Crypto Comes of Age: a16z's State of Crypto 2025 Report Reveals Industry Maturation

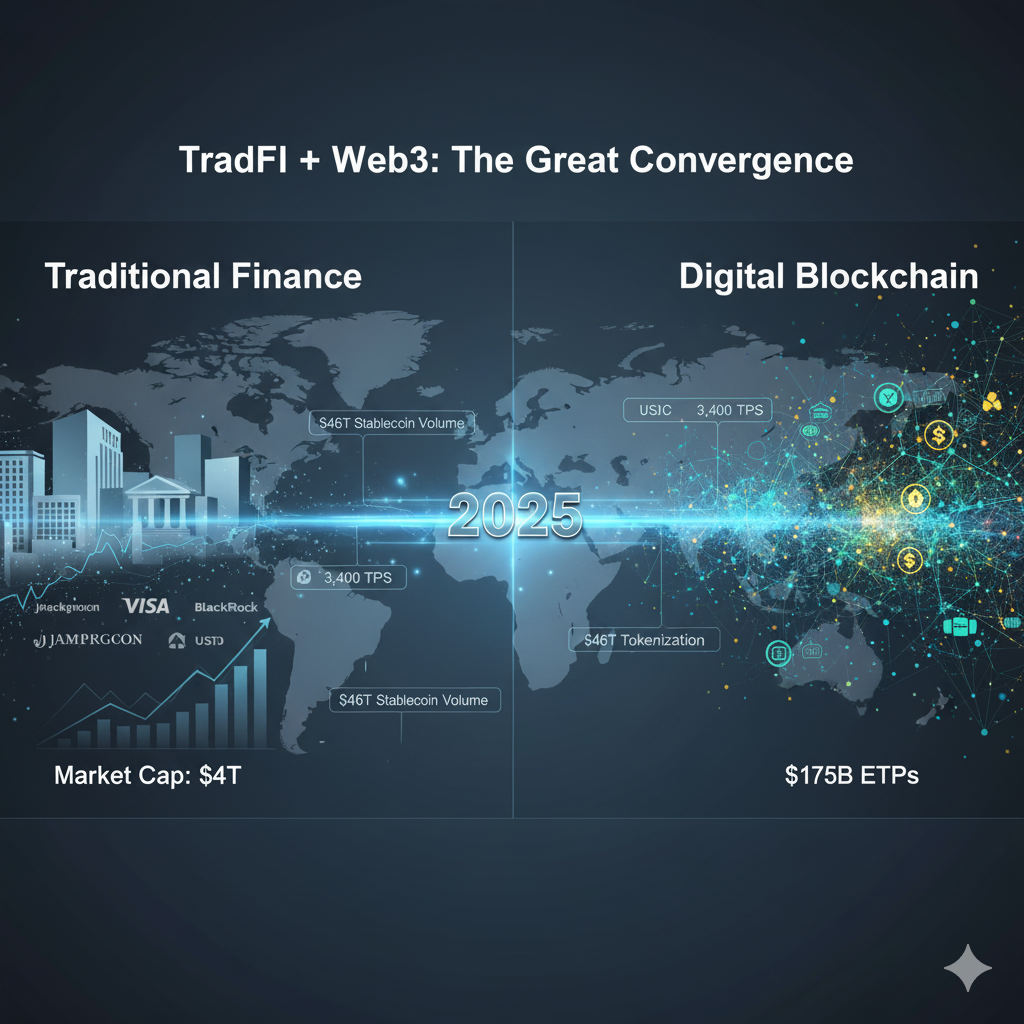

The crypto industry crossed $4 trillion in market cap as major banks embraced blockchain. Stablecoins now process transactions rivaling Visa, while new U.S. legislation provides clarity. a16z's 2025 report reveals an industry transformed from speculation to institutional infrastructure.

Bottom Line: The cryptocurrency industry has crossed a critical threshold in 2025, transitioning from adolescence to maturity as major financial institutions embrace blockchain technology, stablecoins process trillions in transactions, and regulatory clarity finally arrives in the United States.

