The BlackRock-Ripple Infrastructure Connection: A Theory Worth Examining

Ripple's RLUSD now shares infrastructure with BlackRock's $500M tokenized fund. Is this strategic positioning or coincidence? We examine the theory that institutional money is being 'wired' through Ripple rails.

When crypto analyst Stern Drew claimed "the hidden pipeline between BlackRock and Ripple is now visible," he wasn't talking about a partnership announcement—he was describing something potentially more significant: shared financial infrastructure that could reshape how institutional money flows through crypto markets.

🚨 THE HIDDEN PIPELINE BETWEEN BLACKROCK AND RIPPLE IS NOW VISIBLE 🚨

— Stern Drew (@SternDrewCrypto) December 15, 2025

👉 BlackRock’s $BUIDL goes multichain via Wormhole.

👉 Ripple officially integrates Wormhole into XRPL.

👉 BlackRock’s tokenization stack is powered by Securitize, a platform backed by Ripple.

👉 Ripple’s… pic.twitter.com/MfKuU8Ts1z

Ripple officially announced that its USD-backed stablecoin, RLUSD, is expanding to Layer 2 blockchains using Wormhole's Native Token Transfer (NTT) standard. On the surface, this is a straightforward stablecoin expansion story. But Drew's analysis connects technical dots that many observers have missed: the same infrastructure powering BlackRock's tokenization efforts now intersects directly with Ripple's ecosystem.

Is this coincidence, or is it the early architecture of how traditional finance will actually interact with crypto rails? Let's examine the theory, then rigorously separate what's confirmed from what's speculation.

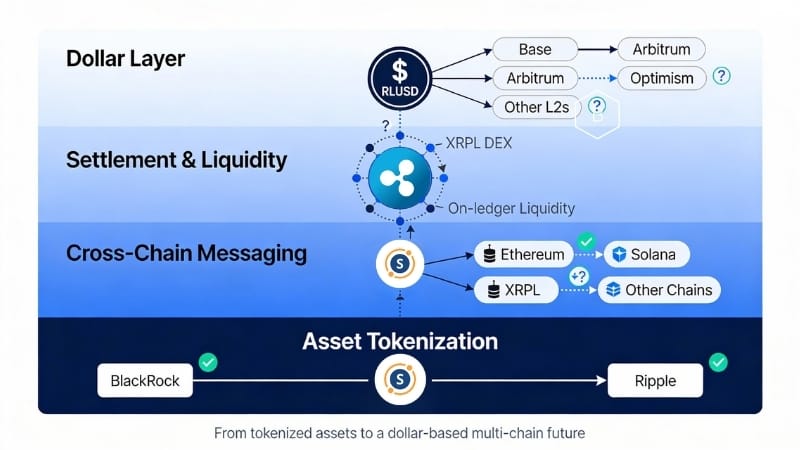

The Infrastructure Alignment Theory: How It Works

Drew's thesis rests on a specific technical observation: institutional-grade financial infrastructure is being built using overlapping technology stacks that position XRP and the XRP Ledger as potential settlement and liquidity layers for tokenized real-world assets.

Here's the architecture he's describing:

Layer 1: Asset Tokenization - Securitize

BlackRock's $BUIDL fund—a tokenized money market fund now exceeding $500 million in assets—uses Securitize as its tokenization platform. Securitize handles compliant issuance and custody of tokenized securities.

The Ripple connection: Ripple invested in Securitize and established a partnership specifically focused on bringing real-world assets to the XRP Ledger. Securitize explicitly announced plans to enable tokenized securities on XRPL as part of this partnership.

Layer 2: Cross-Chain Interoperability - Wormhole

BlackRock's $BUIDL operates across multiple blockchains through Wormhole's cross-chain messaging protocol. Wormhole enables $BUIDL to move between Ethereum, Arbitrum, Avalanche, Optimism, and Polygon while maintaining its tokenized security status.

The Ripple connection: Ripple just announced that RLUSD uses Wormhole's Native Token Transfer standard for its multichain expansion. Both BlackRock's flagship tokenized fund and Ripple's stablecoin now use the same cross-chain infrastructure provider.

