Trump Media Files for Multi-Crypto ETF: XRP Included in Blue Chip Basket

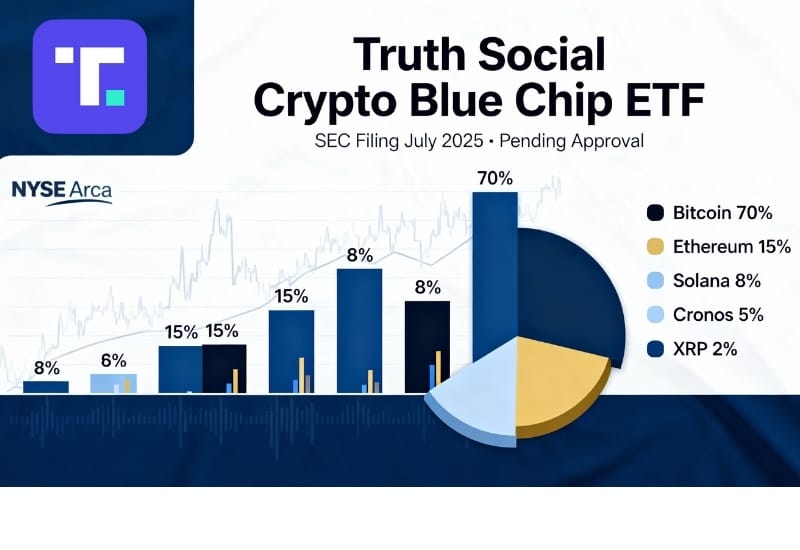

Trump Media files for Crypto Blue Chip ETF including XRP at 2% allocation alongside Bitcoin (70%), Ethereum (15%), Solana (8%), and Cronos (5%). The SEC filing marks Truth Social's third crypto ETF proposal, pending regulatory approval for NYSE Arca trading.

Trump Media and Technology Group has filed a registration statement with the U.S. Securities and Exchange Commission for the Truth Social Crypto Blue Chip ETF, marking the company's latest venture into the digital asset space. The fund includes XRP alongside Bitcoin, Ethereum, Solana, and Cronos, with the initial allocation expected to approximate 70% Bitcoin, 15% Ethereum, 8% Solana, 5% Cronos, and 2% XRP.

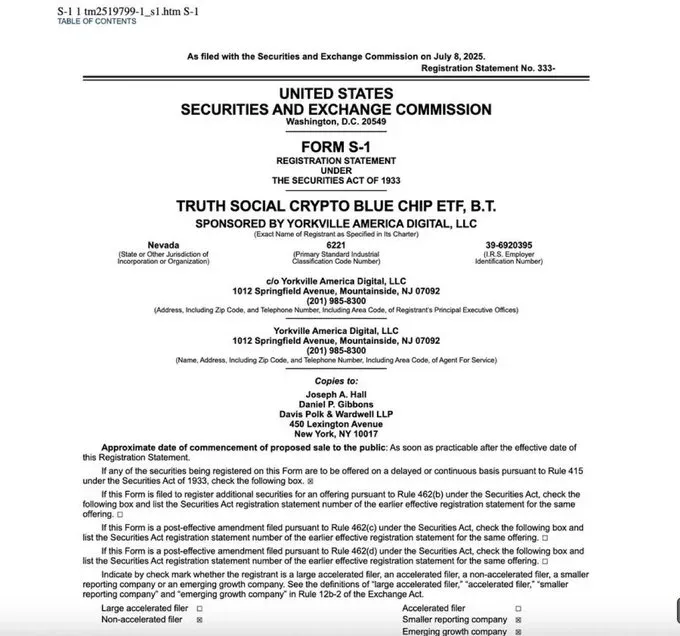

Filed on July 8, 2025, this represents Trump Media's third crypto ETF application, following previous filings for Bitcoin-only and Bitcoin-Ethereum combination funds. The ETF will be sponsored by Yorkville America Digital, with Crypto.com serving as the exclusive digital asset custodian and prime execution agent.

What the Filing Includes

The S-1 registration statement filed with the SEC outlines a multi-asset basket approach to cryptocurrency exposure. According to the preliminary prospectus, any changes to the allocation ratio will require an amendment to the agreement and regulatory approval.

