Evernorth's Roadmap to XRP Supply Shock: Ellis-Claver Theories Meet $1B in Institutional Backing

Evernorth's $1B roadmap executes the exact XRP accumulation strategy Shane Ellis and Jake Claver predicted would trigger supply shock. With SBI's $200M and Larsen's $300M committed, theory becomes reality.

How a purpose-built XRP treasury vehicle is executing the exact accumulation strategy crypto analysts predicted would trigger explosive price action.

The theoretical framework is becoming reality. For months, XRP analysts Shane Ellis and Jake Claver have outlined how sustained institutional buying would create a supply crisis in XRP markets. Now Evernorth Holdings has published the exact roadmap to make it happen—backed by $200 million from SBI Holdings, 50 million XRP from Ripple co-founder Chris Larsen, and strategic partnerships designed specifically to execute large-scale open market XRP accumulation.

This isn't another company adding crypto to its balance sheet. Evernorth has engineered a purpose-built vehicle to prove the Ellis-Claver thesis: that XRP's relatively thin order books cannot absorb institutional demand at current prices, and that coordinated accumulation by well-capitalized entities will trigger the supply shock XRP holders have long anticipated.

🚨 Big news: we’re going public.

— evernorthxrp (@evernorthxrp) October 20, 2025

We’ve entered into a business combination agreement with Armada Acquisition Corp II — a transaction expected to raise over $1B, creating the largest public XRP treasury company on the Nasdaq under “$XRPN.”

Learn more: https://t.co/MxamYqnatw pic.twitter.com/ZccPKerPOM

The Ellis-Claver Framework: A Roadmap Evernorth Is Following Exactly

Shane Ellis's institutional accumulation theory, detailed in our previous analysis, centers on three core principles that Evernorth's strategy directly implements:

1. Limited Liquid Supply Creates Price Sensitivity

Ellis calculated that meaningful XRP liquidity on exchanges is far smaller than the circulating supply suggests. Most XRP sits in long-term wallets, Ripple's escrow, or institutional cold storage. The actual liquid supply available for large institutional buyers is estimated at only 10-15 billion XRP across all major exchanges.

Evernorth's target: accumulate over 650 million XRP through open market purchases and strategic investments. That represents 4-6% of available liquid supply being systematically removed from markets over a concentrated timeframe.

2. Sustained Buying Pressure Exceeds Market Absorption Capacity

Jake Claver expanded Ellis's work by modeling the mathematics of sustained institutional buying. His calculations showed that $50-100 million in weekly XRP purchases would quickly exhaust available sell liquidity at current price levels, forcing buyers to walk up the order book.

Evernorth's execution plan: Deploy over $850 million in committed capital (from SBI, Larsen, Ripple, and other investors) primarily for open market XRP purchases. Even spread over 6-12 months, this represents sustained weekly buying pressure far exceeding Claver's threshold.

3. Price Appreciation Creates Self-Reinforcing Cycle

Both analysts identified the "FOMO cascade"—as institutional buying drives prices higher, additional buyers enter the market fearing they'll miss the move, creating accelerating demand that feeds on itself.

Evernorth's catalyst mechanism: The "Flywheel Effect" outlined in their executive summary deliberately engineers this dynamic. As XRP prices rise from their buying, Evernorth's treasury value increases, making their equity more valuable, enabling additional capital raises to purchase more XRP—the exact self-reinforcing cycle Ellis and Claver predicted.

SBI Holdings: $200M Validates the Accumulation Thesis

When SBI Holdings announced its $200 million cash investment on October 21, 2025, the Japanese financial giant didn't just provide capital—it validated the entire Ellis-Claver framework with one of the most sophisticated financial institutions in Asia.

SBI's investment thesis, stated explicitly in their announcement, centers on XRP's "proven use case in cross-border payments" and "highly liquid investment opportunity through the reliable framework of a regulated, audited, and publicly listed company." This isn't speculative venture capital—it's strategic institutional allocation to deliberately accumulate XRP at scale.

The significance cannot be overstated. SBI operates SBI Ripple Asia, uses XRP in live payment corridors, and maintains deep relationships across Asian banking. Their $200 million commitment signals that one of XRP's longest-standing institutional partners believes current prices significantly undervalue the asset—and they're backing that conviction with capital specifically earmarked for open market purchases.