Layer 3: Settlement & Liquidity - XRP Ledger

The XRP Ledger offers fast (3-5 second settlement), low-cost transactions with a built-in decentralized exchange and automated market maker functionality. It's designed specifically for high-volume financial settlement.

The theory: When tokenized assets need to move, exchange value, or settle trades across chains—they'll need liquidity rails. RLUSD positions itself as the compliant dollar layer. XRP, by design, serves as the bridge currency and liquidity mechanism.

Layer 4: The Dollar Layer - RLUSD

RLUSD is now positioned as the first U.S.-based, trust-regulated stablecoin on multiple Layer 2 networks, creating dollar-denominated liquidity pairs with wrapped XRP (wXRP) across these ecosystems.

The theory: This creates standardized dollar rails that tokenized securities can use for settlement, with XRP serving as the inter-chain liquidity layer when assets need to move between different blockchain ecosystems.

Why This Theory Deserves Serious Consideration

1. The Technology Stack Is Real and Operational

These aren't hypothetical integrations or vaporware announcements. BlackRock's $BUIDL fund is live with over $500 million in assets. Securitize is actively tokenizing securities. Wormhole processes billions in cross-chain value transfer. RLUSD is operational on multiple chains. The infrastructure exists and functions today.

2. Follow the Capital, Not the Press Releases

Drew makes a compelling point: "No press release will ever say 'BlackRock uses $XRP.' Instead, they're wiring the plumbing so value, liquidity, and compliance flow through Ripple rails by design."

This matches historical patterns in infrastructure adoption. AWS became dominant not because companies announced "we're switching to Amazon," but because developers used it for specific functions until it became embedded infrastructure. Visa became the global payments standard not through explicit partnerships with every merchant, but by becoming the most efficient rails.

If major financial institutions are building on Securitize (which partners with Ripple) and using Wormhole (which integrates with RLUSD), they're creating technical pathways to XRPL whether or not that was their explicit intent.

3. The Timing Aligns with Regulatory Clarity

Ripple recently achieved significant favorable rulings in its SEC case, with Judge Torres finding that XRP itself is not a security in certain contexts. While legal questions remain, the regulatory picture has clarified considerably since 2020.

BlackRock, meanwhile, has become increasingly vocal about blockchain adoption. CEO Larry Fink has stated that "tokenization of securities will be the next generation for markets" and that blockchain technology represents "the next evolution in financial market infrastructure."

The timing of these infrastructure buildouts—coming after Ripple's legal clarity improves and as BlackRock commits to tokenization—could be deliberate positioning.

4. The Architecture Matches Ripple's Stated Strategy

Ripple hasn't been shy about its institutional ambitions. The company has explicitly positioned XRP as a bridge asset for cross-border payments and value transfer. The RLUSD stablecoin launch was described as complementary to XRP—providing the stable dollar layer while XRP serves as the liquidity mechanism.

If you were designing infrastructure to capture institutional tokenized asset flows, this is roughly what it would look like: compliant stablecoin for dollar settlement, partnership with the leading tokenization platform, integration with the dominant cross-chain messaging protocol, and a purpose-built ledger for high-volume financial transactions.

5. Network Effects Favor Infrastructure Convergence

As tokenization accelerates across traditional finance—with not just BlackRock but also Franklin Templeton, WisdomTree, and others launching tokenized funds—network effects will favor infrastructure convergence.

Multiple isolated blockchain ecosystems create friction. If Securitize becomes the standard tokenization platform, and if Wormhole emerges as the dominant bridge protocol, and if RLUSD establishes itself as the compliant stablecoin, these components naturally interconnect. XRPL is architecturally positioned at that intersection.

The Case for Skepticism: What This Theory Requires

Before accepting the "hidden pipeline" narrative, we must acknowledge what it requires to be true:

BlackRock Would Need to View XRPL as Strategic Infrastructure

Currently, BlackRock's $BUIDL operates on Ethereum, Arbitrum, Avalanche, Optimism, and Polygon—but not on XRPL. If BlackRock considered XRPL essential to its tokenization strategy, why wouldn't $BUIDL be directly integrated there?

