CME Launches CFTC-Regulated XRP Options: Wall Street Validation Arrives

CME launches CFTC-regulated XRP options today, marking Wall Street-level legitimacy for the digital asset. With physical settlement, institutional rails, and definitive legal clarity, XRP has officially arrived in traditional finance. Read the full analysis.

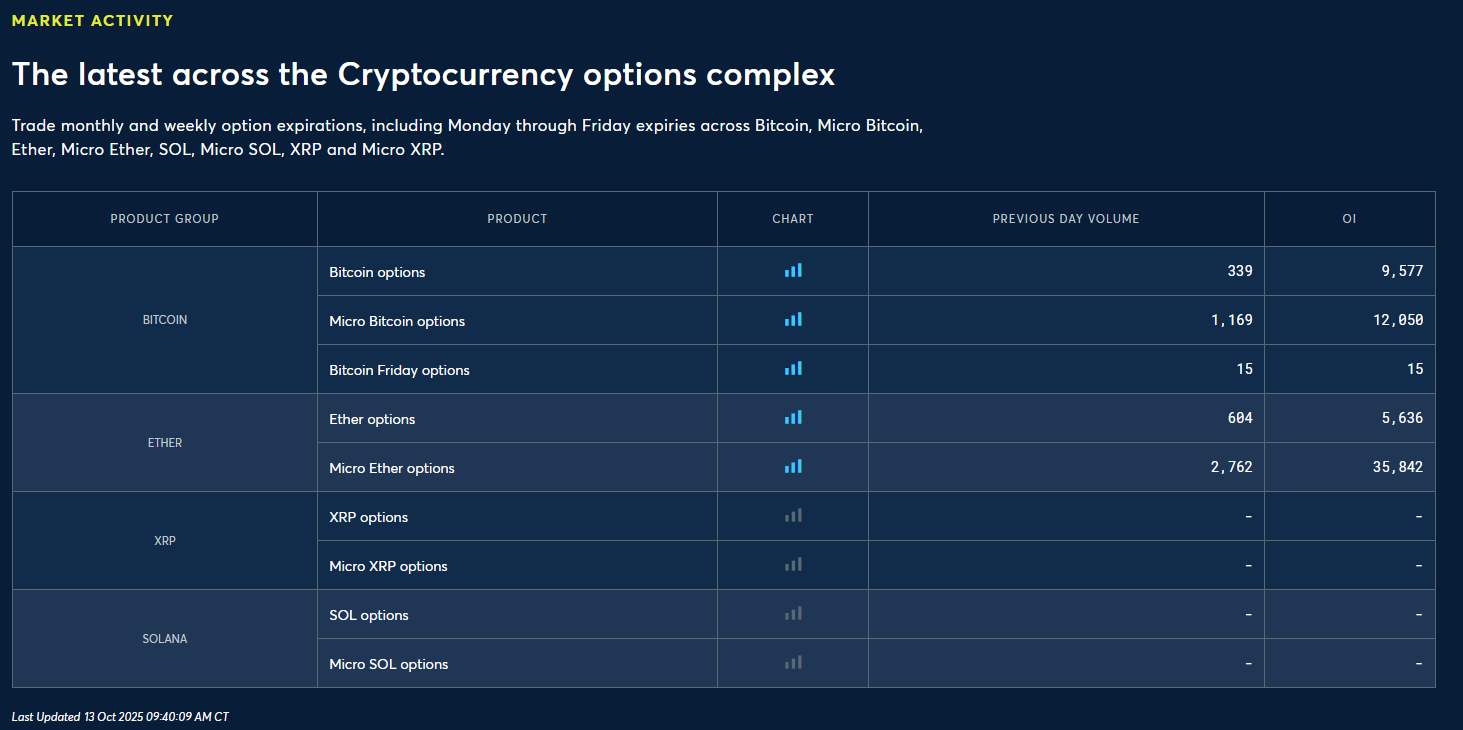

Bottom Line: CME Group has officially launched CFTC-regulated options on XRP futures today, October 13, 2025, marking a watershed moment for institutional crypto adoption and cementing XRP's status as a Wall Street-grade digital asset.

The Chicago Mercantile Exchange has officially launched options contracts on XRP futures, providing institutional and retail traders with physically settled derivatives, both standard and micro contracts, and real institutional rails. This milestone comes less than five months after CME introduced XRP futures in May 2025, which saw remarkable adoption with over 370,000 contracts ($16.2 billion in notional value) traded through August.

Giovanni Vicioso, CME Group Global Head of Cryptocurrency Products, emphasized that the launch builds on "significant growth and increasing liquidity" seen across the exchange's XRP and Solana futures. The new options contracts include daily, monthly, and quarterly expiries, offering sophisticated risk management tools that were previously unavailable for XRP traders.

Why This Matters Now

The timing of this launch is no coincidence. XRP achieved definitive legal clarity in August 2025 when the SEC and Ripple jointly dismissed their appeals, officially ending the five-year legal battle. Judge Analisa Torres's 2023 ruling—which determined that XRP sold on public exchanges is not a security—now stands as the final judgment. This regulatory clarity positioned XRP uniquely among major cryptocurrencies, providing the legal foundation necessary for traditional financial institutions to offer regulated derivatives.

