SEC publishes "Crypto Asset Custody Basics for Retail Investors."

The SEC published critical guidance on crypto custody Dec 12. Learn the key differences between self-custody and third-party storage, what protections exist (and don't), and lessons from $8B+ in losses from FTX and Celsius collapses.

The Securities and Exchange Commission published critical new guidance on December 12, 2025, aimed at helping retail investors navigate one of crypto's most consequential decisions: how to safely store digital assets. The bulletin, "Crypto Asset Custody Basics for Retail Investors," released through the agency's Investor.gov platform, marks a significant educational push as institutional and retail crypto adoption accelerates.

The timing is particularly relevant. As the institutional crypto custody market reached $3.28 billion in 2025—projected to hit $6.03 billion by 2030—and major financial institutions develop compliant custody solutions, understanding proper asset storage isn't just theoretical. It's essential protection against the catastrophic losses that devastated investors during the FTX, Celsius, and other major exchange collapses in 2022.

Understanding the Custody Challenge

The SEC's guidance addresses a fundamental question every crypto investor faces: where and how to safely store digital assets. According to the bulletin, investors must carefully evaluate whether to use custodial services—where a third party holds your assets—or self-custody solutions where you maintain direct control through private keys.

Unlike traditional securities held in brokerage accounts with SIPC protection, cryptocurrency custody presents unique risks that many retail investors don't fully understand. The consequences of getting this wrong are severe: lose your private keys, and you permanently lose your assets. Trust the wrong custodian, and billions in customer funds can vanish overnight.

What the SEC Guidance Covers

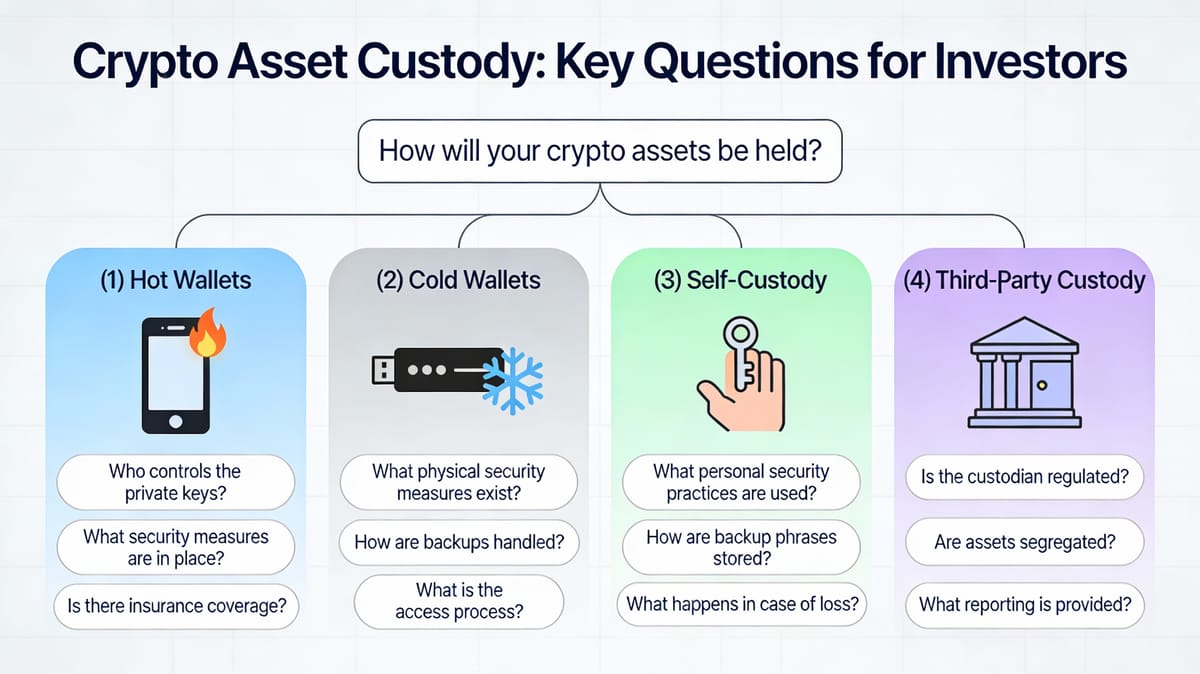

The SEC's bulletin breaks down crypto custody into clear categories and critical questions investors must ask:

Hot vs. Cold Wallets: The guidance explains that hot wallets are connected to the internet (desktop, mobile, or web applications), offering convenience but exposing assets to cyberthreats. Cold wallets—physical devices like USB drives or even paper—provide better security from hacking but can be lost, damaged, or stolen, permanently destroying access to your crypto.

Self-Custody Responsibilities: With self-custody, you control your crypto assets and are responsible for managing private keys. The SEC emphasizes this means sole responsibility for security. If your wallets are lost, stolen, damaged, or hacked, you may permanently lose access. The bulletin stresses the importance of protecting your "seed phrase"—a random sequence of words that allows wallet restoration—and never sharing it with anyone.

Third-Party Custodian Evaluation: For investors choosing professional custody providers, the SEC provides essential due diligence questions: Has the custodian been researched thoroughly? What regulatory oversight do they have? What insurance covers loss or theft? How are assets stored and safeguarded? Do they engage in "rehypothecation" (using your assets as collateral for their own purposes) or commingling customer funds?

The guidance warns that if third-party custodians are hacked, shut down, or go bankrupt, investors may lose access to their crypto assets—a warning that proved tragically prescient for hundreds of thousands who lost billions when major platforms collapsed.

Why This Matters Now: The Custody Crisis of 2022

The SEC's educational push comes as the industry continues recovering from the 2022 crypto bankruptcy cluster that exposed fundamental custody failures across major platforms.

FTX's November 2022 collapse resulted in $8 billion in customer losses affecting over one million users. Investigations revealed customer funds weren't properly segregated, and assets were misused for personal purchases, political donations, and covering losses at affiliated hedge fund Alameda Research.

Celsius Network, which attracted billions by promising "double-digit yields," filed for bankruptcy in July 2022. Due to the platform's terms of service, user deposits were deemed part of the company's assets, meaning users became unsecured creditors with limited recovery prospects. While Celsius has distributed over $2.53 billion to approximately 251,000 creditors through 2024—representing 93% of total claim value—many investors still face substantial losses.

Voyager Digital, BlockFi, and Genesis Global all collapsed in the domino effect triggered by the Three Arrows Capital hedge fund failure. These platforms had significant lending exposure to each other, creating interconnected risk that turned what began as one failure into an industry-wide crisis.

According to research on crypto failures, customer contracts with these platforms were often "long, complex, ambiguous, subject to frequent unilateral modifications, and contained internal inconsistencies." Many customers didn't read or understand terms that essentially made them unsecured creditors rather than asset owners.

How This Changes the Crypto Adoption Landscape

The SEC's custody guidance represents a pivotal shift in how regulators approach digital asset education—and signals major implications for mainstream crypto adoption:

1. Education Over Prohibition

Rather than attempting to eliminate crypto investing through restrictive regulation, the SEC is providing practical information to help investors participate more safely. This educational approach acknowledges that digital assets are becoming a permanent part of the financial landscape and that investor protection works better through informed decision-making than outright bans.

This shift matters because it establishes a regulatory framework focused on transparency and safety rather than prohibition. For potential crypto investors who have been hesitant due to regulatory uncertainty, clear guidance on custody fundamentals removes a significant barrier to entry.

2. Institutional Infrastructure Acceleration

The bulletin's emphasis on evaluating custodian credentials, regulatory status, and insurance coverage creates pressure for custody providers to professionalize their operations. Companies operating in regulatory gray areas or with inadequate safeguards will face increased scrutiny, while those meeting higher standards gain competitive advantages.

This is already driving market consolidation and improvement. The institutional crypto custody market, valued at $3.28 billion in 2025 and projected to reach $6.03 billion by 2030, is seeing major financial institutions develop compliant solutions. Traditional custody banks are extending their services to digital assets, bringing decades of experience in asset safeguarding to the crypto space.

