Evernorth Moves Toward Public Trading and Announces Strategic Doppler Partnership

Evernorth raises $1B+ in historic SPAC deal to create largest public XRP treasury, with backing from SBI, Ripple, and Pantera Capital. Company partners with Doppler Finance to expand institutional infrastructure on XRP Ledger. Q1 2026 Nasdaq listing expected under ticker XRPN.

Major XRP treasury company secures $1B+ funding and partners with leading DeFi infrastructure provider as Q1 2026 launch approaches

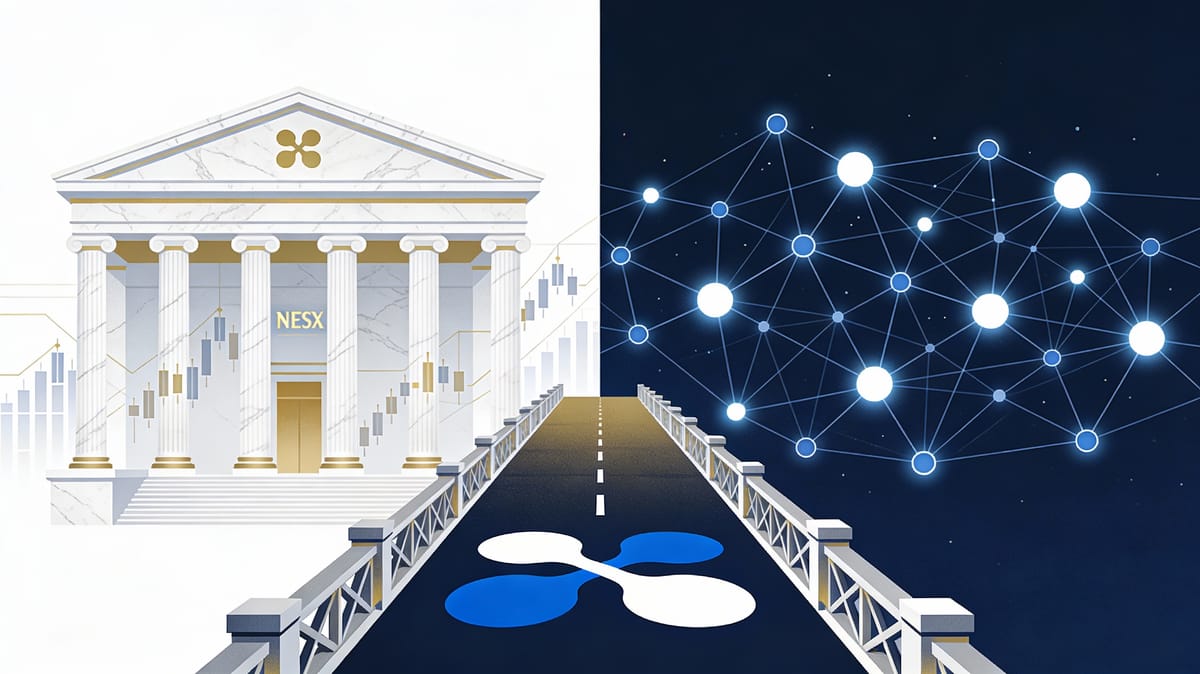

In a significant development for institutional XRP adoption, Evernorth has announced two major milestones: a business combination that will create the largest public XRP treasury company and a strategic collaboration with Doppler Finance to expand institutional infrastructure on the XRP Ledger.

Historic SPAC Deal Brings Evernorth Public

On October 20, 2025, Evernorth announced a business combination agreement with Armada Acquisition Corp II (Nasdaq: AACI), a special purpose acquisition company. The transaction is expected to raise over $1 billion in gross proceeds, with the combined company set to trade on Nasdaq under the ticker symbol "XRPN" upon closing, anticipated in Q1 2026.

The funding round includes substantial institutional backing, with SBI Holdings committing $200 million. Additional investments come from Ripple, Rippleworks, Pantera Capital, Kraken, and GSR, along with participation from Ripple co-founder Chris Larsen. According to the press release, net proceeds will primarily fund open-market purchases of XRP to build what the company describes as "the world's leading institutional XRP treasury."

Active Treasury Model: More Than an ETF

Unlike passive exchange-traded funds, Evernorth's model is designed to actively grow XRP per share over time through institutional lending, liquidity provisioning, and decentralized finance (DeFi) yield opportunities.

"Evernorth is built to provide investors more than just exposure to XRP's price," said Asheesh Birla, CEO of Evernorth, in the October announcement. "As we capitalize on existing TradFi yield generation strategies and deploy into DeFi yield opportunities, we also contribute to the growth and maturity of that ecosystem."

