OCC Green-Lights Banks to Hold Crypto for Blockchain Transaction Fees

The OCC issued new guidance allowing U.S. national banks to hold cryptocurrency on their balance sheets to pay blockchain transaction fees—a practical clarification that removes operational barriers for banks offering digital asset services.

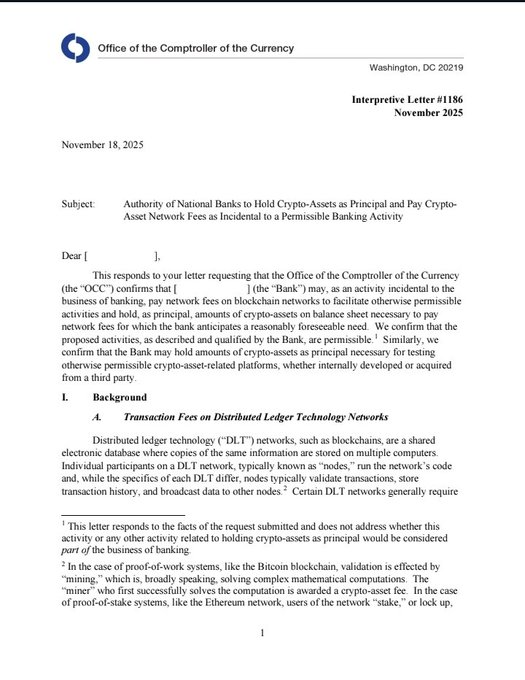

The Office of the Comptroller of the Currency (OCC) issued new guidance Tuesday clarifying that U.S. national banks can hold cryptocurrency assets as principal and pay crypto-asset network fees "as incidental to a permissible banking activity"—marking another regulatory milestone in the evolving relationship between traditional banking and digital assets.

The policy, delivered through Interpretive Letter 1186 dated November 18, 2025, addresses a practical operational need that has created friction for banks attempting to offer blockchain-based services: distributed ledger technology (DLT) networks require users to hold their native tokens to pay transaction fees, commonly known as "gas fees."

The Technical Problem This Solves

The interpretive letter explains that DLT networks—such as blockchains—operate as "a shared electronic database where copies of the same information are stored on multiple computers." Individual participants run network "nodes" that validate transactions and broadcast them across the network. These nodes typically require payment of network fees in the blockchain's native crypto-asset.

For banks offering blockchain-based services, this created a regulatory gray area: Could they legally hold Bitcoin, Ethereum, Solana, or other crypto assets on their balance sheets purely to facilitate transactions for clients?

According to the OCC's guidance, banks engaging in activities "explicitly allowed under the Guiding and Establishing National Innovation for U.S. Stablecoins Act" (GENIUS Act) will need to pay network fees when acting as agents for customers or providing custody operations. The interpretive letter concludes that banks' need "to pay network fees to facilitate otherwise permissible crypto-asset activities and to hold, as principal, amounts of crypto-assets on balance sheet necessary to pay network fees for which the bank anticipates a reasonably foreseeable need is permissible for the bank."

The guidance applies whether banks are accessing "internally developed or acquired from a third party" crypto-asset-related platforms, providing flexibility for banks to either build their own blockchain infrastructure or partner with existing providers.

The Gould Factor: A Pro-Crypto Shift at the OCC

The guidance comes from an OCC now led by Comptroller Jonathan Gould, a Trump appointee confirmed by the Senate in July 2025 who brings significant crypto industry experience to the role. Gould previously served as chief legal officer at blockchain infrastructure firm Bitfury and held senior positions at the OCC during the first Trump administration, including as senior deputy comptroller and chief counsel under Acting Comptroller Brian Brooks—who championed the first federal crypto bank charter for Anchorage Digital.

Speaking at a CoinDesk event in September, Gould emphasized his philosophy on crypto banking: "My view is that it's better for it to be done within the banking system, if it's legally permissible and can be done in a safe and sound manner, so that we can see it and monitor it, versus an ostrich approach, where we put our head in the sand."

Context: The GENIUS Act and Stablecoin Regulation

The interpretive letter specifically references activities permitted under the GENIUS Act, the stablecoin legislation passed by Congress and signed into law in July 2025. That legislation established the first comprehensive federal framework for payment stablecoins—digital assets backed by reserves like cash or Treasuries and designed to maintain a stable value pegged to the U.S. dollar.

The GENIUS Act designated the OCC as a primary federal regulator for certain stablecoin issuers, creating new responsibilities that require banks to interact with blockchain networks. When banks custody stablecoins or facilitate stablecoin transactions under this new framework, they need the technical capability to pay blockchain transaction fees, making Tuesday's guidance operationally essential.

