Ripple's Strategic Tazapay Investment: Is it the Backdoor to Global Play

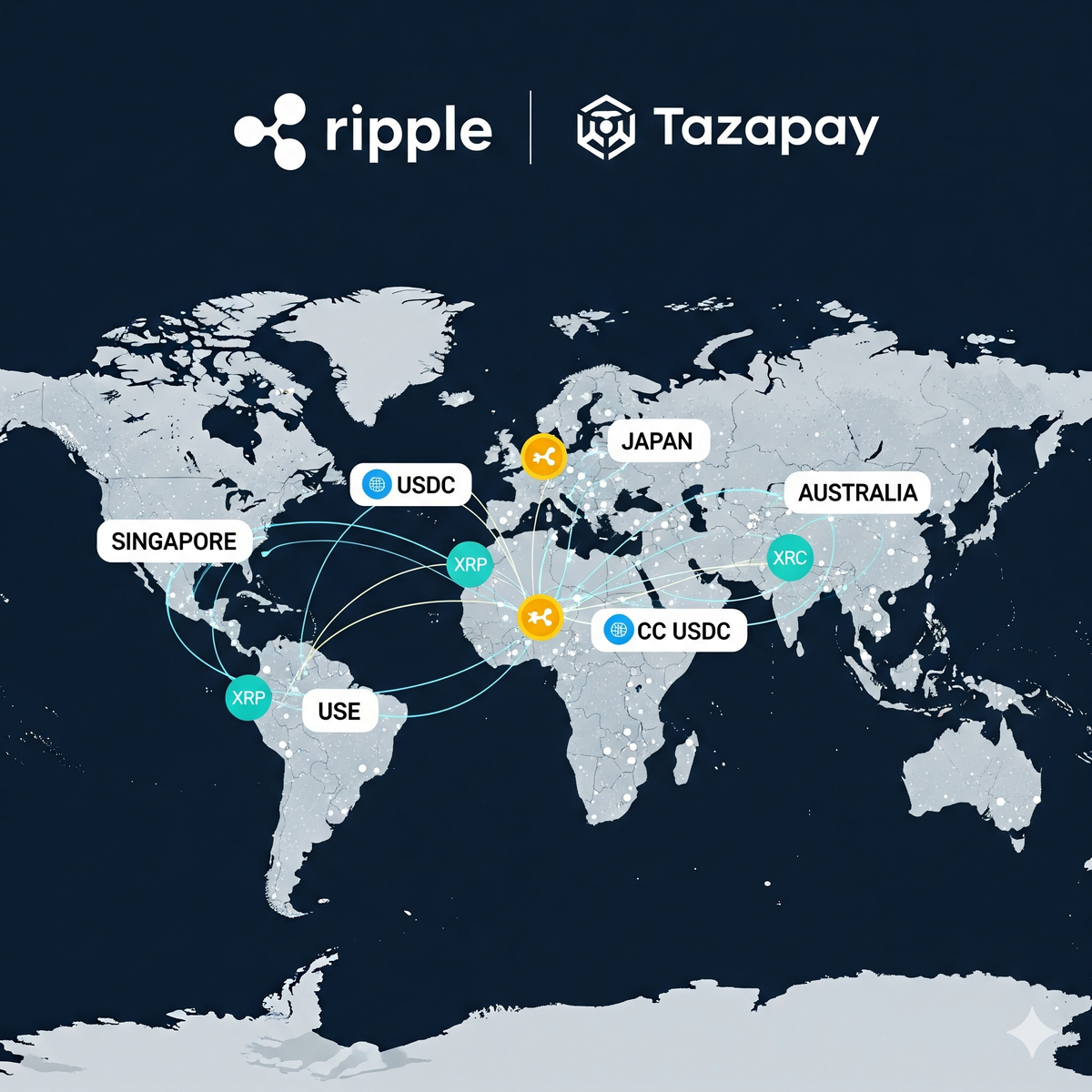

Ripple quietly invested in Singapore's Tazapay—a $10B payment platform across 70+ markets. This strategic move gives Ripple access to compliant banking corridors globally, solving the XRP last-mile conversion challenge. The partnership creates a dual XRP-USDC liquidity grid that could bypass SWIFT.

