Ripple's Double Victory: European Bank Partnership and U.S. Federal Charter Approval Signal Major Institutional Shift

Ripple scores double victory: AMINA Bank becomes first European bank to adopt Ripple Payments while OCC conditionally approves U.S. trust bank charter, creating transatlantic regulatory framework for RLUSD stablecoin and cross-border payments.

In a historic day for Ripple and the broader cryptocurrency industry, Swiss-regulated AMINA Bank AG became the first European bank to integrate Ripple Payments while the U.S. Office of the Comptroller of the Currency (OCC) conditionally approved Ripple's application for a national trust bank charter. Announced simultaneously on December 12, 2025, these developments mark a pivotal moment in Ripple's transformation from a blockchain payments company into a fully regulated financial institution operating on both sides of the Atlantic.

Breaking News: Two Major Announcements in One Day

AMINA Bank Partnership: Europe

According to Ripple's official press release, AMINA Bank will use Ripple's licensed end-to-end payments solution to enable near real-time cross-border transactions for its clients. The FINMA-regulated crypto bank, headquartered in Zug, Switzerland, operates with a global footprint including licenses in Abu Dhabi, Hong Kong, and Austria under the MiCAR framework.

Cassie Craddock, Managing Director for UK & Europe at Ripple, stated that the partnership enables AMINA to "serve as the on-ramp for digital asset innovators into traditional financial infrastructure."

OCC Charter Approval: United States

In an equally significant development, the OCC announced conditional approval for Ripple National Trust Bank (RNTB), allowing Ripple to establish a federally supervised trust bank. The approval follows passage of the GENIUS Act, which President Trump signed into law in July 2025 to establish the first federal regulatory framework for stablecoins.

According to Ripple CEO Brad Garlinghouse, "The conditional approval of our trust bank charter represents a massive step forward - setting the highest standard for stablecoin compliance with both federal and state oversight."

