Critics Slam MicroStrategy's "Reflexive Loop" as Potential Ponzi Scheme

Analyst calls MicroStrategy a 'giant Ponzi scheme' relying on a reflexive loop: issue debt to buy Bitcoin, drive up BTC price, boost market cap, repeat. With 629,000+ BTC worth $41B+, critics warn the cycle collapses if Bitcoin stagnates. Saylor defends it as 'Manhattan real estate economics.

Critics Slam MicroStrategy's "Reflexive Loop" as Potential Ponzi Scheme

Rising analyst concerns about the sustainability of Michael Saylor's Bitcoin treasury strategy spark heated debate as MSTR holds over 629,000 BTC worth $41+ billion.

MicroStrategy's aggressive Bitcoin acquisition strategy faces mounting criticism from analysts who argue the company operates a "giant Ponzi scheme" dependent on continuous Bitcoin price appreciation. As of December 2024, the company holds approximately 446,400 Bitcoins valued at roughly $41.4 billion, making it the world's largest corporate Bitcoin holder.

The "Reflexive Loop" Controversy

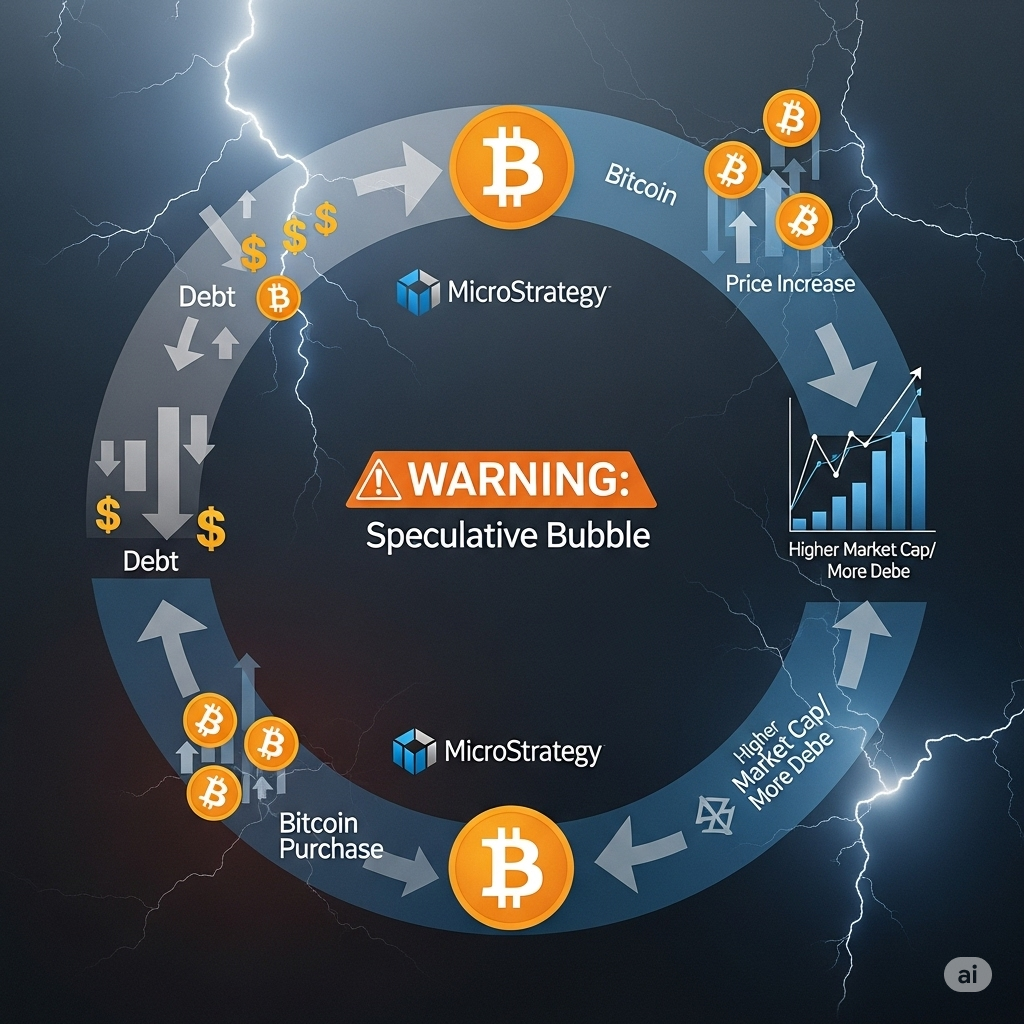

Financial analyst Jacob King, a contributor to the Whalewire newsletter, has emerged as one of the most vocal critics, arguing that MicroStrategy's model relies on a dangerous feedback loop: issuing debt or equity to purchase Bitcoin drives up the cryptocurrency's price, which increases MicroStrategy's market capitalization, allowing the company to raise more capital for further Bitcoin acquisitions.

MicroStrategy’s entire business model in one chart: a reflexive loop that only works if BTC keeps rising.