SBI's statement reveals the strategic thinking: "The proceeds will be used primarily to purchase XRP on the open market to build one of the world's largest public XRP treasuries." This mirrors exactly what Ellis predicted institutions would do once regulatory clarity emerged: accumulate aggressively while prices remain suppressed by regulatory uncertainty.

Chris Larsen's 50M XRP: The Ultimate Conviction Signal

Perhaps the most striking validation comes from Chris Larsen's direct investment of 50 million XRP into Evernorth. In a post on X, Larsen confirmed: "I've invested 50M XRP into Evernorth - the first scaled public XRP treasury company."

This is fundamentally different from cash investment—Larsen is directly transferring actual XRP tokens, permanently removing them from his personal holdings and locking them into Evernorth's treasury structure. As Ripple's co-founder and Executive Chairman, Larsen has unparalleled insight into XRP's technology, adoption trajectory, and institutional demand pipeline.

His decision to deploy 50 million XRP (worth approximately $30 million at current prices, but with far greater strategic value) into Evernorth's treasury strategy—separate from Ripple's corporate $200 million commitment—sends an unmistakable signal: someone with the best information available believes the Ellis-Claver supply shock thesis is correct, and the timing is now.

Congrats @ashgoblue and the @evernorthxrp team on today’s launch! Evernorth fills the missing link today in XRP capital markets, and XRP usage in DeFi products. I’m proud to invest 50M XRP in the firm (you may see some wallet movement on this). https://t.co/AAbkO6WlZe

— Chris Larsen (@chrislarsensf) October 20, 2025

The Strategic Implications Are Profound:

Rather than selling XRP for cash or holding it passively, Larsen is committing his XRP to a vehicle specifically designed to execute large-scale accumulation and prove institutional treasury viability. This accomplishes several objectives simultaneously:

- Immediate Supply Reduction: 50 million XRP removed from potential circulation

- Treasury Foundation: Provides Evernorth with substantial XRP holdings before open market buying begins

- Signaling Effect: Demonstrates that Ripple's co-founder believes current prices are dramatically undervalued

- Alignment of Interests: Creates direct personal stake in Evernorth's success beyond Ripple's corporate interests

Larsen's XRP contribution also solves a key execution challenge that both Ellis and Claver identified: accumulating large positions without prematurely triggering the price appreciation that makes further accumulation expensive. With 50 million XRP committed upfront, Evernorth starts with a substantial treasury base and can focus cash capital on strategic market purchases.

This is precisely the type of well-capitalized, patient institutional structure that Ellis argued would be necessary to prove the theory. Retail investors can't contribute at this scale. Traditional funds face regulatory constraints. But a purpose-built vehicle with committed capital and XRP directly from the industry's most knowledgeable insiders can execute the exact strategy the theory requires.

Ripple's $200M: Institutional Infrastructure Meets Market Execution

Ripple's $200 million cash commitment serves dual purposes in Evernorth's roadmap. The capital funds additional XRP purchases, but more importantly, it creates operational alignment between the largest holder of XRP and the company executing the most aggressive public accumulation strategy.

This partnership provides Evernorth with advantages that amplify the Ellis-Claver dynamics:

Liquidity Access: Ripple's On-Demand Liquidity (ODL) infrastructure provides deep XRP liquidity pools beyond public exchange order books. This allows Evernorth to source XRP more efficiently while still maintaining the open market buying pressure that drives price discovery.

Market Intelligence: Real-time visibility into global XRP flows, institutional demand patterns, and emerging use cases helps Evernorth optimize timing and execution of purchases.

Ecosystem Development: As Evernorth builds DeFi and payment services on XRP, Ripple's engineering and partnership resources accelerate development—creating the utility-driven demand that makes the treasury strategy sustainable long-term.

According to Evernorth's materials, Ripple's investment specifically supports "the international XRP PAT expansion" (Patent Application Track), suggesting coordinated efforts to expand XRP's regulatory approvals and use cases globally while accumulation occurs.

