Crypto.com CEO Demands Investigation After Historic $20B Market Crash

Crypto.com CEO demands regulatory investigation after historic $20B liquidation event. Binance faces scrutiny over pricing errors and platform failures. XRP plunges 41% before swift recovery. Full analysis of the largest crypto crash in history and its impact on XRP's path to ETF approval.

TL;DR: Crypto.com CEO Kris Marszalek has called for regulatory scrutiny of exchanges following the largest liquidation event in crypto history—$20 billion wiped out in 24 hours—amid allegations of pricing errors, frozen trading interfaces, and platform malfunctions during the October 10-11 market crash.

Unprecedented Liquidation Event Rocks Crypto Markets

The cryptocurrency market experienced its most devastating flash crash in history on October 10-11, 2025, with approximately $20 billion in leveraged positions liquidated across major exchanges. The catastrophic event, triggered by President Trump's announcement of 100% tariffs on Chinese goods, sent shockwaves through the industry and exposed critical vulnerabilities in centralized exchange infrastructure.

Crypto.com CEO Kris Marszalek quickly emerged as the industry's voice of accountability, publicly demanding regulatory investigations into exchanges that experienced the heaviest losses. In a direct post on X (formerly Twitter), Marszalek questioned whether platforms deliberately slowed operations, mispriced assets, or failed to maintain essential safeguards during the crisis.

"$20B in liquidations, a lot of users got hurt," Marszalek wrote. "The job of regulatory bodies is to protect the consumers and assure market integrity." His call specifically urged regulators to examine whether exchanges slowed down operations to prevent users from trading, whether trades were priced correctly in line with market indexes, and whether proper anti-manipulation and compliance controls remained in place during the volatility.

Binance at the Center of Controversy

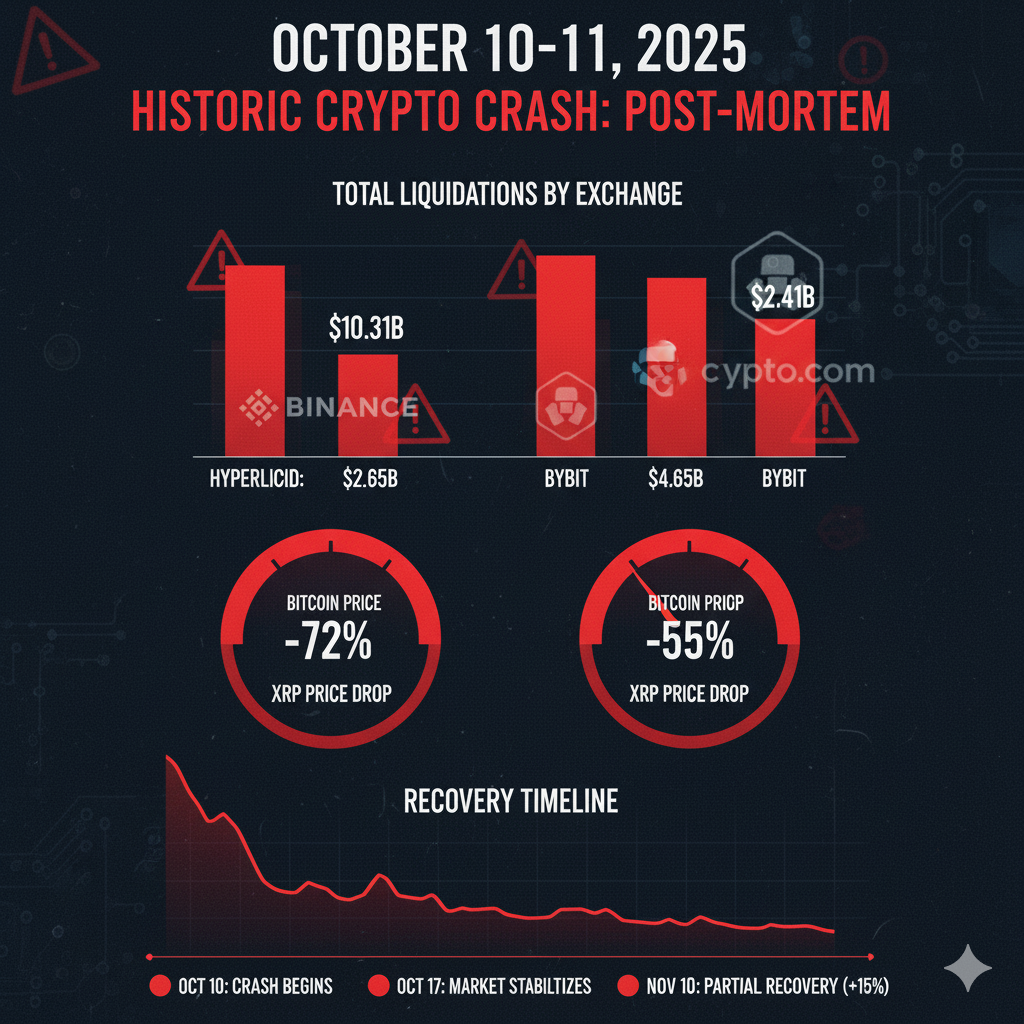

While multiple exchanges suffered massive liquidations—Hyperliquid led with $10.31 billion, followed by Bybit at $4.65 billion—Binance found itself under intense scrutiny for alleged pricing errors and technical failures. According to CoinGlass data, Binance recorded $2.41 billion in liquidations during the crash.

