RLUSD Goes Multichain: Ripple Expands to Layer 2 Networks

Ripple expands RLUSD stablecoin to four Ethereum Layer 2 networks using Wormhole technology, becoming the first U.S. trust-regulated stablecoin on Optimism, Base, Ink, and Unichain. Testing begins ahead of 2026 official launch pending NYDFS approval.

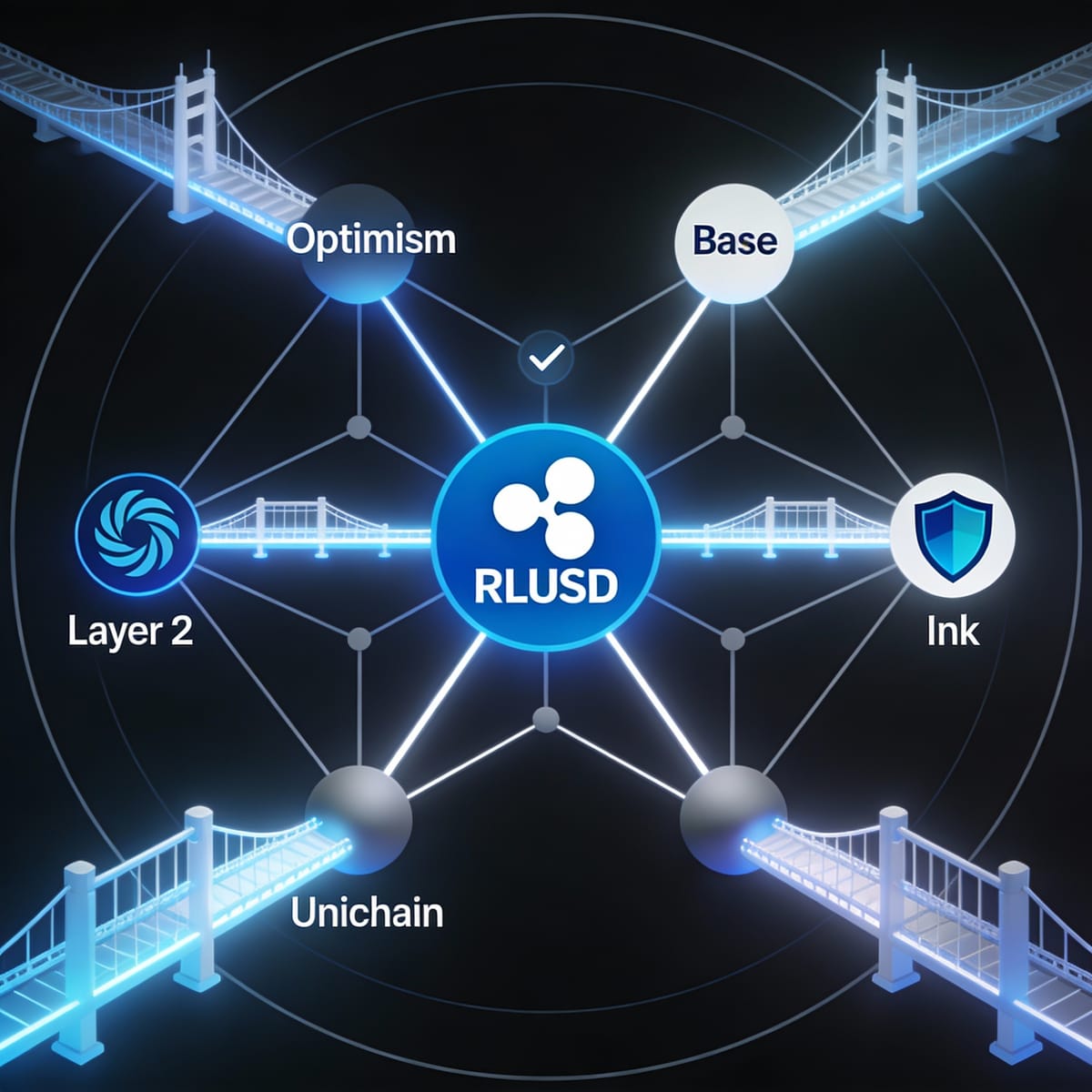

Ripple has announced a significant expansion of its RLUSD stablecoin beyond its initial launch chains, testing deployment on four Ethereum Layer 2 networks—Optimism, Base, Ink, and Unichain—in partnership with Wormhole, one of the leading multichain interoperability protocols. The move positions RLUSD as the first U.S. trust-regulated stablecoin to launch on these networks, pending regulatory approval from the New York Department of Financial Services (NYDFS) for official deployment in 2026.

