ProShares Files for Crypto 20 ETF: Major Diversification Play

ProShares files for groundbreaking Crypto 20 ETF tracking top digital assets including Bitcoin, Ethereum, and XRP. With XRP representing nearly 20% of the index, this could unlock major institutional flows into Ripple's ecosystem.

ProShares, one of the largest ETF providers in the United States, has officially filed with the SEC for a groundbreaking new product: the ProShares CoinDesk Crypto 20 ETF. If approved, this fund would track the CoinDesk Crypto 20 Index (CD20), offering investors exposure to the top 20 digital assets by market capitalization—representing a significant evolution beyond single-asset crypto ETFs.

Beyond Bitcoin: The Diversification Opportunity

The filing marks a pivotal moment in the maturation of cryptocurrency investment vehicles. While Bitcoin and Ethereum ETFs have dominated the institutional landscape since their respective approvals, ProShares is positioning to capture demand for broader crypto market exposure. The CoinDesk CD20 Index currently represents approximately 90% of the total cryptocurrency market capitalization, providing investors with a diversified basket approach to digital assets.

According to the preliminary filing, the ETF would be listed on the NYSE and would provide exposure to major cryptocurrencies including Bitcoin, Ethereum, XRP, Solana, Cardano, and others based on market cap weighting. This structure mirrors traditional equity index funds, bringing familiar investment mechanics to the crypto space.

Market Implications and Regulatory Landscape

The timing of this filing is particularly noteworthy given the evolving regulatory environment under the current administration. The SEC has shown increased openness to crypto-related financial products following the approval of spot Bitcoin ETFs in January 2024 and spot Ethereum ETFs later that year. A multi-asset crypto ETF would represent the next logical step in this progression.

Market analysts suggest this could unlock significant institutional capital currently sitting on the sidelines. "A diversified crypto ETF solves the problem of asset selection for traditional investors who want crypto exposure but lack the expertise or infrastructure to manage multiple positions," notes cryptocurrency research firm Messari in their recent institutional adoption report.

The approval pathway, however, remains uncertain. The SEC has historically been cautious about products offering exposure to assets beyond Bitcoin and Ethereum, citing concerns about market manipulation and custody solutions for smaller-cap cryptocurrencies.

XRP and Ripple: A Critical Component

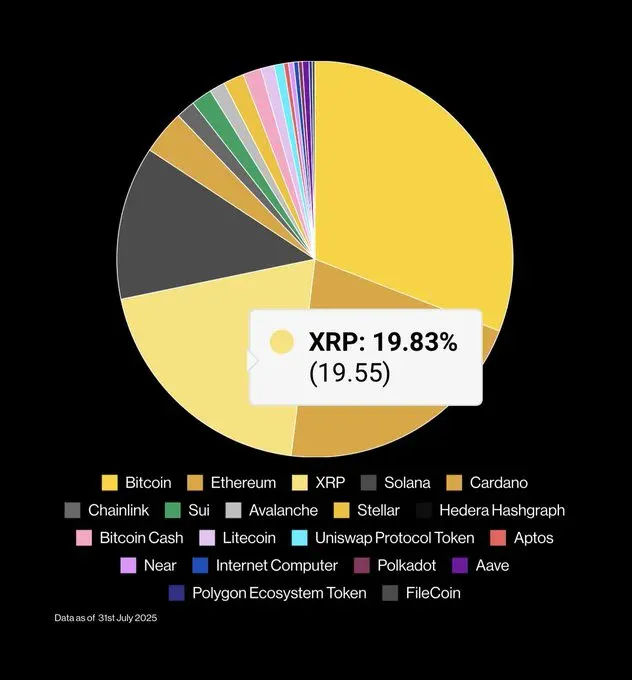

For XRP holders and Ripple stakeholders, this development carries particular significance. As shown in the CoinDesk CD20 Index composition, XRP represents approximately 19.83% of the index—making it the third-largest component behind Bitcoin and Ethereum. This substantial weighting would make the ProShares ETF one of the largest institutional vehicles providing direct XRP exposure.

Impact on XRP Price and Liquidity

If approved, the ETF could channel substantial investment flows into XRP. Traditional ETF launches have historically created significant buying pressure on underlying assets as fund managers acquire positions to match index weightings. Given XRP's nearly 20% allocation in the CD20 Index, ProShares would need to acquire significant XRP holdings to properly track the index, potentially impacting price dynamics.

The development also validates XRP's position as a major cryptocurrency asset from an institutional perspective—particularly important given Ripple's ongoing regulatory journey. The inclusion signals that major financial institutions view XRP as a legitimate, investable asset worthy of index inclusion.

Ripple's Strategic Position

For Ripple Labs, this filing represents another step toward mainstream financial integration. The company has long positioned XRP as a bridge currency for cross-border payments, and institutional products like the ProShares ETF could accelerate adoption by making XRP accessible through traditional brokerage accounts.

Following the partial resolution of Ripple's SEC case in 2023, which clarified XRP's regulatory status in certain contexts, institutional interest has steadily increased. Ripple CEO Brad Garlinghouse recently stated at a fintech conference that "institutional adoption is accelerating faster than ever," pointing to increased on-ledger activity and partnership announcements.

Partnership and Adoption Implications

The ETF could also strengthen Ripple's business development efforts. Financial institutions considering RippleNet or On-Demand Liquidity (ODL) solutions may find comfort in XRP's inclusion in a regulated ETF product. This institutional validation could accelerate partnerships, particularly in regions where regulatory uncertainty has slowed adoption.

Additionally, the liquidity provided by ETF trading could reduce volatility concerns that some potential partners have cited when evaluating XRP for payment corridors. Deeper, more stable markets typically attract larger institutional participants.

What Happens Next

The SEC typically takes several months to review ETF applications, with multiple rounds of comments and potential amendments. ProShares' track record—including the successful launch of the first Bitcoin Strategy ETF in 2021—may work in their favor, but a multi-asset crypto ETF presents novel considerations around custody, valuation, and market surveillance.

Industry observers will be watching closely for the SEC's initial comments and whether other asset managers file competing applications. The approval of a diversified crypto ETF would likely trigger a wave of similar products, fundamentally reshaping how investors access the digital asset market.

For XRP and the broader cryptocurrency ecosystem, the ProShares filing represents another milestone in the journey from speculative asset to institutional investment category. Whether approved or not, the conversation has shifted from "if" institutional crypto products will exist to "what form" they will take.

Sources

- Seeking Alpha: ProShares Files for Crypto 20 ETF

- CoinDesk CD20 Index Methodology

- SEC Litigation Releases - Ripple Case

- Messari Institutional Adoption Report 2025

- ProShares Official Website

DISCLAIMER: This newsletter is for informational purposes only and does not constitute investment advice, advertising, or a recommendation to buy, sell, or hold any securities. This content is not sponsored by or affiliated with any of the mentioned entities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.