Michael Burry's $176 Billion Depreciation Warning: What It Could Mean for Crypto Markets

Michael Burry warns tech giants will understate $176B in depreciation through 2028. While his focus is AI infrastructure, crypto markets have shown troubling correlation with tech stocks. Is a broader correction coming?

TL;DR: Michael Burry warns that major tech companies will understate depreciation by $176 billion through 2028, potentially overstating earnings. While his warnings focus on AI infrastructure spending, market observers note crypto markets have historically moved in tandem with tech sector corrections—though the connection remains speculative and complex.

The Core Warning: What Burry Actually Said

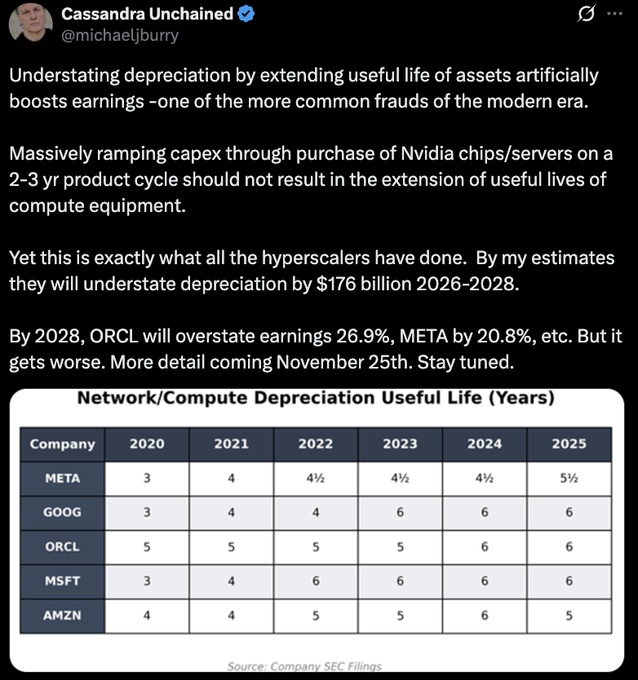

Michael Burry, the investor famous for predicting the 2008 housing collapse, estimates that "hyperscalers"—major cloud computing companies—will understate depreciation by $176 billion between 2026 and 2028. He projects that by 2028, Oracle will overstate earnings by 26.9% and Meta by 20.8%.

Burry's argument centers on tech companies extending the useful lives of computing equipment that typically has a 2-3 year product cycle, particularly NVIDIA chips and AI servers. He promised more details would be coming on November 25th, though as of this writing, no comprehensive follow-up report appears to have been published.

The Depreciation Schedule Changes

The concern extends across all major hyperscalers, who have been systematically extending the useful life of their network and compute equipment:

- Meta: Extended from 3-4 years to 5½ years

- Google/Alphabet: Extended from 3-4 years to 6 years

- Oracle: Extended from 5 years to 6 years

- Microsoft: Extended from 3-4 years to 6 years

- Amazon: Extended from 4 years to 5-6 years

Other short sellers, including Jim Chanos, have also highlighted issues with depreciation practices at these companies.

Burry's Broader AI Skepticism

Beyond the depreciation concerns, Burry has taken an aggressive stance against the AI boom. His Scion Asset Management disclosed put options worth approximately $187 million on Nvidia and $912 million on Palantir, representing roughly 80% of his disclosed portfolio.

In late October 2025, Burry broke nearly two years of social media silence with a cryptic post: "Sometimes, we see bubbles. Sometimes, there is something to do about it. Sometimes, the only winning move is not to play." The timing coincided with Nvidia becoming the first company to reach a $5 trillion market capitalization.

The Circular Financing Concern

Market analysts have flagged the "strangely circular nature" of AI industry spending, where tech giants and AI companies like OpenAI, Microsoft, and Meta are funneling hundreds of billions of dollars into data centers, chips, and infrastructure—effectively funding themselves, their partners, and their customers in a high-stakes ecosystem.

The Crypto Connection: Speculation vs. Reality

IMPORTANT: Michael Burry's depreciation warnings and AI bubble concerns did not mention cryptocurrency markets. The following analysis represents market observers' theories about potential indirect effects, not Burry's stated views.

Why Market Observers See a Connection

Several cryptocurrency analysts have drawn potential links between AI bubble fears and crypto market performance:

1. Correlation with Tech Stocks

In early November 2025, Bitcoin plunged below $100,000, representing a 21% tumble from its early October high of $126,210.5, while Ethereum fell 12% to around $3,100 during the same period. The sell-off in tech stocks following Burry's disclosure bled into crypto markets.

Despite their decentralized ethos, cryptocurrencies often act as high-beta tech plays during tech-led market corrections. Crypto influencers are highlighting the increased correlation between Bitcoin and the Nasdaq index during periods of AI uncertainty.