— Jacob King (@JacobKinge) August 20, 2025

When this Ponzi loop inevitably implodes, it’ll make FTX, Enron, and Madoff look like ants. pic.twitter.com/Ov4zsT88Gr

Adding fuel to the controversy, crypto analyst Vincent Van Code has pointed to concerning performance divergence between MicroStrategy and Bitcoin. In a viral post, Van Code highlighted that while Bitcoin declined 11.34% in the tracked period, MSTR plummeted 28.12%, suggesting the stock's premium to Bitcoin value may be unsustainable. Van Code warns that MicroStrategy is "registered as a public company whose nature of business is SOFTWARE" but is "currently skating on thin ice with regulators as it hoards billions in BTC for its treasuries."

As I have advised people, MSTR is registered as a public company whose nature of business is SOFTWARE.

— Vincent Van Code (@vincent_vancode) August 20, 2025

It is currently skating on thin ice with regulators as it hoards billions in BTC for its treasuries.

That is, it's core business, is software, and losing millions each year.… pic.twitter.com/rZQntoHz0l

Van Code's analysis emphasizes that MicroStrategy's core software business "is losing millions each year" and is "only propped up by paper gains in BTC." He provocatively asks: "This MF is a oily salesman who is about to become the next SBF" - referencing disgraced FTX founder Sam Bankman-Fried. The chart data Van Code shared shows MSTR trading at $7,188 with a sharp decline, illustrating the stock's extreme volatility relative to Bitcoin's more modest fluctuations.

The criticism centers on what King calls "MicroStrategy's business model is a giant scam and relies on a reflexive loop" where each Bitcoin purchase theoretically boosts the company's valuation, enabling larger future purchases. King warns: "The cycle only works if BTC keeps rising. If BTC stalls or crashes (which it will), the loop collapses. This is unsustainable and is a giant Ponzi".

According to the critics' framework, the process works as follows:

- MicroStrategy issues convertible notes or equity

- Proceeds fund massive Bitcoin purchases

- Bitcoin price increases from buying pressure

- MSTR stock price rises with Bitcoin holdings value

- Higher market cap enables more debt/equity issuance

- Cycle repeats with larger purchase amounts

MicroStrategy's Defense and Regulatory Standing

Vincent Van Code's critique goes beyond just financial performance, highlighting potential regulatory risks. He notes that MicroStrategy "is currently skating on thin ice with regulators" while operating what he characterizes as essentially a Bitcoin treasury company under the guise of a software business. This disconnect between the company's official business registration and its actual operations could attract unwanted regulatory scrutiny.

Van Code's comparison of Michael Saylor to Sam Bankman-Fried is particularly damning, suggesting that both executives built unsustainable business models that prioritize crypto speculation over legitimate business fundamentals. The reference to SBF, who was convicted of fraud and sentenced to 25 years in prison, implies Van Code believes MicroStrategy's strategy could similarly end in catastrophe.

The performance data Van Code shared reveals troubling signs: MSTR's 28.12% decline significantly outpaced Bitcoin's 11.34% drop, indicating the stock trades at an increasingly unstable premium to its underlying Bitcoin holdings. This divergence suggests investors are paying far more for MSTR shares than the actual value of the company's Bitcoin assets would justify.

Michael Saylor, MicroStrategy's co-founder and executive chairman, has pushed back against Ponzi scheme allegations, comparing the strategy to Manhattan real estate development: "Every time Manhattan real estate goes up in value, they issue more debt to develop more real estate. That's why your buildings are so tall in New York City. It's been going on for 350 years. I would call it an economy".

Legal experts note that MicroStrategy operates as a fully regulated public company that files quarterly and annual reports with the SEC detailing its Bitcoin holdings, debt, and key financial metrics. This transparency contrasts sharply with typical Ponzi schemes, which rely on secrecy and false representations.

Prominent Bitcoin analyst Lyn Alden has defended MicroStrategy, citing that the company exhibits none of the SEC's traditional Ponzi scheme red flags, including lack of public disclosure, unregistered securities, promises of no risk, overly consistent yield, or difficulty receiving payments.

Financial Engineering or Unsustainable Model?

MicroStrategy announced a $42 billion capital plan in October 2024, including a $21 billion at-the-market equity offering and $21 billion through fixed-income securities to expand Bitcoin holdings. The so-called "21/21 Plan" aims to raise these funds over three years.

Investment advisory firm RIA notes that MicroStrategy's model creates a mathematical advantage: when the company issues $2.5 billion in preferred stock to buy approximately 21,000 Bitcoin, the purchase could increase Bitcoin prices by over 7%, resulting in roughly $5 billion in gains on MicroStrategy's existing 607,000 Bitcoin holdings.

However, critics argue that MicroStrategy cannot afford to sell its Bitcoin holdings without potentially crashing both the cryptocurrency market and its own stock price, creating what they describe as a "self-imposed golden cage" that makes the company extremely susceptible to market downswings.

