"It is" a Big Deal - Musk: SpaceX's Orbital Data Centers Could Transform Cryptocurrency Infrastructure

Elon Musk confirms SpaceX will build orbital data centers—potentially solving crypto's biggest challenges: energy costs, environmental impact, and censorship vulnerability. We explore what Musk actually announced vs. speculative blockchain applications.

Elon Musk recently confirmed that SpaceX will build data centers in orbit using Starlink V3 satellites—a development that's generating excitement across the tech world. While Musk's announcement says nothing about cryptocurrency, the potential implications for blockchain infrastructure have sparked intense speculation. Here's what we actually know, what's theoretically possible, and what challenges stand in the way.

What Musk Actually Announced

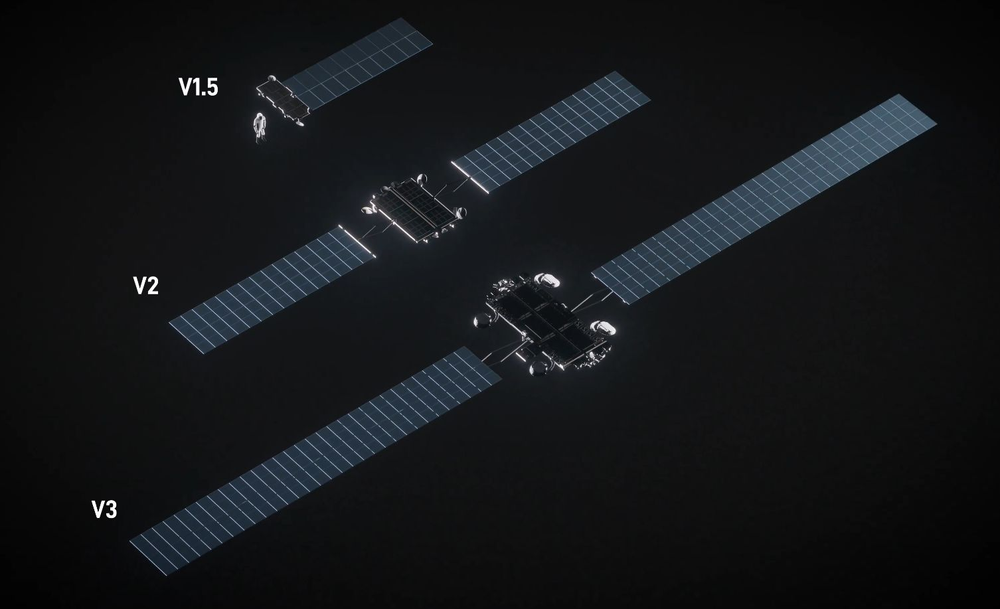

Let's be clear from the start: Musk's announcement was about general-purpose data centers in space, not cryptocurrency mining or blockchain infrastructure. When responding to a story about space-based computing, Musk stated: "Simply scaling up Starlink V3 satellites, which have high speed laser links would work. SpaceX will be doing this."

This follows similar interest from other tech leaders. Former Google CEO Eric Schmidt acquired Relativity Space in May 2025 specifically for space data center development. Amazon founder Jeff Bezos predicted gigawatt-scale orbital facilities within 10 to 20 years. But none of these announcements specifically mention cryptocurrency applications.

The intended use cases likely focus on AI processing, cloud computing, and data storage—applications that don't face the same technical constraints as crypto mining. However, that hasn't stopped crypto enthusiasts from wondering: could this technology eventually benefit blockchain infrastructure?

It is https://t.co/3YmzQl2sH8

— Elon Musk (@elonmusk) October 31, 2025

The Technical Reality: What's Actually Possible

SpaceX's capabilities are impressive and real. Starlink V3 satellites represent genuine technological advancement, with capacity increasing from 15 gigabits per second in early Starlink satellites to 1 terabit per second in the V3 generation. The plan to launch approximately 60 satellites per Starship, potentially beginning in early 2026, demonstrates serious execution capability.

According to Caleb Henry, director of research at Quilty Space, "Nothing else in the rest of the satellite industry comes close to that amount of capacity." SpaceX has also proven it can make satellite infrastructure profitable—something considered impossible before Starlink.

These are facts. What follows is speculation about potential cryptocurrency applications.

Theoretical Crypto Applications (Not Part of Musk's Plan)

If space-based data centers become operational, here's what blockchain infrastructure might theoretically leverage—though significant technical and economic hurdles make many of these scenarios unlikely:

Blockchain Node Hosting (Most Plausible)

Running blockchain validation nodes requires connectivity, data storage, and moderate computing power—not the extreme computational density of mining. Hosting nodes in orbit could theoretically provide censorship-resistant infrastructure beyond any single jurisdiction's control. This application faces fewer technical barriers than mining and aligns better with satellite data center capabilities.

However, latency issues, hardware maintenance limitations, and the question of whether the economics make sense compared to distributed ground-based nodes remain unanswered.

Cryptocurrency Mining (Highly Problematic)

This is where enthusiasm often outpaces physics. Space-based Bitcoin mining faces serious challenges that "free solar power" doesn't solve:

- Cooling Crisis: Mining ASICs generate enormous heat. Ground-based facilities use air cooling or immersion cooling. In space's vacuum, heat dissipation relies on radiative cooling—a far less efficient process. The thermal management requirements may be insurmountable at mining-scale power densities.

