Evernorth Amasses $1 Billion XRP Treasury Ahead of Historic Nasdaq Debut

Ripple-backed Evernorth amasses $1B in XRP ahead of historic Nasdaq SPAC debut. With backing from SBI, Pantera, and Kraken, the firm aims to become the world's largest public XRP treasury.

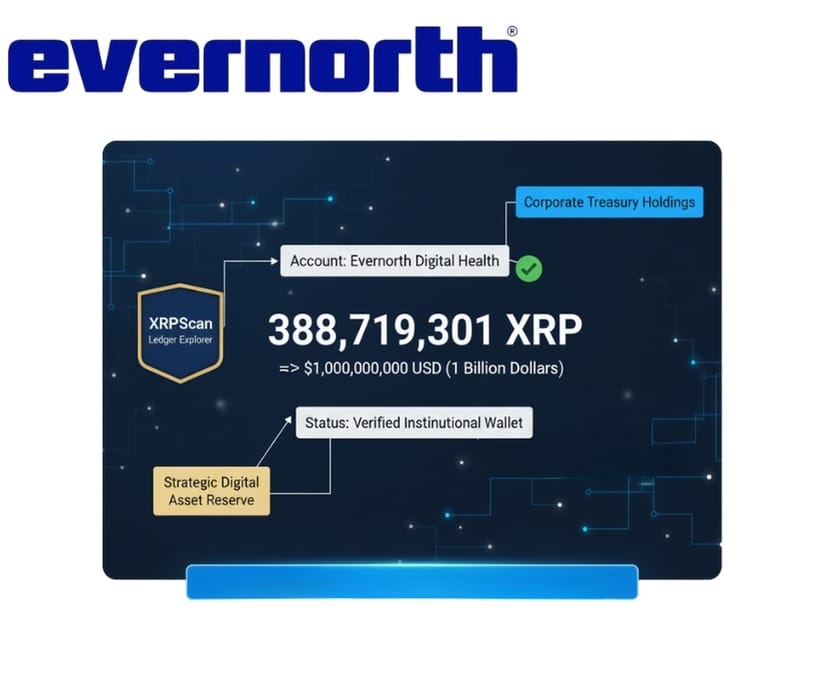

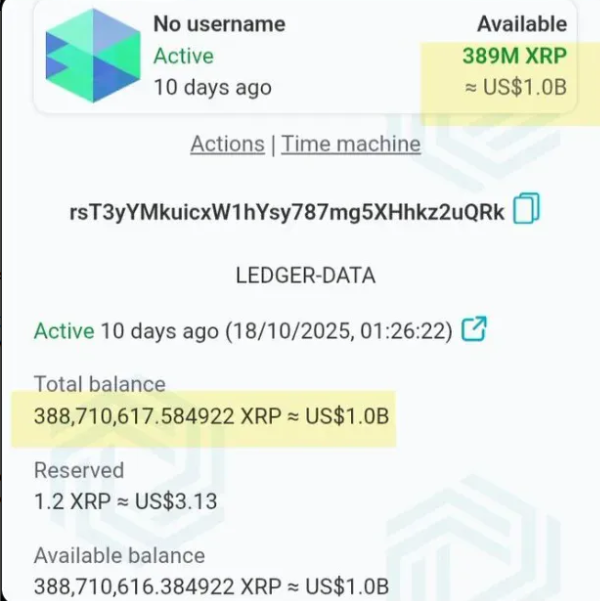

In a landmark move for institutional crypto adoption, Ripple-backed Evernorth Holdings has successfully accumulated over 388 million XRP tokens worth more than $1 billion, just days after announcing its groundbreaking SPAC merger.

The digital asset treasury firm, which will trade as "XRPN" on Nasdaq following its Q1 2026 merger with Armada Acquisition Corp II, has received massive capital inflows from some of the industry's most influential players. According to on-chain data from XRPScan, Evernorth's wallet now holds 388,710,606 XRP, positioning the company as one of the largest institutional XRP holders globally.

Evernorth / Armada Acquisition II deal overview

— Julian Klymochko (@JulianKlymochko) October 20, 2025

XRP digital asset treasury company

$1.4 billion pro forma equity value

Symbol $XRPN

Closing Q1 2026

PR: https://t.co/mnQdZF3vn6

IR deck: https://t.co/CW2aDvLqYu

Disclosure: Long $AACI shares + warrants in $ARB.to pic.twitter.com/hDzoL2ivQB

The $1 Billion Raise: Who's Behind It?