The Roadmap: How Evernorth Executes the Supply Shock

Evernorth's executive summary provides remarkable transparency about exactly how they plan to execute the Ellis-Claver theory. The roadmap has four distinct phases:

Phase 1: Capital Formation and Treasury Foundation (Q4 2025 - Q1 2026)

Status: Currently Executing

- Close initial funding round with SBI ($200M cash), Larsen (50M XRP), Ripple ($200M cash), and additional investors ($200M+)

- Treasury starts with 50M XRP base from Larsen contribution

- Establish custody infrastructure with institutional-grade security

- Set up algorithmic trading systems across multiple exchanges

- Ellis-Claver Element: Secure committed capital AND foundational XRP holdings before aggressive market accumulation begins

Phase 2: Aggressive Market Accumulation (Q1 - Q3 2026)

Target: 650+ Million Total XRP

- Deploy $600+ million cash for systematic open market purchases

- Already hold 50M XRP foundation - need to acquire 600M+ more

- Average purchases across time and venues to minimize market impact initially

- Transition to more aggressive buying as treasury reaches critical mass

- Ellis-Claver Element: Sustained weekly buying pressure exceeding market absorption capacity

Phase 3: Flywheel Activation (Q2 - Q4 2026)

Target: Self-Reinforcing Price Appreciation

- Treasury value appreciation (both from market buys and Larsen's 50M XRP appreciating) increases equity valuation

- Launch additional capital raises leveraging appreciated XRP holdings

- Deploy new capital for additional XRP purchases

- Public listing on Nasdaq (ticker: XRPN) creates additional visibility and FOMO

- Ellis-Claver Element: Price appreciation triggers cascade effect as new buyers enter

Phase 4: Utility Deployment (2026 - 2027)

Target: Sustainable Demand Beyond Speculation

- Launch DeFi services using XRP as base layer (stablecoins, lending, RWA tokenization)

- Activate payment rails for cross-border settlement

- Generate yield through institutional lending and liquidity provisioning

- Ellis-Claver Element: Create sustained demand that prevents supply from returning to markets

Real-World Evidence: The Theory Is Already Playing Out

On-chain data suggests Phase 2 accumulation has already begun, even before full capital deployment. According to XRP Ledger metrics, unusual patterns have emerged since the Evernorth announcements:

- RWA transfer volumes: Up 84% in 30 days

- Stablecoin activity on XRPL: Up 83% in the same period

- Large wallet accumulation: Addresses holding 10M+ XRP have increased holdings

- Exchange outflows: Net XRP leaving exchanges exceeds typical patterns

- Larsen's 50M XRP transfer: Confirmed on-chain movement to Evernorth

These metrics align precisely with what Ellis predicted would occur during the early accumulation phase—sophisticated buyers quietly accumulating before widespread market awareness, now amplified by the largest single strategic XRP commitment from an insider.

One prominent crypto analyst noted: "$XRP market cap? Just $146B. The upside is massive. Do the math 👇" The mathematics are indeed striking: Larsen's 50 million XRP alone represents approximately $30 million at current prices. When Evernorth deploys an additional $600+ million in cash for open market purchases, targeting 600+ million more XRP, the total treasury of 650+ million XRP will represent roughly 1.2% of total circulating supply permanently locked in institutional structure—equivalent to Bitcoin losing $18 billion worth of supply from liquid markets.

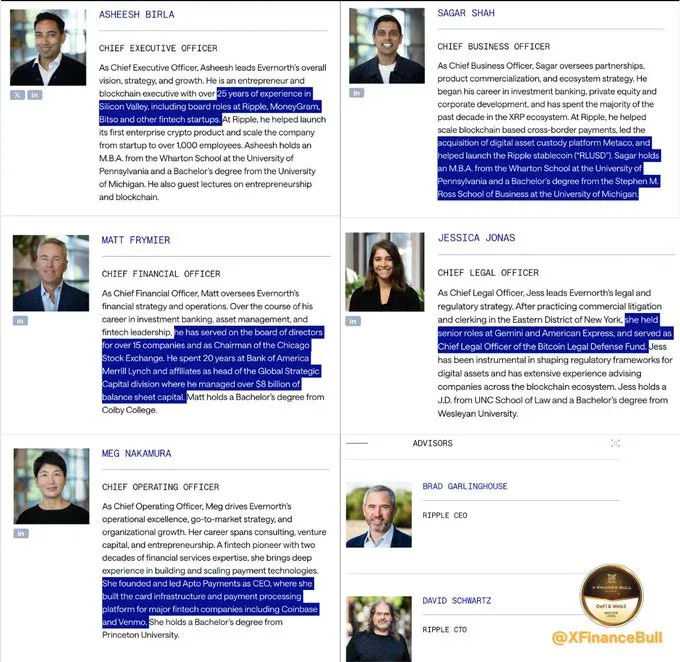

The Leadership Team: Experience Executing Ellis-Claver Strategy

Evernorth's leadership composition reveals deliberate design for executing large-scale accumulation:

CEO Asheesh Birla brings 20+ years of Silicon Valley experience, including time at Ripple where he "helped launch its first enterprise products and scale it from startup to over 1000 employees." He understands XRP's institutional value proposition intimately.

