FalconX Acquires 21Shares: A Vertical Integration Play That Could Reshape XRP Liquidity

FalconX's $11B acquisition of 21Shares creates crypto's most vertically integrated platform—combining institutional OTC trading with retail ETF distribution. With TOXR's December launch, questions emerge: could this streamline XRP supply to ETFs? Here's what's confirmed vs. speculative.

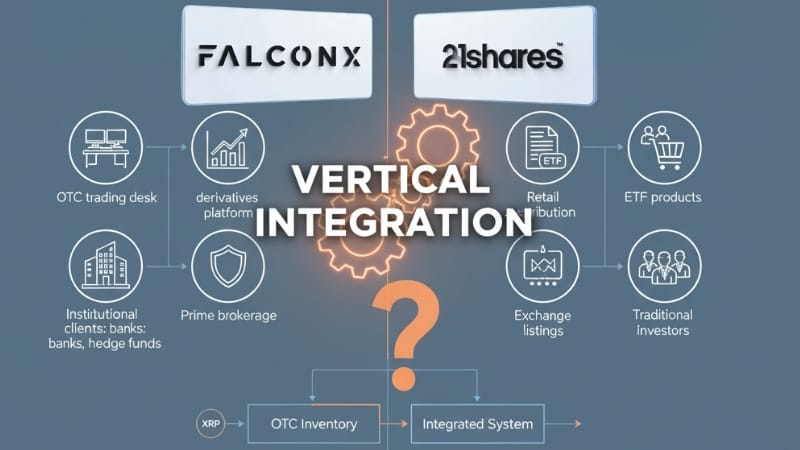

FalconX completed its acquisition of 21Shares on November 20, 2024, creating one of the most vertically integrated crypto infrastructure platforms in the institutional market. The deal brings together FalconX's massive over-the-counter (OTC) trading desk—serving over 2,000 institutional clients—with 21Shares' expertise in launching exchange-traded products, which managed over $11 billion in assets across 55 products globally as of September 2024. Just weeks later, this integration took on new significance when 21Shares launched its XRP ETF (TOXR) on December 12, raising questions about how this vertical integration might affect XRP market dynamics.

Big news: FalconX is acquiring @21shares. Together, the two firms will advance the convergence of digital assets and traditional finance, bringing together FalconX’s crypto-native market infrastructure, structuring expertise, and institutional network together with 21shares’… pic.twitter.com/lbvY8ALWxD

— FalconX (@FalconXGlobal) October 22, 2025

The Strategic Logic: Why FalconX Bought 21Shares

Institutional Infrastructure Meets Retail Distribution

FalconX built its business as a prime brokerage serving hedge funds, asset managers, trading firms, and crypto-native institutions. The company facilitated over $2 trillion in trading volume through its platform, providing OTC trading, derivatives, credit facilities, and liquidity services for large-block cryptocurrency transactions that institutions prefer to execute off public exchanges.

21Shares, meanwhile, pioneered the crypto ETP market in Europe, launching the world's first physically-backed crypto ETP in 2018. The company specialized in structuring regulated investment products that traditional financial advisors, wealth managers, and retail investors could access through standard brokerage accounts.

"This acquisition enhances FalconX's product and structuring capabilities and reinforces our position as a global financial leader," said Raghu Yarlagadda, CEO of FalconX. "The combination of FalconX's institutional trading and risk management platform with 21shares' leadership in exchange-traded products puts us in an even stronger position to accelerate innovation and broaden access to digital assets."

The Vertical Integration Advantage

Prior to this acquisition, the crypto ETF ecosystem relied on separate entities at each stage:

- ETF Issuers (like 21Shares) structure and manage the product

- Authorized Participants (typically large broker-dealers) create and redeem ETF shares

- Liquidity Providers supply the underlying cryptocurrency needed for creation units

- Custodians hold the physical crypto backing the ETF shares

- Market Makers provide trading liquidity on exchanges where ETFs list

FalconX's acquisition of 21Shares collapses multiple steps in this chain. Now, one corporate entity controls both the institutional liquidity provision (FalconX's OTC desk) and the ETF product manufacturing (21Shares' structuring and issuance capabilities).

