Japan's 30-Year Bond Yield Hits Historic 3.29% – A Warning Sign for Global Markets and Crypto

Japan's 30-year bond yield hit 3.29%—the highest in history. This seismic shift could trigger global market contagion, affecting stablecoins and accelerating XRP adoption as traditional finance faces unprecedented stress. Here's what crypto investors need to know.

Japan's 30-year government bond yield surged to 3.29% on October 5, 2025, marking the highest level in recorded history. This unprecedented spike signals a fundamental shift in one of the world's most stable debt markets and could trigger a cascade of consequences across global finance, particularly for cryptocurrency markets and XRP holders.

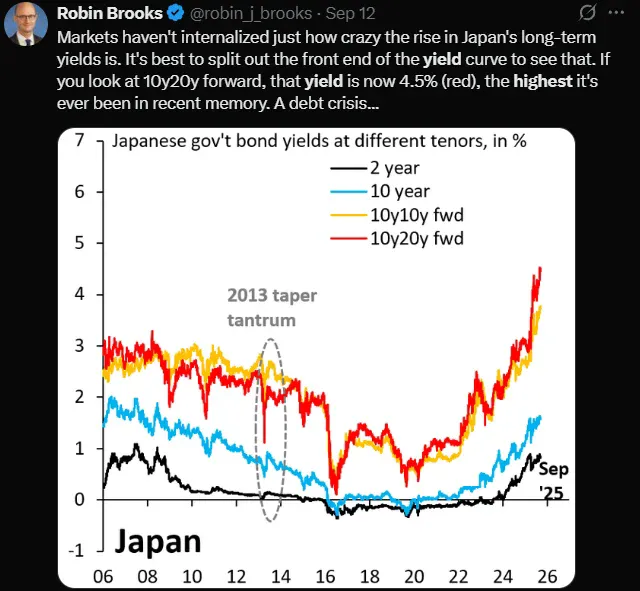

The Unprecedented Yield Surge

For decades, Japan's government bond market represented stability and rock-bottom yields. That era has ended. According to Trading Economics, the 30-year yield climbed to 3.28% on October 6, 2025, up 0.12 percentage points from the previous session and 1.16 points higher than a year ago. This follows reports from Barchart confirming the 3.29% peak—an all-time high that has sent shockwaves through global markets.

The yield surge isn't isolated. Japan's 2-year and 10-year bonds have hit their highest levels in 17 years, as noted by Global Markets Investor. Most alarmingly, Japan's recent auction of 2-year government bonds drew the weakest demand since 2009, with a bid-to-cover ratio falling to 2.81—significantly below the 12-month average of 3.79, according to Bloomberg.

Why This Matters Now

Three critical factors are driving this historic shift:

Bank of Japan's Retreat: The BoJ has dramatically scaled back its bond-buying program, which once made it the "whale" of the Japanese government bond market. The central bank now owns 46.3% of outstanding Japanese government bonds (down from over 50%), and has announced it will continue reducing purchases by 400 billion yen per quarter through March 2026, according to OANDA's fundamental analysis.

Weakening Domestic Demand: Japanese life insurance companies—the second-largest investor group holding approximately 13% of JGBs—trimmed their holdings by 1.35 trillion yen in the three months through March 2025, the steepest reduction since 2017. These traditional buyers are stepping back precisely when the BoJ is pulling away.

Inflation Pressures: Japan's core inflation has consistently exceeded the Bank of Japan's 2% target, forcing a fundamental reassessment of ultra-low yield policies that defined Japanese monetary policy for decades.

Global Market Implications: The Domino Effect

The implications extend far beyond Japan's shores. Japan reduced its US Treasury holdings by $119.3 billion in a single quarter—the steepest quarterly drop since 2012. From January 2022 to January 2025, Japan slashed its total US Treasury holdings from $1.29 trillion to $1.07 trillion.

Financial strategist Jake Claver's "Domino Theory" warned of precisely this scenario. His analysis suggests that rising Japanese bond yields could trigger capital repatriation, forcing Japanese institutions to sell US Treasuries and other foreign assets. This could spike global yields, destabilize bond markets, and create a liquidity crisis that ripples through stablecoins and cryptocurrency markets.

According to CNBC's analysis, if sharply higher JGB yields entice Japanese investors to return home, "the unwinding of the carry trade could cause a loud sucking sound in U.S. financial assets." Societe Generale's global strategist Albert Edwards warned this could "trigger a global financial market Armageddon."

