Senate Finance Committee to Tackle Digital Asset Taxes on October 1

Senate Finance Committee tackles crypto taxes Oct 1. With $50B in unreported digital asset transactions, this hearing could reshape American cryptocurrency regulation and provide the clarity investors desperately need. 🏛️💰 #CryptoTax #Regulation

Bottom Line Up Front: The Senate Finance Committee hearing on October 1 could reshape crypto taxation in America, potentially providing the regulatory clarity that has eluded the industry for years while addressing compliance challenges that cost taxpayers billions.

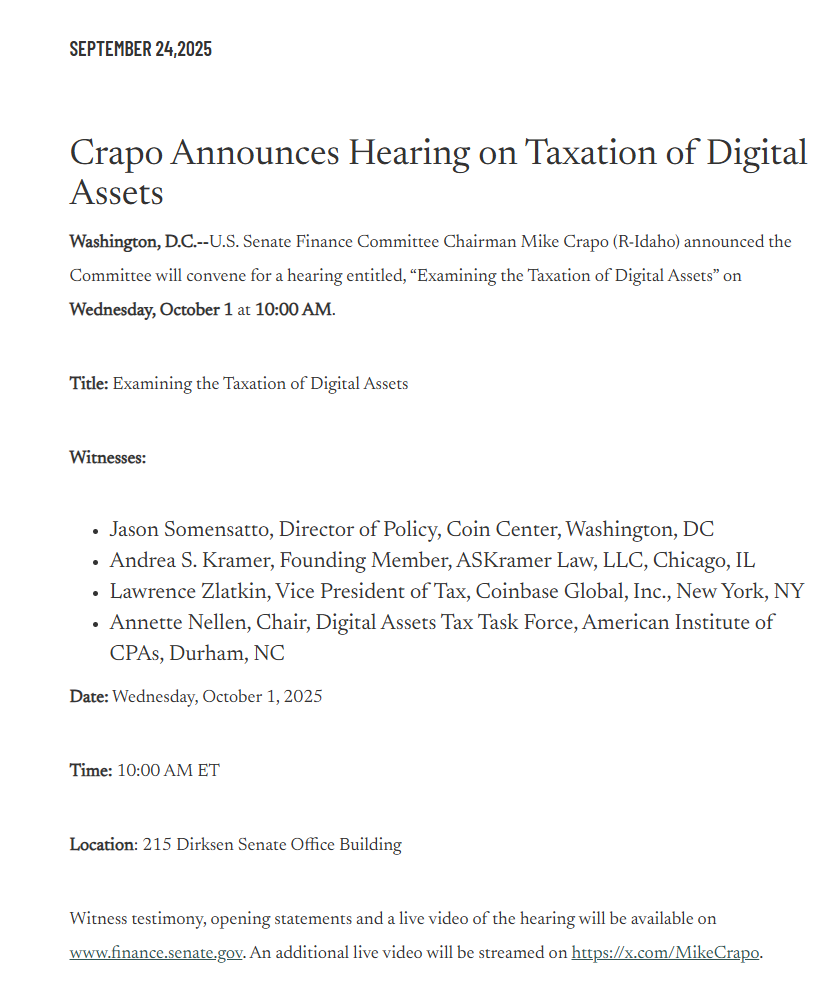

The cryptocurrency industry is about to face its most significant regulatory moment yet. U.S. Senate Finance Committee Chairman Mike Crapo (R-Idaho) announced the Committee will convene for a hearing entitled, "Examining the Taxation of Digital Assets" on Wednesday, October 1 at 10:00 AM. This landmark hearing arrives at a critical juncture when digital asset tax compliance challenges threaten to undermine both investor confidence and federal revenue collection.

Why This Hearing Matters Now

The timing of this congressional examination couldn't be more crucial. Studies suggest that at least $50 billion of that gap is due to unreported digital asset transactions out of a federal tax revenue gap of approximately $688 billion. The cryptocurrency market, now worth over a trillion dollars, has evolved faster than the regulatory frameworks designed to govern it.

Senate tax writers will get their chance to hear from crypto industry officials at a hearing on taxation of digital assets scheduled for Oct. 1, following a House Ways and Means Committee hearing earlier this year. However, crypto-focused tax proposals didn't make it into July's $3.4 trillion GOP tax law, highlighting the urgent need for legislative action.

The hearing features heavyweight witnesses from across the industry: Jason Somensatto, Director of Policy, Coin Center, Washington, DC; Andrea S. Kramer, Founding Member, ASKramer Law, LLC, Chicago, IL; Lawrence Zlatkin, Vice President of Tax, Coinbase Global, Inc., New York, NY; Annette Nellen, Chair, Digital Assets Tax Task Force, American Institute of CPAs, Durham, NC.

