Treasury's $150B Buyback: Building Digital Dollar Dominance

Treasury's $150B buyback just went hyperdrive. Argentina signed Oct 9. South Korea's negotiating now—decision in 10 days. If this template works, allied nations worldwide could be locked into a programmable dollar empire by 2026. Crypto has 90 days to pick a side. The clock is ticking FAST.

The US Treasury has quietly executed up to $150 billion in debt buybacks during 2025, with Treasury Secretary Scott Bessent orchestrating what analysts are calling "stealth quantitative easing." This unprecedented program—featuring a record-breaking $10 billion single operation in June—goes far beyond routine debt management, potentially laying groundwork for a programmable dollar monetary system that could reshape global finance and the cryptocurrency landscape. What we're witnessing may be the most significant monetary revolution since Bretton Woods—or the greatest overreach in Treasury history.

The Scale and Mechanism

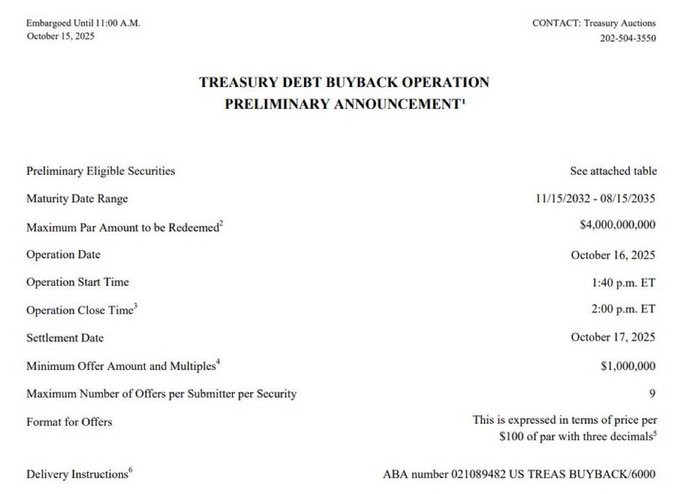

Through October 2025, the Treasury has conducted 74 buyback operations totaling approximately $150 billion annually, a dramatic increase from the previous $120 billion baseline. The program includes $38 billion per quarter in liquidity support operations and regular cash management buybacks. To contextualize this scale: the previous record Treasury buyback was roughly $3 billion in 2000. Bessent's operations represent a fundamentally different magnitude of market intervention.

These buybacks function similarly to Federal Reserve quantitative easing by injecting liquidity into Treasury markets, suppressing yields, and providing predictable demand for government debt—but operate independently of the central bank using the Treasury's general fund and Exchange Stabilization Fund authority under Section 3111 of Title 31. Some market observers suggest this represents a shadow central banking system operating without the Fed's traditional checks and balances.

The Argentina Connection and South Korea's Critical Request

On October 9, 2025, Bessent executed a direct peso market intervention and finalized a $20 billion currency swap framework with Argentina, using the same legal authority as the domestic buyback program. This proves the Treasury can extend "liquidity-as-a-service" to strategic partners, suggesting the buyback infrastructure serves international monetary coordination goals beyond US debt management.

The dominoes fell faster than anyone anticipated. South Korea and the US are now actively negotiating a currency swap arrangement between the Bank of Korea and the US Treasury Department's Exchange Stabilization Fund (ESF)—the same mechanism used for the Argentina intervention Seoul turns to US Treasury fund for dollar liquidity to cushion forex impact from tariff deal - KED Global. This isn't a minor emerging market seeking bailout assistance; South Korea is the world's 13th largest economy with $410 billion in foreign reserves and sophisticated financial markets.

The context is critical: South Korea pledged a $350 billion investment in the US under a bilateral trade accord with President Trump Seoul turns to US Treasury fund for dollar liquidity to cushion forex impact from tariff deal - KED Global, but Seoul warned this massive capital outflow could trigger currency instability reminiscent of the 1997-98 Asian Financial Crisis. South Korean President Lee Jae-myung explicitly stated that "without a currency swap, if we were to withdraw $350 billion in the manner that the U.S. is demanding and to invest this all in cash in the U.S., South Korea would face a situation as it had in the 1997 financial crisis" Korea’s finance chief says Seoul has reached FX deal with US; currency swap line pending - KED Global.