How These Developments Work Together

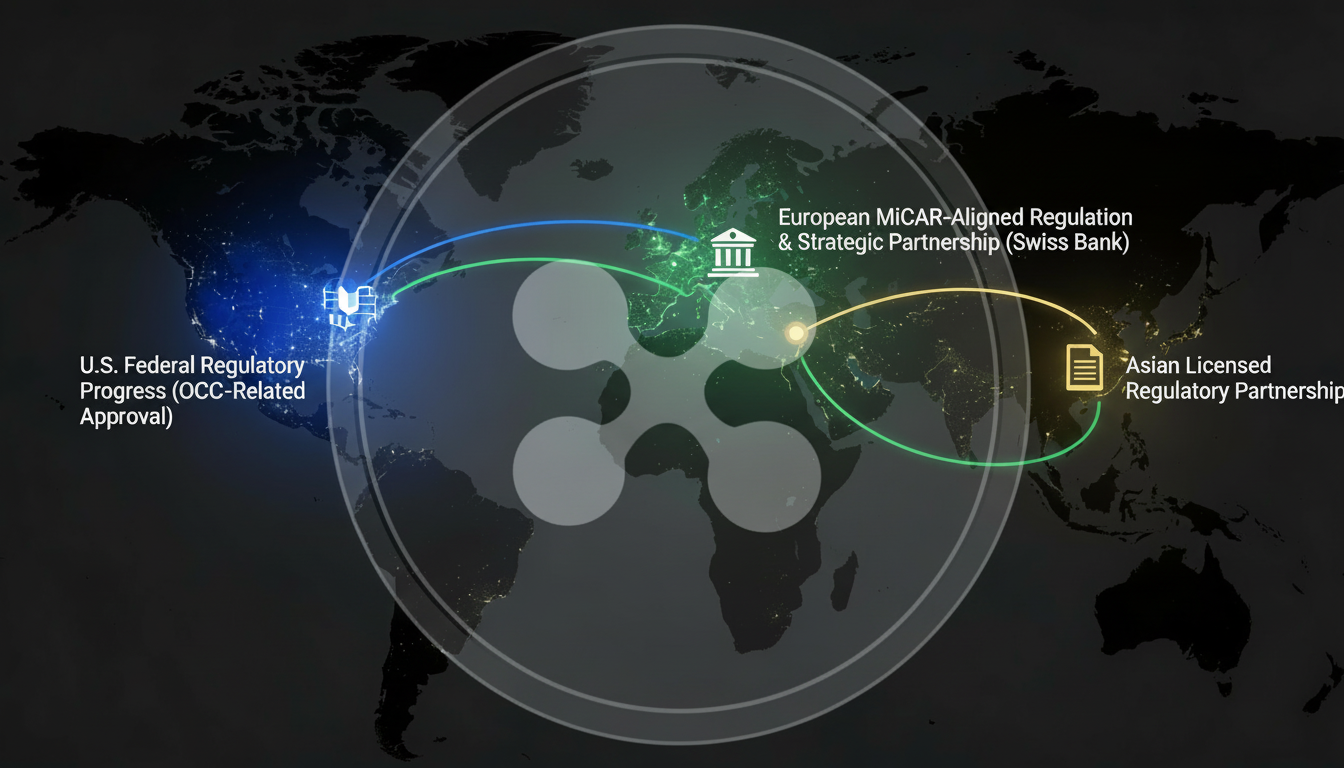

The simultaneous announcements reveal a coordinated global strategy that positions Ripple as a bridge between traditional finance and blockchain infrastructure across multiple jurisdictions:

1. Regulatory Compliance on Two Continents

United States: The OCC charter approval subjects Ripple's stablecoin business to oversight at both federal and state levels—through the OCC and the New York Department of Financial Services. This dual oversight represents "the most transparent and responsibly managed stablecoin in the market today," according to Garlinghouse.

Europe: AMINA Bank's multi-jurisdictional regulatory coverage (Swiss FINMA, Abu Dhabi FSRA, Hong Kong SFC, Austrian FMA under MiCAR) provides compliant access to European and Asian markets. The bank received its FINMA banking license in August 2019 and has steadily expanded its regulatory footprint.

2. RLUSD Stablecoin Infrastructure

Both developments center on Ripple USD (RLUSD), the company's dollar-backed stablecoin that surpassed $1 billion market cap in less than a year.

The national trust bank will manage RLUSD reserves under federal supervision, while AMINA Bank—which became the first bank globally to support RLUSD earlier in 2025—provides custody, trading, and payment services for the stablecoin to European clients.

This creates an integrated infrastructure: RLUSD issuance is managed by a federally chartered U.S. trust bank, while distribution and usage flows through regulated banking partners like AMINA in key international markets.

3. Cross-Border Payment Integration

The AMINA partnership addresses the immediate operational challenge for crypto-native businesses needing to move funds across borders. Myles Harrison, AMINA Bank's Chief Product Officer, noted that "native web3 businesses often run into friction when working with legacy banking systems."

Meanwhile, the U.S. trust bank charter positions Ripple to provide similar services domestically, enabling what analysts describe as "direct Federal Reserve access and correspondent banking relationships" once final approval conditions are met.

The GENIUS Act: Foundation for U.S. Expansion

The OCC approval builds on the GENIUS Act (Guiding and Establishing National Innovation for US Stablecoins Act), which President Trump signed on July 18, 2025. This landmark legislation created the first federal regulatory framework for payment stablecoins, requiring:

- 100% reserve backing with liquid assets (U.S. dollars or short-term Treasuries)

- Monthly public disclosures of reserve composition

- Strict marketing rules to protect consumers

- Anti-money laundering and sanctions compliance programs

- Technical capability to freeze or seize stablecoins when legally required

According to the White House, the GENIUS Act "creates the first-ever Federal regulatory system for stablecoins, ensuring their stability and trust through strong reserve requirements."

Ripple applied for the national trust bank charter on July 2, 2025—just weeks before the GENIUS Act became law—positioning itself to be among the first companies to operate under the new framework.

OCC Charter Details: What Was Approved

The OCC's conditional approval applies to five national trust bank charters announced December 12, 2025:

- De novo (new) entities: Ripple National Trust Bank and First National Digital Currency Bank

- Conversions from state trust companies: BitGo Bank & Trust, Fidelity Digital Assets, and Paxos Trust Company

According to CryptoBriefing, "The approvals expand the number of federally chartered national trust banks—currently around 60—and allow crypto-native firms to operate across state lines under consistent federal oversight."

IMPORTANT: The approval is conditional, meaning Ripple must meet additional OCC requirements before the trust bank can commence operations. These conditions typically involve capitalization requirements, governance structures, compliance programs, and management suitability assessments.

The trust bank will be headquartered at 111-119 West 19th Street in New York City and will operate as a wholly owned subsidiary of Ripple Labs.

XRP/Ripple Analysis: Strategic Implications

Immediate Market Response

XRP traders responded to the dual announcements with cautious optimism. As of December 12, 2025, XRP is trading around $2.03-2.04. While the immediate price movement was modest, the longer-term strategic implications are significant.

Institutional Adoption Accelerates

The combination of European banking integration and U.S. federal charter approval strengthens several key adoption narratives:

Regulated Infrastructure: Ripple now operates within established regulatory frameworks on both sides of the Atlantic, addressing one of the primary barriers to institutional adoption. As CoinDesk notes, this positions Ripple Payments as "a foundational layer for the next phase of global finance."

