Japanese Gaming Giant Gumi Joins Major XRP Treasury Initiative

Tokyo-listed Gumi Inc. invests in Evernorth's historic $1B+ XRP treasury, joining SBI Holdings, Ripple, and Chris Larsen. The Q1 2026 Nasdaq listing marks a major milestone for XRP's institutional adoption.

Tokyo-listed gaming company Gumi Inc. has announced a strategic investment in Evernorth Holdings, joining an elite consortium backing what will become the world's largest public XRP treasury. But beyond the $1 billion headline lies a more profound development: Ripple's contribution of 126.7 million XRP tokens represents the beginning of systematic, permanent supply removal that could fundamentally transform digital asset markets.

According to Evernorth's official announcement, the company has secured over $1 billion in gross proceeds through a SPAC merger with Armada Acquisition Corp II, with major backing from Japan's SBI Holdings ($200 million commitment), Ripple, Pantera Capital, Kraken, GSR, and Ripple co-founder Chris Larsen. While Gumi's specific investment amount in Evernorth was not disclosed in the press release, the document confirms Gumi's participation as an investor alongside these heavyweight institutional players.

Understanding Evernorth's Historic SPAC Deal

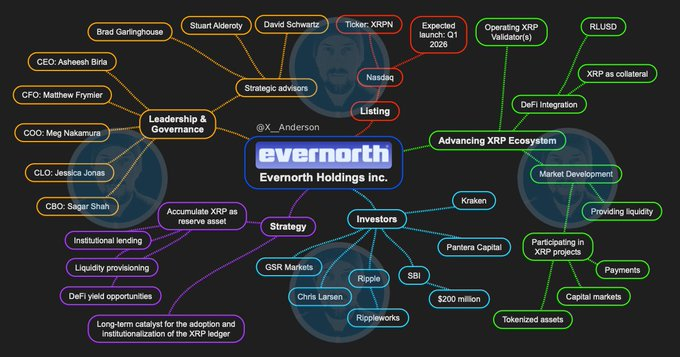

Evernorth Holdings announced on October 20, 2025, that it has entered into a definitive business combination agreement with Armada Acquisition Corp II (Nasdaq: AACI), a special purpose acquisition company. Upon closing, expected in Q1 2026, the combined entity will trade on Nasdaq under the ticker symbol "XRPN."

According to SEC filings disclosed in the Form 8-K, Ripple has entered into a contribution agreement whereby it will contribute 126,791,458 XRP tokens to Evernorth in exchange for company equity. At current market prices, this XRP contribution represents approximately $313-358 million in value, making it one of the largest single institutional XRP deployments on record. These tokens will be automatically converted to equity on a one-for-one basis at closing, subject to certain limitations outlined in the agreement.

The transaction represents a watershed moment for XRP's institutional legitimacy. Led by CEO Asheesh Birla, a former Ripple executive who helped scale the company's cross-border payments business, Evernorth is designed to provide investors with transparent, liquid exposure to XRP through a regulated public vehicle. Unlike passive exchange-traded funds, Evernorth plans to actively grow its XRP holdings per share through institutional lending, liquidity provisioning, and decentralized finance yield strategies.

"Evernorth is built to provide investors more than just exposure to XRP's price," Birla stated in the company's press release. "As we capitalize on existing TradFi yield generation strategies and deploy into DeFi yield opportunities, we also contribute to the growth and maturity of that ecosystem."

Gumi's Strategic Crypto Expansion

Gumi Inc., established in 2007 and publicly traded on the Tokyo Stock Exchange, has been steadily building its digital asset portfolio throughout 2025. The company previously announced in August 2025 a separate initiative to purchase 2.5 billion Japanese yen (approximately $17 million) worth of XRP directly for its corporate treasury, targeting 6 million XRP tokens through a phased acquisition between September 2025 and February 2026.

The gaming company's board earlier approved a 1 billion yen ($6.6 million) Bitcoin investment in February 2025, marking its entry into cryptocurrency holdings. By now expanding into both direct XRP purchases and strategic investments in XRP-focused institutional vehicles like Evernorth, Gumi is implementing a dual-asset strategy that balances Bitcoin's store-of-value properties with XRP's utility in cross-border payments and liquidity networks.

