S&P Dow Jones Launches Revolutionary Crypto Index: What It Means for XRP

S&P Dow Jones launches groundbreaking Digital Markets 50 Index—15 cryptos + 35 stocks. XRP ranks #3 in the source index, strongly positioned for inclusion. With ETF approvals expected Oct 18-25, this validates crypto's institutional arrival.

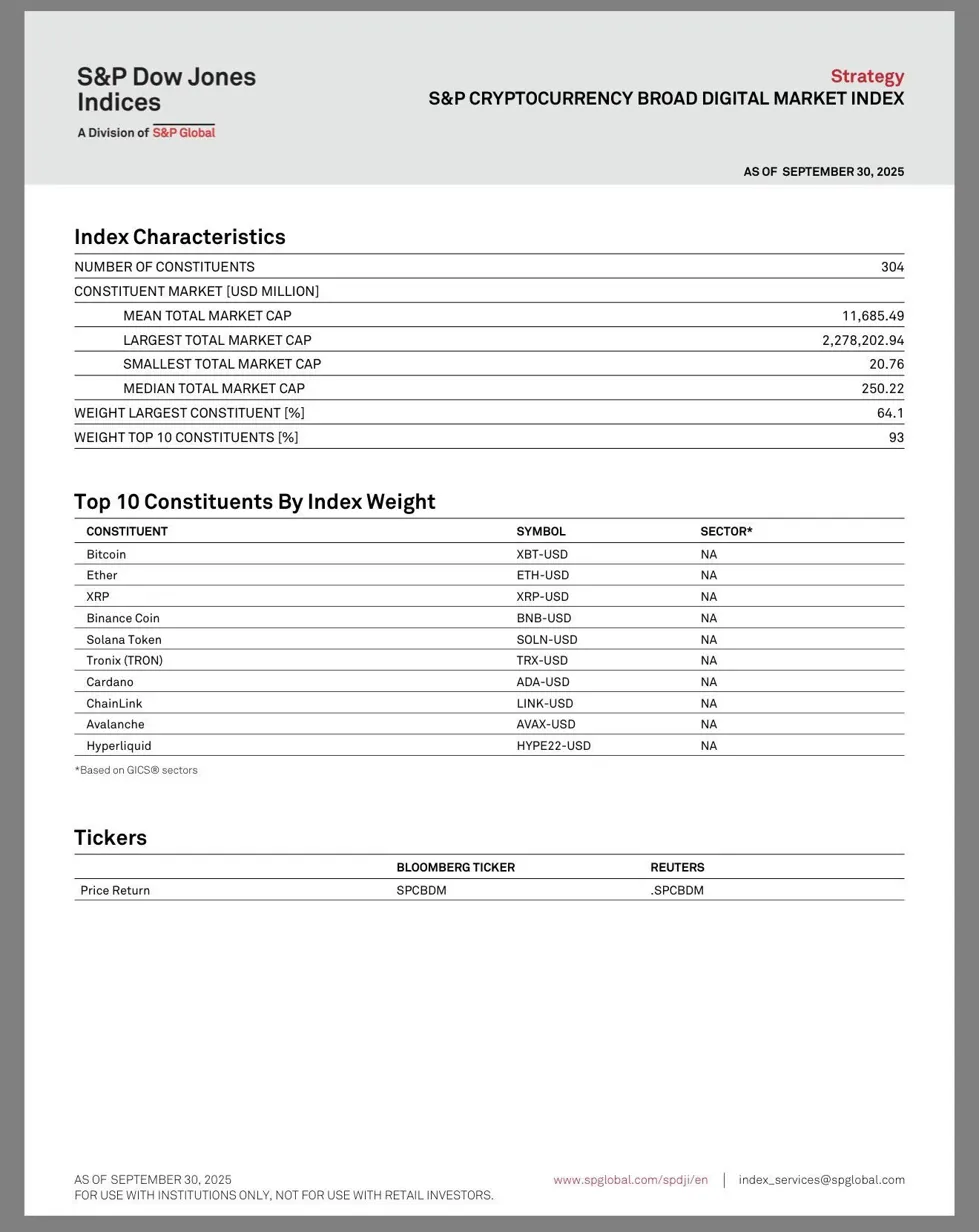

BOTTOM LINE: S&P Dow Jones Indices' launch of the S&P Digital Markets 50 Index marks a watershed moment for institutional crypto adoption, blending 15 major cryptocurrencies with 35 crypto-linked stocks. For XRP holders, this comes at a critical juncture—just weeks before anticipated ETF approvals and fresh off regulatory clarity from the Ripple-SEC settlement. XRP's position as the third-largest cryptocurrency in S&P's Broad Digital Market Index makes it a strong candidate for inclusion in this landmark hybrid benchmark.

Wall Street Embraces Digital Assets with Historic New Benchmark

In a groundbreaking move that signals the maturation of digital assets, S&P Dow Jones Indices announced today the launch of the S&P Digital Markets 50 Index—the first major index to combine traditional equity markets with cryptocurrencies. The hybrid benchmark, developed in partnership with blockchain firm Dinari, represents a pivotal shift in how institutional investors can access the rapidly evolving crypto ecosystem.

The index combines 15 major cryptocurrencies selected from the S&P Cryptocurrency Broad Digital Market Index with 35 publicly traded companies involved in digital asset operations, infrastructure, financial services, and blockchain technologies. This dual approach offers investors diversified exposure across both digital assets and the companies building the infrastructure behind them.

Why This Announcement Matters Now

The timing of this launch couldn't be more significant for the crypto market. Bitcoin recently hit a new all-time high above $125,700, driving total crypto market capitalization past $4.24 trillion, while institutional adoption continues accelerating through spot ETF products and corporate treasury allocations.

Cameron Drinkwater, Chief Product & Operations Officer at S&P Dow Jones Indices, emphasized that "cryptocurrencies and the broader digital asset industry have moved from the margins into a more established role in global markets," noting that from North America to Europe to Asia, market participants are increasingly treating digital assets as part of their core investment toolkit.