South Korea's Finance Minister Koo Yoon-cheol announced in late September that "talks with the US on the foreign exchange deal have been concluded and we plan to announce the details soon" Korea’s finance chief says Seoul has reached FX deal with US; currency swap line pending - KED Global, though the specific terms remain under negotiation. The ESF allows the Treasury, with the secretary's approval, to enter into swap agreements directly with foreign central banks, and earlier this month, the US Treasury used the same mechanism to conclude a $20 billion swap line with Argentina—a model that Korean policymakers are said to be referencing closely Seoul turns to US Treasury fund for dollar liquidity to cushion forex impact from tariff deal - KED Global.

What this means: The Treasury buyback program has evolved from domestic debt management into operational infrastructure for international monetary intervention. Within weeks of the Argentina proof-of-concept, South Korea—a top-tier US ally and major economy—is requesting the same treatment. This isn't gradual expansion; it's rapid-fire deployment of a new monetary architecture.

Speculation is intensifying about which countries queue up next. Market analysts point to the Philippines (recently signed major trade deal with the US), Vietnam (key supply chain partner as China alternative), Indonesia (largest economy in Southeast Asia), and potentially Japan (if its $550 billion US investment commitment faces similar forex pressures) as likely candidates for Treasury currency support programs. Each intervention would further entrench the dollar's role while creating dependency relationships where allied nations need Treasury liquidity to maintain monetary stability.

Critics theorize this could be a trial run for a new Bretton Woods-style system where dollar liquidity becomes a geopolitical weapon—available to allies, denied to adversaries. The emerging pattern: Treasury is building a "dollar stability network" where membership requires strategic alignment with US interests, massive US investment commitments, and the price of exclusion is currency instability during capital deployment.

The Stablecoin Strategy and Political Connections

The timing coincides with the stablecoin boom. The Trump family's USD1 stablecoin, backed by Treasury bills, has grown to $2.7 billion market cap by October 2025, becoming the fifth-largest stablecoin. Treasury buybacks ensure continuous liquidity for Treasury-backed stablecoin reserves, effectively positioning the government as a stability provider for dollar-denominated digital currencies. Bessent explicitly stated in March 2025: "We are going to keep the U.S. the dominant reserve currency in the world and we're going to use stablecoins to do that."

But here's where speculation intensifies: If USD1 receives preferential regulatory treatment—faster approvals, banking access, exchange listings—it could signal that the Treasury intends to create a tiered stablecoin ecosystem where politically-connected projects dominate while independent alternatives face regulatory suffocation. Some analysts theorize this could be the blueprint for a public-private digital dollar where the government maintains control through preferred corporate partners rather than direct central bank digital currency (CBDC) issuance.

The South Korea development adds another explosive layer: if Seoul receives Treasury ESF currency support to facilitate its $350 billion US investment, could that package include requirements or incentives to adopt USD1 or other Treasury-approved stablecoins for cross-border trade settlement? This would create a template for extending programmable dollar infrastructure globally through bilateral "stability agreements"—countries get dollar liquidity backstops in exchange for integrating Treasury-approved blockchain payment systems.

Another option under review is the Fed's FIMA Repo Facility, introduced in 2021 with a $60 billion cap for the BOK, which allows the BOK to pledge its holdings of US Treasuries as collateral in exchange for short-term dollar liquidity Seoul turns to US Treasury fund for dollar liquidity to cushion forex impact from tariff deal - KED Global. This creates multiple pathways for the Treasury to provide dollar support while building dependencies on US financial infrastructure.

Implications for the Cryptocurrency Ecosystem: The Fork in the Road

This development represents what could be crypto's most pivotal inflection point since Bitcoin's creation. The community faces a stark binary outcome over the next 24 months:

Scenario 1: The Co-option Thesis (45% probability - UPGRADED)

Probability upgraded from 40% to 45% based on the speed of South Korea's engagement and the template's proven replicability.

