The Internet of Value Proven: How Cross River Bank is Validating Ripple's Master Plan

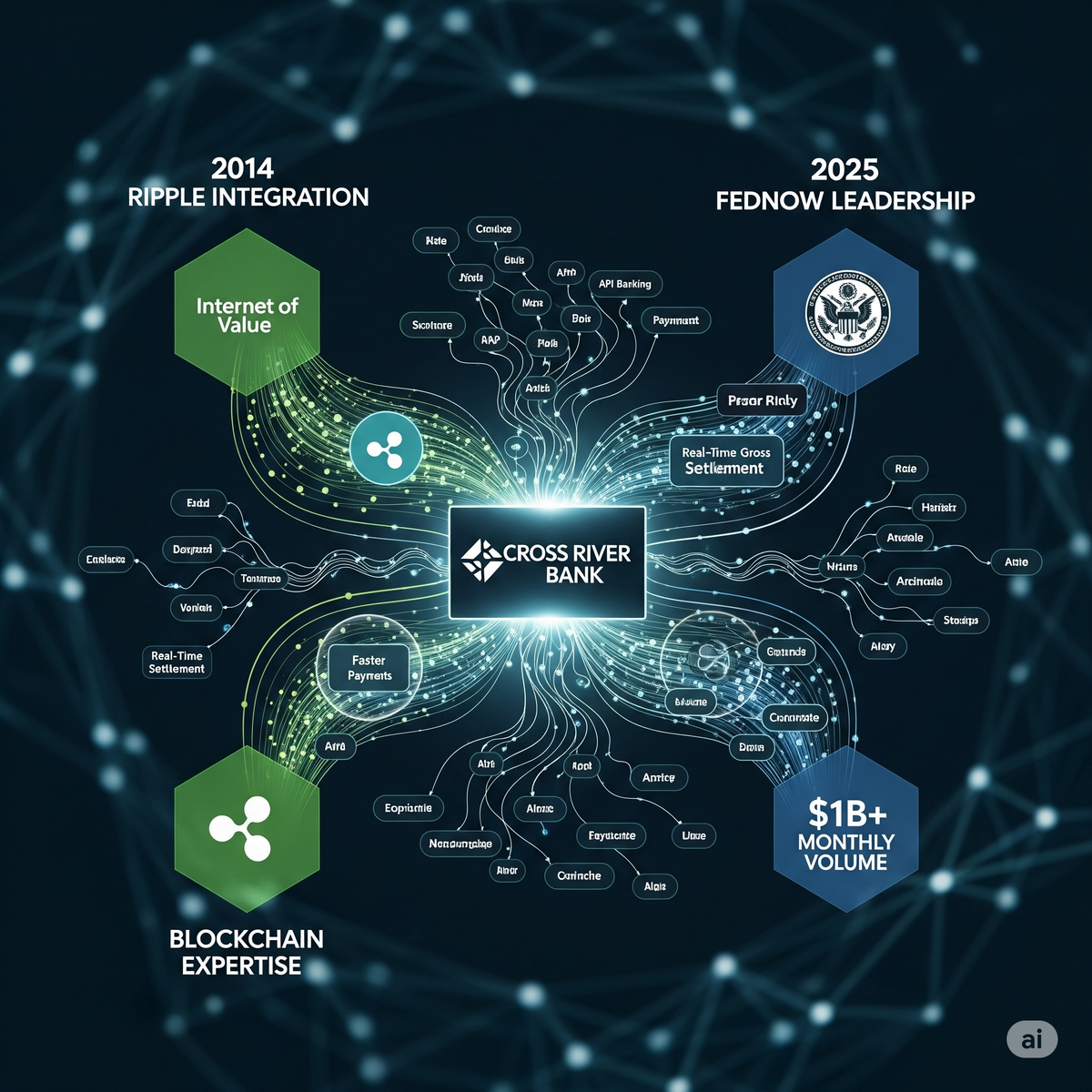

Cross River's evolution from first US Ripple adopter (2014) to FedNow leader processing $1B+ monthly proves Ripple's Internet of Value works at institutional scale. With Ripple's ILP technology embedded in FedNow infrastructure, this is validation of XRP's core mission—not theory, but execution.

