Trump Takes Quantum Stakes: What This Means for Crypto Security

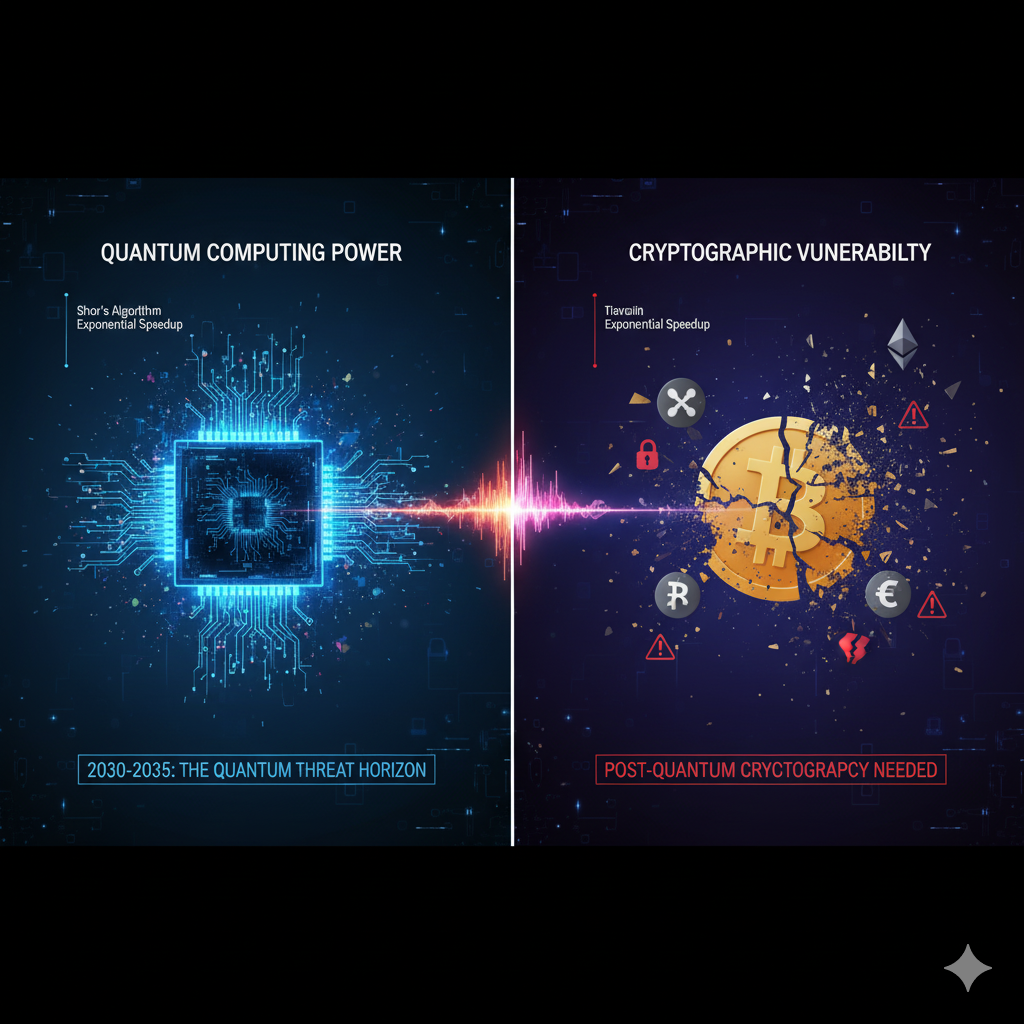

Trump Administration's quantum computing equity stakes accelerate breakthrough tech—and the existential threat to crypto. XRP prepares while Bitcoin faces a $3T vulnerability. Timeline: 2030-2035

The Trump Administration is negotiating equity stakes in major quantum computing firms, marking an unprecedented government intervention that could accelerate both breakthrough technology—and the existential threat it poses to cryptocurrency security.

In a development that sent quantum computing stocks surging over 14% on October 23, 2025, the Trump Administration confirmed discussions to acquire equity positions in several quantum computing companies, including IonQ, Rigetti Computing, and D-Wave Quantum. According to the Wall Street Journal, these companies are negotiating government shareholdings as part of funding agreements, with minimum awards starting at $10 million each.

