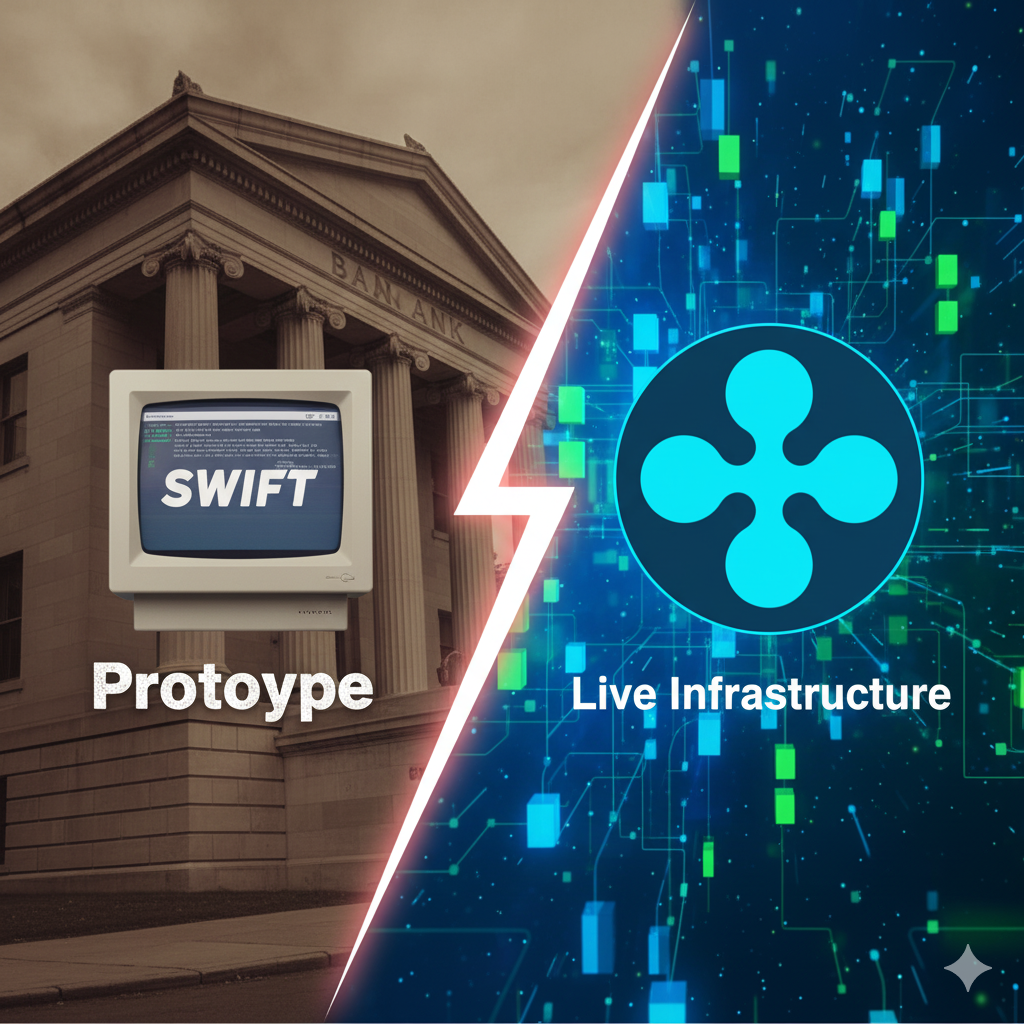

Ripple's Brad Garlinghouse Responds to SWIFT: 13 Years of Building vs. Prototypes

Ripple CEO Brad Garlinghouse dismisses SWIFT's blockchain prototype as "marketing play," highlighting Ripple's 13+ years of deployed infrastructure vs. SWIFT's experimental approach. XRP's payment leadership strengthens as legacy systems play catch-up.

Ripple CEO Brad Garlinghouse has publicly criticized SWIFT's newly announced blockchain-based shared ledger prototype, calling it "more of a marketing play" rather than a meaningful product launch. The sharp response, delivered in Garlinghouse's latest shareholder letter, highlights the growing divide between legacy financial messaging systems and blockchain-native payment solutions.

BREAKING: 🇺🇸 RIPPLE CEO BRAD GARLINGHOUSE RESPONDS TO SWIFT BANKING ANNOUNCEMENT! $XRP HOLDER WATCH VIDEO BELOW! 👇 https://t.co/rDgyUTR6M1 pic.twitter.com/tTv0K1ShKY

— Good Morning Crypto (@AbsGMCrypto) October 2, 2025

SWIFT's Prototype Announcement Draws Skepticism

SWIFT, the dominant global financial messaging network, recently announced it has built a blockchain-based shared ledger prototype focused on real-time cross-border payments. The timing of the announcement—coinciding with SWIFT's annual Sibos conference—raised eyebrows across the cryptocurrency industry.

