Flood Gates Still Closed?: Why Ripple Isn't Using Its Own DEX—And The Amendment That Could Change Everything

Did Ripple CTO's comments reveal the gates that could flood billions in on-chain volume?

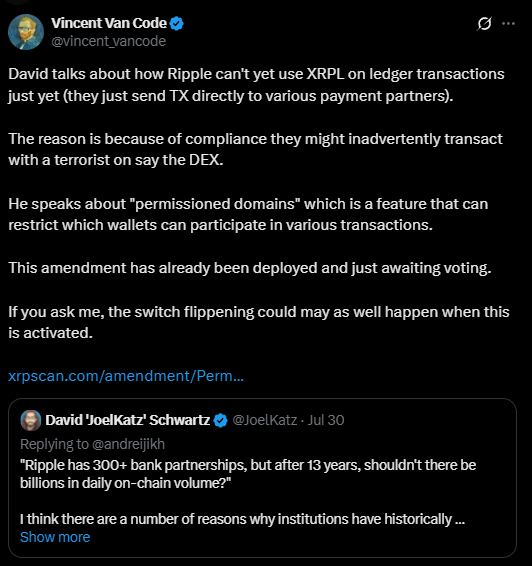

Yesterday on X, a user by the name of Vincent Van Code (@vincent_vancode), self-described as "Software Engineer, founder of various AI start ups. C# C++ Python JS TSQL Java, DLT champion" in his X bio, made a compelling observation following responses from Ripple's CTO David Schwartz (@joelkatz) that laid out an intriguing theory worth exploring further.

After 13 years and 300+ banking partnerships, a stunning revelation from Ripple CTO David Schwartz has exposed why the XRP Ledger isn't processing billions in daily transactions: even Ripple itself can't safely use its own decentralized exchange. But lurking in the network's code is an amendment that could flip this paradigm overnight—if validators vote to activate it.

The $300 Million Question: Where's the Volume?

Ripple's chief technology officer, David Schwartz, addressed some concerns over the XRP Ledger's declining on-chain activity and its perceived lack of adoption, against the backdrop of 30% to 40% drop in XRPL usage reported in this year's first quarter. Crypto commentator Andrei Jikh sparked the conversation by questioning how Ripple could have 300+ bank partnerships yet show minimal on-chain transaction volume.

Schwartz's response was both illuminating and shocking: "Even Ripple can't use the XRPL DEX for payments yet because we can't be sure a terrorist won't provide the liquidity for a payment."

This admission reveals the core paradox: the very openness that makes XRPL powerful also makes it legally dangerous for institutions. Financial companies face strict anti-money laundering (AML) and know-your-customer (KYC) requirements that make public liquidity pools a compliance nightmare.

The Terrorist Liquidity Problem

Schwartz also pointed out a key concern in the difficulty of verifying liquidity sources on an open DEX. In his words, Ripple currently avoids using the XRPL because "we can't be sure a terrorist won't provide the liquidity for payment."

This isn't theoretical—it's a real legal risk. If Ripple or its banking partners unknowingly transact with sanctioned entities providing DEX liquidity, they could face massive fines, regulatory action, and reputational damage. Considering this, Ripple or its counterpart engaging with the DEX poses serious legal and reputational risks without reliable controls.

The result? "Institutions have historically preferred to use digital assets off-chain rather than on-chain," Schwartz explained. Banks stick to Ripple's private payment rails instead of leveraging XRPL's public blockchain capabilities.

Permissioned Domains: The Game-Changing Solution

But there's hope. "Features like permissioned domains will address this," Schwartz stated, referencing a critical amendment that could fundamentally transform XRPL's institutional adoption.

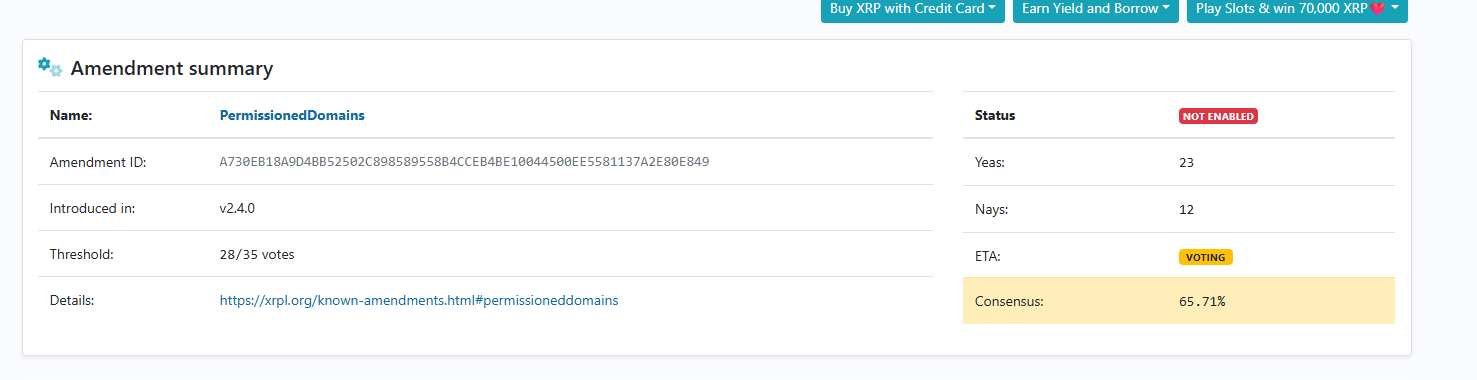

The following amendments are open for voting with this release: PermissionedDomains (XLS-80) - Adds Permissioned Domains, which act as part of broader systems on the XRP Ledger to restrict access to satisfy compliance rules. The amendment was included in Rippled version 2.4.0, released in March 2025, and is currently under validator consideration.

