks Into Stablecoin Integration

- BeInCrypto: Stablecoin Transfers Coming Soon to Western Union

- Cryptopolitan: Western Union to pilot stablecoin-powered cross-border transfers

- ForkLog: Western Union to Integrate Stablecoins into Money Transfers

- CoinPaper: Why Western Union Is Finally Embracing Stablecoins After Years of Caution

- U.S. Congress: Text - S.394 - GENIUS Act of 2025

- Latham & Watkins: The GENIUS Act of 2025: Stablecoin Legislation Adopted in the US

- World Economic Forum: How will the GENIUS Act work in the US and impact the world?

- The White House: Fact Sheet - President Donald J. Trump Signs GENIUS Act into Law

- Fortune: Ripple is branching out into mainstream finance

- 99Bitcoins: Ripple XRP Price Prediction for 2025-2030

- OneSafe: Is XRP Set for a Bright Future by 2025?

- FinancialContent: Ripple's XRP Poised to Revolutionize Global Payments

- The Motley Fool: Is the Cryptocurrency XRP (Ripple) a Millionaire Maker?

- Cointelegraph: Why XRP matters: 5 key factors driving its value beyond price

- Benzinga: Ripple (XRP) Price Prediction: 2025, 2026, 2030