Andreessen Horowitz's a16z crypto division has released its annual State of Crypto 2025 report, revealing that the crypto market cap surpassed four trillion dollars for the first time, while blockchains now process over thirty-four hundred transactions per second—representing more than a hundredfold increase over the past five years.

The comprehensive analysis, led by a16z crypto founder and managing partner Chris Dixon, paints a picture of an industry that has weathered regulatory storms and market downturns to emerge as a meaningful component of the modern global economy.

Institutional Finance Embraces Digital Assets

Perhaps the most striking development documented in the report is the wholesale embrace of cryptocurrency products by traditional financial giants including Visa, BlackRock, Fidelity, and JPMorgan Chase, alongside tech-native companies like PayPal, Stripe, and Robinhood.

The institutional pivot became undeniable when Stripe announced its intent to acquire stablecoin infrastructure platform Bridge just five days after a16z's 2024 report identified stablecoins as having achieved product-market fit. This acquisition triggered a cascade of similar moves across the financial services industry.

Exchange-traded products have emerged as a key driver of institutional investment, with over one hundred seventy-five billion dollars now held in Bitcoin and Ethereum ETPs, up one hundred sixty-nine percent from sixty-five billion dollars a year ago. BlackRock's iShares Bitcoin Trust has been cited as the most traded Bitcoin exchange-traded product launch of all time.

Beyond direct offerings, major fintechs, including Circle, Robinhood, and Stripe are actively developing or have announced plans to develop new blockchains focused on payments, real-world assets, and stablecoins, potentially bringing massive payment flows onto blockchain infrastructure.

Stablecoins Achieve Mainstream Status

The stablecoin sector experienced explosive growth that rivals traditional payment networks. Stablecoins processed forty-six trillion dollars in total transaction volume over the past year, up one hundred six percent from the previous year, approaching the transaction volume of the ACH network that underlies the entire U.S. banking system.

On an adjusted basis that filters out artificial activity, stablecoins processed nine trillion dollars in the last twelve months, up eighty-seven percent year-over-year, representing more than five times PayPal's throughput and more than half of Visa's volume.

Monthly adjusted stablecoin transaction volume reached new all-time highs approaching one point two five trillion dollars in September 2025 alone, with this activity largely uncorrelated with broader crypto trading volume, indicating genuine non-speculative use cases.

The macroeconomic implications are profound. More than one percent of all U.S. dollars now exist as tokenized stablecoins on public blockchains, and stablecoins have become the seventeenth largest holder of U.S. Treasuries, holding over one hundred fifty billion dollars—more than many sovereign nations.

With over ninety-nine percent of stablecoins denominated in USD and projections suggesting ten-fold growth to more than three trillion dollars by 2030, stablecoins are strengthening dollar dominance even as foreign central banks reduce their Treasury holdings.

Regulatory Environment Transforms in the United States

The United States has reversed its formerly antagonistic stance toward crypto, with the passage of the GENIUS Act and House approval of the CLARITY Act signaling bipartisan consensus that crypto is both here to stay and ready to thrive domestically.

These legislative actions were complemented by Executive Order 14178, which reversed earlier anti-crypto directives and created a cross-agency task force to modernize federal digital-asset policy.

According to the report, this regulatory clarity is creating a path for tokens to function as a new digital primitive, allowing network tokens to complete their economic loops by generating revenue that accrues to tokenholders—creating a new economic engine for the internet.

Blockchain Infrastructure Reaches Critical Mass

Technical improvements have been equally dramatic. In just five years, aggregate transaction throughput across major blockchain networks has increased more than one hundred times, from fewer than twenty-five transactions per second to thirty-four hundred transactions per second, on par with completed trades on the Nasdaq or Stripe's global throughput on Black Friday.

Solana has emerged as one of the most prominent blockchain ecosystems, with its high-performance, low-fee architecture now underpinning everything from decentralized physical infrastructure networks to NFT marketplaces, generating three billion dollars in revenue over the past year. Planned upgrades are expected to double the network's capacity by year-end.