"FalconX's institutional infrastructure, along with its synergistic business models and resources, will help to accelerate 21shares growth strategy," 21Shares explained in materials addressing the acquisition. The company emphasized that while operating under the FalconX umbrella, 21Shares would "maintain its independent operations and existing counterparties" to preserve competitive balance.

2024's Third Strategic Acquisition

The 21Shares deal represented FalconX's third major acquisition in 2024, signaling aggressive expansion beyond its core prime brokerage business:

- January 2024: FalconX acquired Arbelos Markets, a crypto derivatives trading firm, strengthening its position as one of the largest crypto derivatives dealers

- June 2024: FalconX made a majority stake investment in Monarq Asset Management to expand into actively managed digital asset strategies

- October 2024: The 21Shares acquisition announcement

Together, these moves position FalconX across the entire institutional crypto value chain: trading, derivatives, asset management, and now listed ETF products.

The XRP ETF Launch: Timing and Market Context

Less than a month after completing the 21Shares acquisition, the combined entity launched the 21Shares XRP ETF (TOXR) on the Cboe BZX Exchange. TOXR became the fifth spot XRP ETF in the U.S. market, joining products from Canary Capital, Grayscale, Bitwise, and Franklin Templeton.

Explosive Market Reception

The timing proved fortuitous. XRP ETFs as a category have experienced unprecedented demand, with total assets reaching approximately $1 billion across six funds by mid-December—less than a month after the first XRP ETF launched on November 13, 2024. This represents one of the fastest ramps to $1 billion for any altcoin ETF, surpassing early adoption rates for both Bitcoin and Ethereum ETF launches.

More remarkably, XRP ETFs recorded 18 consecutive trading days of net inflows with zero outflow days—an unusual pattern suggesting demand from long-term institutional allocators rather than momentum-driven traders. For context, Bitcoin and Ethereum ETFs experienced significant redemptions during the same period.

TOXR's Structure and Custody

The 21Shares XRP ETF tracks the CME CF XRP-Dollar Reference Rate and charges a 0.3% annual management fee. The product uses a multi-custodian model with Coinbase Custody, Anchorage Digital Bank, and BitGo Trust Company holding the physical XRP backing ETF shares, while BNY Mellon serves as cash custodian and administrator.

Notably, Ripple Markets seeded the fund with 100 million XRP (worth approximately $226 million at launch), providing unusually strong initial liquidity backing.

The "Dark Pool" Question: How Vertical Integration Could Affect XRP Supply

The FalconX-21Shares combination has sparked intense speculation in the XRP community about potential supply dynamics, with prominent figures like Jake Claver suggesting that ETF demand could drain FalconX's OTC reserves and tighten overall XRP supply. Here's a balanced assessment of what's plausible versus what's speculative.

Well there goes the rest of Falcon X dark pool of XRP… https://t.co/jgEUVphQCw

— Jake Claver, QFOP (@beyond_broke) December 12, 2025

What "OTC Dark Pools" Actually Are

First, clarification on terminology: FalconX operates OTC trading services, not "dark pools" in the traditional finance sense. However, the crypto community often uses "dark pool" colloquially to describe OTC liquidity.

OTC (over-the-counter) desks facilitate bilateral trades between institutional counterparties—hedge funds, family offices, high-net-worth individuals, corporations—who want to buy or sell large blocks of cryptocurrency without moving public exchange prices. These desks maintain inventory to enable instant settlement and use sophisticated algorithms to hedge their positions across multiple venues.

For an asset like XRP, OTC desks serve a critical function: a pension fund wanting to accumulate $50 million in XRP can do so through an OTC desk in a single transaction at a negotiated price, rather than placing large buy orders on Coinbase or Kraken that would push prices higher as the order fills.