On October 20, 2025, Evernorth announced a definitive agreement to merge with Armada Acquisition Corp II in a transaction expected to generate over $1 billion in gross proceeds. The deal has attracted heavyweight backing from across the crypto and traditional finance sectors.

Key investors include:

- SBI Holdings: The Japanese financial giant has committed $200 million, the largest single investment in the round

- Ripple Labs: Providing both capital and strategic support, with CEO Brad Garlinghouse serving as a strategic advisor

- Chris Larsen: Ripple's co-founder personally transferred 50 million XRP to Evernorth's treasury

- Pantera Capital, Kraken, and GSR: Leading crypto-native firms providing additional capital and market expertise

- Rippleworks: Further strengthening the Ripple ecosystem connection

The company's wallet has received substantial XRP transfers from multiple sources, with Ripple contributing over 338 million XRP directly to Evernorth's holdings. Additional contributions came from major exchanges including Uphold, Coinbase, and Gemini.

Not Just Another ETF: Active Treasury Strategy

Unlike passive exchange-traded funds, Evernorth plans to operate as an active investment vehicle designed to increase XRP per share over time. The company's strategy involves:

- Institutional Lending: Deploying XRP holdings to generate yield through institutional borrowing arrangements

- Liquidity Provisioning: Participating in market-making activities across the XRP ecosystem

- DeFi Yield Generation: Leveraging decentralized finance protocols to create additional returns

- Validator Operations: Running XRP Ledger validators to enhance network security and decentralization

- RLUSD Integration: Utilizing Ripple's RLUSD stablecoin for DeFi on-ramps and collateral use cases

According to CryptoQuant analysis, Evernorth's average purchase price sits around $2.44, and the firm has already gained approximately $46 million in unrealized profits within just four days of initial accumulation.

Leadership and Governance Structure

Former Ripple executive Asheesh Birla, who previously led the company's cross-border payments division, will serve as CEO and Board Chair of Evernorth. Notably, Birla has stepped down from Ripple's board to focus entirely on building Evernorth, signaling his commitment to the venture's success.

While Ripple maintains a strategic investment position, Evernorth will operate with independent governance. Key Ripple executives—including Brad Garlinghouse, Chief Legal Officer Stuart Alderoty, and CTO David Schwartz—are expected to serve as strategic advisors, providing ecosystem alignment without day-to-day control.

This governance structure is designed to provide institutional investors with confidence in Evernorth's operational independence while maintaining strong connections to the broader XRP ecosystem and Ripple's infrastructure.

Market Impact: A Potential Supply Shock

The rapid accumulation of nearly 389 million XRP represents a significant portion of the token's circulating supply and could have meaningful market implications. Industry analysts note that October 2025 is on track to see approximately 650 million XRP in institutional transfers—more than double Ripple's typical monthly distribution for On-Demand Liquidity (ODL) operations, exchange-traded products, and trusts.

Evernorth alone accounts for 388 million XRP of this total, creating unprecedented demand pressure in the institutional market. This accumulation comes at a particularly opportune time, as XRP trades around $2.66 following its recent regulatory clarity.

Chris Larsen's 50 million XRP contribution raised initial concerns among retail investors, but legal experts and community analysts clarified that the transfer was not a market sale but rather a strategic investment in Evernorth's institutional vehicle. Larsen himself confirmed the investment via social media, stating: "Evernorth fills the missing link today in XRP capital markets, and XRP usage in DeFi products."

XRP and Regulatory Clarity: The Ripple Effect

Evernorth's launch comes at an inflection point for XRP's regulatory status in the United States. After a five-year legal battle, Ripple and the SEC officially dismissed their respective appeals on August 7, 2025, bringing the landmark case to a definitive conclusion.

The resolution established that XRP sold on public exchanges does not constitute a securities offering, providing the regulatory clarity that institutional investors have long demanded. This distinction is critical for Evernorth's business model, as it enables the company to freely accumulate, trade, and deploy XRP without the regulatory overhang that plagued the asset from 2020 through mid-2025.