Drinkwater further explained the significance of this development: "Independent, reliable and user-friendly benchmarks are a key component of financial markets. As with traditional financial markets, independent benchmarks can help bring transparency and accessibility to the digital asset ecosystem. With this latest expansion, S&P DJI reinforces its role as a trusted provider of benchmarks across traditional and alternative asset classes – offering market participants clarity and confidence as new markets like cryptocurrency emerge."

The index addresses a critical need in the market: providing investors with rule-based, transparent exposure to crypto without requiring them to navigate multiple exchanges, wallets, or manage diverse risk profiles. To qualify for inclusion, cryptocurrencies must have a minimum market capitalization of $300 million, while equity constituents must exceed $100 million in market cap.

Institutional Validation Through Tokenization

Dinari plans to create a blockchain-based token tracking the index's performance through its dShares platform, with launch expected by year-end 2025. This tokenization represents more than just a technical innovation—it demonstrates how blockchain infrastructure can modernize trusted financial benchmarks.

Anna Wroblewska, Chief Business Officer at Dinari, explained the significance: "By making the S&P Digital Markets 50 investible via dShares, we are not just tokenizing an index, we are demonstrating how blockchain infrastructure can modernize trusted benchmarks. For the first time, investors can access both U.S. equities and digital assets in a single, transparent product. This launch shows how onchain technology can expand the reach of established financial standards, making them more efficient, accessible, and globally relevant."

Market Impact and Early Reactions

The announcement has already generated significant buzz across crypto markets. Social media sentiment spiked within hours of the announcement, with traders calling it a "bombshell for Q4" and expecting the move to draw billions in new institutional liquidity as traditional investors seek structured exposure to the high-growth crypto sector.

Analysts anticipate this index could become a cornerstone for the next wave of crypto-linked ETFs, bridging Wall Street and blockchain markets in unprecedented ways. The participation of S&P Dow Jones—the same firm behind the iconic S&P 500 and Dow Jones Industrial Average—signals how far crypto has evolved from a speculative niche to a data-backed asset class recognized by the world's most trusted index providers.