Possible answer: Early-stage infrastructure is being tested on established chains first, with XRPL integration planned once the model is proven. Or: Direct XRPL integration isn't necessary if Wormhole bridges provide the connectivity.

Counter-argument: Or BlackRock simply hasn't prioritized XRPL because it doesn't view it as strategically important, regardless of technical capabilities.

Institutional Adoption Would Need to Overcome Traditional Finance Conservatism

Major financial institutions move slowly and conservatively. They prioritize regulatory certainty, established counterparties, and proven technology. While Ripple's regulatory picture has improved, XRP still carries history that conservative institutions might avoid.

Possible answer: Infrastructure adoption happens gradually. Initial tokenized assets might not touch XRPL directly, but as the technology proves itself and regulatory clarity strengthens, institutional comfort grows.

Counter-argument: Or institutions will simply use established chains like Ethereum, where regulatory frameworks are clearer and institutional infrastructure is more developed.

Economic Incentives Would Need to Favor XRPL Over Alternatives

For XRPL to capture significant tokenized asset settlement, it would need clear advantages over Ethereum Layer 2 solutions, which are also fast and cheap, or over traditional settlement systems, which institutions already trust.

Possible answer: XRPL's purpose-built financial infrastructure, native DEX, and bridge currency model offer unique advantages for complex institutional transactions involving multiple assets and currencies.

Counter-argument: Or the marginal benefits don't justify the switching costs, and institutions stick with Ethereum-based infrastructure that already has the deepest liquidity and most institutional adoption.

Now Let's Separate Fact from Speculation

CONFIRMED FACTS (Tier 1)

These are documented, verifiable, and sourced:

- Ripple invested in Securitize and established a partnership focused on bringing real-world assets to XRPL. Source: Ripple Official Announcement

- BlackRock's $BUIDL fund is powered by Securitize's tokenization platform. Source: BlackRock BUIDL Fund Documentation

- BlackRock's $BUIDL uses Wormhole for cross-chain functionality. Source: Wormhole Official Integration Page

- Ripple's RLUSD uses Wormhole's NTT standard for multichain expansion. Source: Ripple Official Announcement

- RLUSD is now available on Optimism, Base, Arbitrum, Polygon, Avalanche, and Unichain, creating liquidity pairs with wrapped XRP on these networks. Source: Ripple Official Announcement

- RLUSD is the first U.S.-based, trust-regulated stablecoin on several of these Layer 2 networks. Source: Ripple Official Announcement

- Larry Fink has publicly stated that tokenization represents the "next generation" of financial markets. Source: CoinDesk Interview

- BlackRock's $BUIDL fund has grown to over $500 million in assets. Source: CoinDesk Report

- Securitize announced plans to enable tokenized securities on XRPL as part of its Ripple partnership. Source: Ripple Partnership Announcement

- The XRP Ledger features a built-in decentralized exchange with automated market maker capabilities. Source: XRPL Documentation

EXPERT ANALYSIS & INTERPRETATION (Tier 2)

These are informed opinions from credible sources but represent analysis, not confirmed plans:

- According to crypto analyst Stern Drew: "This isn't a partnership headline. It's a capital-markets architecture quietly locking into place." Drew argues that the shared infrastructure creates pathways for institutional money to flow through Ripple rails. Source: Stern Drew X Thread

Important context: Drew is a crypto analyst with a following in the XRP community. His analysis is based on observable technical integrations, but represents his interpretation of strategic significance rather than confirmed institutional intent.

- According to Drew's analysis: "When tokenized stocks, funds, and treasuries start moving at scale, the demand won't ask for permission, it will pull liquidity straight through XRPL."

Important context: This represents a prediction about future market dynamics based on infrastructure positioning, not a confirmed roadmap from any institution.

- Drew's characterization: "XRP becomes the liquidity layer" and "XRPL becomes the settlement rail" for tokenized assets moving across chains.

Important context: This describes theoretical functionality that the technology could provide, not confirmed use cases from BlackRock or other institutions.

SPECULATION & UNCONFIRMED THEORY (Tier 3)

These are possibilities that lack direct evidence and require significant assumptions:

- SPECULATION: BlackRock deliberately chose Securitize and Wormhole to position $BUIDL for future XRPL integration.