This strategic expansion comes just weeks after RLUSD's initial launch on the XRP Ledger (XRPL) and Ethereum, demonstrating Ripple's commitment to a truly multichain future for its stablecoin offering. With over $1.3 billion in total supply since launching in December 2024, RLUSD is rapidly establishing itself in the competitive stablecoin market.

Why Layer 2 Networks Matter

Layer 2 networks solve Ethereum's scalability challenges by processing transactions off the main blockchain and then batching them back to Ethereum for final settlement. This architecture delivers significantly faster transaction speeds and lower fees while maintaining Ethereum's security guarantees.

The four Layer 2 networks selected for RLUSD's expansion represent major players in the Ethereum ecosystem:

Optimism: A leading optimistic rollup that serves as the foundation for multiple other Layer 2 solutions through its OP Stack technology framework. Optimism processes transactions off-chain and assumes they're valid unless challenged, enabling high throughput while maintaining security.

Base: Launched by Coinbase in August 2023, Base has rapidly grown to approximately $4 billion in total value locked (TVL) and serves as a gateway for mainstream crypto adoption with seamless integration to Coinbase's 100+ million user base.

Ink: Kraken's Layer 2 network, designed specifically for derivatives and trading ecosystems. Ink processes 880,000 daily transactions and its Nado perpetuals platform achieved $1 billion in volume within ten days of launch.

Unichain: The newest addition from Uniswap Labs, officially launched in February 2025. Unichain achieved "stage-1" rollup status at launch—a high decentralization standard—and processes blocks in as little as 250 milliseconds using specialized technology from Flashbots.

All four networks are built on the OP Stack, creating an interconnected "Superchain" ecosystem that enables seamless interoperability between chains.

Wormhole's Native Token Transfers: The Technical Foundation

Ripple's Layer 2 expansion leverages Wormhole's Native Token Transfers (NTT) standard, an open-source framework that enables seamless token movement across blockchains without relying on liquidity pools.

The NTT standard offers several critical advantages:

Native Issuance Control: Ripple maintains full ownership and control of RLUSD across all chains, including customizability, metadata management, and contract upgradeability. This ensures consistent behavior and regulatory compliance across every deployment.

Security Through Verification: Wormhole's Guardian network provides decentralized verification of cross-chain transactions, while the Global Accountant feature performs integrity checks to ensure tokens burned on one chain never exceed tokens minted across the entire system.

No Wrapped Tokens Required: Unlike traditional bridge solutions that create wrapped versions of assets, NTT enables true native tokens on each chain. Users interact with actual RLUSD, not a derivative representation.

Rate Limiting and Safety Controls: NTT includes configurable rate limits for inbound and outbound transfers, helping prevent abuse and providing time to respond to potential security issues.

The technology has proven itself through widespread adoption, already powering natively multichain tokens for Sky's USDS and Lido's wstETH, among other major protocols.

Wrapped XRP Expands DeFi Opportunities

Alongside RLUSD's Layer 2 expansion, Hex Trust announced it will issue and custody wrapped XRP (wXRP), a 1:1-backed representation of native XRP designed for cross-chain DeFi participation.

This development creates powerful synergies with RLUSD. According to Jack McDonald, SVP of Stablecoin at Ripple, "By launching RLUSD—the first US Trust Regulated stablecoin on these L2 networks—we are not just expanding utility; we are setting the definitive standard where compliance and on-chain efficiency converge."

The wXRP/RLUSD pairing creates new opportunities across multiple use cases:

DeFi Trading Pairs: XRP holders can now use wXRP alongside RLUSD for swaps, providing liquidity, and participating in decentralized exchanges across supported chains without leaving those ecosystems.

Cross-Chain Accessibility: Users can move between chains without relying on unregulated third-party bridges, reducing counterparty risk while accessing DeFi opportunities across Solana, Optimism, Ethereum, and HyperEVM.

Business Integration: Merchants and customer-facing services can support both wXRP and RLUSD for payments, swaps, checkout options, or applications that enable users to buy, sell, or send digital assets.

Hex Trust is launching wXRP with over $100 million in Total Value Locked, providing substantial initial liquidity. The wrapped asset maintains 1:1 backing with native XRP held in Hex Trust's regulated custody, ensuring full redeemability and institutional-grade security standards including KYC/AML compliance, insurance coverage, and complete auditability.

Regulatory Compliance as Competitive Advantage

RLUSD's expansion strategy emphasizes regulatory compliance as a core differentiator in the crowded stablecoin market.

The stablecoin is issued under a New York Department of Financial Services (NYDFS) Trust Company Charter, ensuring bank-level oversight and regulation. This charter provides a level of confidence that few stablecoins can match, particularly for institutional adopters who require stringent compliance standards.

