Multiple XRP ETF S-1 Amendments Signal Preparation for October Approval Rush

Multiple major asset managers filed amended S-1 statements for XRP ETFs on August 22, 2025, including Canary Capital, Franklin Templeton, and 21Shares. The coordinated filing signals high confidence as SEC decisions approach in October 2025 following regulatory clarity from Ripple case resolution.

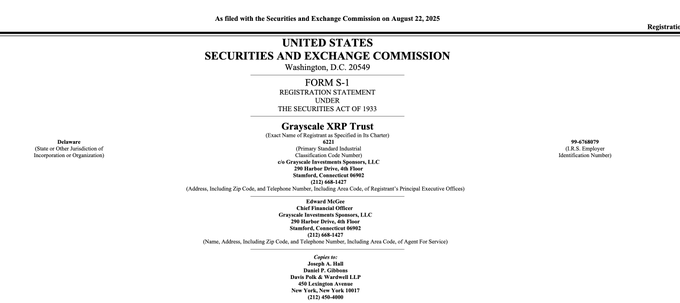

Multiple major asset managers filed amended S-1 registration statements for spot XRP ETFs on August 22, 2025, including Canary Capital, CoinShares, Franklin Templeton, 21Shares, and WisdomTree. This coordinated amendment wave represents a critical milestone as the Securities and Exchange Commission prepares for simultaneous decisions across multiple XRP ETF applications in October 2025.

Major Players Unite for October Decision Window

The amended filings come as the SEC has scheduled final decisions on most XRP ETF applications between October 18-25, 2025, with Grayscale's application facing the earliest deadline on October 18. The updated registration statements outline plans for funds to list on exchanges like Cboe BZX, providing investors with direct exposure to XRP without requiring them to hold the digital asset themselves.

Franklin Templeton's involvement carries particular weight given its management of over $1.5 trillion in client assets. The firm's Trust was formed as a Delaware statutory trust on February 28, 2025, with Coinbase Custody serving as the XRP custodian. This institutional backing demonstrates growing confidence in XRP's regulatory outlook following recent legal developments.

Bunch of XRP ETF filings being updated by issuers today. Almost certainly due to feedback from SEC. Good sign, but also mostly expected pic.twitter.com/GiSL1kc6lt

— James Seyffart (@JSeyff) August 22, 2025

Regulatory Clarity Boosts Approval Prospects

The timing of these amendments coincides with significant regulatory clarity for XRP. Ripple's case saw a major update in early August 2025 as appeals were dismissed, keeping Judge Torres' framework in place, where programmatic sales are not classified as securities while certain institutional sales are. This judicial resolution has substantially improved market expectations heading into the ETF decision window.

The SEC requires 6+ months of XRP futures trading on platforms like Coinbase Derivatives for ETF eligibility, per recent listing guidelines. XRP has successfully met this requirement, with CME Group launching XRP futures contracts earlier this year, providing the regulated derivatives foundation that typically precedes spot ETF approvals.

Market Implications and Institutional Adoption

The coordinated amendment strategy mirrors the SEC's historical approach to crypto ETF approvals. This approach reflects the SEC's handling of Bitcoin ETF applications, where multiple issuers received simultaneous approval or rejection decisions. Industry observers interpret this as a positive signal that the SEC is preparing for coordinated approvals rather than rejections.

Industry sentiment is increasingly optimistic, with recent estimates pegging SEC approval odds at around 95% by year-end. The prospect of multiple simultaneous launches could create substantial trading volume and institutional adoption opportunities for XRP.

XRP/Ripple Analysis: Transformative Impact Potential

For XRP and Ripple Labs, successful ETF approvals would represent a watershed moment. The amendments filed by major institutional players validate XRP's evolution from a regulatory uncertainty to a legitimate institutional asset class. After approval, shares of the ETF could be owned by investors via traditional brokerage accounts and traded on Cboe BZX exchange, allowing investors to benefit from XRP price changes without dealing with wallet management or crypto exchange trading.

This development could significantly impact XRP's price dynamics and adoption trajectory. The institutional accessibility provided by ETFs typically drives substantial new capital inflows, as traditional investors gain regulated exposure to digital assets. For Ripple's business operations, ETF approval would legitimize XRP's utility in cross-border payments and strengthen partnership opportunities with financial institutions previously hesitant about regulatory compliance.

The legal standing improvements following the dismissal of appeals provide additional confidence for institutional adoption. The dismissal of the XRP lawsuit could boost confidence in regulatory compliance for institutions considering XRP integration.

Key Takeaway

The August 22nd wave of XRP ETF S-1 amendments represents the final preparation phase before the SEC's October decision window. With regulatory clarity achieved through the Ripple case resolution and established futures markets providing surveillance foundations, the coordinated approach by major asset managers signals high confidence in imminent approvals. October 2025 could mark XRP's full integration into traditional financial markets through regulated investment vehicles.

DISCLAIMER: This newsletter is for informational purposes only and does not constitute investment advice or a recommendation to buy, sell, or hold any securities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.

Sources

- CoinGape - Canary Capital Files Amended S-1 For XRP ETF, Boosting Approval Hopes

- Coinpedia - Full List of XRP ETFs Awaiting SEC Approval: Dates, Filings, and What's Next

- Bitcoin Ethereum News - SEC Postpones Multiple XRP ETF Decisions to October 2025

- ETF.com - Will There Be a Spot XRP ETF? The Ripple Effect Swells

- SEC EDGAR Database - Franklin XRP ETF S-1 Filing