The company plans to participate in validator operations, integrate with Ripple's RLUSD stablecoin, provide market liquidity, and engage in projects expanding XRP's utility across payments and tokenized assets.

Doppler Finance Partnership Expands Institutional Infrastructure

On January 8, 2026, Evernorth announced a strategic collaboration with Doppler Finance, described as a leading XRPfi infrastructure provider. The partnership focuses on exploring institutional liquidity deployment frameworks and treasury management strategies on the XRP Ledger.

According to the announcement, the collaboration will examine "onchain products and mechanisms for deploying XRP capital at scale" while leveraging Doppler's institutional-grade architecture. The partnership also includes coordinated strategic communications and global market expansion efforts targeting both institutional and retail participants.

"The next phase of XRPL adoption will be driven by institutions that demand clarity, structure, and real economic utility," Birla stated in the January press release. "By collaborating with Doppler, we are advancing practical frameworks for deploying institutional XRP liquidity onchain."

Rox, Head of Institutions at Doppler Finance, added: "Working with Evernorth represents a meaningful step forward in expanding institutional participation across the XRP Ledger. By aligning institutional liquidity with robust infrastructure and disciplined risk frameworks, we aim to unlock XRP's full potential as a scalable, yield-generating asset for global markets."

Leadership and Governance Structure

Evernorth is led by CEO Asheesh Birla, who previously served as a senior executive at Ripple, where he helped scale the company's cross-border payments business. The executive team includes Chief Financial Officer Matthew Frymier, Chief Operating Officer Meg Nakamura, Chief Legal Officer Jessica Jonas, and Chief Business Officer Sagar Shah.

While Ripple is a strategic investor, the company maintains independent governance. Ripple executives Brad Garlinghouse, Stuart Alderoty, and David Schwartz are expected to serve as strategic advisors.

"Ripple has long championed XRP for its utility as a global asset for the efficient settlement of payments around the world," said Garlinghouse in the October announcement. "Evernorth is deeply aligned with that mission, bringing more use cases, participation, and confidence to the XRP ecosystem."

Implications for XRP and the Broader Market

These developments represent significant institutional validation for XRP as both companies position the asset for broader institutional adoption. The combination of substantial capital backing, strategic partnerships with DeFi infrastructure providers, and a focus on yield-generating strategies creates a multi-faceted approach to XRP treasury management.

Potential Market Impact

The infusion of over $1 billion into open-market XRP purchases could provide sustained buying pressure, though the actual market impact will depend on execution timing and market conditions. The active treasury model may demonstrate new use cases for XRP beyond simple price speculation or payment settlement.

The Doppler partnership suggests growing institutional interest in XRP-native DeFi applications, potentially expanding the asset's utility within decentralized financial systems. However, the success of these initiatives will depend on market adoption, regulatory clarity, and the maturation of XRPL's DeFi ecosystem.

Regulatory Considerations

Evernorth's public listing structure provides a regulated vehicle for XRP exposure, which may appeal to institutional investors seeking compliant access to digital assets. The transaction has been structured through established financial institutions, with Citigroup Global Markets serving as Sole Private Placement Agent and Capital Markets Advisor, and legal counsel from Davis Polk & Wardwell LLP.

The business combination remains subject to customary closing conditions, shareholder approvals, and SEC review. Evernorth and Armada II intend to file a Registration Statement on Form S-4 with the Securities and Exchange Commission, which will include detailed information about the transaction.

What's Next

With the Q1 2026 closing timeline approaching, market participants will be watching for:

- Completion of shareholder approvals and regulatory clearances

- Initial open-market XRP acquisition strategy

- Development of the Doppler collaboration framework

- Nasdaq listing under the "XRPN" ticker

- Performance metrics on yield generation strategies

These developments position Evernorth as a significant player in institutional XRP adoption, bridging traditional finance structures with blockchain-native infrastructure. The company's success will serve as a test case for active treasury models in the digital asset space.

Sources

Primary Sources:

- Evernorth Press Release: Business Combination Announcement - October 20, 2025

- Evernorth Press Release: Doppler Finance Collaboration - January 8, 2026

Company Websites:

Financial Advisors:

Additional Information:

- SEC EDGAR Database - For upcoming Form S-4 Registration Statement

- Nasdaq Listing Information

DISCLAIMER: This newsletter is for informational purposes only and does not constitute investment advice, advertising, or a recommendation to buy, sell, or hold any securities. This content is not sponsored by or affiliated with any of the mentioned entities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.