Gumi emphasized that its XRP-related investments reflect a longer-term strategy to align its balance sheet with blockchain-driven revenue opportunities. The company cited its shareholder relationship with SBI Holdings as a key factor in the decision, noting that SBI is Ripple's largest partner in Japan and co-manages SBI Ripple Asia, a joint venture deploying blockchain payment systems across Asian markets.

Gumi announces investment in XRP alongside Japan banking giant SBI, $17Million worth.

— Chad Steingraber (@ChadSteingraber) October 22, 2025

Company by company, XRP becomes a global reserve asset.

Evernorth✅ https://t.co/vwNPL871Hj pic.twitter.com/L1zG1yMSZW

The Power Players Behind Evernorth

The investor consortium backing Evernorth reads like a who's who of cryptocurrency and institutional finance:

SBI Holdings has committed $200 million to the deal, representing the single largest individual investment. The Japanese financial services giant has been a longtime strategic partner of Ripple and operates extensive blockchain payment infrastructure throughout Asia.

Ripple itself is a strategic investor, with CEO Brad Garlinghouse and key executives including Chief Legal Officer Stuart Alderoty and Chief Technology Officer David Schwartz serving as strategic advisors to Evernorth. Beyond financial investment, Ripple is contributing 126,791,458 XRP tokens (worth approximately $313-358 million at current market prices) directly to Evernorth through a contribution agreement disclosed in SEC Form 8-K filings. This represents one of the largest institutional XRP deployments to date. "Having worked alongside Asheesh for many years, I'm fully confident in his and the team's ability to take XRP's presence in capital markets to the next level," Garlinghouse commented.

Chris Larsen, Ripple's co-founder, is participating as an individual investor. Recent reports indicate that Larsen invested 50 million XRP tokens into Evernorth, demonstrating his personal conviction in the project's long-term potential.

Pantera Capital, one of the earliest cryptocurrency-focused hedge funds, brings extensive experience in digital asset markets and institutional investment strategies.

Kraken, one of the world's leading cryptocurrency exchanges, adds crucial market liquidity expertise and operational infrastructure knowledge to the consortium.

GSR, a digital asset trading firm specializing in institutional market-making, will help facilitate large-scale XRP acquisitions with minimal market impact.

Japan's Regulatory Advantage in Crypto

Japan's evolving regulatory framework has created a favorable environment for corporate cryptocurrency adoption. As industry analysts note, the country's clear compliance guidelines have lowered operational risk for publicly listed firms seeking crypto exposure, moving the regulatory stance "from maybe to mostly."

This regulatory clarity is particularly significant for utility tokens like XRP that are tied to actual payment activity. With accounting treatment becoming more defined and local compliance standards hardening, Japanese corporations can now hold digital assets without facing the legal uncertainty that has plagued crypto adoption in other jurisdictions.

The timing of Gumi's investment also aligns with broader plans by Ripple and SBI to introduce the RLUSD stablecoin into Japan by early 2026, aiming to provide enterprises with a regulated settlement option for blockchain-based transactions.

XRP's Institutional Momentum

Evernorth's formation comes amid growing institutional interest in XRP as a reserve asset. While several companies have allocated portions of their balance sheets to XRP, Evernorth's public effort will be the largest focused exclusively on the digital asset:

- VivoPower held an initial $100 million in XRP as part of its digital asset strategy

- Nature's Miracle Holding Inc. announced a $20 million XRP acquisition earlier this year

- Hyperscale Data committed $10 million to XRP in 2025

Evernorth's billion-dollar commitment dwarfs these previous institutional moves, potentially establishing a new benchmark for corporate XRP treasury holdings.

XRP's appeal to institutions stems from several factors: over a decade of consistent network uptime, deep market liquidity, a growing decentralized finance ecosystem, and increasingly clear regulatory status following the resolution of the SEC's lawsuit against Ripple. The digital asset serves as the backbone for Ripple's global payment network, processing cross-border transactions with significantly lower costs and faster settlement times than traditional banking systems.

Impact on XRP and Ripple's Ecosystem

Price Implications: While institutional investments of this magnitude typically signal positive long-term fundamentals, short-term price action remains complex. XRP has experienced volatility in recent months, and analysts suggest that careful attention to how Evernorth executes its $1+ billion open-market purchase strategy will be crucial. The company has indicated it will use a combination of over-the-counter execution, market-making partnerships, and programmatic accumulation to minimize market disruption.

