SEC-CFTC Unite: Spot Crypto Trading Gets Federal Green Light

SEC & CFTC jointly approve spot crypto trading on federal exchanges! Historic September 2025 statement ends regulatory uncertainty, positioning XRP for major gains. Institutional adoption wave incoming as America embraces digital assets.

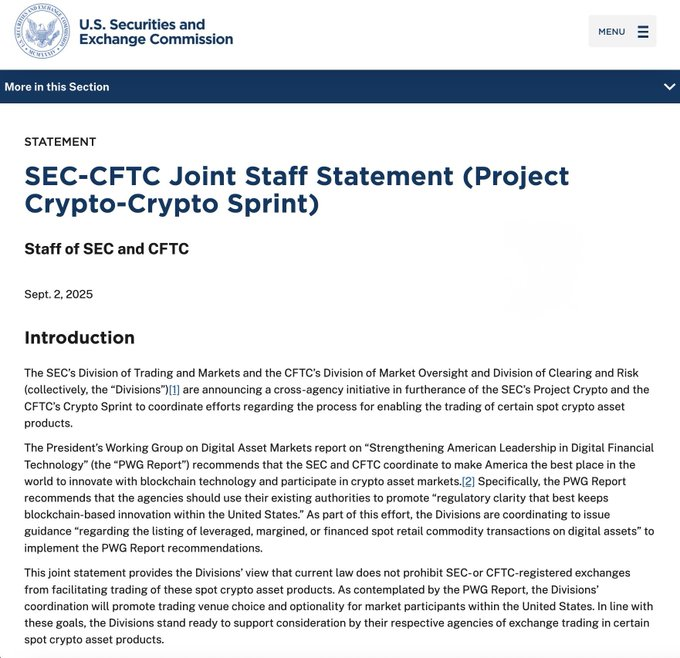

The Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) issued a groundbreaking joint statement on September 2, 2025, signaling that registered exchanges can now facilitate spot crypto asset trading without prohibition. This coordinated move represents the most significant regulatory development for U.S. crypto markets since the Trump administration took office.

The joint statement, released as part of the SEC's "Project Crypto" and CFTC's "Crypto Sprint" initiatives, clarifies that both SEC-registered national securities exchanges and CFTC-registered designated contract markets can list certain spot crypto asset products. This development directly implements recommendations from the President's Working Group on Digital Asset Markets report on "Strengthening American Leadership in Digital Financial Technology."

Breaking Down the Regulatory Shift

The joint statement addresses a critical gap in crypto regulation by coordinating how both agencies will handle spot crypto trading. Under the new framework, retail commodity transactions involving leverage, margin, or financing must occur on CFTC-registered exchanges, but an exception exists for transactions on SEC-registered national securities exchanges.

SEC Chairman Paul Atkins emphasized the significance: "Market participants should have the freedom to choose where they trade spot crypto assets. The SEC is committed to working with the CFTC to ensure that our regulatory frameworks support innovation and competition in these rapidly evolving markets."

CFTC Acting Chairman Caroline Pham declared this marks the end of the previous administration's hostile stance: "Under the prior administration, our agencies sent mixed signals about regulation and compliance in digital asset markets, but the message was clear: innovation was not welcome. That chapter is over."

Market Implications and Trading Opportunities

This regulatory clarity eliminates years of uncertainty that prevented institutional participation in U.S. crypto markets. The joint approach enables market participants to choose their preferred trading venue while ensuring comprehensive oversight through information sharing between agencies.

The statement emphasizes several key operational areas: enhanced market surveillance through shared reference pricing venues, public dissemination of trade data from both exchanges, and promoting fair and orderly markets through efficient executions and transparency.

Institutional investors, previously deterred by regulatory ambiguity, can now confidently engage with crypto assets through established, regulated channels. This development could trigger significant capital inflows as traditional financial institutions gain access to spot crypto trading through familiar regulatory frameworks.

XRP and Ripple: Positioned for Maximum Benefit

The joint statement arrives at a crucial moment for XRP and Ripple Labs, following their recent settlement with the SEC. With XRP now legally recognized as a non-security commodity for secondary market trading, the token stands to benefit substantially from expanded trading opportunities.

The regulatory clarity positions XRP uniquely in the market. Recent developments include the CFTC's reclassification of XRP as a commodity and the launch of XRP futures products on CFTC-regulated exchanges. Ten firms, including ProShares, have filed XRP ETF applications, with analysts projecting a 95% approval probability by October 2025.

Ripple's cross-border payment network, RippleNet, utilizing XRP's speed and cost efficiency through its On-Demand Liquidity service, positions the company to capitalize on renewed institutional interest. With legal uncertainties resolved, Ripple can refocus on global expansion and partnership development.

The settlement reduced Ripple's penalty from $125 million to $50 million, with $75 million returned, while officially acknowledging XRP's status as a commodity rather than a security in secondary markets. This precedent-setting resolution provides the clearest regulatory framework for any major cryptocurrency in the United States.

Regulatory Coordination in Action

The joint statement represents unprecedented cooperation between historically competing agencies. Both the SEC and CFTC committed to prompt review of filings from exchanges seeking to facilitate spot crypto trading, with dedicated staff ready to address questions from derivatives clearing organizations and commercial relationships between clearing organizations and national securities exchanges.

This coordinated approach addresses the President's Working Group recommendations for agencies to "use their existing authorities to immediately enable the trading of digital assets at the Federal level." The initiative demonstrates the Trump administration's commitment to making America "the crypto capital of the world."

Market participants can now submit registrations, proposals, or requests for relief to either agency, with both standing ready to provide guidance. This streamlined approach eliminates previous regulatory fragmentation that created compliance challenges for crypto businesses.

The regulatory framework supports the broader industry transformation from "enforcement-based regulation" under the previous administration to a collaborative approach focused on clear rules and innovation. This shift from litigation-based boundaries to legislative clarity represents a fundamental change in how U.S. agencies approach digital asset oversight.

With major crypto companies like Coinbase and Binance seeing their SEC lawsuits dropped and this joint statement providing trading clarity, the U.S. crypto market appears poised for significant growth. The combination of regulatory certainty and institutional-grade infrastructure could trigger the next major adoption wave for digital assets.

DISCLAIMER: This newsletter is for informational purposes only and does not constitute investment advice, advertising, or a recommendation to buy, sell, or hold any securities. This content is not sponsored by or affiliated with Uphold, XRP, or any mentioned entities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.

Sources

- SEC-CFTC Joint Staff Statement (Project Crypto-Crypto Sprint) - September 2, 2025

- Official SEC and CFTC joint announcement

- Link: https://sec.gov/newsroom/press-releases/2025-110

- CFTC Press Release 9109-25 - "Acting Chairman Pham Announces Next Crypto Sprint Initiative"

- August 21, 2025

- Link: https://www.cftc.gov/PressRoom/PressReleases/9109-25

- CFTC Press Release 9104-25 - "Acting Chairman Pham Announces CFTC Crypto Sprint"

- August 1, 2025

- Link: https://www.cftc.gov/PressRoom/PressReleases/9104-25

- SEC Press Release - "SEC and CFTC Staff Issue Joint Statement On Trading Of Certain Spot Crypto Asset Products"

- President's Working Group on Digital Asset Markets Report - "Strengthening American Leadership in Digital Financial Technology"