SEC vs. Ripple Case Officially Ends: Joint Dismissal Brings Regulatory Clarity

The 5-year SEC vs. Ripple legal battle officially ends! Joint dismissal filed August 7, bringing regulatory clarity to XRP. $125M penalty stands, but the crypto industry gets landmark precedent on token sales. XRP surges 11% on the news. Read the full analysis!

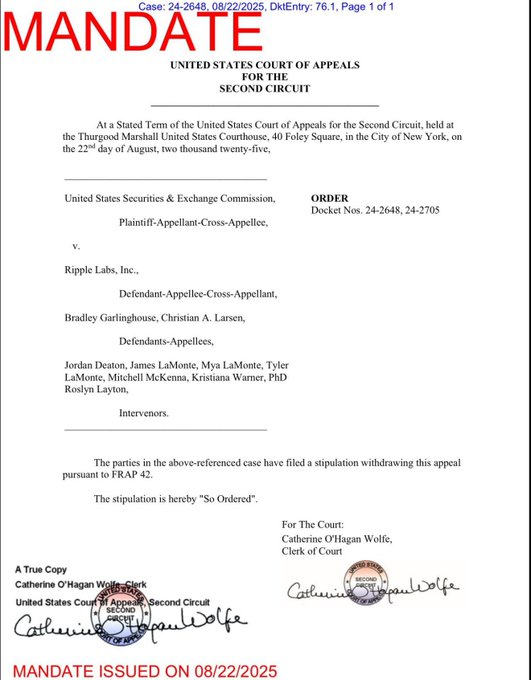

The cryptocurrency industry witnessed a landmark moment on August 7, 2025, when the U.S. Securities and Exchange Commission (SEC) and Ripple Labs filed a joint stipulation to dismiss all appeals in their long-running legal battle. This development officially ends one of the most closely watched regulatory cases in crypto history, bringing much-needed clarity to XRP's legal status.

Historic Legal Battle Concludes

The joint dismissal filing with the U.S. Court of Appeals for the Second Circuit marks the definitive end of litigation that began in December 2020. Under the agreement, each party will bear its own legal costs and fees, with no further appeals or enforcement actions expected.

"Following the Commission's vote today, the SEC and Ripple formally filed directly with the Second Circuit to dismiss their appeals," confirmed Stuart Alderoty, Ripple's Chief Legal Officer, on social media. "The end…and now back to business."

The dismissal covers both the SEC's primary appeal (Case No. 24-2648) and Ripple's cross-appeal (Case No. 24-2705), effectively putting to rest a legal saga that has shaped cryptocurrency regulation for nearly five years.

Background and Key Rulings

The SEC originally sued Ripple Labs and executives Brad Garlinghouse and Christian Larsen in December 2020, alleging the company conducted an unregistered securities offering by selling over $1.3 billion worth of XRP. Ripple consistently argued that XRP functions as a digital currency, not a security.

In a pivotal July 2023 ruling, U.S. District Judge Analisa Torres delivered a split decision that became a watershed moment for crypto regulation. The court found that Ripple's programmatic sales of XRP on crypto exchanges to retail investors did not constitute securities transactions—a landmark determination that established important legal precedent. However, the ruling also found that Ripple's direct institutional sales violated securities laws.

Following the mixed ruling, Judge Torres imposed a $125 million civil penalty on Ripple in August 2024, along with a permanent injunction against future securities law violations. This penalty was significantly lower than the nearly $2 billion originally sought by the SEC.

Market Impact and XRP Performance

The news of the joint dismissal triggered an immediate positive market reaction. XRP surged approximately 11% within hours of the announcement, climbing from around $2.99 to highs of $3.37. Trading volumes exploded, with institutional trading volumes spiking 208% to $12.40 billion on the day of the announcement.

The legal resolution has removed a major regulatory overhang that has clouded XRP's prospects since 2020. Market analysts note that the clarity provides a foundation for renewed institutional adoption and potential exchange-traded fund (ETF) applications.

