The Ripple Effect - 8/15/25

XRP consolidates at $3.06 as Ripple-SEC case hits Aug 15 deadline. XRPL surpasses $1B in tokenized RWAs, outpacing Solana's compliance approach. Flare launches FXRP v1.1 with $2M minted. Analysts target $8-26 by 2030. 95% holders in profit.

XRP: $3.06 (-2.04%) | 24h Volume: $9.16B | Market Cap: $175B | Rank: #3

XRP consolidates near $3.06 amid profit-taking pressure following its impressive post-SEC settlement rally, while critical developments unfold on multiple fronts. The Ripple-SEC case approaches potential final resolution with today's August 15 deadline for status reports, Flare Network advances its ambitious FXRP integration on Songbird, and institutional adoption signals continue strengthening despite short-term technical headwinds.

Market Update

Technical Analysis: XRP faces mounting selling pressure at key Fibonacci resistance levels near $3.31, having declined approximately 8% from recent highs. The token currently trades in a symmetrical triangle pattern with support at $3.20 and resistance at $3.34. The Chaikin Money Flow (CMF) stands at +0.04, indicating mild capital inflows, while XRP continues to hold above multiple key EMA supports.

Volume & Sentiment: Trading volumes remain elevated at $9.16 billion despite the pullback, indicating continued institutional interest. Nearly 95% of XRP holders remain in profit, historically associated with local tops, while the Fear & Greed Index shows 75 (Greed).

Price Targets: Analysts identify key support at $3.13-$3.15 with resistance building at $3.27-$3.31. If bulls break above $3.46, the next major target is $3.66, while failure to hold $3.20 could signal short-term downside toward the 50 EMA at $2.89.

Key Developments

Legal & Regulatory

Ripple-SEC Settlement Watch: Today marks the critical August 15 deadline for both parties to file a joint status report with the appellate court. Former SEC attorney Marc Fagel believes that while the August 15 date is not a hard deadline, it could signal a move towards closure in the case. Legal experts suggest both parties may drop their appeals, with Ripple having already paid the $125 million penalty and the SEC expected to follow internal processes to dismiss its appeal within 1-2 months.

ETF Progress: The SEC is likely to approve at least eight applications for spot XRP ETFs in October, which could unlock significant demand among retail and institutional investors. Standard Chartered's Geoffrey Kendrick anticipates substantial upside due to likely ETF approval.

Ecosystem & Technology

RWA Milestone Achievement: XRP Ledger has achieved a significant milestone in real-world asset tokenization, with over $1 billion in tokenized funds now live on the platform. This includes Aurum Equity Partners' groundbreaking $1 billion tokenized equity and debt fund focused on global data center investments across the US, UAE, Saudi Arabia, India, and Europe—representing the world's first combined equity and debt tokenized fund.