Ethereum continues executing on its scaling roadmap with most economic activity migrating to Layer 2 solutions such as Arbitrum, Base, and Optimism, where average transaction costs have dropped from around twenty-four dollars in 2021 to less than one cent today.

Convergence of AI and Crypto

The report highlights the growing intersection between artificial intelligence and cryptocurrency, noting that decentralized identity systems like World have verified more than seventeen million people to provide proof of human status and help differentiate people from bots.

Protocol standards such as x402 are emerging as a potential financial backbone for autonomous AI agents, helping them make micro-transactions, access APIs, and settle payments without intermediaries in an economy that Gartner estimates could reach thirty trillion dollars by 2030.

The report also addresses concerns about AI centralization, noting that just two companies, OpenAI and Anthropic, control eighty-eight percent of AI-native company revenue, while Amazon, Microsoft, and Google control sixty-three percent of cloud infrastructure and NVIDIA holds ninety-four percent of the data center GPU market. Blockchains offer a potential counterbalance to these centralizing forces.

XRP and Ripple: Capitalizing on the Institutional Wave

The trends documented in a16z's State of Crypto 2025 report have profound implications for XRP and Ripple, which find themselves uniquely positioned at the intersection of multiple growth drivers identified in the report.

Regulatory Clarity Unlocks XRP's Potential

Ripple achieved a landmark victory in August 2025 when the company and the SEC reached a settlement ending their nearly five-year legal battle, with both parties withdrawing their appeals and the ruling reaffirming that XRP is not a security in secondary-market transactions. The one hundred twenty-five million dollar settlement removed years of regulatory uncertainty that had constrained institutional adoption.

This legal clarity enabled the approval of the first U.S. spot XRP ETF, REX-Osprey XRPR, on September 18, 2025, opening the door for institutional capital that had previously remained on the sidelines. XRP's price surged to an all-time high of three dollars and forty cents in July 2025, fueled by renewed investor optimism following the regulatory resolution.

The SEC is expected to decide on several additional spot XRP ETF applications by October 2025, with analysts suggesting that approval could inject five to eleven billion dollars in institutional capital, potentially mirroring Bitcoin's 2024 ETF-driven rally.

CME Group introduced XRP futures in May 2025, which saw five hundred forty-two million dollars in trading volume during their first month, with about forty-five percent originating from outside North America, while open interest climbed from around seventy million dollars to surpass one billion dollars by August.

Stablecoin Infrastructure Drives XRP Utility

The explosive growth in stablecoin adoption documented in the a16z report directly benefits Ripple's business model. Ripple's RLUSD stablecoin, launched in December 2024 and fully collateralized by U.S. Treasuries and cash equivalents with monthly audits and NYDFS compliance, had its market cap surge to four hundred fifty-five million dollars by Q2 2025.

Ripple's RLUSD stablecoin settled forty billion dollars in annualized volume via the XRP Ledger, creating synergy between XRP and stablecoins that underscores the token's adaptability in hybrid financial ecosystems.

Critically, every RLUSD transaction requires XRP for fees on the XRP Ledger, creating direct demand for the token while the ledger's monthly escrow releases create deflationary pressure with one billion XRP released monthly and unused tokens returned to escrow.

Use cases are expanding rapidly, with Ondo Finance's tokenized U.S. Treasuries now using RLUSD as a settlement medium, while Ripple's On-Demand Liquidity service processed one point three trillion dollars in Q2 2025, leveraging RLUSD to cut cross-border remittance costs by seventy percent in corridors like Japan-Philippines and U.S.-Africa.

Institutional Adoption Accelerates

Major financial institutions including Santander, SBI Holdings, and American Express have deepened partnerships with Ripple, leveraging XRP's efficiency in cross-border payment corridors. South Korean and Japanese institutions have also signaled strong support, with Upbit accumulating forty-five point five million dollars in XRP and Gumi Inc. allocating seventeen million dollars.

Ripple has formally applied for a U.S. national banking charter with the Office of the Comptroller of the Currency, a bold move that would position the company at the intersection of traditional and digital finance. A successful charter would enable deeper institutional confidence, increase XRP's utility as a regulated bridge asset for tokenized deposits and cross-border trades, and provide regulatory validation signaling official recognition of blockchain-based financial infrastructure.