2. Risk Sentiment Shift

Both AI and crypto markets are facing synchronized corrections, in 2025 due to overvaluation fears, macroeconomic pressures, and shifting institutional sentiment. The Crypto Fear & Greed Index fell to 24—"Extreme Fear"—in November 2025, its lowest level since early 2023.

3. Shared Investor Base

A BofA Global Research fund manager survey in November 2025 revealed that 54% of investors believe AI stocks are in a bubble, a sentiment that spills over into the crypto investment psyche, given the significant overlap between tech and crypto investors.

Expert Analysis: Is This Connection Real?

The Bearish Case:

Pseudonymous crypto analyst "Trader Deltan" told TheStreet that Burry's bubble warnings "might actually be the most accurate thing anyone's said this cycle," stating: "The AI bubble, the crypto bubble—they're both real. The difference is that people think Bitcoin can't have bubbles because it's decentralized. But it's not immune to human greed, leverage, or liquidity shocks."

Deltan predicts Bitcoin could fall as low as $50,000, marking a 50% correction from recent highs, similar in magnitude to previous mid-cycle pullbacks.

A Massachusetts Institute of Technology study found that despite $30 to $40 billion in enterprise spending on generative AI, 95% of companies reported no measurable return. If AI investments fail to deliver returns, the resulting tech sector correction could trigger broader risk-off sentiment affecting crypto.

The Contrarian View:

Not everyone agrees that an AI bubble burst would necessarily devastate crypto markets. Some analysts argue that even if Burry is correct about AI valuations, there will still be massive demand for the materials and infrastructure that make AI innovations possible.

Proponents argue that unlike the dot-com bubble, AI infrastructure generates immediate economic value, with hyperscalers planning to spend $371 billion on AI capex in 2025 alone. Enterprise deployment of AI shows measurable outcomes, with studies pointing to double-digit productivity gains for developers and meaningful production code now assisted by AI.

Reality Check: Why the Crypto Connection May Be Overstated

Economic Independence:

Cryptocurrency markets have their own fundamental drivers—adoption rates, regulatory developments, institutional investment, and blockchain technology advancement—that operate independently of AI infrastructure spending.

Decoupling Potential:

While crypto has shown correlation with tech stocks during this period, the market was once touted for its uncorrelated nature. If crypto assets mature as an independent asset class, correlation with tech stocks could weaken.

Different Investment Theses:

AI infrastructure companies face questions about return on capital and profit margins. Cryptocurrency's value proposition centers on decentralization, scarcity (in Bitcoin's case), and alternative financial infrastructure—fundamentally different concerns.

The Broader Market Context

Hyperscaler Spending Reaches Historic Levels

The so-called "hyperscaler" companies are now spending close to $400 billion annually on capex supporting AI infrastructure, with Amazon, Alphabet, Microsoft, and Meta reporting they were set to spend as much as a cumulative $364 billion in their respective 2025 fiscal years.

This AI capex contributed an estimated 100 basis points—fully one percentage point—to second-quarter GDP growth. This pace outstrips the rate of underlying consumer spending growth by tenfold.

Free Cash Flow Concerns

Hyperscalers have already seen free-cash-flow growth turn negative, a sign that investment may have outpaced underlying technology returns. Strategas estimates that hyperscaler free cash flow is set to shrink by more than 16% over the next 12 months.

What Crypto Investors Should Watch

If Burry's depreciation thesis proves correct, several scenarios could unfold:

1. Tech Sector Correction:

If major tech companies report lower-than-expected earnings due to understated depreciation, it could trigger a broader tech selloff. Given current correlation patterns, crypto markets might follow.

2. Regulatory Scrutiny:

Questions about accounting practices at major corporations could invite increased regulatory oversight, potentially extending to other speculative assets including crypto.

3. Capital Reallocation:

If AI investments fail to deliver expected returns, institutional investors might reallocate capital. Whether that flows into or out of crypto would depend on broader market conditions and risk appetite.

4. Decoupling Opportunity:

A major tech correction could present an opportunity for crypto to demonstrate independence as an asset class, potentially establishing itself as an alternative to traditional tech exposure.

If Burry's depreciation thesis proves correct, several scenarios could unfold:

1. Tech Sector Correction:

If major tech companies report lower-than-expected earnings due to understated depreciation, it could trigger a broader tech selloff. Given current correlation patterns, crypto markets might follow.

2. Regulatory Scrutiny:

Questions about accounting practices at major corporations could invite increased regulatory oversight, potentially extending to other speculative assets including crypto.

3. Capital Reallocation:

If AI investments fail to deliver expected returns, institutional investors might reallocate capital. Whether that flows into or out of crypto would depend on broader market conditions and risk appetite.

