Kadena's Collapse: What It Reveals About Crypto Project Risks

The sudden collapse of Kadena—once a multi-billion-dollar blockchain founded by ex-JPMorgan engineers—offers critical lessons for crypto investors. What went wrong, and which projects might be next?

The dramatic implosion of Kadena serves as a stark reminder that impressive credentials and technical innovation aren't enough to guarantee success in cryptocurrency. On October 21, 2025, the blockchain project founded by former JPMorgan engineers announced it would cease operations immediately, triggering a catastrophic 75% price crash within hours and leaving investors reeling. The token (KDA) plummeted from $0.225 to nearly $0.056, erasing years of value and exposing vulnerabilities that echo through similar projects across the industry.

The Rise and Fall of Wall Street's Blockchain Experiment

Kadena launched with exceptional pedigree. Founded in 2016 by Stuart Popejoy and Will Martino, who had led JPMorgan's Blockchain Center for Excellence and built the bank's first blockchain (Juno), the project aimed to solve what they saw as fundamental limitations in existing networks. Their vision was ambitious: create a scalable proof-of-work blockchain that maintained Bitcoin-level security while supporting smart contracts through a novel "Chainweb" architecture where multiple chains run in parallel.

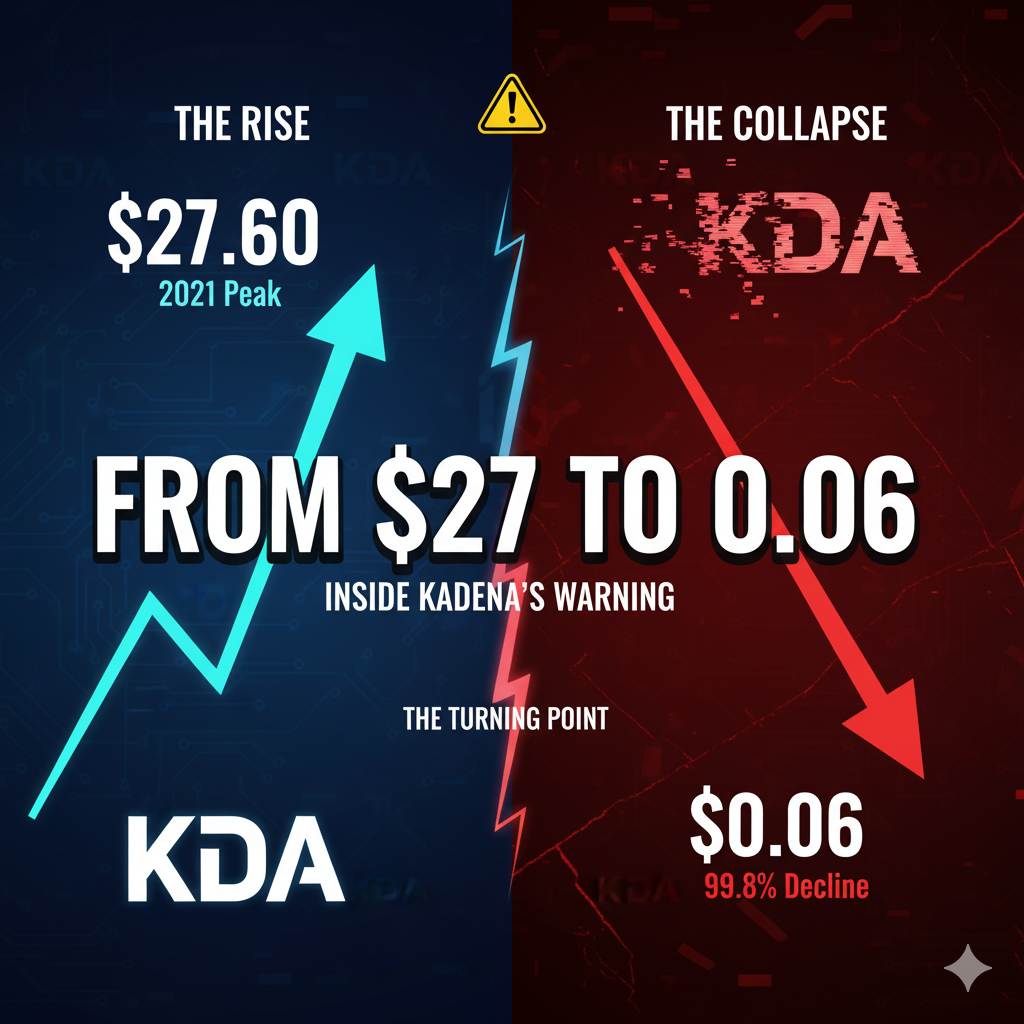

The market initially embraced this vision. At its 2021 peak, KDA traded above $27.60 and reached a multi-billion-dollar market capitalization. The project secured partnerships with healthcare companies, launched on Amazon Web Services to attract smaller businesses, and positioned itself as the institutional-grade blockchain the market desperately needed. However, by October 2025, KDA had crashed 99.8% to around $0.06—a collapse that reveals critical warning signs every crypto investor should recognize.

What Went Wrong: From Enterprise Vision to Ghost Chain

Kadena's original use case centered on solving the blockchain trilemma—achieving scalability, security, and decentralization simultaneously. The team targeted enterprise adoption, pitching their hybrid blockchain platform to Fortune 500 companies for use cases in finance, healthcare, and insurance. Their Pact smart contract language was designed to be accessible even to non-programmers, theoretically lowering barriers to adoption.

Yet despite these advantages, Kadena never achieved meaningful real-world adoption. According to DeFi Llama, total value locked on Kadena peaked at approximately $11 million in August 2022 and had collapsed to just $128,000 by October 2025—a staggering 99% decline that signaled a network with virtually no users. The numbers tell a devastating story: in an ecosystem with over 100 rollups and 200 sovereign chains competing for attention, Kadena gradually lost relevance as developers and capital migrated to networks with stronger network effects and clearer value propositions.