The Vertical Integration Theory: Could TOXR Tap FalconX's OTC Inventory?

The Speculative Scenario:

Because 21Shares now operates under FalconX's corporate umbrella, analysts theorize that TOXR could source XRP directly from FalconX's OTC inventory when Authorized Participants create new ETF shares. According to this theory, this creates a closed loop:

- Traditional investors buy TOXR shares on stock exchanges

- When demand exceeds available shares, Authorized Participants create new shares

- Creating new shares requires delivering physical XRP to custodians

- Instead of buying XRP on public exchanges (which would move prices), Authorized Participants source from FalconX's OTC desk

- XRP moves from FalconX's trading inventory into long-term ETF custody

- This XRP is effectively removed from active trading circulation

- Reduced liquid supply eventually pushes prices higher

Critical Unknown: Sourcing Arrangements

Here's what we don't know and what neither FalconX nor 21Shares has publicly disclosed:

- Whether TOXR's Authorized Participants actually source XRP from FalconX's OTC desk

- What percentage of creation activity (if any) flows through FalconX versus other liquidity providers

- The size of FalconX's XRP inventory (estimates range wildly; some claim 1-2 billion XRP, but FalconX has never disclosed this figure)

- Whether FalconX maintains separate "client" versus "proprietary" XRP pools

- Standard market-making agreements and arm's-length pricing requirements

What Makes This Plausible:

Vertical integration does create operational efficiencies. If FalconX can serve as a primary liquidity source for TOXR creations, this reduces:

- Execution latency (internal transfers versus external purchases)

- Market impact (no need to place large orders on exchanges)

- Counterparty risk (consolidated clearing and settlement)

- Transaction costs (fewer intermediaries taking spreads)

These efficiencies could make TOXR more attractive to Authorized Participants, potentially driving higher creation volume than competing XRP ETFs that must source through external channels.

What Makes This Uncertain:

However, several factors complicate the "dark pool drain" narrative:

- Regulatory Requirements: Authorized Participants and ETF issuers must transact at arm's-length, fair-market prices to comply with securities regulations. Even if FalconX is a liquidity source, TOXR cannot receive preferential pricing that would disadvantage other market participants.

- Multiple Liquidity Providers: The crypto market includes numerous OTC desks beyond FalconX—Cumberland, Galaxy Digital, B2C2, Wintermute, Jump Crypto, and others all facilitate institutional XRP trading. Authorized Participants likely source from whichever venue offers best execution, not exclusively from FalconX.

- Custodian Requirements: TOXR uses Coinbase Custody, Anchorage, and BitGo to hold physical XRP. These are independent entities with their own sourcing relationships, compliance frameworks, and counterparty requirements. They don't simply receive XRP from FalconX without verification and proper documentation.

- Creation/Redemption Elasticity: ETFs don't permanently "lock up" assets. When investors sell ETF shares and Authorized Participants redeem them, XRP flows back out of custody and returns to circulation. This provides natural elasticity that prevents simple supply-and-demand bottlenecks.

- Competitive ETF Landscape: TOXR is the fifth XRP ETF and launched weeks after competitors. Canary Capital (XRPC) leads with $359 million AUM, followed by Grayscale ($211M) and Bitwise ($185M). TOXR must compete for flows, and other ETFs source XRP through entirely separate channels.

The Supply Math: How Much XRP Could Actually Be Affected?