Multiple traders reported severe technical issues on Binance during the critical hours, including frozen trading interfaces, unexecuted limit orders, and disabled stop-loss functions. Most concerning were allegations that Binance's internal price oracles caused artificial depegging of major assets including Ethena's USDe (which dropped to $0.66), BNSOL (Binance Solana), and WBETH (Wrapped Beacon ETH).

One prominent trader known as "Cowboy" on X accused Binance of effectively locking users out of their accounts during the crash, preventing investors from managing positions or "buying the dip." Another analyst, ElonTrades, highlighted that bad actors allegedly exploited flaws in Binance's price structure by manipulating tokens valued according to Binance's internal order books rather than external oracles.

Binance co-founder Yi He acknowledged the complaints in a public statement, citing "significant market fluctuations and a substantial influx of users" as contributing factors. She clarified that losses due to market conditions would not be compensated, but platform-related errors would be reviewed. On October 12, 2025, Binance announced it would pay $283 million in compensation to users affected by the pricing errors across two waves of distributions.

The exchange also released a technical explanation, attributing some issues to obsolete limit orders dating back to 2019 that exacerbated price drops, along with display errors that made certain assets appear to crash to zero. Binance stated it would transition from internal to external oracles by October 14, 2025, to prevent future pricing discrepancies.

Broader Market Impact and Recovery

The flash crash didn't discriminate—every major cryptocurrency suffered devastating losses. Bitcoin plummeted over 10% to briefly fall below $110,000 before recovering to around $115,000. Ethereum crashed approximately 15-20% below $4,000 before rebounding above $4,100. The cascade was particularly brutal for altcoins, with some experiencing drops of 30-40% within minutes.

Trading volumes surged 164% above 30-day averages across exchanges as forced liquidations triggered algorithmic selling cascades. The crash outpaced the liquidations seen during the FTX collapse, which recorded around $1.6 billion—making this event more than 10 times larger.

Despite the severity, the market demonstrated remarkable resilience. Within 48 hours, Bitcoin had recovered to $115,000 and Ethereum climbed back above $4,100. Analysts attributed the swift recovery to institutional accumulation during the dip and the absence of fundamental issues with blockchain infrastructure. Bitwise CIO Matt Hougan noted that decentralized finance venues like Uniswap, Hyperliquid, and Aave maintained normal operations throughout the volatility, suggesting the crypto infrastructure performed better than traditional markets might have under similar strain.

Regulatory Implications and Industry Response

Marszalek's call for investigation resonates beyond simple regulatory oversight—it represents a pivotal moment for crypto market structure. His specific demands included:

- Thorough review of fairness of trading practices during high volatility

- Investigation into whether platforms intentionally slowed or halted trading

- Assessment of asset pricing accuracy against standard market indexes

- Examination of trade monitoring and anti-money laundering programs

- Review of internal trading teams' "Chinese walls" to prevent conflicts of interest

The crypto community's response has been mixed. While many praised Marszalek for standing up for consumer protection, critics noted potential competitive motivations given Crypto.com's rivalry with Binance. Nonetheless, the incident has reignited debates about whether centralized exchanges should bear greater responsibility for preventing crises rather than simply compensating users after the fact.

Industry experts suggest this event could accelerate regulatory frameworks around exchange risk management, liquidation mechanisms, and price oracle integrity. The incident also highlights the growing maturity gap between decentralized protocols, which largely functioned properly, and centralized platforms that struggled under pressure.

XRP and Ripple: Weathering the Storm

XRP, Ripple's native token, was among the assets hit hardest during the flash crash. The token plummeted 41-42% from approximately $2.77 to as low as $1.64 on some exchanges, with over $150 million in XRP futures liquidated. The dramatic $1.14 intraday range marked one of the widest swings in XRP's 2025 trading history.

However, XRP demonstrated remarkable resilience by quickly recovering to around $2.40-$2.47. Analysts described the rebound as driven by institutional accumulation rather than retail speculation, with large holders rebuilding positions in the $2.34-$2.45 range. Trading volumes spiked to 817 million—nearly triple recent daily averages—confirming the capitulation-grade turnover typical of market bottoms.