The project's pivot away from its original enterprise focus became increasingly desperate. In May 2025, Kadena announced a $50 million grant program to fund Chainweb EVM and tokenization projects, attempting to reposition itself in the rapidly evolving landscape of layer-2 solutions and modular architectures. Multiple protocol updates between February and May 2025 tried to inject life into the ecosystem, but these efforts failed to change the fundamental reality: developer activity remained minimal, user participation stayed low, and liquidity was almost nonexistent.

Allegations and Insider Misconduct

The collapse intensified when allegations surfaced suggesting potential insider misconduct. According to reports circulating in the crypto community, traders claimed that Kadena employees may have shorted their own token with leverage before major announcements, allegedly profiting "in the tens of millions" across multiple exchanges. While these allegations remain unverified, they emerged alongside suspicious trading patterns around October 10, when broader market turmoil following President Trump's tariff announcements coincided with KDA's particularly severe decline from $0.38 to $0.08.

The accusations prompted Kaddex, one of Kadena's main ecosystem projects, to announce plans for a class-action lawsuit against Kadena's directors, accusing them of "irresponsible behavior" and market misconduct. The community reaction was visceral, with long-time holders expressing betrayal and anger. One investor wrote: "I was holding this piece of s**t project for years, only for them to dump on everyone. These guys should be thrown in jail."

Warning Signs Other Projects Share

Kadena's collapse mirrors patterns seen in other high-profile crypto failures, particularly Terra/Luna and FTX. Industry analysis from R3 identifies several common failure factors that Kadena exhibited:

Technical Novelty Without Product-Market Fit: Like Kadena, many projects possess impressive technology but fail to identify a sustainable niche. The Terra/Luna ecosystem offered innovative algorithmic stablecoins, but the underlying mechanics proved fundamentally flawed when tested by market stress. Kadena's parallel-chain architecture was technically impressive but never translated into actual user demand or developer adoption.

Lack of Regulatory Framework: Both Terra/Luna and FTX operated in regulatory gray zones, making design decisions that were problematic from technical and business perspectives but didn't violate specific regulations. Academic research on Terra's collapse emphasized how the absence of regulatory oversight enabled the project's fragile structure to persist until catastrophic failure. Kadena similarly operated without clear regulatory classification, potentially enabling decisions that prioritized short-term token economics over long-term sustainability.

Token Economics and Supply Pressure: Kadena's long emission schedule created ongoing supply pressure while demand weakened—a fatal combination. The project confirmed that over 566 million KDA remain to be distributed as mining rewards until 2139, with around 83.7 million tokens set to unlock by November 2029. This inflationary pressure without corresponding demand growth mirrors the dynamics that contributed to Terra's "death spiral", where increasing token supply and decreasing value became self-reinforcing.