3. Bridging Traditional and Digital Finance

By establishing clear custody standards, the SEC is helping bridge the gap between traditional financial services and cryptocurrency markets. Institutional investors—pension funds, endowments, family offices—have been reluctant to enter crypto markets partly due to custody concerns. Clear guidance on what constitutes adequate safeguarding allows these institutions to develop compliant investment strategies.

This matters for retail investors too. As institutions enter the market with proper custody infrastructure, retail investors gain access to regulated products like ETFs and managed funds that provide professional-grade custody without requiring technical expertise in private key management.

4. Marketplace Maturation and Consumer Protection

The guidance signals that regulators view crypto custody failures not as reasons to shut down the industry, but as problems requiring consumer protection solutions. This approach mirrors how traditional financial regulation evolved—through establishing standards, requiring transparency, and holding service providers accountable rather than prohibiting innovation.

As SEC Commissioner Caroline Crenshaw noted, "Trust is particularly important in our relationships with financial institutions. That is why our custody regulations are so important. We have seen the harm that befalls investors when their money is in the hands of untrustworthy actors."

The bulletin's detailed questions about custodian practices—segregation of assets, insurance coverage, use of customer funds, bankruptcy protections—establish baseline expectations that professional custody providers must meet to maintain investor trust.

5. Enforcement Foundation

Educational bulletins often precede enforcement actions. The SEC has already charged investment advisers for custody rule violations after platforms like FTX collapsed, with one adviser agreeing to a $225,000 penalty for failing to ensure crypto assets were held with qualified custodians.

This guidance establishes clear standards that regulators can enforce, creating accountability for custody providers. Platforms that misrepresent their security practices, fail to segregate customer assets, or use customer funds for their own purposes now face clear regulatory standards they're violating—making enforcement more straightforward and penalties more justified.

6. Global Regulatory Alignment

The SEC's approach aligns with international regulatory developments like the EU's Markets in Crypto-Assets Regulation (MiCAR), which mandates operational, technological, and legal segregation of crypto assets. This global convergence toward custody standards creates a more stable foundation for international crypto markets and cross-border digital asset services.

For investors, this means custody protections are strengthening worldwide, not just in the United States. For crypto companies, it means building compliant custody infrastructure opens access to multiple major markets simultaneously.

7. Self-Custody Innovation and Education

By thoroughly explaining both self-custody and third-party custody options, the SEC legitimizes self-custody as a valid approach while emphasizing its technical requirements and risks. This encourages innovation in user-friendly self-custody solutions—hardware wallets, multi-signature arrangements, social recovery mechanisms—that provide security without requiring expert-level technical knowledge.

The guidance also drives demand for custody education. Investors who understand the tradeoffs between convenience and security, and between self-custody and professional services, make better decisions about how to store their assets based on their specific circumstances, technical abilities, and risk tolerance.

What Investors Should Do Now

Based on the SEC's guidance, retail crypto investors should take immediate action:

- Audit Current Holdings: Review where your crypto is stored. Is it on an exchange? In a self-custody wallet? Understand your current custody arrangement completely.

- Evaluate Custodian Background: If using third-party custody, research the provider's regulatory status, insurance coverage, and security practices. Check for complaints and verify their legitimacy through regulatory databases.

- Understand Protection Gaps: Determine what insurance, if any, covers your holdings. Unlike FDIC insurance for bank deposits or SIPC protection for securities, crypto assets typically lack these safety nets.

- Assess Self-Custody Capability: Honestly evaluate whether you have the technical knowledge to secure private keys and seed phrases. Self-custody mistakes are irreversible—lost keys mean permanently lost assets.

- Ask Critical Questions: Before trusting any custodian, ask: How are assets stored? Are customer assets segregated? What happens in bankruptcy? Do they use customer funds for their own purposes? These questions could have saved billions for investors in failed platforms.

- Diversify Custody Approaches: Consider splitting holdings between reputable custodians and self-custody solutions to balance convenience, security, and risk.