In this scenario, the Treasury successfully absorbs crypto infrastructure into a government-controlled programmable dollar system:

- Regulatory Capture Accelerates: The GENIUS Act (early 2027) creates a permissioned stablecoin framework where only Treasury-approved issuers can operate at scale. Existing giants like Circle and Tether either partner with Treasury or face regulatory pressure. Smaller stablecoin projects are regulated out of existence.

- International Network Effects Sprint Ahead: This is the game-changer. South Korea's $350 billion commitment isn't just investment—it's the price of admission to the dollar stability network. If Treasury extends similar ESF support to the Philippines, Vietnam, Indonesia, and other allies, each receiving dollar liquidity in exchange for massive US investments and potential stablecoin infrastructure adoption, network effects accelerate exponentially. Countries wanting to trade with the US alliance system face pressure to use Treasury-approved digital dollars. This creates the "programmable Bretton Woods" architecture where dollar dominance is enforced through technological lock-in rather than gold backing.

- The Trojan Horse Hypothesis: South Korea's forex deal could establish precedent where ESF currency support includes undisclosed conditions: data sharing agreements, restrictions on Chinese tech partnerships, requirements to adopt specific payment infrastructure (like USD1 for trade settlement), or mandates for government-affiliated investment vehicles (like Korea's $206 billion sovereign wealth fund) to hold increased Treasury allocations. Each bilateral agreement becomes a vector for extending programmable dollar control.

- Banking Integration Mandate: Major banks receiving benefits from Treasury buybacks (steeper yield curves, volatility reduction) are incentivized or mandated to adopt Treasury-approved blockchain infrastructure. JPMorgan's JPM Coin, Bank of America's digital assets division, and similar projects become extensions of Treasury monetary policy. Korean banks facilitating the $350 billion US investment would be natural pilot partners for Treasury-backed stablecoin settlement systems.

- DeFi Compliance Layer: DeFi protocols face existential pressure to implement KYC/AML features compatible with programmable dollars or lose access to fiat on-ramps, institutional liquidity, and banking relationships. The "decentralized" finance ecosystem becomes a compliance-first hybrid where smart contracts include government backdoors for sanctions, tax collection, and transaction monitoring.

- Bitcoin as Strategic Reserve: Following the DJT Media accumulation model, the Treasury announces Bitcoin inclusion in the Exchange Stabilization Fund—not as recognition of crypto's independence, but as strategic commoditization. Bitcoin becomes "digital gold" in Treasury reserves while losing its monetary alternative narrative. Price moons to $200K+ but the revolution is neutered.

- Crypto Winners: USD1 (massive winner if integrated into bilateral stability agreements), USDC (if compliant), Coinbase (regulated exchange monopoly), Ripple/Stellar (government payment rails for cross-border allied nation settlements), Chainalysis (surveillance infrastructure for ESF agreements), compliant DeFi protocols with embedded compliance

- Crypto Losers: Privacy coins (Monero, Zcash face bans across allied nations), non-compliant DeFi, algorithmic stablecoins, Bitcoin maxis who reject reserve status, any project emphasizing censorship resistance, Chinese blockchain initiatives explicitly excluded from the dollar network

Scenario 2: The Parallel System Thesis (30% probability - DOWNGRADED)

Probability downgraded from 35% to 30% because South Korea's rapid engagement suggests Treasury's model is working faster than resistance can organize.

In this scenario, Treasury overreach triggers a bifurcation where crypto hardens into an explicitly anti-government alternative:

- Constitutional Challenges Gain Traction: Post-Chevron doctrine lawsuits successfully constrain Treasury authority. Democrats introduce the "No Argentina Bailout Act" and similar legislation. South Korea's opposition parties are already condemning the arrangement—they could provide political ammunition for US legal challenges. Courts rule that Section 3111 doesn't authorize foreign currency intervention or stablecoin market-making. The programmable dollar project stalls in legal battles.