Impact on XRP Price Potential

The combination of regulatory clarity and institutional accumulation has created a favorable technical setup for XRP. Following the SEC case resolution in August 2025, XRP reached an all-time high above $3.40 in July 2025, representing a 480% gain in just one month. As of late October 2025, the token has consolidated around $2.60-$2.70, with analysts projecting potential moves toward $4.00-$4.50 if institutional adoption continues accelerating.

The Evernorth treasury could serve as a price stabilization mechanism while simultaneously reducing available supply on the open market. As crypto analyst Vincent Van Code noted, Evernorth's strategy mirrors MicroStrategy's Bitcoin playbook but with "legal transparency" given XRP's clarified regulatory status.

Ripple's Business Operations and Strategic Positioning

For Ripple Labs, Evernorth represents a significant validation of its long-term XRP strategy. The company has successfully positioned XRP as a bridge asset for cross-border payments, with its On-Demand Liquidity (ODL) service processing $1.3 trillion in Q2 2025 alone.

Major financial institutions including Santander, SBI Holdings, and American Express have deepened partnerships with Ripple, leveraging XRP's efficiency in international payment corridors. The addition of a publicly-traded institutional treasury provides these partners—and potential new clients—with additional liquidity infrastructure and validation of XRP's role in modern finance.

Ripple's recent acquisition of Hidden Road for $1.25 billion in April 2025, one of the largest M&A deals in crypto history, further strengthens its institutional trading and liquidity capabilities. Combined with Evernorth's treasury operations, Ripple is building a comprehensive ecosystem that bridges traditional finance with blockchain-based payment rails.

Legal Standing and Future Regulatory Environment

The definitive conclusion of the SEC case removes a major impediment to institutional adoption. The court's ruling established clear legal precedent that XRP's programmatic sales on public exchanges do not meet the Howey Test for securities classification, a distinction that sets XRP apart from many other digital assets still facing regulatory uncertainty.

Under the current pro-crypto SEC leadership following President Trump's second term, the regulatory environment has shifted dramatically from the enforcement-heavy approach of previous years. The SEC has dropped over a dozen crypto-related cases and investigations since the leadership change, signaling a move toward clearer rulemaking rather than regulation by enforcement.

For Evernorth, this regulatory clarity provides the foundation for its business model. The company can now accumulate XRP, deploy it in various yield-generating strategies, and offer institutional investors a regulated vehicle for exposure—all without the legal uncertainty that previously constrained similar ventures.

Partnership Opportunities and Ecosystem Growth

The Evernorth treasury opens new partnership avenues across multiple sectors:

Traditional Finance: Banks and financial institutions can now access XRP liquidity through a Nasdaq-listed vehicle rather than navigating direct cryptocurrency holdings. This intermediated structure may appeal to institutions with compliance constraints around direct digital asset ownership.

DeFi Integration: Evernorth's stated intention to participate in DeFi protocols could accelerate XRP's integration into decentralized lending, borrowing, and yield generation platforms. The combination of institutional capital and XRP Ledger's native DeFi capabilities creates opportunities for protocol partnerships and liquidity provisioning.

Payment Corridors: As Ripple expands its ODL network globally, Evernorth's treasury can serve as a deep liquidity pool for high-volume payment corridors. This could reduce friction in cross-border transactions and improve execution prices for financial institutions using RippleNet.

Validator Infrastructure: Evernorth's plans to operate XRP Ledger validators contribute to network decentralization and security. This infrastructure investment signals long-term commitment to the XRP ecosystem beyond purely financial returns.

Adoption Prospects: The Institutional Gateway

Perhaps most significantly, Evernorth provides a regulated on-ramp for institutional capital that has been waiting on the sidelines. The SPAC structure and Nasdaq listing offer:

- Familiar Investment Vehicle: Institutions can gain XRP exposure through traditional equity markets without navigating cryptocurrency custody and compliance challenges

- Professional Management: Experienced leadership with deep Ripple ecosystem knowledge managing active treasury strategies

- Transparent Reporting: Public company disclosure requirements providing visibility into holdings, strategies, and financial performance

- Liquidity: Nasdaq trading enabling institutional investors to enter and exit positions with traditional market infrastructure

The timing of Evernorth's launch coincides with increasing institutional appetite for digital assets. Following Bitcoin ETF approvals in 2024 and the first U.S. spot XRP ETF approval (REX-Osprey XRPR) in September 2025, traditional asset managers are actively building crypto product suites. Evernorth's active management approach differentiates it from passive ETF products while potentially delivering superior returns through yield generation strategies.