4. Decoupling Opportunity:

A major tech correction could present an opportunity for crypto to demonstrate independence as an asset class, potentially establishing itself as an alternative to traditional tech exposure.

Expert Perspectives: The Debate Continues

The Bulls Say:

BlackRock CEO Larry Fink expressed confidence that major hyperscalers like Meta, Microsoft, and Alphabet are in a "really good position" to be winners, noting "That is capitalism. We're going to have some big winners and we're going to have some big losers... but if you have a diversified portfolio, you're going to be fine."

The Bears Counter:

Morgan Stanley Wealth Management's chief investment officer Lisa Shalett warned that the market boom represents a "one-note narrative" almost entirely dependent on massive capital expenditures in generative AI, raising questions about its durability. She expressed concerns about a "Cisco moment" like when the dotcom bubble burst in 2000, suggesting we're "a lot closer to the seventh inning than the first or second inning" when considering actual spending and capital flowing into the space.

Burry's Track Record: A Cautionary Note

While Burry's 2008 call was legendary, his recent track record is mixed. He made bearish bets that didn't pan out, such as warnings about overvalued tech stocks during bull runs, a short bet against Tesla in 2021, and in January 2023 he posted "SELL" on X right before the market surged about 19% that year.

In the first quarter of 2025, Burry bet big against Nvidia with $97.5 million in put options. Since then, Nvidia is up 50% in 2025 and 85% higher since his trade was revealed.

Bottom Line

Michael Burry's depreciation warnings highlight legitimate accounting concerns about AI infrastructure spending by major tech companies. His broader AI skepticism, backed by over $1 billion in put options, represents one of the most concentrated contrarian positions in modern investing history.

However, the connection to cryptocurrency markets is largely theoretical, based on observed correlation between crypto and tech stocks during risk-off periods. Whether crypto continues to move in tandem with tech stocks during a potential AI bubble burst—or establishes independence as a separate asset class—remains an open question.

For crypto investors, Burry's warnings serve as a reminder to:

- Monitor correlation with tech sector performance

- Maintain diversification across asset classes

- Focus on fundamental crypto adoption metrics rather than purely speculative momentum

- Prepare for potential volatility if broader tech markets correct

The AI infrastructure buildout represents unprecedented capital deployment. Whether that spending delivers returns justifying current valuations—or whether Burry's skepticism proves prescient—will likely become clearer over the next 12-24 months.

DISCLAIMER: This newsletter is for informational purposes only and does not constitute investment advice, advertising, or a recommendation to buy, sell, or hold any securities. This content is not sponsored by or affiliated with any of the mentioned entities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.

Sources

Primary Sources:

- Investing.com. (November 10, 2025). "Michael Burry warns of $176 billion depreciation understatement by tech giants."

- CNN Business. (November 5, 2025). "Michael Burry of 'The Big Short' is back with cryptic messages — and two massive bets."

- Invezz. (November 4, 2025). "Nvidia stock falls: is Michael Burry's short a sign of what's coming?"

Crypto Market Analysis:

- TheStreet Crypto. (November 7, 2025). "Analyst says 'Big Short' Michael Burry's warning is real, Bitcoin may crash 50%."

- CryptoSlate. (November 9, 2025). "Michael Burry's big short: Is the AI bubble bigger than Bitcoin?"

- Crypto News. (November 6, 2025). "Looming AI bubble could bite deep into Bitcoin and crypto markets."

- FinancialContent Markets. (November 5, 2025). "The AI Bubble's Looming Burst: A Crypto Market Correction on the Horizon?"

- AInvest. (November 7, 2025). "The AI and Crypto Sell-Off: Has the Tech Bubble Peak Passed?"

Market Context & Analysis:

- Fortune. (October 7, 2025). "75% of gains, 80% of profits, 90% of capex—AI's grip on the S&P is total and Morgan Stanley's top analyst is 'very concerned'."

- CNBC. (October 21, 2025). "Are we in an AI bubble? Here's what analysts and experts are saying."

- Yahoo Finance. (August 1, 2025). "Big Tech's AI investments set to spike to $364 billion in 2025 as bubble fears ease."

- Investing.com. (October 6, 2025). "Why the AI Boom May Defy History: 4 Reasons This Time Could Be Different."

Contrarian Perspectives:

- InvestorPlace. (November 5, 2025). "Ignore Michael Burry, Stay Invested in Tech."

- 24/7 Wall St. (November 5, 2025). "'Big Short' Investor Michael Burry Is Betting Big Against the AI Revolution."

Additional Context:

- Under the Market Lens. (November 7, 2025). "The Contrarian Returns: Michael Burry's Billion-Dollar Short Against AI's Hype."