- Fed Rebellion: Federal Reserve Chair publicly opposes Treasury buybacks as "fiscal dominance" that undermines central bank independence. The Fed explicitly argues that Treasury ESF swaps with South Korea, Argentina, and others constitute monetary policy—the Fed's constitutional domain, not Treasury's. Markets panic over inflation risk and institutional conflict. Treasury-Fed turf war destroys credibility of the programmable dollar project before it launches.

- Foreign Creditor Revolt: China, Japan (ironically, despite its own $550B US commitment), and Saudi Arabia view Treasury's system as weaponized dollar hegemony. South Korea's forex arrangement is interpreted by Beijing as hostile encirclement—Seoul choosing Washington's monetary system over regional alternatives. They accelerate de-dollarization efforts, dump Treasuries en masse, and back alternative payment systems (BRICS+ digital currency, gold-backed settlement). Treasury buybacks can't absorb the selling. Yields spike, dollar crashes, programmable dollar project collapses.

- Allied Nation Backlash: South Korea's National Security Adviser already stated publicly "our position is not a negotiating tactic. It is objectively and realistically not a level we are able to handle. We are not able to pay $350 billion in cash" South Korea’s trade deal with Trump could sink its currency and trigger a financial crisis | Fortune. If the ESF agreement includes undisclosed sovereignty compromises, South Korean opposition parties could trigger a political crisis. Anti-American sentiment rises in recipient countries who feel they've traded monetary independence for dollar access. The political cost exceeds economic benefits. Treasury forced to retreat.

- Surveillance Backlash: Public outcry over programmable dollar surveillance capabilities—transaction censorship, targeted debasement, smart contract kill switches—drives adoption of privacy-focused alternatives. Leaked details of Treasury's South Korea agreement reveal unprecedented financial data-sharing requirements, fueling privacy fears. The "cashless society" narrative turns dystopian in public perception.

- Crypto Hardens: Bitcoin doubles down on censorship resistance, privacy protocols proliferate, DeFi refuses compliance integration. The space accepts being relegated to "dark pools" and offshore exchanges but maintains ideological purity. A true parallel financial system emerges serving dissidents, sanctions-evaders, and libertarians. South Korean retail investors, historically crypto-enthusiastic, could drive domestic resistance to government-controlled digital dollar systems.

- Crypto Winners: Bitcoin (digital resistance asset), Monero/privacy tech, truly decentralized DeFi, self-custody solutions, offshore exchanges, Lightning Network, potentially Chinese/BRICS digital currency alternatives

- Crypto Losers: Compliant stablecoins (lose market share to resistance), Coinbase (regulatory overreach), blockchain analytics firms, any project that bet on government partnership, South Korean won-denominated stablecoins if the forex arrangement fails spectacularly

Scenario 3: The Hybrid Chaos (25% probability)

Neither clean victory nor clean defeat—regulatory chaos and market fragmentation:

- The Treasury launches its programmable dollar infrastructure but faces constant legal challenges, creating years of uncertainty

- Some allies embrace it fully (Argentina, potentially South Korea), others partially (Japan negotiates better terms), others resist (EU opposes, India plays both sides, Southeast Asian nations split)

- Some states embrace it (New York, California financial centers), others resist (Texas, Wyoming crypto havens)

- International adoption is patchy—creating fragmented liquidity pools and regulatory arbitrage opportunities

- Crypto splits into "white market" (compliant protocols, KYC'd stablecoins, regulated exchanges) and "grey market" (privacy tools, DEXs, peer-to-peer)

- South Korea becomes a live stress test: USD1 gains traction in Seoul's financial district through government encouragement, but faces grassroots retail resistance from crypto-native Koreans who prefer decentralized alternatives. Political volatility creates arbitrage opportunities.

- Finance Minister Koo already faces pressure, denying reports that "the US has urged Seoul to increase the headline figure above the $350 billion" Korea’s finance chief says Seoul has reached FX deal with US; currency swap line pending - KED Global, suggesting contested negotiations that could produce a compromised, unstable outcome

- Constant regulatory arbitrage as projects jurisdiction-shop

- No clear winner, maximum uncertainty, continued volatility

The Timing Question: Why Now?