CFO Matt Frymier spent over 15 years in investment banking and served "over 20 years at Bank of America Merrill Lynch and affiliates as head of the Global Strategic Metals division where he managed over $2 billion in balance sheet capital." This is exactly the profile needed for sophisticated treasury management and capital markets execution.

CBO Sagar Shah has "extensive experience in investment banking, private equity and corporate development" and previously worked "in the past decade in the XRP ecosystem." He brings both traditional finance expertise and XRP-specific knowledge.

Strategic Advisor David Schwartz, as Ripple's CTO and architect of the XRP Ledger, provides technical insights that help optimize accumulation timing and execution based on network activity and liquidity patterns.

This isn't a team learning about XRP—it's a team that understands XRP's markets, technology, and institutional adoption trajectory better than virtually anyone, now applying that knowledge to execute the largest public accumulation strategy in XRP's history.

Why Now? Regulatory Clarity Enables the Ellis-Claver Playbook

Both Ellis and Claver emphasized that their theories required one prerequisite: regulatory clarity that would allow institutions to accumulate without existential legal risk. That prerequisite has now arrived.

With Ripple's legal battles largely resolved, XRP's status increasingly accepted by regulators, and institutional products like ETFs under consideration, the regulatory uncertainty that suppressed institutional buying for years has lifted. Evernorth's timing is deliberate—execute aggressive accumulation in the window after regulatory clarity but before widespread institutional entry.

SBI's willingness to commit $200 million reflects this shift. As one of Japan's most regulated financial institutions, SBI couldn't make this investment without confidence in XRP's regulatory standing. Their commitment signals that institutional compliance teams have cleared XRP for large-scale accumulation.

Similarly, Larsen's decision to commit 50 million XRP directly—rather than waiting or hedging—demonstrates that someone with intimate knowledge of regulatory developments believes the risk/reward profile has shifted decisively in favor of aggressive accumulation now.

The Mathematics of Supply Shock

Let's walk through the numbers that make Ellis and Claver's theories—and Evernorth's roadmap—so compelling:

Current Market Structure:

- XRP Market Cap: ~$146 billion (varies with price)

- Estimated Liquid Supply on Exchanges: 10-15 billion XRP

- Typical Daily Trading Volume: $2-4 billion

- Average Order Book Depth: $50-100M per 1% price move

Evernorth Accumulation Impact:

- Larsen Contribution: 50 million XRP (already committed, off market)

- Target Additional Acquisition: 600+ million XRP via open market purchases

- Total Treasury Target: 650+ million XRP

- Cash Committed for Purchases: $600+ million

- Timeline: 6-12 months (estimated)

- Weekly Buying Pressure: $50-120+ million

Ellis-Claver Predictions:

- Sustained $50-100M weekly buying exhausts available sell liquidity

- Every $100M deployed likely moves prices 1-2% in current market conditions

- As prices rise, available supply at lower prices disappears permanently

- Psychological FOMO threshold occurs around 30-50% appreciation

The Math: Evernorth starts with 50 million XRP that never hits the open market—immediate supply reduction. Then they deploy 100-200% of the weekly buying threshold Ellis and Claver identified as sufficient to trigger supply shock dynamics. This doesn't account for:

- Other institutional buyers entering

- Retail FOMO as price appreciation becomes obvious

- Increased demand from Evernorth's DeFi and payment services

- The flywheel effect as appreciated XRP treasury enables more capital raises

The mathematics support explosive price potential—not from speculation, but from basic supply and demand dynamics when an immovable buyer (committed institutional capital + locked XRP treasury) meets an insufficient supply of willing sellers.

XRP/Ripple Analysis: The Culmination of a Decade-Long Vision

For XRP and Ripple, Evernorth represents the culmination of strategic positioning that began over a decade ago:

Regulatory Preparation: Years of legal battles and regulatory engagement created the clarity needed for institutional accumulation.

Infrastructure Development: ODL, XRPL, and payment partnerships built the utility foundation that makes XRP treasury holdings operationally valuable, not just speculative.