The Current Tax Compliance Crisis

Digital asset taxation presents unprecedented challenges that traditional tax systems weren't designed to handle. Except for a few brokers like Robinhood, CashApp, Etoro & PayPal, the vast majority of US cryptocurrency exchanges do not issue any 1099-Bs for taxpayers. Moreover, annual gain & loss reporting is almost nonexistent in overseas cryptocurrency exchanges and decentralized exchanges.

This reporting gap creates enormous compliance burdens for individual investors. For U.S. tax purposes, digital assets are considered property, not currency, meaning every transaction potentially triggers taxable events. From buying coffee with Bitcoin to complex DeFi yield farming strategies, Americans must track and report every digital asset transaction.

The complexity extends beyond individual compliance. The most fundamental difficulty in taxing crypto assets is that they are "pseudonymous." That is, transactions use public addresses that are extremely difficult to link with individuals or firms. This can make tax evasion easier.

Market Implications and Industry Response

The hearing comes as the broader crypto industry pushes for regulatory clarity that could unlock institutional adoption. Major financial institutions are already positioning themselves for expanded crypto services. Morgan Stanley, Bank of America, and Goldman Sachs have indicated plans to expand their crypto-related operations, but tax uncertainty remains a significant barrier.

Recent legislative proposals demonstrate the potential scope of reform. Senator Lummis' legislation addresses major digital asset taxation issues, including small transaction practicality (a $300 de minimis rule), ending the double taxation of digital asset miners and stakers, parity with other financial assets (digital asset lending, wash sales, mark-to-market tax treatment) and providing that charitable contributions do not require an appraisal.

The economic stakes are substantial. The legislation is estimated by the Congressional Joint Committee on Taxation to generate approximately $600 million in net revenue during the 2025-2034 budget window.

XRP/Ripple Analysis: A Case Study in Regulatory Clarity

The hearing's implications for XRP and Ripple illustrate the broader challenges facing digital assets. After more than two and a half years of litigation, Ripple secured a partial victory in July 2023 when Judge Analisa Torres ruled that XRP itself is not a security. This legal clarity has transformed XRP's market position and tax implications.

The resolution of regulatory uncertainty has already sparked institutional interest. Ripple's acquisition of Hidden Road, a prime broker, for $1.25 billion in April 2025 underscores the company's strategic pivot toward institutional-grade services. For XRP holders, regulatory clarity could mean:

Price Potential: The legal clarity provided by Judge Analisa Torres's 2023 decision and the SEC's subsequent withdrawal of appeals in 2025 created a framework that distinguishes XRP from securities, potentially reducing regulatory risk premiums in XRP's valuation.

Tax Benefits: Emerging reports suggest potential preferential treatment for U.S.-based digital assets. Eric Trump has reportedly confirmed upcoming tax policies exempting U.S.-based cryptocurrencies such as XRP and HBAR from capital gains tax. Meanwhile, non-U.S. projects could be subjected to a tax rate of approximately 30%.

Business Operations: Ripple CEO Brad Garlinghouse announced a significant shift in US crypto regulations, highlighting potential growth and increased banking interest in cryptocurrency following recent SEC developments. Clear tax rules would eliminate compliance uncertainties that have hindered institutional adoption.

Partnership Opportunities: The company has announced new partnerships with banks and payment providers in Asia-Pacific and the Middle East. They're leveraging their XRP Ledger for cross-border payments. Domestic tax clarity could accelerate similar U.S. partnerships.

Looking Ahead: What to Expect

The October 1 hearing represents more than just another congressional examination – it's a potential turning point for American cryptocurrency policy. Senate Democrats have recently demanded co-authorship on a crypto market structure bill, potentially delaying clarity until late October 2025 to ensure bipartisan input on digital asset oversight.

The stakes extend beyond compliance costs. Firms that invest in scalable, automated tax reporting solutions now will be better positioned to compete in an increasingly regulated market. For investors, the hearing could herald an era of clearer rules that eliminate the current maze of conflicting guidance.

Key Takeaway: The Senate Finance Committee hearing on October 1 could finally deliver the tax clarity that crypto has desperately needed, potentially transforming compliance from a nightmare into a manageable business process while positioning America as a global leader in digital asset regulation.

DISCLAIMER: This newsletter is for informational purposes only and does not constitute investment advice, advertising, or a recommendation to buy, sell, or hold any securities. This content is not sponsored by or affiliated with any of the mentioned entities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.

Sources

- Senate Finance Committee Official Announcement

- Bloomberg Tax - Crypto Taxation Hearing

- IRS Digital Assets Guidance

- Bloomberg Tax - Digital Asset Tax Complexity

- Senator Lummis Digital Asset Tax Legislation

- Gibson Dunn Digital Assets Regulatory Update

- Gordon Law Group - SEC vs. Riple Analysis

- The Crypto Basic - Eric Trump Tax Policy Report

- Bitget News - XRP Regulatory Clarity Analysis

- Wolters Kluwer - Tax Compliance Challenges

- Crypto Briefing - Senate Digital Assets Taxation Hearing

- IMF - Crypto Tax Problems