Ripple's Business Operations: For Ripple, Evernorth represents a significant validation of its decade-long efforts to build XRP-based payment infrastructure. The company's strategic advisory role and investment in Evernorth creates a public vehicle that can help drive adoption while maintaining operational independence from Ripple itself. This structure addresses longstanding concerns about XRP's relationship with Ripple by creating an independent institutional player with aligned but distinct interests.

Legal Standing: The formation of a Nasdaq-listed XRP treasury company carries important regulatory implications. By successfully navigating the SPAC process and meeting Nasdaq listing requirements, Evernorth will establish precedent for how digital asset-focused companies can operate within traditional securities frameworks. This development follows the resolution of the SEC's lawsuit against Ripple, which provided crucial clarity on XRP's legal status.

Partnership Opportunities: Evernorth plans to go beyond passive treasury management by operating XRP Ledger validators to strengthen network decentralization, integrating Ripple's RLUSD stablecoin as a DeFi bridge, and backing projects that expand XRP's role in payments, tokenization, and capital markets. These activities could open new partnership channels for companies like Gumi that are already invested in the XRP ecosystem.

Adoption Prospects: The involvement of major institutional players from Japan (SBI, Gumi), the United States (Ripple, Pantera, Kraken), and the broader crypto ecosystem signals that XRP adoption is transcending geographic and sectoral boundaries. As Birla noted, the model is "symbiotic"—Evernorth's strategy is designed to align with and accelerate the growth of the entire XRP ecosystem, not just generate returns for shareholders.

The Supply Shock Nobody's Discussing

While the financial headlines focus on the $1 billion fundraise, a more profound dynamic is unfolding: systematic, permanent removal of XRP from liquid circulation.

When Ripple contributes 126,791,458 XRP tokens to Evernorth through equity conversion, those tokens aren't being "invested" in the traditional sense. They're being locked into a publicly traded corporate treasury structure that will list on Nasdaq. Once converted to company equity, these tokens become balance sheet assets subject to fiduciary duties, regulatory oversight, and long-term strategic holding requirements.

They're effectively gone from circulation. Forever.

This Pattern Will Repeat—And Accelerate

The Evernorth structure isn't a one-time event. It's a blueprint that will be replicated across the institutional landscape:

Corporate Adoption: Every CFO observing Evernorth's successful Nasdaq listing will evaluate similar treasury strategies. If even 50 companies over the next five years adopt comparable models—each locking 100-200 million XRP—that represents 5-10 billion tokens permanently removed from liquid supply.

Governmental Adoption: The more significant factor that many analysts are overlooking is sovereign-level adoption. Central banks developing CBDC infrastructure need proven blockchain settlement systems. XRP has demonstrated over a decade of consistent performance with 3-5 second finality, minimal transaction costs, and 100% uptime. When governments begin establishing strategic XRP reserves for CBDC interoperability and cross-border settlement systems, they won't acquire millions of tokens—they'll need billions. And unlike corporate investors who might eventually liquidate positions, governmental treasuries operate on generational timescales. Those tokens will never return to market.

DeFi and Ecosystem Lockup: As the XRP Ledger's DeFi ecosystem expands, with protocols like Evernorth planning to integrate Ripple's RLUSD stablecoin and provide liquidity services, additional tokens will be locked in smart contracts, liquidity pools, and lending protocols.

The Mathematics of Scarcity

Consider a conservative five-year projection:

- Evernorth and similar vehicles: 5-7 billion XRP

- Government strategic reserves: 2-5 billion XRP

- DeFi protocol lockups: 1-2 billion XRP

- Additional institutional holdings: 2-3 billion XRP

Total: 10-17 billion XRP (17-28% of current circulating supply)

This occurs while utility demand increases through Ripple's On-Demand Liquidity expansion, CBDC settlement use cases, and cross-border payment adoption. The economic outcome of decreasing liquid supply combined with increasing utility demand is mathematically straightforward: significant price appreciation becomes not merely possible, but probable.