TL;DR: Ripple and Circle just invested in Singapore's Tazapay, a $10B payment platform operating across 70+ markets. This isn't just another funding round—it's Ripple's strategic move to access compliant global banking corridors and turn XRP liquidity into local payouts worldwide.

Ripple has quietly executed what industry analysts are calling a "backdoor strategy" for global financial infrastructure penetration. Through its recent investment in Singapore-based Tazapay's Series B funding round, Ripple has gained access to regulated payment corridors spanning over 70 markets and processing more than $10 billion annually.

The funding round, led by Peak XV Partners, included strategic participation from Ripple and Circle Ventures alongside Japanese investors GMO VenturePartners and Norinchukin Capital. While the exact investment amount remains undisclosed, the strategic implications are crystal clear.

🚨 RIPPLE JUST WENT GLOBAL THROUGH THE BACK DOOR

— Stern Drew (@SternDrewCrypto) August 27, 2025

While the world was distracted, Ripple quietly invested in Tazapay — a Singapore-based payments giant moving $10B annually across 70+ markets.

This isn’t a startup play. This is the new SWIFT, and XRP is the engine. 👇🧵 pic.twitter.com/YesHsxQQpM

Understanding Tazapay's Payment Infrastructure

Tazapay provides seamless local collection and payout capabilities in over 70 markets, supporting a growing base of global enterprises and platforms across industries. The company processes more than $10 billion in annualized payment volume, has reached operational breakeven, and is growing at 300% year-over-year.

What makes Tazapay particularly attractive to Ripple isn't just its impressive growth metrics. The company was recently named in CNBC's World's Top Fintech Companies 2025, a prestigious ranking developed in partnership with Statista, specifically recognized under the Payments category.

Tazapay's platform delivers comprehensive coverage across alternative payment methods, cards, virtual bank accounts, payouts and stablecoins. Combined with institutional-grade security and compliance across multiple jurisdictions, and a robust fiat bridge for stablecoin settlements in emerging markets, Tazapay offers an unparalleled solution for global businesses.

The Strategic Play: Solving Ripple's Last-Mile Challenge

XRP community analyst Stern Drew, who first highlighted this development, identifies Ripple's core strategic challenge: "Despite having strong technology, Ripple has historically struggled with converting XRP liquidity into local payouts in several markets, such as Lagos in Nigeria and Jakarta in Indonesia."

"The future of global payments depends on the seamless convergence of traditional and digital finance. Tazapay is a clear leader in building these essential, compliant last-mile connections, especially in emerging markets," said Eric Jeck, SVP Corporate and Business Development at Ripple.

This partnership addresses Ripple's biggest operational hurdle: accessing local banking infrastructure in emerging markets. Rather than building these connections from scratch or navigating complex regulatory frameworks independently, Ripple can now leverage Tazapay's existing licensed corridors.

Market Implications: Building Parallel Payment Rails

The collaboration between Ripple and Circle through Tazapay creates what analysts describe as a "dual liquidity grid" combining XRP and USDC stablecoin infrastructure. The investments from Circle and Ripple, both key players in blockchain-based and stablecoin-powered payments infrastructure space, underline Tazapay's role in "connecting traditional finance with the evolving world of digital currencies."

This isn't a direct challenge to SWIFT's dominance but rather the creation of parallel payment corridors that could gradually capture market share. The Singapore-based company already processes more than $10 billion in annualized payment volume and claims 300% year-over-year growth.