Garlinghouse didn't mince words in his assessment. "It's true in the early days we did view Swift as a major competitor, but the reality is in the time it's taken for them to announce a prototype, we've been building robust digital asset infrastructure," he stated in his shareholder communication. The Ripple CEO emphasized that while SWIFT continues to experiment with concepts, Ripple has spent over 13 years developing and deploying live blockchain infrastructure for payments, custody solutions, stablecoins, and applications on the XRP Ledger (XRPL).

Ripple's Track Record vs. SWIFT's Experiments

The contrast between the two companies' approaches is stark. Ripple has moved from concept to execution across multiple product lines, including the recent launch of RLUSD, its U.S. dollar-backed stablecoin. The company has expanded its digital asset ecosystem through strategic acquisitions and partnerships with financial institutions worldwide, delivering working solutions that process real transactions daily.

Meanwhile, SWIFT—which has served as the backbone of international banking for decades—remains in the prototype phase for blockchain integration. According to industry analysis, this announcement appears more aligned with conference publicity than product readiness, particularly given SWIFT's history of exploring but not fully implementing blockchain technology.

Market and Regulatory Implications

The public exchange underscores a critical inflection point in global finance. Traditional financial infrastructure providers like SWIFT face increasing pressure to modernize, while blockchain-native companies like Ripple have built systems designed for digital asset movement from the ground up. This technological divide could reshape how financial institutions choose their cross-border payment partners in the coming years.

From a regulatory perspective, Ripple's position has strengthened following progress in its legal battle with the SEC. While the company continues navigating regulatory frameworks, its operational momentum with institutional partners demonstrates growing confidence in blockchain-based payment rails. SWIFT, conversely, benefits from established regulatory relationships but faces the challenge of integrating newer technologies into decades-old infrastructure.

XRP and Ripple Impact Analysis

This development carries significant implications for XRP and Ripple's market position:

XRP Price Potential: Garlinghouse's confident dismissal of SWIFT's prototype reinforces Ripple's technological leadership narrative, which historically correlates with positive sentiment around XRP. The clear differentiation between Ripple's deployed solutions and SWIFT's experimental approach could strengthen investor confidence in XRP's utility for cross-border payments.

Business Operations: Ripple's comprehensive digital asset infrastructure—spanning payments, custody, and stablecoins—positions the company well beyond simple competition with SWIFT. As Garlinghouse noted, Ripple's vision extends to reshaping global finance infrastructure, not merely replicating existing systems with blockchain technology.

Competitive Positioning: The SWIFT announcement, rather than threatening Ripple, may actually validate the blockchain payment thesis that Ripple has championed for over a decade. Financial institutions evaluating modernization options now see a clear choice between established but slower-to-innovate networks and blockchain-native solutions with proven deployment records.

Partnership Opportunities: Banks and financial institutions watching SWIFT's slow blockchain adoption may accelerate their evaluation of alternatives. Ripple's existing network of institutional partners and working products provides a ready-made solution for organizations seeking immediate blockchain payment capabilities rather than future prototypes.

Adoption Prospects: According to crypto market analysis, the XRP community has responded enthusiastically to Garlinghouse's stance, viewing SWIFT's belated blockchain interest as confirmation of Ripple's strategic foresight. This community support, combined with institutional momentum, strengthens XRP's adoption trajectory in the payments sector.

The Bottom Line

Brad Garlinghouse's pointed response to SWIFT's blockchain prototype announcement draws a clear line in the sand: announcements don't move money, deployed infrastructure does. After 13 years of building real-world blockchain solutions while SWIFT experimented with concepts, Ripple has positioned itself not just as a competitor to legacy systems, but as a comprehensive digital finance platform. For XRP holders and the broader crypto market, this public confidence from Ripple's leadership signals continued momentum in the blockchain payments revolution—one that's already happening, not just being prototyped.

Sources

- TradingView/Coinpedia: SWIFT vs XRP Explained - Ripple CEO Breaks Down Market Impact

- Binance Square: Community Discussion on Garlinghouse's SWIFT Response

- Brad Garlinghouse Shareholder Letter (as quoted in X post by @AbsGMCrypto)

DISCLAIMER: This newsletter is for informational purposes only and does not constitute investment advice, advertising, or a recommendation to buy, sell, or hold any securities. This content is not sponsored by or affiliated with any of the mentioned entities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.