Comparing Evernorth to Other XRP Treasuries

While several companies have allocated capital to XRP, Evernorth's scale is unprecedented:

- VivoPower: Holds approximately $100 million in XRP as part of its digital asset strategy

- Nature's Miracle Holding: Announced a $20 million XRP acquisition earlier in 2025

- Hyperscale Data: Committed $10 million to XRP for cross-border payment use cases

- Trident Digital Tech Holdings: Smaller institutional position

- Webus: Additional corporate treasury allocation

Evernorth's $1 billion commitment dwarfs all existing corporate XRP treasuries combined, representing a quantum leap in institutional participation. The company's public listing structure also provides a replicable model for other digital assets to attract traditional investment capital.

The Road to Nasdaq: Timeline and Next Steps

The SPAC merger between Evernorth and Armada Acquisition Corp II is expected to close in Q1 2026, subject to shareholder and regulatory approvals. Upon completion:

- Armada's Class A shares will convert to Evernorth shares on a one-for-one basis

- The combined company will operate under the Evernorth name

- Trading will commence on Nasdaq under the ticker symbol "XRPN"

- Citigroup Global Markets serves as sole private placement agent and capital markets advisor

- Legal counsel includes Davis Polk & Wardwell for Evernorth and Ripple, with Skadden, Arps advising Citigroup

CEO Asheesh Birla has indicated that Evernorth will continue hiring and evaluating acquisition opportunities to strengthen XRP's institutional presence. The company has already committed to using the majority of its capital raise for open-market XRP purchases, though the exact timing and size of these acquisitions will depend on market conditions and the merger timeline.

Citigroup's involvement as capital markets advisor brings significant Wall Street credibility to the transaction, potentially opening doors to additional institutional investors who rely on established financial intermediaries for crypto exposure.

Industry Implications and Future Outlook

Evernorth's emergence signals a broader trend of digital assets moving from speculative instruments to institutional treasury assets. The company's model could inspire similar vehicles for other major cryptocurrencies, creating a new category of publicly-traded crypto treasury companies.

For the XRP ecosystem specifically, the Nasdaq listing provides:

- Price discovery mechanism through regulated equity markets

- Institutional validation of XRP's utility beyond speculation

- Liquidity infrastructure supporting broader market development

- Precedent for regulation of crypto treasury companies

As blockchain technology continues integrating with traditional finance, Evernorth positions itself at the intersection of these worlds. The company's success or failure will likely influence how other digital assets pursue institutional adoption strategies in coming years.

The XRP community, often referred to as the "XRP Army," has demonstrated remarkable resilience throughout the SEC legal battle. Now, with regulatory clarity achieved and institutional capital flowing in, the community's conviction appears validated. The coming months will reveal whether Evernorth can deliver on its ambitious vision of becoming the world's largest publicly-traded XRP treasury while generating sustainable returns for shareholders.

Sources

- Evernorth to Build World's Largest Institutional XRP Treasury via $1B SPAC Merger - Coinspeaker

- XRP Company Evernorth Plans $1 Billion SPAC - PYMNTS

- Evernorth XRP Wallet on XRPScan

- Chris Larsen Offloads 50 Million XRP - Coinpedia

- Ripple-Backed Evernorth Nears $1B XRP Treasury - Coinpedia

- Ripple-backed Evernorth to go public via $1B Nasdaq SPAC - Tech Startups

- XRP Treasury Firm Evernorth to Go Public - CoinLaw

- Ripple-Backed Evernorth Grows XRP Treasury to $1B - CoinGape

- SEC's Long-Running Case Against Ripple Officially Over - CoinDesk

- XRP's 2025 Breakout: Regulatory Clarity - AInvest

- Ripple vs. SEC: How the lawsuit strengthened XRP's narrative - Cointelegraph

- XRP Army Credited with Helping Ripple - CoinDesk

- Court approves Ripple, SEC's motion to dismiss appeal - Crypto Briefing

DISCLAIMER

This newsletter is for informational purposes only and does not constitute investment advice, advertising, or a recommendation to buy, sell, or hold any securities. This content is not sponsored by or affiliated with any of the mentioned entities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.