- Stay Informed: As custody standards evolve and new regulated products emerge, continue educating yourself about best practices and available options.

The Path Forward: Adoption Through Protection

The SEC's publication of crypto custody guidance for retail investors represents a turning point in how regulators view digital asset markets. By focusing on investor education and protection rather than prohibition, the agency signals that cryptocurrency is being integrated into the broader financial system—not pushed out of it.

This approach accelerates adoption by addressing the fundamental trust problem that has plagued crypto markets since their inception. When investors understand how their assets are stored, what protections exist, and what risks they face, they can make informed decisions about whether and how to participate in digital asset markets.

For the cryptocurrency industry, this creates both opportunity and obligation. The opportunity lies in serving the millions of potential investors who have been hesitant to enter crypto markets due to safety concerns. The obligation is to build custody infrastructure that actually delivers the security and transparency that investors—and now regulators—expect.

The 2022 bankruptcy cluster demonstrated catastrophically what happens when custody protections fail. Billions in losses, millions of affected investors, years of bankruptcy proceedings, and damaged trust in the entire crypto ecosystem. The SEC's guidance represents a collective effort to ensure those failures don't repeat.

As custody standards mature—supported by clear regulatory guidance, institutional infrastructure, and investor education—cryptocurrency moves closer to mainstream adoption. Not through hype or speculation, but through the boring, essential foundation of proper asset safeguarding that makes all financial systems work.

Investors who understand these custody basics now will be better positioned to protect their assets and participate in digital asset markets as they continue evolving. As the SEC's guidance makes clear: knowing how your crypto is stored isn't optional—it's the foundation of everything else.

DISCLAIMER: This newsletter is for informational purposes only and does not constitute investment advice, advertising, or a recommendation to buy, sell, or hold any securities. This content is not sponsored by or affiliated with any of the mentioned entities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.

Sources

Primary Source:

- SEC Investor Bulletin: Crypto Asset Custody Basics for Retail Investors - U.S. Securities and Exchange Commission, December 12, 2025

SEC Guidance and Regulatory Framework:

- SEC: Exercise Caution with Crypto Asset Securities - Investor Alert

- SEC Commissioner Remarks on Crypto Custody Standards - Commissioner Caroline Crenshaw, April 2025

- SEC Division of Trading and Markets: FAQs on Crypto Asset Activities

Crypto Exchange Failures and Bankruptcy:

- Novel Issues in the Crypto Bankruptcy Cluster - Harvard Bankruptcy Roundtable, February 2025

- Cleary Gottlieb: Novel Issues in the Crypto Bankruptcy Cluster

- FTX Scam Explained: Everything You Need to Know - TechTarget

- Judge Denies Alex Mashinsky Any Celsius Bankruptcy Payout - Cryptonews.com, June 2025

- Crypto Fortunes Lost in a Flash - Blockchain Magazine, May 2025

- What Happens to Your Assets if a Crypto Exchange Goes Bankrupt? - CCN, May 2025

- Crypto Failures: Contract, Property and Regulatory Law - Oxford Law Blogs, March 2024

XRP and Ripple Custody Developments:

- Ripple Partnership with BDACS for XRP Custody in South Korea - CoinDesk, August 2025

- Ripple Partners with South Korea's BDACS - The Crypto Basic, February 2025

- Ripple's Strategic Expansion into Custody and Stablecoins - AInvest, August 2025

- Ripple Swell 2025: XRP Custody Expansion - CoinDCX

- What's Behind XRP's Institutional Push in Late 2025? - Yahoo Finance, November 2025

- XRP's Regulatory Clarity and Institutional Adoption - AInvest, December 2025

- Ripple's Strategic Influence on Wall Street - AInvest, December 2025

- XRP Wrapped Asset Launch on Solana and Ethereum - CoinDesk, December 2025

- Strategic Case for XRP as High-Yield Institutional Investment - AInvest, December 2025

Regulatory Enforcement:

- Crypto-Focused Private Fund Adviser Settles with SEC for Custody Rule Violations - Sidley Austin, September 2024