Regulatory Landscape and Broader Implications

The case's conclusion comes amid a broader shift in SEC enforcement strategy under the Trump administration. The agency has dismissed over a dozen crypto-related cases and investigations in recent months, signaling a more accommodative approach to digital asset regulation.

The Ripple ruling established important legal distinctions between different types of token sales, creating precedent that secondary market sales to retail investors may not automatically constitute securities transactions. This nuanced approach contrasts with the previous administration's more aggressive "regulation by enforcement" strategy.

XRP and Ripple's Future Outlook

With regulatory clarity achieved, Ripple is positioning itself for expanded operations. The company has applied to establish a national trust bank in New York, which would enable it to facilitate institutional liquidity and global settlements using XRP and its RLUSD stablecoin.

International developments are also boosting confidence in XRP's future. Japan's SBI Holdings has filed to launch the country's first Bitcoin-XRP ETF, while South Korea's BDACS has integrated XRP into its regulated custody platform. These moves signal growing institutional acceptance of XRP in major Asian markets.

Technical Analysis and Price Projections

From a technical perspective, XRP has established strong support around $3.15-$3.25, with resistance forming near $3.30-$3.35. The token's breakout above the psychological $3.00 level, combined with sustained institutional buying, suggests continued bullish momentum.

Analyst projections for XRP's price by end-2025 vary significantly, with conservative estimates ranging from $4.00-$5.00, while more optimistic scenarios project potential targets between $6.00-$8.00, depending on institutional adoption rates and potential ETF approvals.

Legal Precedent and Industry Impact

The Ripple case has established several important precedents for the crypto industry:

- Clarity on Token Sales: The ruling distinguished between retail and institutional token sales, providing guidance for future projects

- Securities Law Application: The decision clarified that not all cryptocurrency transactions automatically constitute securities offerings

- Regulatory Certainty: The resolution demonstrates that crypto companies can successfully defend against SEC enforcement actions

Legal experts note that while the case doesn't create binding precedent for all cryptocurrencies, it provides valuable guidance for how courts may evaluate similar disputes in the future.

Looking Forward

The end of the SEC vs. Ripple case represents more than just legal resolution—it marks a potential turning point for cryptocurrency regulation in the United States. With XRP's legal status clarified and Ripple free to expand its business operations without the overhang of federal litigation, the company can focus on institutional partnerships and cross-border payment solutions.

The $125 million penalty remains in effect, along with the permanent injunction requiring Ripple to comply with securities registration requirements for any future institutional offerings. However, these constraints are viewed as manageable compared to the existential threat the lawsuit once posed.

As the crypto industry continues to mature, the Ripple case will likely be remembered as a watershed moment that helped establish clearer boundaries between legitimate digital asset businesses and potential securities violations.

DISCLAIMER: This newsletter is for informational purposes only and does not constitute investment advice or a recommendation to buy, sell, or hold any securities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.

Sources

- CoinDesk - SEC's Long-Running Case Against Ripple Officially Over

- Cointelegraph - SEC, Ripple lawsuit to end after joint agreement to drop appeals

- The Street Crypto - SEC and Ripple case is officially over

- Blockchain Reporter - SEC vs. Ripple Ends: Parties File Joint Dismissal of Appeals

- Brave New Coin - Ripple‑SEC Lawsuit News: XRP Case Officially Ends

- CCN - Ripple vs. SEC Lawsuit Decision: Appeals Dropped, Penalties Cut in Landmark Case

- MEXC News - Ripple and SEC End Legal Fight With Joint Dismissal of Appeals

- Finance Magnates - Judge Imposes $125 Million Penalty on Ripple and Bans Future Securities Violations

- CoinDesk - XRP Price News: Gains 4% as Ripple-SEC Settlement Spurs Institutional Buying

- The Market Periodical - XRP SEC News: Court Appeal Dismissal Could Clear Path to Settlement