A Broader Regulatory Reversal

This guidance represents one piece of a significant regulatory pivot since the Trump administration took office in January 2025. Earlier in the year, the OCC issued Interpretive Letter 1183 in March, which rescinded Biden-era restrictions and reaffirmed that crypto custody, certain stablecoin activities, and participation in blockchain node verification networks are permissible for national banks—without requiring prior supervisory approval.

The agency also withdrew from joint statements issued during the Biden administration warning banks about crypto-asset risks. The Federal Reserve similarly sunset its Novel Activities Supervision Program in August 2025, returning crypto activities to standard supervisory processes rather than treating them as exceptional risks requiring special oversight.

Market Response and Industry Impact

The clarification arrives as approximately 55 million Americans—roughly 21% of the adult population—now own cryptocurrency, according to an April 2025 Harris Poll. With the global crypto market capitalization hovering around $3.3 trillion, the scale represents a significant opportunity for banks to compete for custody fees, transaction revenues, and customer retention.

However, challenges remain. The ongoing jurisdictional contest between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) means some digital assets still occupy regulatory gray areas. Additionally, the FDIC does not insure digital asset holdings—a critical disclosure point for banks marketing crypto services to customers.

What This Means for Banks and Consumers

For national banks, the guidance removes a key operational barrier to offering blockchain-based financial services. Banks can now:

- Hold ETH to pay gas fees when executing Ethereum transactions for clients

- Maintain SOL or other tokens needed for transactions on alternative blockchain networks

- Keep reserves of network-specific tokens proportional to their anticipated transaction volume

- Operate stablecoin custody services without the friction of acquiring network tokens for each transaction

- Access crypto-asset platforms either by developing them internally or through third-party providers

The guidance specifies that banks can hold crypto assets on their balance sheet for "reasonably foreseeable need," suggesting banks should size their holdings based on expected transaction volumes rather than holding speculative amounts.

For consumers and businesses, this could translate to smoother, more cost-effective blockchain-based banking services as institutions integrate these capabilities into their existing infrastructure. Banks entering the space will compete with crypto-native firms and fintech companies that have traditionally dominated digital asset custody and transaction services.

Looking Ahead: Charter Applications and Implementation

The policy shift comes as several major crypto companies—including Coinbase, Circle, Paxos, and Ripple—have applied for national trust charters that would allow them to operate as banks under OCC supervision. Traditional banking trade groups have pushed back against some of these applications, but Gould has indicated the OCC will evaluate applications on a case-by-case basis.

U.S. banking regulators, including the Federal Reserve, FDIC, and Treasury Department, are now working to develop comprehensive regulations implementing the GENIUS Act's stablecoin framework. The OCC's guidance on gas fees provides one piece of the operational clarity banks will need as these broader rules take shape.

The interpretive letter emphasizes that while banks now have explicit permission to hold crypto for transaction fees, they must still maintain "strong risk management controls" and ensure operations remain "safe, sound, and fair" under applicable banking law—the same standards applied to any other banking activity.

The letter frames this authority as "incidental to a permissible banking activity," positioning crypto holdings for gas fees not as a separate line of business but as a necessary operational component of already-approved blockchain-based banking services.

DISCLAIMER: This newsletter is for informational purposes only and does not constitute investment advice, advertising, or a recommendation to buy, sell, or hold any securities. This content is not sponsored by or affiliated with any of the mentioned entities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.

Sources

Primary Sources:

- OCC News Release: Interpretive Letter 1186 - Office of the Comptroller of the Currency, November 18, 2025

- Interpretive Letter 1186 (PDF) - Office of the Comptroller of the Currency, November 18, 2025

- OCC News Release: Interpretive Letter 1183 - Office of the Comptroller of the Currency, March 7, 2025

News Coverage:

- U.S. Regulator OCC Clarifies How Banks Can Handle Network 'Gas Fees' - CoinDesk, Jesse Hamilton, November 18, 2025

- Former Bitfury Exec Gould Confirmed to Take Over U.S. Banking Agency OCC - CoinDesk, July 10, 2025

- Top U.S. Banking Regulator Gould Says Crypto Debanking 'Is Real' - CoinDesk, September 10, 2025

- US banking authority clears path for crypto services at national banks - CryptoSlate, May 13, 2025

- Crypto's Bid for Trust Charters Sparks Alarm in Banking Industry - Bloomberg, November 5, 2025

- Gould confirmed as OCC head - American Banker, July 10, 2025

Legal Analysis:

- What the GENIUS Act Means for Payment Stablecoin Issuers, Banks, and Custodians - WilmerHale, July 18, 2025

- US Crypto Policy Tracker: Regulatory Developments - Latham & Watkins

- Blockchain & Cryptocurrency Laws & Regulations 2026: USA - Global Legal Insights

- OCC's Gould leans away from 'ostrich' approach - Banking Dive, November 5, 2025