Cross River Bank's evolution from 2014 Ripple pioneer to America's FedNow payment leader isn't just a success story—it's the clearest real-world proof that Ripple's vision of the "Internet of Value" works at institutional scale. The bank's $1 billion monthly instant payment volume demonstrates how XRP's core mission of seamless value transfer has quietly infiltrated and transformed traditional banking infrastructure.

The first Ripple Bank partnership -- Cross River Bank

— Chad Steingraber (@ChadSteingraber) August 21, 2025

RIPPLE // CROSS RIVER // COINBASE // FEDNOW https://t.co/p5o4slrACw pic.twitter.com/QWoHBVFiVp

The Strategic Vision Behind the Partnership

When Cross River Bank became the first U.S. financial institution to integrate Ripple's protocol in September 2014, it wasn't just adopting new technology—it was betting on Ripple's fundamental thesis that financial systems could move value as easily as the internet moves information.

CEO Gilles Gade's statement at the time reveals the deeper understanding: "Our business customers expect banking to move at the speed of the Web, but with the security and confidence of the traditional financial system. Ripple will help make that a reality."

This wasn't early adoption for adoption's sake. Cross River recognized that Ripple's distributed ledger technology could solve the core inefficiency plaguing global payments: the multi-day settlement delays and correspondent banking friction that cost the industry hundreds of billions annually.

The partnership proved transformational because it validated Ripple's core architectural principle: that a neutral bridge asset (XRP) combined with distributed ledger settlement could eliminate the need for pre-funded nostro/vostro accounts while maintaining regulatory compliance and institutional-grade security.

From Ripple Pioneer to FedNow Infrastructure: The Evolution

Cross River's journey from Ripple integration to FedNow leadership represents the ultimate validation of Ripple's strategic vision. The bank didn't abandon blockchain technology for traditional instant payments—it leveraged its decade of distributed ledger expertise to become America's instant payment infrastructure leader.

Today's numbers are staggering: Cross River processes over $1 billion monthly across RTP® and FedNow combined. The bank and partner Trustly handle nearly 10% of all Real-Time Payments network transactions in America. This massive scale proves that Ripple's early institutional partners didn't just survive—they thrived by mastering the principles of instant, low-cost value transfer.

The Federal Reserve's recognition of Cross River as a FedNow success story reveals something profound: the blockchain-inspired payment innovations that Ripple pioneered have become the foundation of America's financial infrastructure modernization.

The Hidden Ripple DNA in America's Payment System

Research reveals that Cross River's success isn't isolated—it's part of a broader infiltration of Ripple's technological DNA into America's payment backbone. Analysis shows that 27 of 37 FedNow-certified service providers maintain connections to Ripple's ecosystem through partnerships, shared technology, or direct integration.

Most significantly, Ripple's Interledger Protocol (ILP) provides core technology infrastructure within FedNow's transaction system. This represents Ripple's ultimate achievement: its payment innovations have become so fundamental that they're embedded in the Federal Reserve's own instant payment infrastructure.

Cross River's dual expertise—mastering both Ripple's blockchain technology and Federal Reserve payment systems—positions the bank as a living bridge between these ecosystems. The bank proves that Ripple's vision wasn't about replacing traditional banking, but about providing the technological foundation for banking's evolution.

Mission Accomplished: The Internet of Value in Action

Cross River's transformation validates every core element of Ripple's original mission:

Instant Settlement: Cross River's ability to process $1 billion monthly in real-time payments proves that XRP's 3-5 second settlement capability scales to institutional volumes while maintaining operational reliability.

Cost Efficiency: The bank's leadership in instant payments demonstrates how Ripple's sub-penny transaction costs enable new business models and operational efficiencies impossible with traditional correspondent banking.

Global Interoperability: Cross River's evolution from international Ripple payments to domestic FedNow leadership shows how the same technological principles work across different payment networks and regulatory environments.