Why this is speculation: BlackRock has made no statements connecting $BUIDL strategy to XRP or XRPL. Securitize and Wormhole are leading providers in their respective categories—BlackRock might have chosen them purely based on technical merit and compliance capabilities, regardless of Ripple connections.

What would confirm this: Official statements from BlackRock executives discussing XRPL integration plans, or internal documents revealing strategic considerations around Ripple partnerships.

- SPECULATION: Tokenized securities will primarily settle through XRPL rather than Ethereum or other established chains.

Why this is speculation: Currently, the vast majority of DeFi activity, institutional crypto adoption, and tokenized asset activity occurs on Ethereum and its Layer 2 ecosystems. XRPL would need to capture significant market share from established alternatives.

Technical barriers: Ethereum has far deeper liquidity, more institutional infrastructure, clearer regulatory frameworks in many jurisdictions, and substantially more developer activity. XRPL would need compelling advantages to overcome these network effects.

What would confirm this: Major institutions announcing XRPL as a settlement layer, tokenized asset volume flowing through XRPL exceeding other chains, or explicit institutional mandates favoring XRPL infrastructure.

- SPECULATION: The Securitize-Wormhole-Ripple connection represents intentional strategic coordination rather than independent technical decisions.

Why this is speculation: These could simply be three separate entities making independent choices about quality service providers. Ripple investing in Securitize creates a business relationship, but that doesn't mean Securitize's other clients are coordinating with Ripple.

Analogy: If Company A invests in AWS, and Company B also uses AWS, that doesn't mean Company A and Company B are strategically coordinated—they might just both recognize AWS as quality infrastructure.

What would confirm this: Joint announcements between BlackRock, Securitize, and Ripple discussing coordinated strategy, or reporting revealing discussions about infrastructure alignment.

- SPECULATION: XRPL will become the dominant liquidity layer for cross-chain tokenized asset transfers.

Why this is speculation: Multiple competing solutions exist for cross-chain liquidity, including Ethereum Layer 2 solutions, Cosmos ecosystem bridges, Polkadot's parachain model, and others. XRPL is one option among many.

Economic barriers: For XRPL to become dominant, it would need to offer superior economic incentives compared to alternatives. This requires not just technical capability but also network effects, liquidity depth, and institutional adoption—all of which currently favor Ethereum-based solutions.

What would confirm this: Measurable liquidity flowing through XRPL exceeding competing solutions, institutions explicitly choosing XRPL for cross-chain settlement, or economic analysis showing clear cost advantages.

- SPECULATION: BlackRock's use of Securitize indicates intention to utilize XRP or XRPL in any direct capacity.

Why this is speculation: BlackRock's $BUIDL fund doesn't currently operate on XRPL. Using a service provider that has relationships with Ripple doesn't indicate BlackRock's strategic intent regarding XRP.

What would confirm this: BlackRock announcing XRPL integration for $BUIDL or other products, BlackRock executives discussing XRP utility, or regulatory filings indicating XRP holdings or usage.

- SPECULATION: This infrastructure will drive significant XRP demand and price appreciation.

Why this is speculation: Even if institutions use XRPL infrastructure, that doesn't automatically translate to XRP demand. The relationship between infrastructure usage and token value is complex and depends on tokenomics, actual transaction volume, and whether XRP is required for the specific use cases institutions adopt.

Economic uncertainty: Would institutions hold XRP for liquidity, or use RLUSD exclusively? Would cross-chain transfers require XRP, or could they occur through wrapped assets and stablecoins alone? These mechanics determine actual XRP demand.

What would confirm this: Clear tokenomics showing institutional use cases require XRP holdings, measurable XRP transaction volume tied to institutional activity, or economic analysis demonstrating the value capture mechanism.

The Honest Assessment: Plausible Infrastructure Positioning, Uncertain Institutional Adoption

Here's the most accurate characterization of the situation:

What we can say with confidence: Ripple has strategically positioned itself within institutional tokenization infrastructure through its Securitize investment, RLUSD development, and technical integrations with Wormhole. These connections create technical pathways that could theoretically support institutional use of XRPL and XRP.