Why Ripple's $350 Million Contribution Makes Strategic Sense

Some observers question why Ripple would contribute such a massive XRP amount to Evernorth. The answer reveals sophisticated long-term thinking: Ripple isn't just seeking investment returns—they're building the market infrastructure their On-Demand Liquidity product requires to operate at global scale.

By seeding Evernorth with 126.7 million XRP, Ripple creates:

- The world's largest public XRP treasury with institutional credibility

- A Nasdaq-listed reference vehicle for traditional allocators

- Price discovery mechanisms integrated into capital markets

- Deep liquidity that ODL transactions can leverage

- Regulatory precedent for digital asset treasury companies

The equity conversion avoids selling pressure while maintaining exposure to XRP's appreciation through Evernorth's performance. More importantly, it establishes a template that other institutions will follow, accelerating the systematic supply reduction that ultimately benefits all XRP stakeholders—including Ripple's remaining holdings.

Market Context and Future Outlook

The Evernorth SPAC deal comes during a period of renewed interest in cryptocurrency public listings after years of regulatory uncertainty. In July 2025, The Ether Machine announced plans for a $1.6 billion SPAC merger focused on Ethereum, suggesting that crypto ventures are re-entering public markets with new confidence.

For Gumi and other corporate investors, the calculus extends beyond simple treasury diversification. They're positioning themselves at the beginning of what could become a fundamental transformation in XRP's supply dynamics. As institutional and governmental adoption systematically removes tokens from circulation while utility demand accelerates, early participants stand to benefit from structural scarcity that may take years to fully materialize.

Industry observers will be closely watching how Evernorth executes its strategy following the Q1 2026 closing. Success won't just validate one company's business model—it will accelerate replication across the institutional landscape, potentially triggering the supply shock scenario that many in the XRP community have long anticipated.

Key Takeaways

Gumi's investment in Evernorth, combined with its separate $17 million direct XRP purchase program, positions the Japanese gaming company at the forefront of corporate cryptocurrency adoption. But the implications extend far beyond a single company's treasury strategy.

The backing of Evernorth by SBI Holdings, Ripple (with 126.7 million XRP tokens), Chris Larsen (50 million XRP), and leading crypto-native firms creates a powerful consortium with the expertise and resources to execute on an ambitious vision. However, this vision isn't just about building the world's largest public XRP treasury—it's about fundamentally transforming XRP's supply dynamics through systematic, institutional-scale token removal from circulation.

When these 126.7 million XRP tokens convert to Evernorth equity and trade on Nasdaq as $XRPN, they're not coming back to liquid markets. When additional corporations replicate this model, those tokens aren't coming back. When governments eventually establish XRP reserves for CBDC infrastructure—and they will—those tokens definitely aren't coming back.

For XRP holders and the broader cryptocurrency community, Evernorth represents more than a milestone in digital asset maturation. It's potentially the inflection point where XRP transitions from abundant to structurally scarce, as permanent lockups in institutional and governmental treasuries systematically reduce available supply while utility demand accelerates.

The Q1 2026 Nasdaq listing will be closely watched not just for Evernorth's immediate performance, but as validation of a model that could reshape digital asset markets. If successful, this blueprint may inspire similar vehicles across the cryptocurrency landscape—but more importantly, it will accelerate XRP's transformation from a payment utility token into a strategic reserve asset held by institutions and sovereigns worldwide.

As one observer noted: this pattern will continue with other companies... and governments... until the liquid supply is fundamentally transformed. The only question remaining is: what does price discovery look like when 30-40% of a utility-driven digital asset is permanently locked away in treasuries that never sell?

We're about to find out.

Sources

- Evernorth Holdings Inc. Press Release - PRNewswire

- SEC Form 8-K Filing - Armada Acquisition Corp II (Items 7.01 & 8.01, Contribution Agreement)

- Coinspeaker - Gumi XRP Purchase Announcement

- BeInCrypto - Evernorth $1B XRP Treasury

- Finance Magnates - Japan's Corporate Crypto Adoption

- TradingView News - Gumi XRP Strategy Analysis

- CoinPedia - Chris Larsen Evernorth Investment

- Tech Startups - Evernorth SPAC Analysis

DISCLAIMER: This newsletter is for informational purposes only and does not constitute investment advice, advertising, or a recommendation to buy, sell, or hold any securities. This content is not sponsored by or affiliated with any of the mentioned entities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.