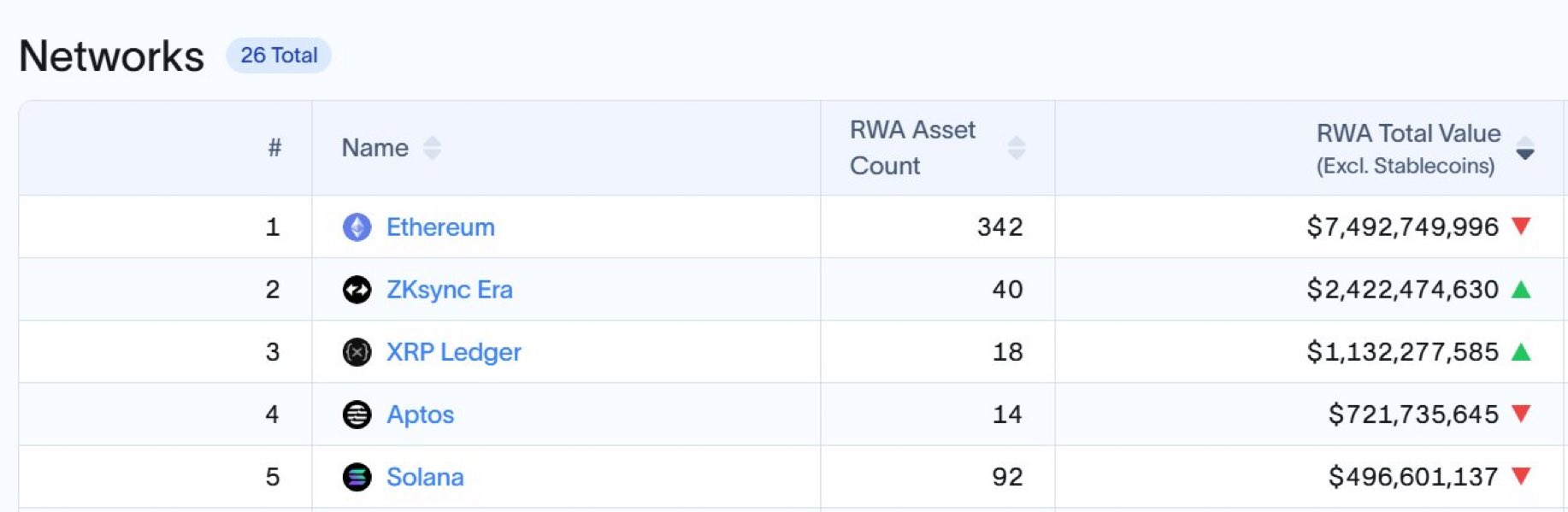

RWA Growth Acceleration: XRPL posted impressive 34% monthly growth in tokenized RWAs, reaching $157.4 million, making it the 10th-largest blockchain by total RWA value. US Treasury debt comprises the largest portion at $90.1 million (57% of network's RWA base), followed by public equity receipts at $55.4 million. Brazilian exchange Mercado Bitcoin plans to tokenize over $200 million in additional assets, representing one of Latin America's most extensive tokenization campaigns.

Flare Network Developments: Major progress on the XRP DeFi front as FAssets v1.1 launches on Songbird, marking a major upgrade of Flare's interoperable protocol for bringing DeFi to XRP via FXRP. The system introduces the Core Vault innovation to enhance liquidity and scalability, allowing agents to deposit XRP and unlock FLR collateral for additional minting capacity.

Firelight Innovation: Flare Network CEO Hugo Philion has teased Firelight as "hugely innovative" and capable of putting "billions, if not tens of billions, of XRP to work". Nasdaq-listed VivoPower has already committed $100 million worth of XRP to the Flare ecosystem through Firelight, while Uphold confirmed plans to integrate FXRP.

Institutional Adoption

Corporate Treasury: Nasdaq-listed Thumzup Media recently committed to holding XRP in its $50M crypto treasury expansion, alongside Bitcoin and Ethereum. The firm is partnering with Coinbase Prime for custody services.

Real-World Assets Leadership: XRP Ledger now leads institutional RWA tokenization with over $1 billion in tokenized assets. Key partnerships include Archax and abrdn plc, with Ripple investing $5 million in abrdn's tokenized money market fund. The platform has processed $325 million in tokenized real estate and secured partnerships with OpenEden for US Treasury bill tokenization, with Ripple allocating $10 million to TBILL tokens.

Competitive Position vs Solana: While Solana has seen 141% growth in RWAs during 2025 and holds 3.9% of the overall RWA market (approximately $517 million), XRP Ledger's focus on institutional-grade compliance and regulatory clarity positions it strategically. XRPL offers built-in KYC compliance, account freezing capabilities, and institutional-grade security without complex smart contracts, making it preferred for regulated financial institutions over Solana's permissionless model.

Notable Mentions

Jake Claver (Digital Ascension Group): The managing director continues his bold XRP advocacy, recently revealing his firm holds over $200 million worth of XRP and maintains his ambitious $10,000 price target. Claver argues that XRP is "programmed" to reach $10,000 within 24 months based on network efficiency requirements for large institutional transfers.

Black Swan Capitalist: Co-founder Versan Aljarrah reinforces his bullish thesis, stating once XRP becomes the bridge asset for global financial infrastructure, $1,000 will mark the floor, not the ceiling. Aljarrah sees XRP holders positioned to "control the new financial system" through tokenized ownership and decentralized infrastructure built on XRPL.

Standard Chartered: Geoffrey Kendrick anticipates XRP will reach $8 by 2026, implying substantial upside due to the recent conclusion of Ripple's legal battle and likely ETF approval.