What requires more evidence: Whether major institutions like BlackRock view these connections as strategically significant, whether they intend to leverage XRPL for tokenized asset settlement, and whether economic incentives will drive adoption over competing alternatives.

The most honest framing: This is plausible infrastructure positioning that creates optionality for future institutional adoption, not confirmed strategic alignment or inevitable institutional usage.

Think of it this way: Ripple has built the on-ramp and the infrastructure is technically compatible. Whether institutions actually use that on-ramp depends on factors beyond Ripple's control—regulatory clarity, economic incentives, competitive offerings, institutional preferences, and network effects.

What Would Actually Confirm the Theory?

If the "hidden pipeline" theory is correct, we should see specific developments:

Short-term indicators (6-12 months):

- Securitize announces additional XRPL integrations for tokenized securities beyond initial partnership announcements

- Other tokenization platforms (not just Securitize) begin integrating XRPL

- Measurable transaction volume of tokenized assets flowing through XRPL

- Traditional finance institutions making statements about XRPL evaluation or testing

Medium-term indicators (1-2 years):

- BlackRock or other major institutions explicitly announcing XRPL integration for tokenized products

- Regulatory frameworks emerging that favor or enable institutional XRPL usage

- XRP transaction volume demonstrably tied to institutional tokenized asset activity

- Additional major institutions choosing Securitize and discussing Ripple connections

- Liquidity metrics showing significant growth in XRPL-based tokenized asset markets

Long-term confirmation (3-5 years):

- Dominant market share of tokenized securities settlement occurring on XRPL

- Institutional treasury operations holding XRP for liquidity purposes

- Clear economic advantages demonstrated through cost savings or efficiency gains

- Network effects creating momentum toward XRPL as standard infrastructure

If these indicators don't materialize, the theory remains interesting but unconfirmed speculation.

The Bottom Line: Infrastructure Matters, But Adoption Is Uncertain

Drew's analysis identifies something genuinely significant: shared infrastructure creates potential pathways that didn't exist before. The technical connections between BlackRock's tokenization stack and Ripple's ecosystem are real and observable.

But identifying potential infrastructure pathways is different from confirming strategic intent or predicting inevitable adoption. The crypto industry is littered with technically superior solutions that failed to achieve adoption due to network effects, regulatory barriers, or simply being outcompeted by established alternatives.

What makes this theory worth watching:

- The infrastructure is real and operational, not vaporware

- The timing aligns with broader institutional tokenization trends

- The technical architecture makes strategic sense

- Major capital (BlackRock) is committed to blockchain-based tokenization

- Regulatory clarity around XRP is improving

What makes this theory uncertain:

- No explicit institutional statements supporting the connection

- Competing infrastructure has stronger network effects currently

- Economic incentives for institutions remain unclear

- Regulatory frameworks are still developing

- Historical patterns suggest infrastructure adoption takes years

The most accurate assessment is that Ripple has positioned itself strategically within emerging institutional infrastructure, creating optionality that could prove valuable if tokenization accelerates and if institutions choose these particular rails. But this is positioning, not confirmation.

Drew's characterization of "infrastructure alignment" is more accurate than "hidden pipeline"—the former suggests potential synergies, the latter implies intentional coordination we cannot verify.

For investors and observers, this is a situation worth monitoring closely, but not one where outcomes are predetermined. The infrastructure exists. Whether institutions use it remains to be seen.

The next 12-24 months will reveal whether this is prescient analysis of emerging institutional infrastructure, or an interesting theory that overestimated the strategic significance of technical overlap.

Sources

Primary Sources:

- Ripple: RLUSD Expands to Layer 2 Networks

- Ripple: Investment in Securitize Announcement

- BlackRock: BUIDL Fund Information

- Wormhole: BUIDL Integration

- XRPL: Decentralized Exchange Documentation

News & Analysis:

DISCLAIMER: This newsletter is for informational purposes only and does not constitute investment advice, advertising, or a recommendation to buy, sell, or hold any securities. This content is not sponsored by or affiliated with any of the mentioned entities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.