XRP's Strategic Position for Index Inclusion

For XRP holders and Ripple supporters, this announcement carries particular weight. According to the S&P Cryptocurrency Broad Digital Market Index composition data as of September 30, 2025, XRP ranks as the third-largest cryptocurrency by market capitalization and index weight, positioned behind only Bitcoin and Ethereum. As the S&P Digital Markets 50 Index will select 15 cryptocurrencies from this Broad Market Index, XRP is strongly positioned for inclusion among the elite tier of digital assets featured in the new hybrid benchmark.

This positioning places XRP among the top-tier digital assets that institutional investors will likely gain exposure to through products tracking the new index, alongside Bitcoin and Ethereum as the market's most established cryptocurrencies by market weight.

Regulatory Clarity Paves the Way

XRP's potential inclusion comes at a pivotal moment in its evolution. In August 2025, Ripple Labs and the SEC officially resolved their five-year legal battle, with the Second Circuit Court of Appeals approving a joint stipulation dismissing all appeals. The settlement confirms Ripple's $125 million penalty and upholds the landmark court clarification that XRP is not a security for secondary market trades.

This regulatory clarity has transformed institutional sentiment toward XRP. The SEC-Ripple settlement in August 2025 removed a major regulatory hurdle for XRP, giving it legal clarity similar to Ethereum's, while positioning XRP increasingly as a model for regulated crypto integration.

Institutional Adoption Accelerating

The institutional embrace of XRP has accelerated dramatically in 2025:

- CME Group's XRP futures, launched earlier in 2025, crossed the $1 billion open interest mark in just three months, with Tim McCourt, the exchange's Global Head of Equity & FX Products, noting that both XRP and Solana futures are enjoying strong institutional adoption with open interest at record highs

- The first U.S. spot XRP ETF, the REX-Osprey XRPR, launched successfully on September 18, 2025, quickly attracting significant trading volume and signaling robust institutional appetite for regulated XRP exposure

- Multiple additional spot XRP ETF applications from major asset managers including Grayscale, Bitwise, and Franklin Templeton are pending SEC review, with final decisions expected between October 18-25, 2025. Analysts project these approvals could trigger capital inflows ranging from $5 to $11 billion in the first year

Real-World Utility Driving Value

Unlike many cryptocurrencies that remain primarily speculative assets, XRP's value proposition is grounded in solving real-world payment infrastructure challenges:

- Ripple's On-Demand Liquidity (ODL) service processed $1.3 trillion in transactions during 2025, cutting cross-border payment costs by 90% for participating institutions

- Over 300 financial institutions have adopted Ripple's ODL service, which leverages XRP to reduce cross-border payment costs by 70% while aligning with the ISO 20022 global messaging standard for financial transactions

- XRP Ledger daily active addresses have surged past 295,000, while the number of wallets holding over 1 million XRP has grown by 14% year-over-year, indicating sustained institutional interest

Broader Crypto Market Context

The S&P Digital Markets 50 Index launch arrives during a period of exceptional momentum for digital assets. Bitcoin achieved its strongest weekly close at $123,400 on October 3, 2025, before hitting new all-time highs above $125,000, with spot Bitcoin ETFs recording $3.24 billion in inflows last week.

The crypto industry market capitalization is estimated at approximately $3 trillion as of June 30, 2025, using the S&P Cryptocurrency Broad Digital Market Index as a proxy, though recent rallies have pushed the total market above $4 trillion. This growth reflects not just speculative interest but fundamental shifts in how traditional finance views digital assets.

Major institutional players are embracing crypto exposure, with Morgan Stanley endorsing digital assets for client portfolios—recommending up to 4% crypto allocation in "opportunistic growth" portfolios and up to 2% for "balanced growth" accounts.