The Motley Fool: Conservative analysts project XRP could double to $6.50 in the next three years, assuming it continues to outperform the broader crypto market.

RWA Ecosystem: XRP Ledger Surpasses Major Milestone

$1 Billion+ Achievement: XRP Ledger has officially surpassed $1 billion in tokenized real-world assets, establishing itself as a major player in the institutional RWA space. This milestone represents a 2,260% increase since January 2025, with the platform now hosting over $118 million in active tokenized assets across diverse categories.

Market Position vs Competitors: While Solana has grown 141% in RWAs during 2025 to reach approximately $517 million (3.9% market share), XRP Ledger's strategic focus on institutional compliance gives it distinct advantages:

- XRPL Advantages: Built-in KYC/AML compliance, account freezing capabilities, institutional-grade security, and settlement in 3-5 seconds for ~$0.01 per transaction

- Solana Challenges: Permissionless model creates compliance difficulties for regulated institutions despite faster speeds and lower base fees

- Regulatory Clarity: XRP's non-security status provides clearer regulatory framework for institutional adoption

Key RWA Projects:

- Aurum Equity Partners: $1B tokenized equity/debt fund for global data centers

- Archax/abrdn: First tokenized money market fund ($4.77B fund) with Ripple's $5M investment

- OpenEden: US Treasury bill tokenization with $10M Ripple allocation

- Mercado Bitcoin: $200M+ Latin American tokenization pipeline

- Dubai DFSA: Government-backed property tokenization initiatives

Market Trajectory: Boston Consulting Group projects tokenized assets could reach $16 trillion by 2030, with XRP positioned to capture significant institutional market share through its compliance-first approach and growing partnership ecosystem.

Flare Network & Songbird Impact

The integration of FXRP on Flare's Songbird network represents a significant development for XRP's utility expansion. The FAssets v1.1 system with its Core Vault innovation allows for enhanced liquidity and scalability, enabling agents to refresh their minting capacity without needing new capital.

#Songbird gets a HUGE Upgrade with the Launch of #FAssets v1.2!

— Flare Community ☀️ (@CommunityFlare) August 15, 2025

Coming Next Week - August 20th pic.twitter.com/cqq8Q2uyqE

The system handled approximately 263,000 mints, 395,000 redemptions, and over 48,000 participants during the open beta, demonstrating strong user engagement. In just a few days on Songbird, over $2 million in FXRP was minted, driving a 220% surge in total value locked (TVL).

This development could significantly impact XRP by:

- Increased Utility: Bringing DeFi capabilities to XRP without smart contracts

- Liquidity Enhancement: Creating new demand sources through DeFi applications

- Institutional Bridge: Providing regulated pathways for XRP utilization

- Ecosystem Growth: Expanding XRP's role beyond payments into broader financial services

Songbird serves as Flare's canary network for testing new features before implementation on the main Flare network, meaning successful FXRP deployment could lead to even larger-scale adoption.

Looking Ahead

Immediate Catalysts:

- August 15 SEC status report outcome

- XRP ETF decision timeline clarity

- Flare mainnet FXRP deployment schedule

- RLUSD adoption metrics

Medium-Term Developments:

- Ripple's national trust charter application

- Additional institutional treasury adoptions

- XRPL real-world asset tokenization expansion

- Federal rate policy impacts on crypto

Long-Term Outlook: Price predictions vary significantly, with analysts forecasting XRP could reach $26.97 by 2030 on the high end, while more conservative estimates suggest $6-10 by the same timeframe.

Sources

- Yahoo Finance XRP Historical Data

- Investing.com XRP Data

- Fingerlakes1.com XRP Analysis

- Finance Magnates Market Analysis

- The Motley Fool XRP Prediction

- Brave New Coin SEC Lawsuit Update

- FX Leaders Lawsuit Update

- Flare Network FAssets Launch

- Times Tabloid Firelight Coverage

- The Crypto Basic Jake Claver Analysis

- CryptoSlate XRP RWA Growth

- The Tokenizer Aurum Partnership

- CoinTelegraph Solana RWA Report

- The Motley Fool XRP vs Solana Analysis

- AI Invest XRP RWA Strategic Position