Speculation centers on several catalysts that may have triggered this 2025 acceleration:

Geopolitical Chess at Breakneck Speed: With China aggressively pushing digital yuan internationalization and BRICS+ nations exploring gold-backed settlement, the US may view programmable dollar infrastructure as urgent national security. The Argentina intervention on October 9—followed within two weeks by South Korea's forex negotiations—suggests a coordinated sprint campaign to lock in allied allegiance before Chinese alternatives gain traction. The speed is the signal: this isn't careful policy rollout, it's a geopolitical land grab disguised as liquidity provision.

Some analysts speculate that South Korea's approach wasn't entirely spontaneous but rather orchestrated—a demonstration project to show larger allies (Japan, Saudi Arabia, UK) that Treasury support is available, effective, and comes with a clear framework. South Korea's $350 billion price tag for forex support establishes the going rate for dollar stability network membership.

Debt Trap Escape: Some analysts theorize that Treasury buybacks represent an attempt to solve the "Triffin Dilemma" (US must run perpetual deficits to supply world with dollars, but this undermines dollar's value). If Treasury can provide algorithmic, on-demand liquidity through programmable mechanisms, the US might escape needing trade deficits. South Korea's $350 billion investment directly funds US priorities while Treasury provides offsetting dollar liquidity—the Triffin paradox solution in action. This would be the most significant monetary innovation in 80 years—if it works.

Technology Window Closing: Blockchain technology has matured to production-ready scale, stablecoin adoption is exploding, and regulatory frameworks are crystalizing globally. There may be a narrow window (2025-2027) where the US can establish standards before China, EU, or private actors (Tether, Circle) lock in alternative architectures. Bessent may view this as "now or never" for dollar dominance. The rapid expansion from Argentina to South Korea in weeks suggests extreme urgency—Treasury is racing to sign up allies before competitors can offer alternatives.

Political Alignment and Personal Stakes: Trump administration + crypto-friendly Congress + Treasury Secretary with hedge fund agility creates unique conditions for radical monetary experimentation. A Harris administration or conventional Republican might never attempt this. Critically, the Trump family's USD1 stablecoin could directly benefit from this infrastructure—raising uncomfortable questions about whether foreign policy is being designed around private business interests. The political window matches the technological window, but the conflicts of interest are unprecedented.

Market Implications: The Speculation Trade

CRITICAL UPDATE: South Korea development changes probability-weighted positioning.

If the Co-option Thesis plays out (45% probability):

- Go long AGGRESSIVELY: USD1 (massive asymmetric upside if it becomes the settlement layer for ESF bilateral agreements), USDC (if it partners with Treasury), Coinbase (becomes the regulated on-ramp for allied nations' stablecoin access), Ripple/Stellar (government payment rails for cross-border allied nation settlements), Chainalysis/blockchain analytics (surveillance infrastructure mandatory for ESF agreements)

- Go long: US Treasuries (especially long-dated—permanent Treasury bid from buybacks + increased foreign demand from ESF collateral requirements), South Korean won (with Treasury ESF backstop), Philippine peso/Vietnamese dong if they join the network, major US banks (JPM, BAC benefit from steeper curves and new correspondent banking for stablecoin infrastructure)

- Go short: Privacy coins (facing coordinated allied nation bans), non-compliant DeFi, offshore exchanges without US partnerships, Bitcoin volatility (institutionalization reduces swings), Chinese digital yuan (loses competitive positioning), BRICS+ alternative payment systems (network effects favor dollar infrastructure)

- Wild card: Bitcoin could 10x if Treasury ESF holds it as reserve asset alongside gold and foreign currencies, but the asset fundamentally transforms from revolutionary alternative to commoditized "digital gold" in government portfolios

If the Parallel System Thesis plays out (30% probability):

- Go long: Bitcoin (hardens as pure resistance asset), Monero/Zcash (privacy demand surges), truly decentralized DeFi protocols, self-custody technology, offshore exchanges, Chinese digital yuan (as dollar alternative), gold (neutral reserve asset if dollar system fractures)

- Go short: Compliant stablecoins (lose market share to non-compliant alternatives), Coinbase (regulatory backlash), government blockchain partnerships, South Korean won (political instability from sovereignty debates could trigger 1997-style crisis despite ESF support), USD1 (massive downside if political corruption allegations stick)

- Wild card: Dollar itself faces crisis if China, Japan, and Gulf states coordinate Treasury dump. US loses monetary hegemony in worst-case scenario.