Regulatory Compliance: The bank's success operating under Federal Reserve oversight while maintaining its blockchain payment expertise proves that Ripple's technology enhances rather than complicates regulatory compliance.

Network Effects: Cross River's growth from community bank to payments powerhouse demonstrates how participation in distributed payment networks creates multiplicative benefits for all participants.

Proof of Execution at Institutional Scale

The August 2025 SEC-Ripple case resolution removes the final regulatory uncertainty around XRP's role as payment infrastructure. With legal clarity achieved, Cross River's decade of operational experience becomes invaluable proof that Ripple's technology works in the real world.

Cross River didn't just implement Ripple technology—it mastered the art of blockchain-based value transfer at institutional scale. The bank's current $1 billion monthly volume proves that XRP's utility extends far beyond speculative trading to become critical infrastructure for modern payment systems.

This matters because Cross River's success demonstrates sustainable, profitable implementation of Ripple's vision. The bank generates real revenue from real payment volumes using technology that originated with XRP's development. This is execution proof, not theoretical potential.

The Strategic Bridge to Global Liquidity

Cross River's unique positioning—deep expertise in both Ripple technology and Federal Reserve systems—creates unprecedented opportunities to fulfill Ripple's ultimate vision of global payment interoperability.

The bank could potentially bridge FedNow's domestic instant payments with XRP's global settlement network, enabling seamless international transfers that settle in seconds rather than days. This would represent the final piece of Ripple's Internet of Value puzzle: connecting national payment systems through blockchain-based global liquidity.

With Japan's SBI Holdings filing for Bitcoin-XRP ETFs and institutional adoption accelerating worldwide, Cross River's early-mover advantage becomes increasingly strategic. The bank possesses operational knowledge that the broader financial industry is just beginning to recognize as essential.

Validation of the Master Plan

Cross River Bank's evolution from 2014 Ripple pioneer to 2025 FedNow leader provides the clearest real-world validation of Ripple's strategic vision. The bank didn't just adopt blockchain technology—it proved that Ripple's Internet of Value concept could operate at institutional scale while generating sustainable business value.

This success story matters because it demonstrates that XRP's utility thesis was correct from the beginning. Ripple's technology doesn't just move numbers on a ledger—it enables fundamental improvements in how financial institutions move real value for real customers at massive scale.

Cross River's $1 billion monthly transaction volume represents more than impressive growth metrics. It's proof that Ripple's decade-long mission to enable seamless global value transfer has achieved institutional validation at the highest levels of the financial system.

The revolution isn't theoretical anymore. It's processing real payments through institutions like Cross River that understood Ripple's transformative potential before the rest of the world recognized what was possible. The Internet of Value isn't coming—it's here, and Cross River Bank is the blueprint for how it transforms traditional finance.

DISCLAIMER: This newsletter is for informational purposes only and does not constitute investment advice or a recommendation to buy, sell, or hold any securities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.

Sources

- CoinDesk - "US Banks Announce Ripple Protocol Integration" (2014)

- Globe Newswire - Cross River Bank Ripple Integration Announcement (2014)

- CoinDesk - "US Banks: Why We Embraced Ripple" (2014)

- The Crypto Basic - "Research Shows Ripple Links to FedNow Service Providers" (2025)

- Supra Academy - "FedNow and Ripple: What You Need To Know"

- Open Banking Expo - "Trustly and Cross River Bank expand partnership with FedNow integration" (2024)

- Business Wire - "Cross River Launches Request for Payment (RfP)" (2025)

- CoinDesk - "XRP Price News: XRP Bull Flag Points to $8 as Ripple-SEC Case Reaches End" (2025)

- CoinDesk - "SEC's Long-Running Case Against Ripple Officially Over" (2025)

- CNBC - "Crypto's long battle with SEC comes to a close with Ripple victory" (2025)

- Cross River Bank - About Us

- Federal Reserve Financial Services - FedNow Industry Stories

- Cross River Bank - FedNow Information

- Ripple Press Release - Cross River Bank Partnership (2014)

- Modern Treasury - "Partnering with Cross River to Implement FedNow"