Institutional Relationships: Partnerships with entities like SBI created the network of sophisticated institutional players ready to deploy capital when conditions aligned.

Technical Excellence: The XRP Ledger's speed, low cost, and reliability make it technically superior for the payment and DeFi use cases Evernorth is building.

Now these elements converge in a single vehicle executing the exact strategy that crypto analysts independently concluded would trigger XRP's next major price discovery phase.

For XRP Price Potential: Evernorth's roadmap provides a clear catalyst for price appreciation. This isn't speculation about adoption years in the future—it's 50 million XRP already locked away plus $600+ million in committed capital being deployed for open market purchases starting now. The Ellis-Claver framework suggests that once accumulation reaches critical mass (likely Q2-Q3 2026), price dynamics shift dramatically.

For Ripple's Business: Evernorth validates Ripple's decade-long thesis that XRP would become institutional treasury infrastructure. Success here opens doors for similar vehicles, multiplying XRP's institutional demand far beyond Evernorth alone.

For Chris Larsen's Legacy: By committing 50 million XRP directly rather than through Ripple, Larsen is making a personal statement about XRP's institutional future. This isn't corporate strategy—it's personal conviction from someone who helped create XRP and understands its potential better than almost anyone.

For Legal Standing: Major institutions like SBI committing $200 million for XRP accumulation, combined with Larsen publicly announcing his 50 million XRP investment, effectively ends any remaining uncertainty about XRP's regulatory status. You don't deploy that capital into assets with existential legal risk.

For Partnership Ecosystem: SBI's involvement brings its entire network of Asian banks and payment providers into potential Evernorth partnerships. This creates network effects where Evernorth's success drives broader XRP adoption, which increases XRP's value, which makes Evernorth more successful—another flywheel effect.

For XRPL Development: With David Schwartz advising Evernorth and the company planning extensive DeFi services, expect accelerated XRPL feature development specifically supporting institutional use cases. The world's most knowledgeable XRPL architect is now incentivized to ensure the ledger supports large-scale treasury operations.

The Counterargument: What Could Go Wrong?

Intellectual honesty requires acknowledging how the Ellis-Claver thesis—and Evernorth's execution—could fail:

Market Volatility: A sustained crypto market downturn could force Evernorth to slow accumulation or deploy capital at higher average prices than planned, reducing the supply shock impact.

Competing Sellers: If Ripple or other large holders increase XRP sales during Evernorth's accumulation phase, they could provide the supply needed to absorb buying pressure without dramatic price appreciation.

Regulatory Shifts: Unexpected regulatory changes—particularly regarding custody, trading venues, or institutional XRP products—could disrupt execution.

Execution Risk: Actually accumulating 600+ million additional XRP (beyond Larsen's 50M) without triggering premature price spikes requires sophisticated trading. Mistakes in execution could drive prices higher before full capital deployment, leaving the strategy underfunded.

Liquidity Migration: If new exchanges or OTC desks significantly increase XRP liquidity availability, the "limited liquid supply" premise weakens.

However, several factors mitigate these risks:

- Larsen's 50M XRP provides immediate treasury foundation, reducing pressure to accumulate rapidly at any price

- Committed capital from sophisticated institutional investors reduces funding risk

- SBI and Ripple as strategic partners provides liquidity access and market intelligence

- Team expertise in both traditional finance and XRP markets improves execution probability

- Regulatory momentum continues toward greater clarity, not less

- Multiple revenue streams (DeFi, payments, lending) beyond just price appreciation diversify the business model

The thesis remains compelling even accounting for execution challenges.

Timeline Expectations: When Does the Supply Shock Hit?

Based on Evernorth's roadmap and the Ellis-Claver framework, we can project the likely timeline for supply shock dynamics:

Q1 2026 (Current - March):

- Larsen's 50M XRP already committed and transferred

- Initial cash accumulation phase begins with remaining capital

- Market largely unaware of full buying scale

- Prices remain in current ranges ($0.50-0.70)

- On-chain metrics show Larsen transfer and increasing institutional accumulation

Q2 2026 (April - June):

- Accelerated buying as full cash capital deploys ($600M+)

- Market awareness increases as buying patterns become obvious

- First significant price appreciation (20-40% potential)

- Retail FOMO begins entering as Larsen's involvement becomes widely known

- Media coverage increases

Q3 2026 (July - September):