Banking Network Expansion: According to CCN, Ripple now reports more than 300 banking and financial institution partners across over 40 countries, with Ripple's payments network covering over 90% of global FX markets by volume, processing more than $95 billion in transactions.

Post-SEC Settlement Momentum: These partnerships come at an optimal time. Following the May 2025 settlement with the SEC, where Ripple paid a final $50 million penalty (reduced from $125 million) and both parties dropped their appeals in August 2025, Ripple has shifted focus to expansion. The regulatory clarity has enabled new developments including multiple XRP ETF applications, several of which received approval in late 2025.

What the Trust Bank Charter Enables

Once final conditions are met, the trust bank charter would provide Ripple with capabilities that could significantly impact XRP utility:

Direct U.S. Financial Rails Access: The charter enables "secure asset custody and frictionless fiat-to-crypto transitions," according to industry analysts. This means Ripple could potentially facilitate institutional transfers directly through federal banking infrastructure rather than relying on correspondent banks.

XRP as Bridge Asset: While not all Ripple partnerships require XRP usage, the company's On-Demand Liquidity (ODL) system uses XRP as a bridge asset for currency conversions. CCN reports that an estimated 20-30% of Ripple's partners currently use XRP via ODL, typically in high-volume remittance corridors.

Institutional Custody Services: The trust bank can provide federally regulated custody for digital assets, potentially attracting institutional clients who require regulated custodians for compliance purposes.

Price Outlook: Realistic Assessment

CRITICAL DISCLAIMER: While the announcements represent significant business developments, future price movements remain highly speculative and depend on multiple factors.

Current Technical Position: CoinCodex analysis indicates XRP is trading below key moving averages with an RSI of 42.68, suggesting a neutral technical position. Near-term technical targets remain around $2.00-2.02, though new catalysts could shift this outlook.

Analyst Perspectives on Impact: Market analysts present varied views on how these developments might influence price:

- According to Cryptonomist, "Ripple's new alignment with Amina Bank, combined with rising activity on South Korean platforms and clear signs of whale accumulation, gives XRP a stronger fundamental and liquidity backdrop. However, the price still needs a clear catalyst to escape its current $2 trading band."

- Some analysts suggest the bank charter approval could theoretically support significant price appreciation once regulatory clearance enables large-scale institutional adoption, though specific price targets remain highly speculative and timeframes uncertain.

Key Variables That Will Determine Impact:

- Actual Transaction Volume: Whether institutions route significant payment volumes through Ripple's network and specifically through XRP-utilizing ODL corridors

- Trust Bank Implementation: The timeline for meeting OCC conditions and launching operations

- Additional Bank Partnerships: Whether other European and U.S. banks follow AMINA's lead

- ETF Adoption: The pace of XRP ETF approvals and institutional investment flows

- Broader Market Conditions: Overall cryptocurrency market sentiment and regulatory developments

Risk Factors: Investors should consider continued competition from other payment solutions, the fact that many Ripple partnerships don't require direct XRP usage, potential regulatory changes, and normal cryptocurrency market volatility. The conditional nature of the OCC approval means there's still implementation risk before the trust bank operates.

On-Chain Signals

Whale behavior shows interesting accumulation patterns. Large XRP holders have reduced deposits to centralized exchanges and placed bigger buy orders around the $2 area, suggesting institutional positioning for potential future moves. However, derivatives open interest remains near six-month lows at $1.36 billion, indicating derivative traders remain cautious.

Regulatory Context: A Multi-Jurisdictional Framework

The dual announcements highlight Ripple's strategy of building compliant infrastructure across multiple regulatory regimes:

United States - GENIUS Act Framework

The GENIUS Act established several key requirements that Ripple's trust bank must meet:

- Reserve Requirements: 100% backing with U.S. dollars or Treasury securities

- Transparency: Monthly public disclosure of reserve composition

- Consumer Protection: Strict marketing rules and prohibition on misleading claims about government backing

- AML/Sanctions Compliance: Full Bank Secrecy Act obligations and technical capability to freeze assets when legally required

SEC Chairman Paul Atkins noted that "payment stablecoins will play a significant role in the securities industry moving forward," while Comptroller Jonathan V. Gould stated that "new entrants into the federal banking sector are good for consumers, the banking industry and the economy."

Europe and Asia - AMINA Bank's Regulatory Coverage

AMINA Bank operates under multiple frameworks:

- Switzerland: FINMA Banking and Securities Dealer License (August 2019)

- Abu Dhabi: FSRA Financial Services Permission (February 2022)

- Hong Kong: SFC Type 1, 4, and 9 licenses, with October 2025 approval for digital asset dealing services

- European Union: Austrian FMA CASP license under MiCAR framework (October 2025)

This multi-jurisdictional coverage provides compliant access to key global markets and positions AMINA as a model for other banks considering blockchain integration.