The fund aims to reflect the price performance of Bitcoin, Ethereum, Solana, Cronos, and XRP, with shares expected to be offered on the New York Stock Exchange Arca. The ETF will hold these digital assets directly rather than through derivatives or futures contracts.

The filing is part of a broader partnership between Trump Media and Crypto.com, announced earlier this year, to launch a series of ETFs focusing on digital assets and securities with a "Made in America" focus.

XRP's 2% Allocation: What It Means

While XRP represents the smallest allocation at 2% of the proposed fund, its inclusion signals institutional recognition of the asset's standing in the cryptocurrency market. This development comes after years of regulatory uncertainty surrounding XRP.

Important context: The SEC and Ripple Labs officially resolved their legal dispute in August 2025. Both sides dropped appeals and Ripple agreed to a $125 million civil penalty, ending a case that began in December 2020. Judge Analisa Torres ruled that XRP is not a security when sold in public retail transactions, though certain institutional sales were deemed securities transactions.

With regulatory clarity now established, XRP has become eligible for inclusion in registered investment products. Multiple asset management firms have recently launched spot XRP ETFs, with Franklin Templeton, Bitwise, Canary Capital, and Grayscale all bringing products to market in November 2025.

The Broader XRP ETF Landscape

The Truth Social filing joins a growing field of XRP-focused investment products. Franklin Templeton's XRP ETF secured approval for listing on NYSE Arca, trading under ticker XRPZ with a 0.19% NAV-based sponsor fee. The firm plans to waive the fee entirely on the initial $5 billion in assets through May 31, 2026.

Bitwise's XRP ETF closed at $11.40 on NASDAQ under ticker XRPI, while Canary Capital's first XRP ETF, XRPC, raised more than $250 million on its first day of trading. According to market analysts, over $500 million in combined day-one volume was anticipated from the Franklin Templeton and Grayscale launches.

Regulatory Status and Timeline

The Truth Social Crypto Blue Chip ETF remains in the registration phase. The registration statement has been filed with the SEC but has not yet become effective. The fund will need both SEC approval of the registration statement and a separate 19b-4 filing through an exchange before shares can begin trading.

According to the filing, the ETF will not operate as a registered investment company and will not be subject to Commodity Futures Trading Commission rules as a commodity pool. Instead, the ETF will issue and redeem shares in blocks of 10,000 through authorized broker-dealers.

Market Context for XRP

As of December 10, 2025, XRP trades around $2.08, according to current market data showing a 24-hour high of approximately $2.17 and low of $2.05. The token has traded in a tight band near $2.03-$2.10 for most of the past week, underscoring consolidation rather than a clear breakout.

XRP's market capitalization sits around the mid-$120 billion mark, ranking it firmly among the top five crypto assets by market cap alongside Bitcoin, Ethereum, Tether, and BNB.

Technical analysis from multiple sources suggests near-term resistance around the $2.12-$2.17 zone, with support holding above the psychological $2.00 level. According to Ray Youssef, CEO of NoOnes, "December is likely to look very different for XRP this year, mainly because institutional demand has now arrived through ETFs."

Ripple's Post-Settlement Expansion

Following the SEC case resolution, Ripple has moved forward with strategic initiatives. The company has introduced the RLUSD stablecoin, which reached over $1 billion in market capitalization by November 2025, and acquired a prime brokerage firm.

Ripple spent more than $150 million defending itself during the litigation, but emerged with its core business intact and leadership free of liability. The settlement cleared the way for new product development and institutional partnerships that were previously on hold.

What This Means for XRP Investors

The inclusion of XRP in the Truth Social Crypto Blue Chip ETF, alongside established assets like Bitcoin and Ethereum, represents continued institutional validation. However, investors should understand several key points:

1. Allocation Size Matters: At 2% of the fund's allocation, XRP represents a relatively small position compared to Bitcoin's 70% weighting. This means the ETF's price performance will be heavily influenced by Bitcoin movements rather than XRP specifically.

2. Regulatory Approval Required: The filing does not guarantee approval. The SEC must review the registration statement, and the fund requires exchange approval before trading can begin. No timeline has been provided for when these approvals might occur.