Ripple's Strengthened Position Post-SEC Settlement

The timing of this crash comes during a transformative period for Ripple and XRP. In August 2025, Ripple and the U.S. Securities and Exchange Commission jointly dismissed their appeals, ending a five-year legal battle with Ripple agreeing to a $125 million settlement. The resolution officially classified XRP as a utility token rather than a security—a distinction with profound implications for institutional adoption.

This regulatory clarity has directly accelerated XRP's path to mainstream financial products. In September 2025, the first U.S. spot XRP ETF—the REX-Osprey XRP ETF—launched successfully. As of October 2025, six additional XRP ETF applications from major asset managers including Grayscale, Bitwise, Franklin Templeton, 21Shares, WisdomTree, and CoinShares await SEC decisions, with analysts predicting a 82-96% probability of approval by year-end 2025.

Impact on XRP Price Potential

The flash crash, while painful in the short term, may have created an attractive entry point for institutional investors ahead of anticipated ETF approvals. Technical analysts note that XRP's quick recovery and ability to maintain support above $2.30 suggests underlying strength. Market analyst Patrick Riley projected that a close above $3.115 could result in XRP's most bullish weekly candle ever.

Key resistance remains at $3.05, with upside projections toward $3.65-$4.00 if recovery momentum sustains. Some analysts, including prominent figure Egrag Crypto, maintain long-term targets as high as $19-$100 based on XRP's technical patterns and potential "supply shock" from institutional ETF purchases directly from the market.

Ripple's Business Operations and Partnerships

Despite market turbulence, Ripple's core business—RippleNet and its On-Demand Liquidity (ODL) service—continues expanding globally. The company's focus on cross-border payment solutions for financial institutions positions it well for sustained adoption regardless of short-term price volatility. The settlement with the SEC has already resulted in several exchanges relisting XRP, significantly improving liquidity and accessibility.

The launch of Ripple USD (RLUSD), the company's stablecoin, provides additional diversification for its payment network. However, the company's control of approximately 40 billion XRP tokens remains a consideration for investors, as gradual releases could impact supply dynamics.

Legal Standing and Regulatory Outlook

With the SEC case conclusively settled, XRP now operates in a clearer regulatory environment than most cryptocurrencies. The classification as a utility token rather than a security removes significant barriers to institutional adoption and exchange listings. This precedent may influence how regulators approach other tokens with clear functional use cases.

The pending ETF approvals represent the next critical milestone. Should the SEC approve multiple XRP ETFs in October 2025 as anticipated, it would mark the first time the agency extends its ETF framework beyond Bitcoin and Ethereum—potentially opening the door for broader altcoin investment products.

Key Takeaways and Market Outlook

The October 2025 crypto flash crash represents a watershed moment for digital asset markets:

- Infrastructure Stress Test: Centralized exchanges revealed critical vulnerabilities in pricing mechanisms and trading infrastructure, while DeFi protocols largely maintained stability

- Regulatory Reckoning: Crypto.com CEO's call for investigation may accelerate regulatory frameworks around exchange risk management and consumer protection

- Market Resilience: Swift recovery suggests institutional support and mature market structure, with no fundamental blockchain failures

- XRP's Position: Despite severe short-term impact, XRP's regulatory clarity and pending ETF approvals position it favorably for long-term institutional adoption

- Transparency Imperative: The incident underscores the need for exchanges to implement external oracles, robust risk controls, and clear communication during volatility

Looking ahead, traders should monitor whether exchanges implement meaningful reforms in oracle systems, liquidation mechanisms, and trading infrastructure. For XRP specifically, the October ETF decisions and continued institutional accumulation around $2.30-$2.50 support levels will be critical indicators of future price direction.

The crypto market has proven its ability to recover quickly from severe shocks, but this event serves as a stark reminder that infrastructure—not just innovation—must evolve to support the industry's growing institutional participation and multi-trillion-dollar valuations.

Sources

- CryptoSlate: Crypto.com CEO urges regulators to probe exchanges

- CoinDesk: Bitwise CIO Analysis of Oct. 10 Flash Crash

- Cointelegraph: Crypto.com CEO calls for probe

- Shib Daily: Crypto Market Crash Coverage

- Cointribune: Binance, Bybit, Hyperliquid targeted after crash

- CoinDesk: XRP Price Analysis After Flash Crash

- AInvest: XRP Black Swan Crash Analysis

- AInvest: Regulatory Clarity and Market Transformation

- CoinMarketCap: SEC Drops Ripple Appeal

- ETF.com: SEC Drops Ripple Case as XRP ETF Odds Rise

DISCLAIMER: This newsletter is for informational purposes only and does not constitute investment advice, advertising, or a recommendation to buy, sell, or hold any securities. This content is not sponsored by or affiliated with any of the mentioned entities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.