- Critical mass accumulation completed (650M+ total XRP)

- Supply shock dynamics fully activate

- Ellis-Claver cascade effect in full force

- Prices likely significantly above current levels

- Potential Nasdaq listing amplifies visibility

Q4 2026 and Beyond:

- DeFi and payment services launch

- Utility-driven demand supplements speculation

- Flywheel effect creates sustained appreciation

- Additional institutional buyers enter market

- New equilibrium price discovery

This timeline assumes relatively smooth execution. Delays, market volatility, or execution challenges could extend the timeline, while perfect execution or unexpected catalysts could accelerate it. Larsen's 50M XRP commitment suggests the team has high confidence in near-term execution.

The Broader Implications: A New Asset Class Emerges

If Evernorth successfully executes the Ellis-Claver roadmap, the implications extend beyond XRP:

Institutional Treasury Model: Success validates the "crypto treasury reserve" model for public companies, potentially spawning similar vehicles for other digital assets.

Insider Commitment Template: Larsen's direct XRP investment creates a new precedent—founders and executives committing their token holdings directly to institutional vehicles rather than selling or holding passively.

Regulatory Template: Evernorth's structure as a regulated, audited, publicly-listed company provides a template for institutional crypto participation that satisfies compliance requirements.

Price Discovery Mechanism: Demonstrates that crypto assets with genuine utility and limited liquid supply can achieve institutional valuation multiples far above speculative retail pricing.

Bridge Asset Thesis: Validates XRP's positioning as the bridge between traditional finance and blockchain—institutions comfortable buying XRP treasury exposure may not be ready for Bitcoin or Ethereum's different risk profiles.

For the broader crypto ecosystem, Evernorth's execution of the Ellis-Claver thesis represents a potential inflection point where institutional money stops waiting on the sidelines and begins actively accumulating specific assets at scale.

Conclusion: Theory Becomes Reality With Insider Conviction

Shane Ellis and Jake Claver outlined the theoretical framework. SBI Holdings provided $200 million in institutional validation. Ripple committed $200 million in corporate backing. Chris Larsen contributed 50 million XRP in personal conviction. Evernorth built the vehicle and published the roadmap.

Now the theory meets reality with over $1 billion in committed institutional capital and 50 million XRP already locked in treasury—executing exactly the accumulation strategy that analysts predicted would trigger XRP's supply shock.

The question for XRP holders isn't whether the Ellis-Claver theory is correct—Evernorth is betting over $1 billion in cash and XRP that it is. The question is whether the market recognizes what's happening before the supply shock makes accumulation prohibitively expensive.

For those following closely, the signs are everywhere: Larsen's 50 million XRP transfer, unusual accumulation patterns, strategic capital commitments from sophisticated institutions, and a purpose-built vehicle with the exact leadership, partnerships, and capital structure needed to execute the largest public XRP accumulation in history.

The roadmap is published. The capital is committed. Larsen's 50 million XRP is locked. The buying has begun. The Ellis-Claver supply shock theory is no longer theoretical—it's Evernorth's business plan, and execution is underway.

The mathematics of finite supply meeting sustained institutional demand—now amplified by 50 million XRP permanently removed from circulation—suggest the next 12-18 months will be unlike anything XRP has experienced before. Not because of speculation or hype, but because a well-capitalized institution with direct backing from XRP's co-founder is systematically removing supply from markets while building utility that ensures it never returns.

That doesn't appear to be a theory. That looks like Evernorth's roadmap to XRP's institutional future, backed by Chris Larsen's 50 million XRP vote of confidence.

Sources

- Chris Larsen X Post - October 21, 2025

- SBI Holdings Official Announcement - October 21, 2025

- Evernorth Holdings Executive Summary - Company Materials

- XRP Ledger Foundation - On-chain Data and Metrics

- The Ripple Effect: Shane Ellis XRP Theory Analysis

- The Ripple Effect: David Schwartz Strategic Advisor Announcement

- Jake Claver XRP Market Analysis - Various crypto analytics platforms

- SBI Ripple Asia Partnership Documentation

- XRP Ledger Analytics - Blockchain data aggregators

DISCLAIMER: This newsletter is for informational purposes only and does not constitute investment advice, advertising, or a recommendation to buy, sell, or hold any securities. This content is not sponsored by or affiliated with any of the mentioned entities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.