ProShares Files for Revolutionary HORNET 75/25 Strategy ETFs Including XRP

ProShares files for revolutionary HORNET ETFs blending S&P 500 with crypto in 75/25 ratio, including first-ever XRP variant. Following Bitcoin HORNET's 39% 2024 return, new filings target Ethereum, Solana & XRP for institutional adoption.

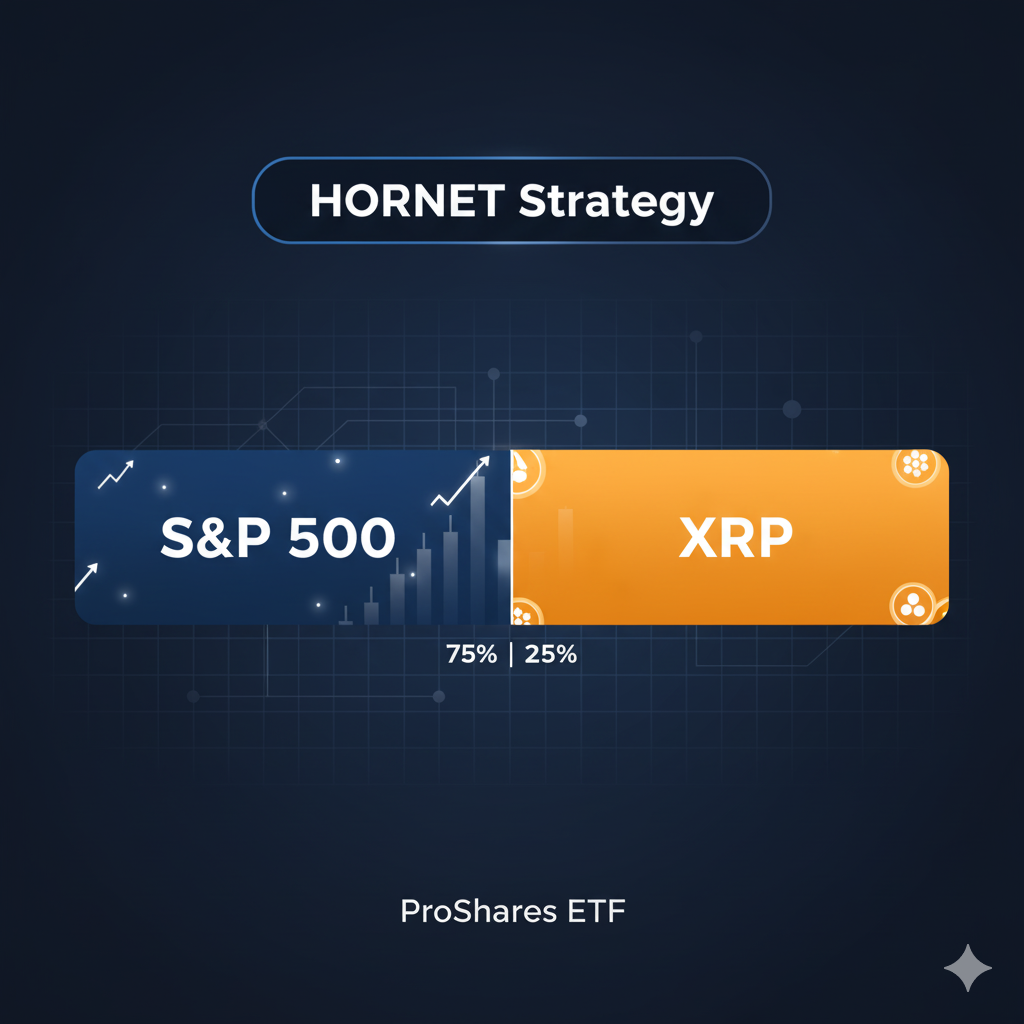

ProShares has filed with the SEC for a groundbreaking new series of HORNET strategy ETFs that blend traditional S&P 500 exposure with cryptocurrency allocations in a 75/25 ratio. The latest SEC filings reveal three new funds, including the first-ever S&P 500 and XRP 75/25 Strategy ETF, marking a significant milestone for institutional crypto adoption.

The December 2025 filing documents show ProShares Trust seeking approval for three innovative HORNET (Hybrid Optimized Risk-Adjusted Networked Exchange Traded) funds: the CYBER HORNET S&P 500 and Ethereum 75/25 Strategy ETF, the CYBER HORNET S&P 500 and Solana 75/25 Strategy ETF, and the pioneering ProShares HORNET S&P 500 and XRP 75/25 Strategy ETF.