How Permissioned Domains Work

Permissioned Domains allow institutions to define access requirements for specific parts of the XRPL, ensuring that only authorized users — those with verifiable credentials — can participate in certain transactions.

Permissioned Domains enable institutions, businesses, and issuers to define rules for participation in specific financial activities. These rules are recorded directly on the XRPL, enabling domain creators to establish a trusted, transparent framework for their blockchain-based operations, helping traditional financial institutions meet the regulatory requirements they face.

The system allows for credential-gating ensures that via a Domain object, institutions can specify which credentials are required for access to their permissioned domain, ensuring compliance with relevant KYC/AML regulations.

The "Flippening" Potential

Vincent Van Code, a prominent XRPL community member, captured the potential impact: "If you ask me, the switch flippening could may as well happen when this is activated."

This isn't hyperbole. Consider the implications:

For Ripple: The company could finally utilize its own DEX infrastructure for enterprise payments, potentially driving massive on-chain volume growth.

For Banking Partners: One such tool under development, permissioned domains, could help institutions identify trustworthy liquidity providers, potentially unlocking safer use of on-chain payment rails.

For XRPL: The network could transition from being primarily a behind-the-scenes settlement layer to a visible, high-volume public blockchain handling institutional transactions.

The Broader Compliance Infrastructure

Permissioned Domains represents just one piece of a larger compliance puzzle. The Credentials amendment is also required. If the PermissionedDomains amendment is enabled without Credentials, PermissionedDomainSet transactions are considered invalid.

PermissionedDEX: Create controlled environments for trading in the Decentralized Exchange, restricted by permissioned domains. This upcoming amendment would directly apply permissioned domains to DEX functionality, creating the exact compliance-friendly trading environment institutions need.

XRP and Ripple: Positioned for Transformation

This development comes at a critical time for XRP and Ripple:

Regulatory Timing: The Permissioned Domains amendment aligns perfectly with America's new crypto-friendly regulatory environment following the GENIUS Act.

Market Position: XRP is showing signs of technical weakness on the charts after falling 2.6% in the past week, now trading at $3.15. However, successful amendment activation could catalyze long-term institutional adoption.

Competitive Advantage: Schwartz suggested that this precedent may hint at how future institutions could use XRPL in similar ways, provided compliance features catch up. Permissioned Domains could give XRPL a significant edge over competitors lacking sophisticated compliance tools.

The Amendment Process: Democracy in Action

Any amendments that are open for voting can become enabled following two weeks of support from a supermajority of greater than 80% of trusted validators, per the amendment process.

The voting process is transparent and democratic. For an amendment to be enabled, it must receive support from at least 80% of voters for a period of at least two weeks. If support falls below 80% at any point during this period, the amendment is temporarily rejected and the two-week period must start again.

Currently, validators are evaluating the technical and economic implications of Permissioned Domains. Some community members have expressed concerns about prioritization, but the compliance benefits appear substantial.

What's at Stake: The Future of Institutional DeFi

The implications extend far beyond XRPL. If successful, Permissioned Domains could become the template for institutional blockchain adoption across the industry. Permissioned Domains represent a major step toward institutional-grade decentralized finance (DeFi) by ensuring privacy, regulatory compliance, and controlled asset flows.

For XRP holders, the amendment represents a potential inflection point where theoretical utility becomes practical reality. Innovations like permissioned domains aim to address security concerns by controlling network participation, making XRPL more attractive to banks.

The Bottom Line: A Watershed Moment

David Schwartz's candid admission about Ripple's inability to use its own DEX exposes the fundamental compliance gap that has limited XRPL's institutional adoption. But his solution—Permissioned Domains—could be the missing piece that finally unlocks the network's potential.

The amendment is deployed, the validators are deliberating, and the crypto industry is watching. If activated, Permissioned Domains could trigger the institutional "flippening" that transforms XRPL from a settlement network into a compliance-ready public blockchain processing billions in daily volume.

After 13 years of building relationships and infrastructure, Ripple may finally have the regulatory tools to make those partnerships visible on-chain. The question now is whether the validator community will vote to make it happen.

DISCLAIMER: This analysis is for informational purposes only and does not constitute investment advice. Cryptocurrency investments carry significant risks, including potential total loss, extreme volatility, and regulatory uncertainty. Always consult qualified financial professionals and conduct thorough research before making investment decisions.