Centralized Governance Despite Decentralization Claims: Development and governance remained concentrated within Kadena's central organization rather than a genuinely decentralized community. When the company announced its shutdown, it claimed "independent miners and community developers will keep the network live," but this sudden handoff left the network without leadership, funding, or direction. Similar failures at Three Arrows Capital and Celsius Network demonstrated how centralized decision-making creates single points of failure in supposedly decentralized systems.

Network Effects and Interconnectedness Risk: The crypto ecosystem's interconnectedness means failures cascade. Terra's collapse triggered the downfall of Three Arrows Capital, which then contributed to failures at Voyager Digital, BlockFi, and ultimately FTX. While Kadena's impact was more contained due to its smaller ecosystem, the pattern remains: projects without strong, independent value propositions become vulnerable when broader market conditions deteriorate.

Which Projects Could Be Next?

Investors should watch for similar warning signs in other projects. Key red flags include: vanishing total value locked (TVL) despite continued token inflation; migration of developers and users to competing platforms; increasingly desperate pivots in messaging or focus; concentrated insider holdings with unclear vesting schedules; lack of transparent financial reporting; and ecosystems dependent on unsustainable incentive programs rather than organic usage.

The saturation of the layer-1 and layer-2 space creates particular risk. With over 100 rollups and 200 sovereign chains now operational, most struggle to attract even 2,000 daily users. Projects that raised substantial funding during the 2021-2022 boom but have failed to build sustainable ecosystems face increasing pressure as runway depletes and market conditions remain challenging.

XRP and Ripple: Contrasting Approaches to Sustainability

The Kadena collapse offers an instructive contrast with XRP and Ripple's trajectory. While both projects emerged from traditional finance backgrounds—Kadena from JPMorgan, Ripple from working with financial institutions—their paths diverged dramatically. Ripple faced its own existential crisis through the SEC's December 2020 lawsuit, which alleged $1.3 billion in unregistered securities sales and caused XRP's price to plummet over 60%.

However, Ripple's response demonstrated institutional resilience that Kadena lacked. Rather than collapsing under regulatory pressure, Ripple fought through five years of litigation, mobilized over 75,000 XRP holders to support the case, and ultimately secured a landmark partial victory in July 2023 when Judge Analisa Torres ruled that XRP's programmatic sales on secondary exchanges were not securities violations. The case finally concluded in August 2025 when both parties agreed to drop their appeals, with Ripple paying a $125 million settlement—95% less than the SEC's original $2.2 billion demand.

Most importantly, Ripple maintained actual utility throughout its legal battle. The XRP Ledger processes approximately 2 million transactions daily as of 2025, with weekly payments exceeding 8 million—an 800% increase since 2023. The network's five to 10-second settlement times and growing use as a bridge currency in cross-border payments demonstrate real-world adoption that Kadena never achieved. Ripple's acquisition of Hidden Road for $1.25 billion in April 2025 and expanding partnerships with banks in the Middle East and Asia show a company building sustainable business operations rather than surviving solely on speculative token value.

The legal clarity XRP achieved positions it uniquely in the crypto landscape. With institutional custody providers like BitGo holding XRP at 3.9% of total crypto assets as of June 2025, and multiple spot ETF applications pending approval with 95% probability estimates from analysts, XRP demonstrates how regulatory engagement—rather than avoidance—can create sustainable value. The distinction between XRP's retail sales (not securities) and institutional sales (requiring SEC registration) provides a regulatory framework that other projects lack.

For XRP holders, the Kadena collapse reinforces the importance of fundamental value. While XRP's price remains subject to market volatility and ETF approval timing, the token's legal standing, established payment network usage, and institutional adoption trajectory contrast sharply with Kadena's vanishing ecosystem. The lesson isn't that blue-chip origins guarantee success—both emerged from elite financial institutions—but that sustained execution, real-world utility, and transparent governance matter far more than technical elegance or impressive founding teams.

Lessons for Crypto Investors

The Kadena collapse provides several critical takeaways. First, impressive credentials and institutional pedigree don't guarantee success—execution and product-market fit matter far more. Second, monitor on-chain metrics like TVL, daily active users, and developer activity rather than relying on promises or technical whitepapers. Third, be wary of projects that repeatedly pivot or announce new initiatives without demonstrating traction on previous commitments. Fourth, understand token economics and vesting schedules, particularly when large supplies remain unlocked. Finally, recognize that in saturated markets, network effects and clear value propositions become increasingly essential for survival.