A Pattern of Strategic Government Investment

This quantum initiative follows the administration's 10% equity stake in Intel, which converted approximately $9 billion in CHIPS Act grants into government ownership. That deal, finalized in August 2025, resulted in Intel's market capitalization surging from $107 billion to $181 billion. Commerce Secretary Howard Lutnick revealed that similar discussions are underway for defense contractors like Lockheed Martin, signaling a broader strategy to align corporate priorities with national security imperatives.

The administration frames these equity stakes as necessary to secure America's technological edge against China's dominance in critical industries. By positioning the government as a long-term investor, President Trump may fundamentally reshape how the U.S. economy operates—a shift that some analysts compare to the most significant restructuring of American capitalism since the New Deal.

The Quantum Computing Race: Why This Matters Now

Quantum computing represents a paradigm shift in computational power. Unlike classical computers that process information in binary (0s and 1s), quantum computers use "qubits" that can exist in multiple states simultaneously through quantum phenomena like superposition and entanglement. This allows quantum machines to perform calculations at speeds that would take classical computers millennia to complete.

Recent breakthroughs have dramatically accelerated the timeline for practical quantum applications. In February 2025, Microsoft unveiled a new chip showing that quantum computing is "years, not decades" away. Google and IBM have made similar predictions, with IBM's quantum computing roadmap projecting systems surpassing 1,000 qubits within the next few years and potentially exceeding several thousand qubits by 2035.

The Crypto Industry's $3 Trillion Vulnerability

For the cryptocurrency industry, quantum computing presents an existential threat. Quantum computers equipped with Shor's algorithm could potentially break the elliptic curve cryptography (ECC) and RSA encryption that secure Bitcoin, Ethereum, and virtually all major cryptocurrencies. This could enable bad actors to decrypt private keys from public keys, gaining unauthorized access to digital wallets worth hundreds of billions of dollars.

The stakes are enormous. According to the Quantum Alliance Initiative, a successful quantum attack on Bitcoin alone could lead to losses exceeding $3 trillion, sending shockwaves through the global economy. Research published in ScienceDirect estimates that by 2035, quantum computers capable of breaking RSA2048—a vital cryptographic scheme—will exist.

How Quantum Computers Threaten Blockchain Security

The threat manifests in several critical areas:

1. Private Key Extraction: Current cryptographic algorithms make it virtually impossible for classical computers to derive private keys from public keys. However, quantum computers using Shor's algorithm could potentially accomplish this in hours or minutes, exposing user funds to theft.

2. Mining Centralization: Quantum computers could dominate the mining process, disrupting the decentralization fundamental to blockchain systems. Scientific research indicates that quantum machines could more easily solve consensus mechanism puzzles like proof-of-work, potentially enabling 51% attacks.

3. "Harvest Now, Decrypt Later" Attacks: Adversaries are already collecting encrypted blockchain data with the intention of decrypting it once quantum computers become powerful enough. This poses a long-term risk to the confidentiality of transactions.

Timeline: When Will Quantum Threaten Crypto?

Expert predictions for when quantum computers will pose a genuine threat to cryptocurrency security vary, but consensus is building around a critical window:

Optimistic Estimates (2027-2030): Some academic forecasts suggest quantum machines capable of threatening Bitcoin could arrive as early as 2027 to 2030. David Carvalho, CEO of Naoris Protocol, warned that Bitcoin could be cracked within five years, pointing to Microsoft's Majorana chip and other emerging technologies.

Moderate Estimates (2030-2035): The U.S. National Institute of Standards and Technology (NIST) recommends migrating to quantum-resistant systems by 2030-2035. Google quantum researcher Craig Gidney suggested in May 2025 that Bitcoin's encryption could be vulnerable between 2030 and 2035, requiring significantly fewer quantum resources than previously estimated.

Conservative Estimates (2035+): Some Bitcoin researchers and industry veterans, including Blockstream CEO Adam Back, believe the threat is still at least two decades away. However, even conservative estimates acknowledge that the timeline could accelerate with unexpected breakthroughs.

The Boston Consulting Group warns that state-sponsored attackers could be the first movers around 2035, exploiting quantum capabilities for espionage purposes.

XRP and Ripple: Positioning for a Quantum-Resistant Future

Among major cryptocurrencies, XRP has emerged as a potential leader in preparing for the quantum era. Ripple has actively engaged with cryptography experts like Professor Massimiliano Sala of the University of Trento to understand and address quantum vulnerabilities.

"Quantum computers could easily solve problems that are foundational to digital signatures, thus potentially undermining the mechanisms that protect users' assets on blockchain platforms," Professor Sala explained in a discussion with Ripple. He emphasized the necessity of transitioning to quantum-resistant cryptographic systems, stating that "all classical public-key cryptosystems should be replaced with counterparts secure against quantum attacks."