Let's examine the numbers to assess whether ETF demand could meaningfully constrain XRP supply:

Total XRP Circulation: Approximately 57.1 billion tokens

Current ETF Holdings: Around 512 million XRP across six funds (less than 1% of total supply)

Monthly ETF Inflow Rate: At current pace, roughly $170-200 million per month, translating to approximately 80-100 million XRP

FalconX's Potential Inventory: Unknown, but even generous estimates of 1-2 billion XRP would represent only 1.75-3.5% of total supply

Other Large Holders:

- Ripple holds billions in escrow and treasury

- Exchanges maintain hundreds of millions in hot/cold wallets

- Institutional OTC desks collectively hold significant inventory

Even if TOXR exclusively sourced from FalconX (an unverified assumption), and even if ETF inflows continued at aggressive rates, constraining overall XRP supply would require absorbing many billions of additional tokens—a multi-year process, not an imminent squeeze.

Market Price Contradicts Tight Supply Thesis

If ETF demand were meaningfully tightening XRP supply, market prices should reflect this. Instead, XRP has traded around $2.09-$2.15, down approximately 20-30% from recent highs despite $1 billion in ETF inflows.

Glassnode data shows that XRP futures open interest collapsed from 1.7 billion XRP in early October to about 0.7 billion XRP—a 59% decline—indicating large-scale position unwinding. Funding rates have also compressed sharply, suggesting minimal speculative appetite.

This price action indicates that ETF demand is being offset by selling pressure from other holders—derivatives traders closing positions, early investors taking profits, general crypto market weakness. The ETF bid is functioning more as a buffer absorbing supply than as a catalyst driving prices higher.

What the Acquisition Actually Accomplishes

Setting aside speculative supply theories, the FalconX-21Shares combination creates tangible strategic advantages:

1. Operational Efficiency for Institutional Clients

Institutional allocators now have a single relationship that spans:

- OTC trading execution (FalconX)

- Prime brokerage and custody (FalconX)

- Derivatives and hedging (FalconX via Arbelos Markets)

- Listed ETF products for retail distribution (21Shares)

- Actively managed strategies (Monarq Asset Management)

This consolidated stack reduces operational complexity, potentially lowering costs and improving execution quality compared to coordinating multiple vendors.

2. Global Distribution Reach

21Shares maintains established relationships with European exchanges and distributors, having listed products on major European venues since 2018. FalconX gains immediate access to these distribution channels, accelerating its international expansion.

3. Product Innovation Pipeline

The combined entity can develop new crypto investment products more rapidly. 21Shares has already launched leveraged ETFs and multi-coin index products, demonstrating appetite for innovation. With FalconX's derivatives expertise and institutional relationships, the platform can create increasingly sophisticated structured products.

4. Competitive Moat

Few crypto platforms span institutional trading, derivatives, prime brokerage, and retail ETF distribution. This integrated offering creates switching costs and network effects that could prove durable competitive advantages as the crypto infrastructure market matures.

5. Regulatory Positioning

As jurisdictions worldwide implement comprehensive crypto regulations—Europe's MiCA framework, potential U.S. federal standards—integrated platforms that can demonstrate robust compliance, custody, and risk management across multiple product lines may gain regulatory approval more easily than single-function operators.

Counterparty and Concentration Risks

The flip side of vertical integration is centralization. The FalconX-21Shares combination now concentrates significant XRP market infrastructure—prime brokerage, OTC liquidity, derivatives, and ETF issuance—inside one corporate structure.

For institutional allocators, this creates considerations:

- Counterparty Risk: Greater exposure to a single entity's financial health and operational continuity

- Conflict of Interest Potential: FalconX could theoretically prioritize its own ETF products in ways that disadvantage competing issuers or clients

- Systemic Risk: If FalconX faced operational disruptions, multiple aspects of XRP's institutional market structure could be affected simultaneously

- Competitive Balance: 21Shares has stated it will "maintain its independent operations and existing counterparties", but incentives may evolve as integration deepens

Prudent risk management suggests diversifying across multiple ETF issuers, custodians, and liquidity providers rather than concentrating exposure.

Looking Ahead: What This Means for XRP's Institutional Adoption

The FalconX-21Shares acquisition represents a significant milestone in XRP's journey from retail speculation to an institutional asset class. The deal validates several important trends:

Institutional Infrastructure Maturation: Major crypto platforms are investing heavily in regulated product development, custody, and compliance—signals that institutional adoption is expected to accelerate.