Daniel Keller, co-founder of Flux and an early Kadena ecosystem partner, has pledged to support the remaining community in establishing a foundation and maintaining the network. Whether this community-led effort succeeds remains highly uncertain. The blockchain itself continues to operate through independent miners, but without institutional backing, development resources, or clear purpose, Kadena joins the growing graveyard of technically sophisticated projects that failed to build sustainable ecosystems.

For investors, the Kadena story serves as a powerful reminder: in cryptocurrency, survival requires more than innovation—it demands adoption, utility, transparent governance, and the ability to weather both market downturns and regulatory scrutiny. Projects that lack these fundamentals, regardless of their technical merits or founding pedigree, face existential risk in an increasingly competitive and regulated market environment.

DISCLAIMER: This newsletter is for informational purposes only and does not constitute investment advice, advertising, or a recommendation to buy, sell, or hold any securities. This content is not sponsored by or affiliated with any of the mentioned entities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.

Sources

- What really happened to Kadena – inside a collapse no one saw coming - October 21, 2025

- JP Morgan: two former employees invent Kadena blockchain - October 4, 2021

- Kadena becomes first launch out of JP Morgan's Blockchain Center for Excellence - January 16, 2020

- The Story of Kadena's Proof of Work Blockchain - October 16, 2023

- JPMorgan's Blockchain Offshoot Kadena Gets First Ever Token Listing - June 25, 2020

- JP Morgan blockchain spinoff hits 480,000 transactions per second - August 20, 2020

- JP Morgan Spinoff Kadena Hits All-Time High After Rising 210% in Week - November 7, 2021

- JPMorgan spinoff Kadena puts blockchain on AWS - January 28, 2022

- Kadena launches $50M grant for Chainweb EVM, AI and tokenization projects - May 2025

- Anatomy of a Stablecoin's failure: The Terra-Luna case - September 22, 2022

- Unpacking upheaval: Interpreting 2022's blockchain failures - December 14, 2022

- Five Lesson from 2022's Blockchain Failures - January 23, 2023

- Top Failed Crypto Projects of 2022 - November 12, 2024

- Anatomy of a Run: The Terra Luna Crash - May 22, 2023

- Terra/LUNA Stablecoin Collapse Also Killed FTX: Report - November 18, 2022

- New Evidence Surfaces: Was Terra's Downfall Engineered - April 14, 2025

- The Rise & Fall of Terra (LUNA): Key Takeaways for Investors - May 23, 2022

- XRP News: SEC's Long-Running Case Against Ripple Officially Over - August 7-8, 2025

- Ripple vs. SEC Lawsuit Decision: Appeals Dropped, Penalties Cut in Landmark Case - August 8, 2025

- SEC Drops Ripple Appeal, Paving the Way for Potential XRP ETF Approval in 2025 - March 27, 2025

- Ripple vs. SEC: How the lawsuit strengthened XRP's narrative - September 17, 2025

- Ripple vs. SEC Lawsuit: A Complete Timeline of the Crypto Legal Battle - August 5, 2025

- Ripple (XRP) at a Critical Inflection Point: Legal Resolution and Institutional Adoption Drivers - October 21, 2025

- XRP SEC Case: Complete Analysis Of Ripple Lawsuit And ETF Approval Timeline 2025 - August 4, 2025

- XRP in Focus as SEC Nears Decision on Ripple Lawsuit and ETF Approval - July 18, 2025

- 'Cluster' of amended XRP ETF filings roll in as Ripple seals SEC case dismissal - August 23, 2025

- SEC vs. Ripple: A Turning Point for US Crypto Regulation? - April 21, 2025

- DeFi Llama - Kadena Chain Data - Accessed October 2025

- What Is Kadena, How Does It Work, And Should You Invest In $KDA? - December 24, 2021

- JPMorgan blockchain spin-off Kadena solves bitcoin scaling and Ethereum security issues - January 15, 2020

- The Story of Kadena's Proof of Work Blockchain - Accessed 2025

- Five Lesson from 2022's Blockchain Failures - January 27, 2023