Gemini Teams With Ripple to Launch XRP Credit Card Edition

Gemini launches XRP Credit Card with up to 4% cashback in partnership with Ripple. This mainstream adoption milestone brings XRP into everyday spending with Mastercard's global network. A game-changing bridge between crypto and traditional finance.

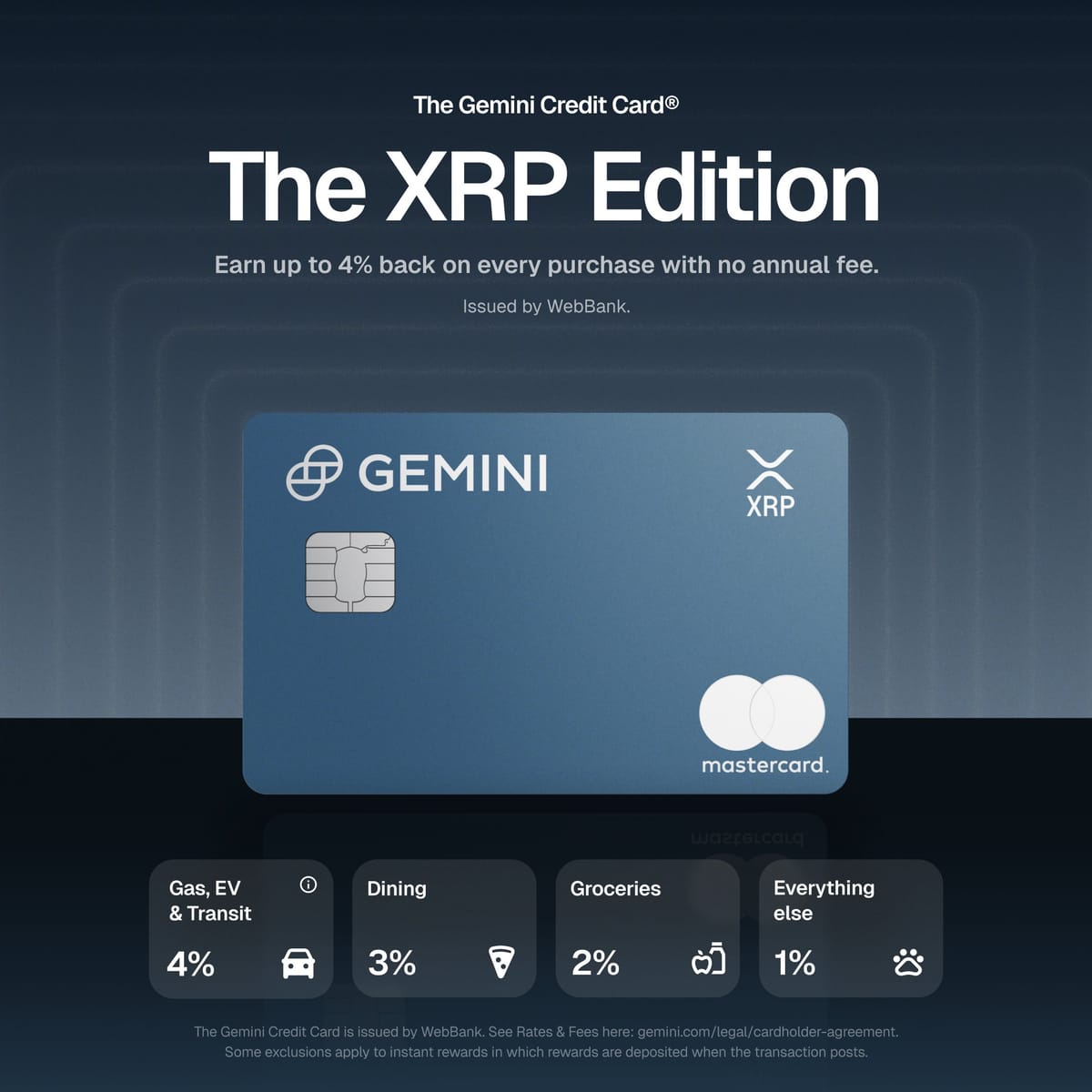

Bottom Line Up Front: Gemini just launched an XRP edition of its credit card in partnership with Ripple, offering up to 4% cashback in XRP tokens and marking a significant step toward mainstream crypto adoption in daily spending.

Crypto exchange Gemini has officially rolled out its XRP Credit Card Edition in collaboration with Ripple, bringing XRP rewards directly to everyday purchases. The card launched today after weeks of viral marketing, including a prominent billboard campaign in Manhattan's busy Broadway corridor.

Revolutionary Rewards Structure

The card, issued with WebBank similarly to other Gemini cashback cards, allow holders to earn up to 4% back in XRP on fuel, EV charging and rideshare purchases, 3% on dining, 2% on groceries and 1% on other transactions, according to Gemini's official announcement. The exchange is also partnering with select merchants to provide up to 10% back on eligible purchases.