ETF Success Demonstrates Demand: The rapid growth of XRP ETFs to $1 billion AUM confirms that traditional allocators want exposure to XRP but prefer regulated, custodial products over direct token ownership.

Vertical Integration as Competitive Strategy: As crypto markets mature, integrated platforms that control multiple value chain components may outcompete specialized point solutions, similar to traditional finance where large banks offer comprehensive services.

Ripple's Regulatory Progress: The XRP ETF wave became possible only after Ripple's SEC settlement in May 2024 provided regulatory clarity. This demonstrates how legal resolution unlocks institutional capital flows.

Beyond Supply Narratives: While "dark pool drain" theories generate social media engagement, the more substantive story is about expanding distribution channels for XRP exposure through products that traditional financial advisors, wealth managers, and institutions can actually access and recommend.

The Bottom Line

The FalconX acquisition of 21Shares is a strategic play focused on building a vertically integrated crypto infrastructure platform that serves institutional clients across trading, derivatives, asset management, and ETF distribution. The TOXR launch demonstrates this integrated approach in action, bringing XRP exposure to traditional investors through a regulated, custodial product.

Could this vertical integration theoretically affect XRP supply dynamics by creating more efficient pathways for institutional accumulation? Possibly, on the margins. But claims that TOXR will "drain FalconX's dark pool" and trigger an imminent supply shock rest on multiple unverified assumptions about sourcing arrangements, inventory levels, and market structure.

The confirmed facts—aggressive ETF adoption, institutional demand, operational integration—provide sufficient foundation for understanding this acquisition's significance without requiring speculation about unmeasurable OTC inventory dynamics.

For investors, the more important questions are strategic: Does XRP have compelling long-term utility? Is Ripple executing on its payments vision? Are institutional adoption metrics improving? Can XRP maintain regulatory clarity? These fundamentals will drive outcomes far more than short-term supply-demand theories about OTC desk inventory.

DISCLAIMER: This newsletter is for informational purposes only and does not constitute investment advice, advertising, or a recommendation to buy, sell, or hold any securities. This content is not sponsored by or affiliated with any of the mentioned entities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.

Sources

- FalconX Completes Acquisition of 21Shares - FalconX Official Announcement, November 20, 2024

- FalconX Acquires 21Shares Press Release - PR Newswire, October 22, 2024

- FalconX Completes Acquisition Announcement - PR Newswire, November 20, 2024

- 21Shares and FalconX Join Forces - 21Shares Official Communication

- New XRP ETF Hits the Market with Launch of 21Shares' TOXR - The Block, December 12, 2024

- 21Shares XRP ETF Product Page - 21Shares Official Website

- 21Shares Launches XRP ETF TOXR in the United States - Crypto Valley Journal, December 12, 2024

- XRP ETF Tracker - Live Dashboard - Real-time XRP ETF data

- XRP ETFs' Unique $1 Billion Inflow Pattern - CryptoSlate, December 11, 2024

- XRP ETF Inflows Hit $1 Billion in Under 4 Weeks - 24/7 Wall St., December 12, 2024

- Analyst Says End of the Line for FalconX's XRP Dark Pool - The Crypto Basic, December 12, 2025

- Jake Claver X Post - X (Twitter), December 12, 2025

- Jake Claver Predicts Crazy XRP Price Movements - The Crypto Basic, November 28, 2024

- 21Shares TOXR XRP ETF Cleared by Cboe - Coinpedia, December 2024

- XRP Price Data - CoinGecko

- SEC vs. Ripple Labs Settlement - U.S. Securities and Exchange Commission

- Markets in Crypto-Assets Regulation (MiCA) - European Securities and Markets Authority

- 21Shares Launches Leveraged Dogecoin ETF - The Block, November 2024