XRP/Ripple Analysis: Potential Market Implications

The MicroStrategy controversy carries significant implications for the broader cryptocurrency ecosystem, including XRP and Ripple:

Market Contagion Risk: If MicroStrategy's model proves unsustainable and the company faces forced Bitcoin liquidation, the resulting market crash could severely impact all major cryptocurrencies, including XRP. MicroStrategy's holdings now represent over 2.5% of Bitcoin's total supply, making any large-scale selling potentially catastrophic for crypto markets.

Regulatory Scrutiny: Increased regulatory attention on MicroStrategy's practices could extend to other crypto-focused companies and affect regulatory clarity that XRP has sought following its legal battles with the SEC.

Corporate Treasury Trends: MicroStrategy's approach has inspired other companies to adopt Bitcoin treasury strategies, with 82 publicly listed companies now holding Bitcoin collectively worth around 656,700 BTC. A collapse could reverse this corporate adoption trend, potentially affecting institutional demand for all cryptocurrencies.

Investment Vehicle Alternatives: The controversy highlights risks in concentrated crypto exposure strategies, potentially driving institutional interest toward more diversified approaches or direct cryptocurrency holdings rather than proxy investments.

Regulatory and Tax Pressures

MicroStrategy faces additional challenges from new tax regulations, with the company announcing plans to redeem $1.05 billion in convertible notes due to potential tax implications under corporate alternative minimum tax (CAMT) rules, which could impose a 15% tax rate on the company's $18 billion in unrealized Bitcoin gains.

The company also faces a class-action investigation from Pomerantz Law Firm following disclosure of a $5.91 billion unrealized loss on digital assets in Q1 2025, with allegations that executives may have downplayed risks tied to Bitcoin's price volatility.

Market Performance and Volatility

Despite concerns, MicroStrategy stock rose over 370% in 2024, significantly outperforming Bitcoin's 123% gain during the same period. The company's Bitcoin holdings are currently worth over $46 billion against $7 billion in debt.

However, recent performance shows divergence, with Bitcoin remaining relatively stable while MSTR declined nearly 50% in recent months, highlighting the stock's susceptibility to market sentiment beyond just Bitcoin price movements.

Consequences If Critics Prove Correct

If the Ponzi scheme allegations prove accurate, the consequences could be severe:

For MicroStrategy: Potential bankruptcy, forced liquidation of Bitcoin holdings, massive shareholder losses, and possible criminal charges for executives.

For Bitcoin Markets: A fire sale of 629,000+ Bitcoin could trigger a catastrophic price collapse, potentially dropping Bitcoin below key support levels and destroying confidence in corporate Bitcoin adoption.

For Crypto Industry: The failure of the most prominent corporate Bitcoin strategy could set back institutional adoption by years, affect regulatory treatment of cryptocurrencies, and damage credibility of Bitcoin as a treasury asset.

For XRP/Ripple: Secondary effects from broader crypto market collapse could undermine XRP price stability and affect Ripple's business partnerships, despite being fundamentally unrelated to MicroStrategy's model.

Key Takeaways

The MicroStrategy debate represents a critical test case for aggressive Bitcoin corporate strategies. While supporters argue the company operates transparently within regulatory frameworks and benefits from legitimate Bitcoin appreciation, critics warn of systemic risks from over-leveraged, Bitcoin-dependent business models.

As Ki Young Ju, CEO of CryptoQuant, notes: MicroStrategy only goes bankrupt "if an asteroid hits Earth," pointing to Bitcoin's historical resilience. However, the sustainability question remains: can a feedback loop dependent on continuous asset appreciation truly represent sound corporate strategy, or does it constitute a sophisticated form of market manipulation?

The answer may determine not just MicroStrategy's fate, but the future of corporate cryptocurrency adoption and the broader digital asset market's maturation.

DISCLAIMER: This newsletter is for informational purposes only and does not constitute investment advice or a recommendation to buy, sell, or hold any securities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.

Sources

- CoinTelegraph - "MicroStrategy's Bitcoin debt loop: Stroke of genius or risky gamble?" January 9, 2025

- Crypto News - "MicroStrategy is a 'desperate' Ponzi scheme: analyst" December 18, 2024

- CCN - "Is MicroStrategy a Ponzi Scheme? Michael Saylor's MSTR Bitcoin Strategy Under Growing Scrutiny" January 14, 2025

- Trade The Pool - "MicroStrategy Stock and Bitcoin 2025: Dive into Bitcoin's Impact" June 17, 2025

- TheStreet Crypto - "Michael Saylor Responds to Critics Who Call Microstrategy A Ponzi Scheme" December 17, 2024

- Bitwise Europe - "Is (Micro)Strategy a risk for Bitcoin?"

- Real Investment Advice - "A Ponzi Scheme: The Graph Driving MicroStrategy And Others"

- Bitcoin Ethereum News - "The great MSTR Ponzi scheme debate"

- Crypto Briefing - "MicroStrategy to redeem $1.05B in convertible notes amid concerns over Bitcoin tax rules" January 24, 2025

- AInvest - "Pomerantz Investigation and MicroStrategy's Bitcoin Paradox: A Risky Gamble?" April 29, 2025