Crypto Market Vulnerabilities

The August 2024 mini-crisis provided a preview. When the BoJ adjusted its yield curve control stance, crypto markets experienced violent volatility. Bitcoin and Ethereum faced significant sell-offs as Japanese institutions liquidated overseas assets. Stablecoin trading volumes surged as investors fled to perceived safety, but even USDC temporarily lost its peg by 0.5% on some decentralized exchanges due to liquidity dislocations.

The current yield spike poses specific risks to stablecoins backed by US Treasuries. Major stablecoins like Tether and USDC hold significant portions of their reserves in US government debt. If Japanese selling pressure drives Treasury yields sharply higher and prices lower, it could affect the reserve backing of these stablecoins, potentially triggering confidence crises in the crypto ecosystem.

XRP and Ripple: A Japanese Opportunity Amid Crisis

Paradoxically, this crisis could accelerate adoption of bridge currencies like XRP, particularly in Japan where Ripple has deep partnerships. SBI Group, led by CEO Yoshitaka Kitao—a strong XRP advocate—recently launched an institutional XRP lending program, sending XRP prices up 5.2% in a 24-hour window.

Japanese Banking Adoption: Reports indicate that approximately 80% of Japanese banks are exploring Ripple's technology for cross-border payments, according to Nasdaq. While specific adoption timelines remain unconfirmed, Japan's $6.372 trillion banking sector represents massive potential for XRP utility.

Price Impact Potential: If Japanese institutions need faster, more efficient cross-border settlement systems amid bond market volatility and capital repatriation pressures, XRP's real-time settlement capabilities become increasingly attractive. Analysts at CoinGape suggest aggressive adoption scenarios could push XRP prices significantly higher, with conservative estimates ranging from $2.50 to $6 in 2025.

Regulatory Clarity: The March 2025 settlement between Ripple and the SEC has improved regulatory clarity in the United States. Combined with an 85% probability of XRP ETF approval in 2025 according to Bloomberg's analysts, institutional adoption pathways are clearer than ever.

Strategic Positioning: As Claver's theory suggests, a crisis in traditional bond markets could hasten the transformation of global payment systems. XRP is positioned as a bridge currency solution precisely when traditional financial infrastructure faces stress from unwinding carry trades and capital repatriation.

A $10 trillion financial disaster is looming and the Bank of Japan faces an impossible choice: let the yen appreciate and wreck export markets or work to defend bond markets and risk hyperinflation...

— Jake Claver, QFOP (@beyond_broke) July 28, 2025

Could XRP provide the third option they desperately need. pic.twitter.com/p0sJnr2rBL

Key Takeaways

- Historic Milestone: Japan's 30-year bond yield at 3.29% represents the highest level ever recorded, signaling the end of decades of ultra-low rates

- Systemic Risk: Weak auction demand and Japanese institutional selling of US Treasuries could trigger global liquidity stress

- Crypto Vulnerability: Stablecoins backed by US Treasuries face reserve valuation risks if yields spike further

- XRP Opportunity: Japanese banking sector adoption combined with bond market stress could accelerate real-time settlement solutions

- Watch for Contagion: The "domino effect" Claver predicted—from Japanese repatriation to US Treasury stress to stablecoin crisis—appears to be in motion

Financial markets are interconnected in ways that make regional crises rapidly global. Japan's bond market transformation isn't just an Asian story—it's a warning signal for anyone holding crypto assets, particularly those backed by traditional financial instruments.

Sources

- Trading Economics - Japan 30 Year Bond Yield

- Barchart X Post - Historic Yield Announcement

- Bloomberg - Japan Bond Auction Demand Slumps

- OANDA - Record Spike in Japan JGB Yield Analysis

- CNBC - Japan's Bond Market Ignites Fears of Carry Trade Unwind

- Cointelegraph - What Japan's Fiscal Debt Crisis Means for Crypto Markets

- Foreign Affairs Forum - Japan's Major Selloff of US Treasury Bonds

- CoinDesk - XRP Jumps 5% as SBI Lending Program Launches

- Nasdaq - 80% of Japanese Banks Set to Embrace XRP

- Bloomberg - Japan's 30-Year Bond Yields Hit Record High

- Bitpanda Academy - Forecast for XRP in 2025

- 99Bitcoins - Ripple XRP Price Prediction for 2025-2030

DISCLAIMER: This newsletter is for informational purposes only and does not constitute investment advice, advertising, or a recommendation to buy, sell, or hold any securities. This content is not sponsored by or affiliated with any of the mentioned entities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.