"We're giving customers and the XRP Army new ways to earn XRP and express their passion, loyalty, and excitement," Tyler Winklevoss, co-founder and CEO of Gemini, said in a statement.

This represents a dramatic shift for Gemini, which previously avoided listing XRP due to regulatory uncertainties. The exchange only added XRP trading after Ripple's legal victory over the SEC in 2025, demonstrating how regulatory clarity can unlock new financial products.

Broader Ripple Integration

Beyond the credit card, Gemini is expanding its relationship with Ripple across multiple fronts. The exchange is also broadening the use of Ripple USD (RLUSD), the $680 million U.S. dollar stablecoin issued by Ripple. The token is now available as a base currency for all spot trading pairs on the platform for U.S. users, streamlining trading operations.

"Fifty-five million Americans own crypto and that number is only increasing as more people look for easier ways to access and use it in their daily lives," Ripple CEO Brad Garlinghouse said in a statement. "With Gemini, we're making everyday spending a chance to earn and connect with both XRP and RLUSD."

Market Context and Regulatory Backdrop

The timing coincides with renewed optimism around XRP's regulatory position. XRP is back above $3 after slipping under its 50-day moving average earlier this week, when whale selling dragged the token as low as $2.72. The token has shown resilience despite recent volatility, with analysts pointing to institutional flows and technical setups as potential catalysts for further gains.

The regulatory environment has dramatically improved for XRP following the resolution of the SEC case. Seven major asset managers, including Grayscale and Franklin Templeton, updated their filings for spot XRP ETFs on August 22, shortly after the Ripple–SEC case concluded. This institutional interest signals growing confidence in XRP's compliance status.

Strategic Financial Partnership

The firm also revealed in its IPO paperwork a $75 million credit facility from Ripple and reported $282 million net loss in the first half of the year. This financial partnership extends beyond the credit card, with Ripple supporting Gemini's broader growth initiatives as the exchange prepares for its public offering.

The collaboration represents a significant bet on XRP's utility beyond speculative trading. By integrating XRP into everyday spending through a major credit card network, both companies are positioning the token as a practical digital currency rather than just an investment vehicle.

XRP/Ripple Analysis: Mainstream Adoption Catalyst

For XRP holders, this development represents a fundamental shift in the token's utility proposition. The credit card creates a direct use case for XRP in daily commerce, potentially driving consistent demand as users earn and spend tokens for routine purchases.

The partnership addresses one of crypto's biggest challenges: bridging the gap between digital assets and traditional commerce. By leveraging Mastercard's global network, XRP gains instant acceptance at millions of merchants worldwide, dramatically expanding its practical utility.

From a price perspective, the card could create a "flywheel effect" where increased usage drives demand, potentially supporting price stability and growth. Analysts project that the Gemini Mastercard could drive XRP's price toward $3.34 or even $4 if adoption accelerates. The card's potential to attract 1 million users in its first year—coupled with Ripple's expanding presence in Asia and Europe—creates a strong tailwind for XRP's utility and demand.

For Ripple's business operations, the Gemini partnership validates its strategy of moving beyond cross-border payments into consumer finance. The integration with RLUSD as a trading base currency also strengthens Ripple's stablecoin ecosystem, creating multiple revenue streams from the partnership.

The regulatory clarity achieved through the SEC resolution has been crucial for enabling this type of mainstream financial product. It demonstrates how legal certainty can unlock innovation in the crypto space, potentially setting a precedent for other digital assets seeking similar integrations.

Key Takeaways

The Gemini XRP Credit Card represents more than a new financial product—it's a strategic bridge between crypto and mainstream finance. With substantial backing from both companies, comprehensive rewards structure, and timing that coincides with regulatory clarity, this launch could serve as a template for how digital assets integrate into traditional financial systems.

The success of this initiative will likely be measured not just in user adoption numbers, but in its ability to demonstrate XRP's utility as a practical medium of exchange in the broader economy.

Sources

- CoinDesk - "Gemini Targets XRP Army With New Credit Card, Expands Ripple USD Use for U.S. Customers"

- Gemini Official Blog Post - "Gemini Releases XRP Edition of the Gemini Credit Card and Broadens"

- CryptoNews - "Gemini Partners With Ripple to Launch XRP Rewards Credit Card and Expand RLUSD Use"

- AInvest - "XRP's Mainstream Breakthrough: How the Gemini Mastercard is Reshaping Digital Asset Adoption"

- DailyCoin - "Gemini's Drops Ripple Surprise: XRP Army Marks This Date"

- CoinDesk - "Watch Out for XRP and Solana as Price Action Flashes Bullish Signals, Analyst Says"

DISCLAIMER: This newsletter is for informational purposes only and does not constitute investment advice or a recommendation to buy, sell, or hold any securities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.