Ripple has also applied for an Office of the Comptroller of the Currency (OCC) charter, which would ultimately provide RLUSD with both state and federal oversight—a dual regulatory structure that no stablecoin currently holds.

Beyond U.S. borders, Ripple's commitment to compliance is evident in its global footprint with over 75 licenses globally. Most recently, RLUSD has been recognized by regulators in key international hubs like Dubai and Abu Dhabi, positioning it for global institutional adoption.

What This Means for XRP and RLUSD

The multichain expansion represents a significant milestone in Ripple's vision for both RLUSD and XRP.

According to Ripple, "A truly successful digital asset ecosystem needs a reliable, stable currency. Ripple prioritizes issuing RLUSD wherever there is demand for XRP (wXRP), strengthening the utility of both assets."

For XRP Holders: The introduction of wXRP across multiple Layer 2 networks provides new opportunities for yield generation, liquidity provision, and participation in DeFi protocols that were previously inaccessible to XRP holders.

For RLUSD Adoption: Layer 2 deployment dramatically reduces transaction costs and increases speed, making RLUSD more practical for everyday payments, swaps, and DeFi operations. The lower barriers to entry could accelerate adoption among both retail users and institutional players.

For the Broader Ecosystem: By establishing RLUSD as the first U.S. trust-regulated stablecoin on these networks, Ripple is positioning itself to capture institutional demand for compliant, efficient stablecoin infrastructure across the expanding Layer 2 ecosystem.

Markus Infanger, SVP of RippleX, noted: "There's growing demand to use XRP across the wider crypto ecosystem and institutions, and so we are excited to see Hex Trust address this demand. It also fits naturally with the work we're doing with RLUSD, giving people a regulated way to access DeFi and manage their XRP positions across supported chains."

Timeline and Next Steps

The current phase involves testing RLUSD on the four Layer 2 networks ahead of an official public launch planned for 2026. This testing period is crucial for ensuring security, performance, and regulatory compliance before full deployment.

According to Ripple, the company "expects to launch RLUSD on additional chains next year, subject to final regulatory approval." The NYDFS must approve each new chain deployment, ensuring that RLUSD maintains its regulatory standing as it expands.

The timing positions Ripple well within the rapidly evolving Layer 2 landscape. As the Optimism Superchain ecosystem continues to grow—with major players like Coinbase, Kraken, and Uniswap committing to the shared infrastructure—RLUSD's early presence on these networks could establish it as the preferred stablecoin for the next generation of Ethereum scaling solutions.

Competitive Landscape

RLUSD enters a competitive stablecoin market dominated by Tether's USDT and Circle's USDC, but its regulatory positioning and strategic Layer 2 deployment create distinct advantages.

While both USDT and USDC have broader distribution, RLUSD's dual regulatory oversight (current NYDFS charter with pending OCC approval) positions it uniquely for institutional adoption, particularly among U.S.-based financial institutions requiring stringent compliance standards.

The Layer 2 expansion also arrives at an opportune moment. As Ethereum scaling solutions mature and transaction volumes migrate to more efficient Layer 2 networks, establishing early presence and liquidity on these chains could prove strategically valuable.

However, success will depend on execution across multiple dimensions: maintaining regulatory approval as the footprint expands, building sufficient liquidity to support meaningful transaction volumes, and integrating with DeFi protocols and institutional platforms to drive actual usage.

Conclusion: Building the Multichain Future

Ripple's announcement represents more than just a technical expansion—it signals a comprehensive strategy to establish RLUSD as the compliant, efficient stablecoin infrastructure for the multichain future.

By combining regulatory rigor, cutting-edge interoperability technology through Wormhole NTT, and strategic positioning on the fastest-growing Layer 2 networks, Ripple is building the foundation for RLUSD to serve both institutional finance and the broader on-chain economy.

The introduction of wXRP alongside RLUSD's expansion creates a powerful ecosystem effect, giving XRP holders new utility while providing institutional-grade infrastructure for regulated DeFi participation across multiple chains.

As the testing phase progresses toward 2026 launch, the crypto industry will be watching closely to see whether Ripple's compliance-first, multichain approach can carve out significant market share in the competitive stablecoin landscape.

Sources

All information in this article is sourced from official announcements and established crypto news outlets:

- Ripple Official Announcement

- Wormhole Native Token Transfers Documentation

- Hex Trust wXRP Announcement

- The Block: Ripple Wormhole Expansion

- CoinDesk: RLUSD L2 Expansion

- Optimism Superchain Overview

- Unichain Launch Details

DISCLAIMER: This newsletter is for informational purposes only and does not constitute investment advice, advertising, or a recommendation to buy, sell, or hold any securities. This content is not sponsored by or affiliated with any of the mentioned entities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.