3. Market Impact Uncertain: While ETF filings can generate positive sentiment, technical analysis indicates XRP must clear $2.307 and then the key breakout level at $2.459 for sustained upward momentum. According to analysts, a clean daily close above $2.459 unlocks the next zone near $2.612.

4. Competition Among Products: Multiple XRP ETFs are now competing for investor capital, which could fragment demand rather than concentrate it. Investors can choose between dedicated XRP ETFs from Franklin Templeton, Bitwise, Grayscale, and Canary Capital, or diversified products like the Truth Social offering.

Critical Considerations for Investors

Price Predictions Vary Widely: Market forecasts for XRP range significantly. OpenAI's ChatGPT recently predicted around $2.02 by early December, while crypto analysts see targets clustering around $2.70-$2.85 for December 2025. This 41% gap reflects uncertainty about near-term price direction.

AI models focused on bearish technicals noted that XRP trades below its 50-day and 200-day moving averages, signaling the overall trend remains down. However, analysts point to improving fundamentals and historical patterns favoring a rebound.

ETF Launches Don't Guarantee Price Appreciation: While regulated investment products provide institutional access, they don't automatically drive prices higher. Wallets holding 1-10 million XRP sold more than 390 million coins in a week, worth roughly $783 million at current prices, indicating whale distribution. Simultaneously, 1- to 2-year holders increased their share of XRP supply from about 8.58% to 9.81% in seven days, suggesting longer-term accumulation.

Market Sentiment Remains Cautious: The current forecast for XRP in 2025 is bearish according to multiple technical indicators, with the Fear & Greed Index showing 22 (Extreme Fear). XRP recorded 12/30 (40%) green days with 6.35% price volatility over the last 30 days.

Bottom Line

The Truth Social Crypto Blue Chip ETF filing adds XRP to a basket of major cryptocurrencies, providing another potential avenue for institutional exposure. However, at just 2% allocation, this development represents incremental rather than transformative impact for XRP.

The real significance lies in continued institutional recognition of XRP as a legitimate digital asset worthy of inclusion in regulated investment products. This comes after years of regulatory battles that previously prevented such offerings.

For XRP to break out of its current consolidation range, market participants suggest it will require sustained buying pressure beyond ETF-related speculation. According to Ray Youssef, "If BTC and ETH experience another downturn in December, XRP will likely follow suit," noting that broader market conditions remain critical.

The filing is currently under SEC review with no confirmed timeline for approval or launch. Investors should monitor both the registration process and XRP's ability to hold support above $2.00 while building momentum toward the $2.30-$2.60 resistance zone.

Sources

Primary Sources:

- Trump Media & Technology Group - Official Press Release (Globe Newswire)

- SEC.gov - Ripple Settlement Statement

- SEC.gov - Ripple Labs Litigation Release

Industry News Outlets:

- The Block - Trump's Truth Social Files for Crypto Blue Chip ETF

- Cointelegraph - Truth Social Files for Blue-Chip Crypto ETF

- CoinDesk - Trump Media Aims to Bring Blue Chip Crypto ETF to Market

- Crypto Briefing - Franklin Templeton's XRP ETF Receives NYSE Listing Approval

- Crypto Briefing - Court Approves Ripple, SEC's Motion to Dismiss Appeal

Market Analysis:

- Trading News - XRP ETFs Launch on NYSE

- BeInCrypto - XRP Price Looks Extremely Bullish For December

- TS2 Tech - XRP Price Today, December 10, 2025

- TS2 Tech - XRP Price Forecast for December 2025

- Yahoo Finance - XRP Price Target December 2025

- CoinCodex - XRP Price Prediction 2025

Legal & Regulatory Analysis:

- Coincub - Ripple vs SEC: Full Case Timeline

- Capital.com - Ripple vs SEC: What the Ruling Means for XRP

- CCN - Ripple vs. SEC Lawsuit: Complete Timeline

Additional Resources:

- Crypto Ninjas - Bitwise XRP ETF Confirmed Launch Dates

- Rolling Out - Franklin Templeton Wins Major Approval for New XRP ETF

- Nasdaq - Trump Media Files Registration Statement

DISCLAIMER: This newsletter is for informational purposes only and does not constitute investment advice, advertising, or a recommendation to buy, sell, or hold any securities. This content is not sponsored by or affiliated with any of the mentioned entities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.