What Comes Next for XRP

The convergence of multiple catalysts positions XRP for potential significant price appreciation in the coming weeks and months:

Immediate Catalysts (October 2025):

- Multiple spot XRP ETF decisions expected between October 18-25, 2025

- Ripple's application for a U.S. national bank charter under the name "Ripple National Trust Bank," with the Office of the Comptroller of the Currency expected to rule by late October 2025

- Potential confirmation of inclusion in the S&P Digital Markets 50 Index constituent list

Medium-Term Developments:

- Integration into products tracking the S&P Digital Markets 50 Index (if included)

- Continued expansion of Ripple's global banking partnerships

- Growth in RippleNet and ODL adoption

Long-Term Trajectory: XRP's alignment with ISO 20022 standards ensures seamless interfacing with existing banking infrastructure, accelerating adoption in regulated environments. Combined with Ripple's Q2 2025 launch of an EVM-compatible sidechain, XRP's utility extends beyond payments into decentralized finance and tokenized asset markets.

Investment Considerations and Risks

While the outlook appears bullish, investors should carefully consider several factors:

Positive Factors:

- Regulatory clarity following SEC settlement

- Strong institutional adoption trajectory

- Real-world utility in cross-border payments

- #3 position in S&P Crypto Broad Index increases likelihood of inclusion in Digital Markets 50

- Upcoming ETF approvals

Risk Factors:

- XRP's momentum depends heavily on institutional participation, and if that interest fades, growth could slow. Additionally, XRP's developer community remains smaller compared to Ethereum's extensive ecosystem

- Competition from central bank digital currencies (CBDCs) and stablecoins

- Broader market volatility

- Potential regulatory changes

- No guarantee of inclusion in the final Digital Markets 50 constituent list

Price forecasts vary widely depending on adoption trajectories, with bullish predictions placing XRP above $3-$5, while more conservative scenarios suggest it could remain below $1 if regulatory uncertainty persists or institutional adoption slows.

The Bigger Picture: Crypto's Mainstream Moment

The S&P Digital Markets 50 Index represents more than just another financial product—it symbolizes the formal integration of digital assets into the traditional financial system. The index signals how far crypto has matured, from a speculative niche to a data-backed asset class recognized by S&P Dow Jones, the same firm behind the S&P 500.

For XRP specifically, its top-three position in the source index validates years of work by Ripple to build real-world utility and regulatory compliance. With the SEC case resolved, ETF approvals on the horizon, and institutional adoption accelerating, XRP stands at a potential inflection point.

As Cameron Drinkwater noted in today's announcement, independent and reliable benchmarks are key components of financial markets, helping bring transparency and accessibility to emerging sectors. The launch of the S&P Digital Markets 50 Index, with XRP strongly positioned for inclusion, represents exactly that—a bridge between the established financial system and the digital asset revolution.

DISCLAIMER: This newsletter is for informational purposes only and does not constitute investment advice, advertising, or a recommendation to buy, sell, or hold any securities. This content is not sponsored by or affiliated with any of the mentioned entities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.

Sources

- Morningstar/PR Newswire - S&P Global to Launch S&P Digital Markets 50 Index - October 7, 2025

- S&P Global Press Release - S&P Digital Markets 50 Index Launch - S&P Global, October 7, 2025

- CoinDesk - S&P's New Index Blends 15 Cryptos With 35 Crypto-Linked Stocks - October 7, 2025

- 99Bitcoins - S&P Dow Jones Unveils Digital Markets 50 Index - October 7, 2025

- S&P Dow Jones Indices - Cryptocurrency Investment Theme - S&P Global

- S&P Dow Jones Indices - Cryptocurrency Broad Digital Market Index - S&P Global

- CoinDesk - XRP Futures See Institutional Adoption - October 1, 2025

- Crypto Briefing - Court Approves Ripple, SEC's Motion to Dismiss Appeal - August 22, 2025

- SEC.gov - Ripple Labs Settlement Agreement - May 8, 2025

- Cointelegraph - How XRP's Regulatory Clarity Opened Doors to Institutional Adoption - October 6, 2025

- AInvest - Post-SEC Clarity: XRP Primed for Institutional Adoption - October 6, 2025

- Investing News - Crypto Market Update: Bitcoin Price Hits New All-Time High - October 6, 2025

- AInvest - XRP's Long-Term Value Catalysts - August 20, 2025

- AInvest - XRP ETF Approval and October Regulatory Catalysts - August 26, 2025