A Game-Changing Approach to Crypto-Traditional Asset Blending

These new ETFs represent an evolution from ProShares' existing leveraged crypto products. Unlike the company's 2x leveraged ETFs like UXRP and SLON launched in July 2025, these HORNET funds offer a more conservative approach by combining 75% S&P 500 exposure with 25% cryptocurrency futures exposure through regulated derivatives.

"This filing represents the next phase of crypto-traditional asset integration," said Michael Sapir, ProShares CEO, in previous statements about the company's crypto expansion. The HORNET strategy aims to provide investors with broad market exposure while capturing the growth potential of digital assets in a risk-managed framework.

Building on Success: The CYBER HORNET Foundation

ProShares already operates a successful CYBER HORNET S&P 500 and Bitcoin 75/25 Strategy ETF (ticker: BBB, formerly ZZZ), which delivered an impressive 39% return in 2024, ranking in the top 2% of Morningstar's Large-Blend category among 1,386 funds. This proven track record demonstrates institutional appetite for blended crypto-traditional strategies.

The success of the Bitcoin-focused HORNET fund has paved the way for expansion into other major cryptocurrencies. The new filings suggest ProShares is positioning to capture growing institutional demand for diversified crypto exposure beyond Bitcoin.

Regulatory Momentum Fueling XRP Products

The timing of these filings coincides with significant regulatory clarity for XRP following the conclusion of Ripple's SEC lawsuit in March 2025. ProShares has already launched multiple XRP futures-based products, including the Ultra XRP ETF (UXRP) and Short XRP ETF products that began trading in April and July 2025.

With XRP futures now trading on CME Group and multiple spot XRP ETF applications pending SEC review, the regulatory environment has become increasingly favorable for XRP-linked investment products. The HORNET S&P 500 and XRP 75/25 Strategy ETF would be the first fund to combine traditional equity exposure with XRP futures in a balanced allocation.

Market Context and Competitive Landscape

The crypto ETF market has experienced explosive growth in 2025. Following the approval of Bitcoin and Ethereum spot ETFs, asset managers have filed for products tracking Solana, XRP, and other major cryptocurrencies. ProShares currently manages over $85 billion in assets, with crypto-linked ETFs accounting for more than $1.5 billion in assets under management.

The 75/25 allocation strategy addresses institutional concerns about crypto volatility while providing meaningful exposure to digital asset growth. This approach allows traditional investors to gain crypto exposure within familiar portfolio construction frameworks.

XRP/Ripple Analysis: Strategic Positioning for Growth

XRP Price Impact: The announcement of new XRP-linked ETF products has historically driven positive price action for XRP, which has gained over 480% in the past year, currently trading around $2.27. The introduction of a conservative 75/25 strategy fund could attract institutional investors who have been hesitant to take direct crypto positions.

Ripple Business Operations: These developments support Ripple's broader strategy of legitimizing XRP as an institutional asset. With regulatory clarity achieved and multiple ETF products launching, Ripple's RippleNet platform benefits from increased XRP liquidity and institutional adoption.

Legal Standing: The resolution of the SEC lawsuit has removed the primary regulatory overhang for XRP products. The SEC's decision not to appeal the partial victory creates a stable legal foundation for XRP-linked investment products.

Partnership Opportunities: Growing ETF adoption could accelerate partnerships between traditional financial institutions and Ripple, as banks and asset managers seek exposure to payment-focused cryptocurrencies.

Adoption Prospects: Institutional-grade ETF products lower barriers to XRP adoption among pension funds, endowments, and registered investment advisors who require regulated investment vehicles.

Looking Ahead: Timeline and Expectations

While the exact launch timeline remains subject to SEC review, ProShares' track record suggests these products could debut within 75 days of filing effectiveness, as indicated in the regulatory documents. The company's success with previous crypto ETF launches positions it well for approval of these innovative blended strategies.

The broader crypto ETF approval cycle suggests October 2025 as a potential decision deadline for various pending applications, including spot XRP ETFs from major asset managers like Grayscale, VanEck, and Bitwise.

These HORNET strategy ETFs represent the maturation of crypto investing from speculative trading to institutional portfolio allocation. By combining the stability of S&P 500 exposure with measured crypto allocations, ProShares is addressing the evolving needs of institutional investors seeking digital asset exposure within traditional risk management frameworks.

The success of these blended strategies could establish a new category of hybrid ETFs, potentially attracting billions in institutional capital while providing retail investors with professionally managed crypto exposure. As the crypto market continues to evolve, products like the HORNET ETFs may become the standard for institutional crypto adoption.

DISCLAIMER: This newsletter is for informational purposes only and does not constitute investment advice, advertising, or a recommendation to buy, sell, or hold any securities. This content is not sponsored by or affiliated with any of the mentioned entities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.