Broader Industry Impact

Stablecoin Market Competition

With RLUSD now backed by both a federally chartered U.S. trust bank and distribution through European banking partners, Ripple competes directly with established stablecoin issuers. The GENIUS Act passage has sparked a wave of institutional interest in issuing regulated stablecoins, with Circle, Paxos, and others also receiving conditional OCC approval on December 12, 2025.

Template for Crypto-Banking Integration

AMINA Bank's integration of Ripple Payments signals a broader trend of regulated financial institutions moving from blockchain experimentation to production-grade deployment. As Cryptopotato notes, "This collaboration builds on a previous one between the two parties, as AMINA Bank became the first such institution globally to support Ripple's native stablecoin, RLUSD."

Regulatory Precedent

According to legal analysis, "The passage of the GENIUS Act, and the potential passage of a broader crypto market structure bill later in 2025, marks a significant step forward in integrating digital assets and blockchain technology into the mainstream financial system."

Looking Ahead: Implementation Timeline

Near-Term (Q1-Q2 2026)

- OCC Conditions: Ripple must fulfill all conditional requirements for final trust bank approval

- AMINA Integration: Full operational deployment of Ripple Payments infrastructure

- Additional Bank Partnerships: Potential announcements from other European or Asian banks

- XRP ETF Developments: Continued regulatory review of pending XRP ETF applications

Medium-Term (2026-2027)

- Trust Bank Operations: Launch of custody, payment, and stablecoin management services

- Cross-Border Volume: Measurement of actual transaction volumes through Ripple's network

- Regulatory Evolution: Potential additional guidance from SEC, CFTC, or international regulators

- Partnership Expansion: Growth in both number and geographic diversity of banking partners

Conclusion: A Transformative Day for Ripple

December 12, 2025, marks a watershed moment for Ripple's evolution from a blockchain payments company to a globally regulated financial infrastructure provider. The simultaneous approval of a U.S. national trust bank charter and the first European bank partnership demonstrates successful execution of a multi-jurisdictional compliance strategy.

For XRP holders and Ripple watchers, these developments provide tangible evidence of institutional adoption progressing from pilot programs to production deployment. While immediate price impacts have been modest, the strategic foundations being laid—federally chartered banking operations, regulated stablecoin infrastructure, and integration with traditional financial institutions—position Ripple to capture meaningful market share in the multi-trillion-dollar cross-border payments sector.

The key question now shifts from "Can Ripple operate in regulated markets?" to "How much volume will flow through these newly approved channels?" That answer will determine whether today's announcements translate into sustained business growth and, potentially, increased XRP utility as institutions route payments through Ripple's infrastructure.

DISCLAIMER: This newsletter is for informational purposes only and does not constitute investment advice, advertising, or a recommendation to buy, sell, or hold any securities. This content is not sponsored by or affiliated with any of the mentioned entities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. The OCC approval for Ripple National Trust Bank is conditional and does not guarantee final approval or successful operations. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.

Sources

Ripple & AMINA Bank Partnership:

- Ripple Official Press Release - Ripple Payments sees first European bank adoption with AMINA Bank

- CoinDesk - Ripple Payments Lands First European Bank Client in AMINA

- CoinTelegraph - Ripple expands European footprint with AMINA stablecoin payment partnership

OCC Trust Bank Charter: 4. OCC Official Release - OCC Announces Conditional Approvals for Five National Trust Bank Charter Applications 5. Business Wire - Ripple Secures Federal Approval to Establish National Trust Bank 6. CryptoBriefing - Ripple gets OCC approval to become national trust bank 7. CoinDesk - Five Crypto Firms Step Closer to Become a Bank

GENIUS Act & Regulatory Context: 8. White House Fact Sheet - President Donald J. Trump Signs GENIUS Act into Law 9. Latham & Watkins - The GENIUS Act of 2025: Stablecoin Legislation Adopted in the US 10. CBS News - Trump signs landmark GENIUS Act

SEC Settlement & Market Context: 11. SEC Official Release - SEC Settlement with Ripple Labs 12. Coincub - Ripple vs SEC: Full Case Timeline, Rulings, and 2025 Settlement 13. Capital.com - Ripple vs SEC: what the ruling means for XRP

Market Analysis: 14. Cryptonomist - XRP comeback: Amina Bank deal fuels optimism for Europe 15. CCN - AMINA Bank Global First European Bank To Go Live With Ripple Payments 16. CoinCodex - XRP Price Prediction 2025, 2026-2030