If Hybrid Chaos plays out (25% probability):

- Trade volatility and arbitrage: Crypto correlation to macro decreases, project-specific fundamentals matter more

- Jurisdiction arbitrage premium: Wyoming-based projects outperform, offshore exchanges in Singapore/Dubai gain market share as neutral hubs, Korean crypto projects with domestic focus outperform those dependent on US relationships

- Optionality premium: Hold diversified portfolio across both compliant (USD1, USDC, Coinbase) and resistance assets (Bitcoin, Monero, decentralized DeFi)

- Regional fragmentation plays: South Korea becomes high-volatility trading opportunity—long when government supports dollar integration, short when opposition gains political momentum

- Split the difference: 60% allocation to co-option winners (higher probability), 25% to resistance assets (catastrophic hedge), 15% cash/volatility strategies for chaos arbitrage

The Uncomfortable Questions That Just Got More Uncomfortable

Is this even legal? Post-Chevron doctrine suggests federal agencies can't expand their authority without explicit Congressional authorization. Treasury claims Section 3111 authority from 1976, but that statute wasn't written for currency interventions with major economies or stablecoin market-making. South Korea formalizing an ESF agreement will trigger immediate lawsuits challenging Treasury's authority to conduct monetary policy with foreign governments—Democrats are already drafting the "No South Korea Bailout Act."

Who's actually in control—and who benefits? If Treasury operates a parallel monetary authority independent of the Fed, and the Treasury Secretary has direct ties to USD1 stablecoin (Trump family business), where does public policy end and private interest begin? Does South Korea's government understand that their forex support might flow through mechanisms that directly benefit Trump family business interests? Are allied nations being sold stability or a private business model disguised as public policy?

The $350 billion precedent problem: South Korea's $350 billion investment commitment establishes a price point for ESF forex support Seoul turns to US Treasury fund for dollar liquidity to cushion forex impact from tariff deal - KED Global. If the Philippines wants similar treatment, do they also commit $350 billion? How much can the Treasury realistically backstop? The ESF has $221 billion in total assets. If five countries each get Argentina-style $20 billion swap lines plus South Korea gets a larger facility, the fund approaches capacity. At what point does Treasury become the implicit guarantor for allied nations' entire monetary systems?

The sovereignty trap intensifies: South Korea requested unlimited currency swap capacity because officials warned the $350 billion outflow could trigger economic catastrophe similar to the 1997-98 Asian Financial Crisis KED GlobalKED Global. If accepting ESF support is the only way to avoid currency collapse during mandated US investments, allied nations face a Hobson's choice: surrender monetary policy independence to Washington or face financial crisis. This isn't partnership—it's coercion wrapped in liquidity provision. Does any allied democracy willingly accept these terms once they're public?

Can this actually work at scale? Algorithmic, programmable monetary policy sounds sophisticated, but markets are adversarial and adaptive. High-frequency traders, nation-states, and crypto degens will probe every weakness. The Fed has 110 years of institutional knowledge managing monetary crises. The Treasury has Scott Bessent's hedge fund experience and a 1934 statute designed for gold standard stabilization. Now multiply that challenge by coordinating currency interventions across dozens of allied nations with different political systems, economic cycles, and crisis triggers. One country's currency crisis under ESF support could cascade across the entire network. Are we catastrophically overestimating competence?

The stablecoin conflict of interest: If bilateral ESF agreements include incentives or requirements for USD1 adoption, and the Treasury Secretary is actively promoting "using stablecoins to keep the dollar as dominant reserve currency," and the Trump family owns USD1, this represents potentially the most significant financial conflict of interest in American history. Even if completely legal, does it pass the smell test internationally? Would allied nations accept this once domestic opposition parties expose the arrangement?