XRP's Quantum Resistance Strategy

According to D24 Fintech Group, Ripple's developers are actively enhancing the XRP Ledger with quantum-resistant cryptography, incorporating post-quantum algorithms like Hash-Based Signatures and Lattice-Based Cryptography. This proactive approach could position XRP as a security benchmark, attracting financial institutions and governments seeking future-proof payment infrastructure.

"If quantum machines reach full capability, they could compromise crypto security within seconds," said Osama Bari, Chief Technology Officer at D24 Fintech Group. "Ripple's developers are preparing for this challenge by enhancing the XRP Ledger with quantum-resistant cryptography."

However, Ripple CTO David Schwartz has urged patience, noting that current quantum-safe cryptographic methods are not yet well-suited to blockchain applications. "The problem is that current quantum-safe cryptographic methods are not well-suited to blockchain applications. They are inefficient, difficult to implement and simply not worth the tradeoffs right now," Schwartz stated.

Strategic Implications for XRP

The quantum computing developments could significantly impact XRP in several ways:

1. Central Bank Digital Currency (CBDC) Adoption: With quantum-resistant security, XRP could become a preferred blockchain for CBDCs, positioning it for institutional adoption by governments seeking secure payment infrastructure.

2. Competitive Advantage: Unlike Bitcoin, which faces significant challenges in upgrading its decentralized network, XRP's centralized governance structure allows for more rapid implementation of quantum-resistant protocols.

3. Financial Institution Appeal: Banks and payment networks prioritizing security could favor XRP's quantum-ready infrastructure over potentially vulnerable alternatives.

4. Price Impact: If the SEC drops its appeal against Ripple and an XRP ETF gains approval, the combination of regulatory clarity and quantum resistance could drive significant price appreciation.

Global Security Considerations: Beyond Cryptocurrency

The Trump Administration's quantum computing strategy extends far beyond cryptocurrency concerns. The national security implications are profound and multifaceted.

Strategic Technology Competition

Quantum computing represents a critical battlefield in the technological competition between the United States and China. The Department of Defense's equity approach is designed to secure supply chains, accelerate innovation, and ensure long-term U.S. dominance in technologies that could determine the balance of global power.

By taking equity stakes, the administration creates a hybrid public-private partnership model that aligns corporate financial incentives with national security objectives. This could accelerate the development of quantum technologies while ensuring they serve American interests.

Dual-Use Technology Concerns

Quantum computing is inherently dual-use technology—valuable for both commercial applications and military/intelligence purposes. Intelligence agencies have demonstrated interest in quantum computing for surveillance, with programs like "Penetrating Hard Targets" specifically aimed at developing quantum capabilities to break encryption.

The same quantum computers that could optimize drug discovery and financial modeling could also crack military communications, compromise classified information, and undermine the security infrastructure of adversary nations.

Supply Chain Vulnerabilities

The administration's focus on domestic quantum computing development addresses critical supply chain vulnerabilities. Similar to rare earth elements and semiconductor manufacturing, quantum computing capabilities concentrated in foreign nations—particularly China—pose strategic risks.

Government equity stakes enable the U.S. to break China's potential stranglehold on quantum computing supply chains, ensuring American access to this transformative technology regardless of geopolitical tensions.

Market Implications and Investor Considerations

The quantum computing equity announcements triggered immediate market reactions. IonQ shares surged over 14%, with other quantum computing stocks experiencing similar rallies. Trading volumes spiked dramatically, surpassing average daily figures by over 200%.

For cryptocurrency investors, the quantum developments present a complex risk-reward scenario:

Short-Term Opportunities: Cryptocurrencies positioning themselves as quantum-resistant, like XRP, could see increased investor interest and price appreciation as the quantum threat becomes more widely understood.

Mid-Term Risks: As quantum computing capabilities advance toward the 2030-2035 threshold, cryptocurrencies without credible quantum resistance plans could face significant selling pressure and capital flight to safer alternatives.

Long-Term Transformation: The crypto industry will likely divide between quantum-resistant "next-generation" protocols and legacy systems that fail to adapt, similar to how Y2K-compliant software separated winners from losers.