- Economics Don't Add Up: Launch costs, even with Starship, mean every kilogram matters. Mining hardware becomes obsolete within 2-3 years as more efficient ASICs emerge. Ground-based miners can upgrade equipment. Space-based miners must launch entirely new satellites. When you factor in launch costs, hardware replacement cycles, and inability to repair or upgrade, the math likely doesn't work even with free solar power.

- Power Density Mismatch: Mining rigs draw massive power per unit volume. Satellite solar panels may not provide sufficient power density for mining-scale operations without prohibitively large arrays.

- Latency and Connectivity: Mining requires receiving block templates and submitting solutions with minimal delay. Orbital mechanics and satellite positioning create latency variables that could impact mining competitiveness.

The reality? Building solar farms on Earth next to mining facilities is probably cheaper and more practical than launching mining equipment to orbit.

Exchange and DeFi Infrastructure (Possible But Questionable)

Cryptocurrency exchanges and DeFi protocols require data processing, storage, and transmission—capabilities that align better with planned satellite data centers than mining does. Theoretically, exchanges could host infrastructure beyond any single jurisdiction's regulatory reach.

However, exchanges still need to interact with traditional banking systems for fiat on/off ramps, making jurisdictional independence less valuable than it appears. Regulatory arbitrage through space infrastructure would likely trigger new regulations rather than avoiding them entirely.

Web3 and Decentralized Storage (Speculative)

Projects focused on decentralized cloud storage could theoretically integrate with orbital infrastructure. But ground-based distributed storage networks face fewer technical constraints and lower costs. The value proposition for space-based decentralized storage remains unclear.

The Environmental Narrative (Real Benefit, Overstated Impact)

Space-based infrastructure powered by solar energy does eliminate direct carbon emissions. For cryptocurrency's public image, this could matter significantly. Bitcoin mining's energy consumption has become a political and regulatory liability.

However, we need perspective. Manufacturing and launching satellites carries its own environmental cost. Rocket launches emit greenhouse gases. The lifecycle environmental impact of space-based computing versus ground-based solar-powered facilities requires honest analysis—not just focusing on operational emissions while ignoring manufacturing and launch impacts.

That said, if orbital data centers become economically viable for general computing, and if blockchain infrastructure can leverage that capacity cost-effectively, the environmental optics do improve substantially.

Why This Probably Won't Transform Crypto (Yet)

Several realities temper the enthusiasm:

Technical Mismatch: The specific computational needs of crypto mining (high power density, frequent hardware updates, extreme cooling requirements) don't align well with satellite data center capabilities optimized for different workloads.

Economic Barriers: Launch costs, hardware replacement cycles, and inability to repair or upgrade equipment create economic challenges that free solar power doesn't overcome.

Regulatory Reality: Operating crypto infrastructure in space doesn't avoid regulation—it likely invites new regulatory frameworks specifically addressing orbital crypto operations.

Timeline Uncertainty: Even if SpaceX begins launching Starlink V3 satellites in 2026, building out data center capabilities, testing them, and adapting them for cryptocurrency applications (if that's even pursued) extends the timeline significantly.

Proven Alternatives Exist: Ground-based solar-powered mining facilities, distributed node networks, and existing cloud infrastructure already work. They're cheaper, easier to maintain, and face fewer technical constraints.

What Could Actually Happen

The most realistic near-term scenario: cryptocurrency companies might use general-purpose space-based cloud infrastructure the same way they currently use AWS or Google Cloud—for exchange backends, wallet services, data storage, and processing. Not for mining. Not for revolutionary decentralization. Just as another cloud provider option.

Running some blockchain validation nodes in orbit could provide additional redundancy and geographic diversity. This is plausible and might offer modest benefits.

But transformative impact on crypto mining, complete regulatory independence, or solving the industry's "existential crises"? That's speculation running far ahead of reality.

The Bottom Line: Interesting, But Still Theory

SpaceX's orbital data center plans are real and represent impressive technological development. The potential applications to cryptocurrency infrastructure make for compelling thought experiments. But we should be honest about what's actually announced versus what's theoretical speculation, and what's technically feasible versus what sounds good but faces serious practical barriers.

Musk confirmed plans for space-based data centers. He did not announce crypto mining satellites. He did not propose blockchain-specific infrastructure. He did not claim this will solve cryptocurrency's energy or regulatory challenges.

Could blockchain infrastructure eventually leverage orbital computing capacity? Possibly—in limited ways, for specific applications like node hosting or data storage. Will it revolutionize cryptocurrency mining or create truly regulation-proof networks? The technical and economic realities suggest probably not.

The crypto industry should watch these developments with interest, not assume they represent imminent transformation. Space-based infrastructure may offer incremental benefits for certain blockchain applications. But expecting it to fundamentally reshape cryptocurrency operations requires believing a lot of technical and economic challenges will be solved that currently have no clear solutions.

As always in crypto: verify, don't just speculate.

DISCLAIMER: This newsletter is for informational purposes only and does not constitute investment advice, advertising, or a recommendation to buy, sell, or hold any securities. This content is not sponsored by or affiliated with any of the mentioned entities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.

Sources

- Ars Technica - Elon Musk on Data Centers in Orbit: SpaceX Will Be Doing This

- SpaceX - Starlink Infrastructure Development

- Quilty Space - Satellite Industry Analysis