Conclusion: The 90-Day Window Just Became Critical

The Treasury's 2025 buyback program represents either the most ambitious monetary innovation since 1944 or the most dangerous overreach in federal financial authority. We're watching Bessent attempt to build, in real-time, a programmable dollar empire that could either cement American financial hegemony for another century or trigger the worst dollar crisis since Nixon closed the gold window.

The timeline just compressed dramatically. Argentina signed October 9. South Korea entered active negotiations within two weeks. Sources suggest "the final contours of the financing framework are expected to be discussed this week in Washington" with a conclusion possible "within 10 days" Seoul turns to US Treasury fund for dollar liquidity to cushion forex impact from tariff deal - KED Global. If South Korea formalizes by early November 2025, Treasury will have deployed the ESF bilateral model to two major economies in under 30 days—a pace that suggests either brilliant execution or reckless overconfidence.

The crypto community faces an existential choice with no middle ground: integrate as infrastructure for the new system or harden into explicit resistance. The next 90 days are the inflection point:

Watch these critical signals:

- South Korea ESF formalization or collapse (expected by early November 2025)—the make-or-break moment

- Third country announcement (Philippines? Vietnam?)—confirms pattern or reveals South Korea was one-off

- Congressional hearings post-midterms—Democrats control House, expect "No South Korea Bailout Act"

- USD1 regulatory approvals—if it gets preferential treatment while South Korea agreement pending, conflict of interest becomes undeniable

- Fed Chair public response—silence signals acquiescence, pushback signals institutional warfare

- South Korean domestic politics—opposition party reaction could torpedo the entire model

- Chinese countermeasures—Treasury dumping? Accelerated BRICS+ digital currency? Capital controls on South Korea?

Probability assessment updated:

- Controlled Co-option: 45% (+5% from South Korea speed)

- Parallel Resistance: 30% (-5% as window for organized opposition narrows)

- Hybrid Chaos: 25% (unchanged—complexity increases with each bilateral deal)

Position accordingly, but move quickly. If South Korea formalizes in early November and a third country announces by December, the co-option thesis accelerates toward inevitability and entry prices for compliant crypto infrastructure assets will gap higher. Conversely, if South Korea's deal collapses under domestic political pressure or Congressional challenges succeed, the entire programmable dollar thesis could unravel in Q1 2026, creating catastrophic losses for co-option bets and explosive gains for resistance assets.

This isn't financial advice—it's a warning that the next three months will determine whether cryptocurrency fulfills its revolutionary promise or becomes another tool of the very system it was designed to replace. The programmable dollar empire is being built at sprint speed, whether we're ready or not, and South Korea's decision in the next 10 days may determine the outcome for the next decade.

Sources

- US Treasury Bureau of the Fiscal Service - Treasury Buyback Operations Data

- Treasury Secretary Scott Bessent March 2025 Stablecoin Remarks

- Argentina-US Currency Swap Framework Announcement, October 9, 2025

- Seoul Turns to US Treasury Fund for Dollar Liquidity - KED Global

- Korea's Finance Chief Says Seoul Has Reached FX Deal with US - KED Global

- South Korea's Trade Deal Could Trigger Financial Crisis - Fortune

- USD1 Stablecoin Market Data - CoinMarketCap

- GENIUS Act Stablecoin Regulatory Framework Analysis

- Federal Reserve Bank of New York - Treasury Market Liquidity Analysis

- Statement of US Treasury and Korea Ministry of Economy and Finance

Note on Speculation: Probability assessments, scenario analyses, and outcome predictions in this article represent speculative analysis based on current developments and expert commentary. South Korea's ESF negotiations are confirmed by official sources, but final terms remain undisclosed. The connection between ESF bilateral agreements and USD1 stablecoin adoption is speculative analysis, not confirmed policy. These are analytical frameworks, not certainties, and should be weighed against your own research and risk tolerance.

DISCLAIMER: This newsletter is for informational purposes only and does not constitute investment advice, advertising, or a recommendation to buy, sell, or hold any securities. This content is not sponsored by or affiliated with any of the mentioned entities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. The speculative scenarios presented are theoretical analyses based on current events, not predictions. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.