Ripple's recent partnership with a leading South African bank marks significant expansion into Africa's fast-developing fintech landscape, while a multi-party collaboration with DBS Bank and Franklin Templeton in Singapore will leverage the XRP Ledger to tokenize and trade money market funds, stablecoins, and other financial products.

At Apex 2025, XRPL's flagship event held in June, five new stablecoins went live on the ledger—USDC, XSGD, EUROP, RLUSD, and USDB—each bringing region-specific utility, regulatory compliance, and fiat-backed credibility, while Ondo Finance's tokenized U.S. Treasuries enabled Qualified Purchasers to access these assets twenty-four-seven using RLUSD for settlement.

XRP's Strategic Position in Hybrid Finance

XRP's biggest role in 2025 is serving as a connector in a financial sector becoming a hybrid world where crypto, stablecoins, and fiat currency coexist, with Ripple's network allowing institutions to access crypto liquidity without abandoning existing financial regulations.

What sets XRP apart is its capacity to function as a borderless bridge asset, linking disparate stablecoin networks across various regulatory environments, allowing XRP to navigate cross-border regulatory obstacles that stablecoins alone cannot.

With XRP's market capitalization surpassing one hundred eighty billion dollars, the token has emerged as a key player in institutional portfolios, with its low correlation to Bitcoin and Ethereum making it an attractive diversification tool.

BitGo reported that XRP made up three point nine percent of its holdings as of June 30, 2025, highlighting its growing share in regulated institutional portfolios.

Risk Factors and Future Outlook

Despite the positive momentum, challenges remain for XRP's adoption trajectory. Regulatory uncertainty outside the United States remains a significant hurdle, along with competition from robust stablecoins and central bank digital currencies, while the success of Ripple's RLUSD stablecoin in capturing market share will play a crucial role in determining XRP's growth capacity.

However, the confluence of regulatory clarity, institutional infrastructure development, and proven utility in cross-border payments positions XRP to capitalize on the broader industry maturation documented in the a16z report. As traditional finance and blockchain technology continue converging, XRP's role as a bridge asset becomes increasingly valuable in the hybrid financial ecosystem emerging in 2025 and beyond.

Looking Forward

The report concludes that seventeen years into crypto's existence, the industry is leaving its adolescence and entering adulthood, with infrastructure, distribution, and hopefully soon regulatory clarity combining to take this technology mainstream.

The report estimates there are roughly forty to seventy million active crypto users, representing an increase of about ten million over the last year, though this remains a fraction of the estimated seven hundred sixteen million people who own crypto. The gap between passive holders and active users represents a significant opportunity for builders to convert ownership into engagement.

Notably, while the AI industry attracted about one thousand workers from crypto since ChatGPT's launch in November 2022, blockchain companies gained an equivalent number of employees from other industries including traditional finance and tech during the same period, suggesting the crypto builder ecosystem remains robust despite competition from adjacent technologies.

For investors and industry participants, the message is clear: the speculative phase of cryptocurrency is giving way to a utility-driven era where real-world applications, institutional adoption, and regulatory frameworks are creating sustainable foundations for long-term growth.

Sources

- State of Crypto 2025 Report - a16z crypto

- State of Crypto Dashboard - a16z crypto

- Chris Dixon Biography - a16z crypto

- Fortune: Crypto Lost 1,000 Jobs to AI - Fortune Crypto

- XRP's 2025 Breakout: Regulatory Clarity - AI Invest

- How XRP's Regulatory Clarity Opened Doors - Cointelegraph

- Ripple Eyes U.S. Banking License - CoinDCX

- Ripple's Strategic Expansion into Custody - AI Invest

- Apex 2025: Turning Point for Institutional Adoption - Ripple

- XRP Institutional Adoption Analysis - XBTFX

DISCLAIMER: This newsletter is for informational purposes only and does not constitute investment advice, advertising, or a recommendation to buy, sell, or hold any securities. This content is not sponsored by or affiliated with any of the mentioned entities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.