Industry Response: Post-Quantum Cryptography Solutions

The cryptocurrency industry is not standing idle. NIST has been leading efforts to standardize post-quantum cryptographic algorithms designed to resist quantum attacks. Several promising approaches have emerged:

Lattice-Based Cryptography: Creates puzzles too complex for quantum computers to solve efficiently. CRYSTALS-Kyber leads this approach.

Hash-Based Methods: Quantum Resistant Ledger (QRL) uses XMSS signatures to ensure data integrity against quantum attacks.

Code-Based Cryptography: The McEliece system uses noisy signals to protect messages.

Multivariate Polynomial Cryptography: Adds robust defenses through complex equations.

A recent proposal for Bitcoin outlines a phased strategy to retire vulnerable legacy signature schemes by 2030, introducing quantum-resistant addresses under the "Pay-to-Quantum-Resistant-Hash" (P2QRH) format.

Expert Perspectives: Divided on Urgency

The crypto community remains divided on how urgently to address the quantum threat:

Immediate Action Camp: A recent CoinDesk opinion piece warns that "many operators are prioritizing hypergrowth over responsible scaling and are neither acting with sufficient urgency nor partnering with AI and quantum experts to future-proof systems."

Measured Response Camp: Ripple CTO David Schwartz compared quantum computing to cold fusion—"always just a few years away, but never quite arriving." He argues that while the threat is real, the urgency is often overstated.

Skeptical Camp: Some researchers view quantum computing as still decades away from practical applications that could threaten cryptocurrency security, citing the enormous technical challenges in achieving the millions of qubits required.

Conclusion: A Race Against Quantum Time

The Trump Administration's unprecedented move to acquire equity stakes in quantum computing firms represents a pivotal moment in the convergence of technology, national security, and financial infrastructure. By accelerating quantum development through government investment, the administration is inadvertently hastening both the promise and the peril of this transformative technology.

For the cryptocurrency industry, the message is clear: adaptation is not optional. The quantum threat timeline may be debated, but the direction is certain. Cryptocurrencies that proactively implement quantum-resistant protocols—like XRP's ongoing efforts—will be positioned to survive and thrive in the post-quantum era. Those that delay risk obsolescence.

The global security implications extend far beyond digital assets. Quantum computing will reshape cybersecurity, military intelligence, financial systems, and international power dynamics. Government equity stakes ensure national champions emerge in this critical technology sector, but they also raise questions about market distortion, governance conflicts, and the proper role of government in technological development.

As we approach the 2030-2035 quantum threshold, one certainty emerges: the next decade will determine whether blockchain technology evolves to meet the quantum challenge or becomes a historical footnote in the annals of cryptographic vulnerability. The race against quantum time has begun, and the stakes—financial, technological, and geopolitical—could not be higher.

Sources

- Reuters via Yahoo Finance - Trump administration in talks to take stakes in quantum-computing firms

- Investing.com - Trump administration in talks to take stakes in quantum-computing firms

- Tom's Hardware - Intel gains $73 billion in market cap since U.S. government investment

- CNBC - Trump Pentagon weighing equity stakes in defense contractors

- ScienceDirect - Vulnerability of blockchain technologies to quantum attacks

- Coinbase - Is quantum computing a threat for crypto?

- Cointelegraph - Cryptocurrency vs. Quantum Computing

- Nature Scientific Reports - Quantum-resistance in blockchain networks

- Ripple - Quantum Computing's Impact on Blockchain

- FF News - XRP Has the Potential to Pioneer Quantum-Ready Blockchain Security

- U.Today - Is XRP at Risk? Ripple CTO Ends Speculation About Quantum Threat

- The Quantum Insider - Blockchain And Quantum Computing Are on a Collision Course

- OKX - Quantum Bitcoin Cryptography: Threats

- Cointelegraph Magazine - Bitcoin vs. the quantum computer threat: Timeline and solutions

- Bitcoin Magazine - What Happens To Bitcoin When Quantum Computers Arrive?

- Boston Consulting Group - How Quantum Computing Will Upend Cybersecurity

- CoinDesk - It's Time for the Crypto Industry to Take the Threat of Quantum Computing Seriously

- Ledger - Bitcoin And Quantum Computing - is it a Threat?

- AIInvest - U.S. Government's Strategic Equity Stakes in Defense

- Christian Science Monitor - Bucking tradition, Trump pushes the US as an investor in for-profit companies

DISCLAIMER: This newsletter is for informational purposes only and does not constitute investment advice, advertising, or a recommendation to buy, sell, or hold any securities. This content is not sponsored by or affiliated with any of the mentioned entities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.