Regulatory Compliance Strategy

Tazapay is already licensed in Singapore, Canada, and the EU, and will use the new funding to accelerate its licensing roadmap across key global markets. Applications are underway for licenses in the UAE, US, Hong Kong, Australia, and for a Digital Payment Token (DPT) license in Singapore.

This licensing strategy is crucial for Ripple's compliance-first approach, particularly given the company's ongoing regulatory clarity efforts in the United States. By partnering with already-licensed entities, Ripple can expand its reach without directly confronting regulatory uncertainty in new jurisdictions.

XRP/Ripple Analysis: Long-Term Strategic Impact

XRP Price Potential

The Tazapay investment represents institutional validation of Ripple's payment infrastructure vision. Access to $10 billion in annual payment flows could provide significant utility demand for XRP, particularly if Tazapay's stablecoin bridge functionality integrates XRP for cross-border settlements.

Ripple's Business Operations

The investments from GMO VenturePartners and Norinchukin Capital will accelerate Tazapay's expansion into Japan. Leveraging these partnerships, Tazapay will enable local Japanese payment methods for its global customer base and establish a dedicated sales team in Japan to help Japanese enterprises scale internationally.

This expansion aligns perfectly with Ripple's existing strong presence in Japan through its partnership with SBI Holdings, creating a comprehensive Asian payment corridor.

Legal Standing and Compliance

The investment demonstrates Ripple's shift toward compliance-first partnerships. Rather than challenging existing financial infrastructure directly, Ripple is embedding itself within regulated payment networks, reducing regulatory friction and potential legal challenges.

Partnership Opportunities

"We're entering the next chapter of our journey — one where modern payment technologies, regulatory compliance, and partnerships with global leaders will enable the future of cross-border commerce," said Rahul Shinghal, Co-founder and CEO of Tazapay.

The partnership positions both companies to attract additional enterprise clients seeking compliant cross-border payment solutions.

Adoption Prospects

With Tazapay's coverage spanning over 70 markets and its focus on B2B payments, this partnership could significantly accelerate institutional adoption of Ripple's technology stack. The company's 300% growth rate suggests strong market demand for these services.

Global Financial Infrastructure Play

The strategic significance extends beyond immediate payment processing. Tazapay's expansion plans target key financial hubs: the United States, UAE, Hong Kong, Australia, and Japan. This geographic coverage creates a comprehensive network spanning major time zones and economic regions.

"One of the key use cases this infrastructure serves is being the fiat bridge for stablecoins in emerging markets," according to Tazapay's CEO. This functionality directly complements Ripple's vision of XRP as a bridge currency for international settlements.

The Quiet Revolution?

Ripple's Tazapay investment represents a masterclass in strategic infrastructure development. Rather than pursuing headline-grabbing announcements or direct SWIFT competition, Ripple is systematically building the foundation for a parallel global payment system.

The partnership provides Ripple with immediate access to regulated corridors, compliant last-mile connections, and a growing $10 billion payment network. For XRP holders and the broader crypto community, this represents the kind of institutional infrastructure development that could drive long-term adoption and utility.

As the global financial system continues evolving toward digital asset integration, partnerships like these may prove more valuable than any single technological breakthrough. Ripple isn't just building better payment technology—it's quietly rewiring the world's financial infrastructure.

Credit: Initial analysis and concept by @SternDrewCrypto

DISCLAIMER: This newsletter is for informational purposes only and does not constitute investment advice, advertising, or a recommendation to buy, sell, or hold any securities. This content is not sponsored by or affiliated with Uphold, XRP, or any mentioned entities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.

Sources

- PYMNTS - Ripple and Circle Back Cross-Border Payments Platform Tazapay

- PR Newswire - Tazapay Lands Strategic Investments from Ripple and Circle

- The Crypto Basic - Ripple's Tazapay Deal Is a Backdoor Strategy

- Crypto Briefing - Ripple and Circle invest in cross-border payments startup Tazapay

- Business Standard - Tazapay Named in CNBC's List of World's Top Fintech Companies 2025