CME's CFTC-regulated marketplace represents the gold standard for derivatives trading, offering price transparency, central clearing, and institutional-grade infrastructure. The exchange's XRP products settle to the CME CF XRP-Dollar Reference Rate, calculated daily at 4:00 p.m. London time, ensuring pricing credibility that institutional investors demand.

According to Tim McCourt, CME's Global Head of Equity & FX Products, speaking at the Token2049 conference in October, institutional adoption of XRP futures has been rapid. XRP futures crossed the $1 billion open interest threshold in August 2025, just three months after launch, with record monthly average daily volume of $385 million in notional trading.

Market Implications and Institutional Demand

The launch of regulated options contracts transforms XRP's market dynamics in several critical ways. Options provide institutions with precise hedging capabilities, enabling them to manage downside risk while maintaining upside exposure—a requirement for treasury departments and asset managers seeking crypto allocation. Market makers like Cumberland and FalconX have welcomed the additions, with FalconX's global co-head of markets Joshua Lim noting increased demand for "institutional hedging tools" as digital asset treasury adoption grows.

The physical settlement structure means actual XRP delivery for futures contracts, creating genuine price discovery and tighter linkage between spot and derivatives markets. Both standard contracts (50,000 XRP) and micro contracts (2,500 XRP) accommodate institutional volume while remaining accessible to active retail traders.

Combined cryptocurrency futures and options trading on centralized exchanges reached $9.72 trillion in August 2025, the highest monthly volume of the year. CME's total crypto futures open interest has doubled year-over-year to $30-35 billion daily, demonstrating surging institutional participation across digital assets.

XRP/Ripple-Specific Analysis

Legal Standing and Regulatory Clarity

XRP now possesses what many competitors lack: explicit judicial validation. The August 2025 settlement left Judge Torres's ruling intact, establishing that XRP secondary market sales are not securities transactions. This clarity was essential for CME to launch regulated derivatives, as CFTC oversight requires legal certainty about the underlying asset's status.

Stuart Alderoty, Ripple's Chief Legal Officer, confirmed that the final settlement involved Ripple paying $50 million of the original $125 million penalty (with $75 million returned from escrow), while the SEC agreed to lift its injunction. This resolution cost Ripple far less than the $2 billion penalty the SEC originally sought and closed the chapter on regulatory uncertainty that had hung over XRP since December 2020.

Price Potential and Market Positioning

XRP has demonstrated significant price appreciation following key regulatory and institutional developments. The token surged 72% after Judge Torres's July 2023 ruling, jumping from $0.47 to $0.81. Following the final dismissal of appeals in August 2025, XRP rose approximately 7%, trading around $3.27. The token reached an all-time high of $3.65 in July 2025, reflecting renewed investor confidence in its regulatory clarity and institutional adoption trajectory.

The launch of regulated derivatives typically enhances price stability and liquidity while attracting sophisticated market participants. Bitcoin and Ethereum both experienced sustained institutional inflows following the introduction of CME futures and options. XRP's options launch today positions it to capture similar institutional capital flows, particularly from hedge funds and asset managers who require regulated instruments for compliance and risk management.

Ripple's Business Operations and Strategic Positioning

Beyond XRP's market dynamics, Ripple Labs has aggressively expanded its corporate footprint. In April 2025, Ripple acquired Hidden Road, a prime broker, for $1.25 billion—one of crypto's largest M&A transactions. This acquisition provides Ripple with deeper trading infrastructure and liquidity capabilities for institutional clients.

Ripple has also applied to establish the Ripple National Trust Bank in New York, aiming to facilitate institutional liquidity and global settlement using both XRP and its stablecoin, RLUSD. If approved, this would enable Ripple to bypass traditional intermediaries like ACH and FedWire, directly integrating with U.S. financial infrastructure. Such banking capabilities would position Ripple uniquely among crypto companies, combining regulated banking services with blockchain-based payment rails.

Partnership Opportunities and Adoption Prospects

International developments are driving renewed optimism for XRP adoption. Japan's SBI Holdings, a major Ripple stakeholder, filed to launch Japan's first Bitcoin/XRP ETF and plans to purchase up to $1 billion in XRP as part of its diversification strategy. South Korea's BDACS, a regulated crypto custodian, integrated XRP into its platform, enabling institutional access to major Korean exchanges including Upbit and Coinone.

The first U.S.-listed XRP spot ETF launched in September 2025 through REX-Osprey, trading under ticker XRPR on the Cboe BZX Exchange. This provides traditional investors with regulated exposure to XRP without requiring direct cryptocurrency custody, complementing the derivatives infrastructure CME is building.

Ripple CEO Brad Garlinghouse stated in June 2025: "We're closing this chapter once and for all, and focusing on what's most important—building the Internet of Value." With regulatory battles resolved and institutional infrastructure in place, Ripple can now focus entirely on expanding XRP Ledger use cases and forging partnerships across traditional finance sectors.

Key Takeaways

CME's launch of CFTC-regulated XRP options represents far more than a new trading product—it signals XRP's graduation from speculative crypto asset to Wall Street-grade financial instrument. The combination of definitive legal clarity, institutional adoption through regulated derivatives, and Ripple's aggressive business expansion positions XRP uniquely among digital assets.

Institutional investors now have the regulated tools, legal certainty, and infrastructure necessary to incorporate XRP into portfolios and trading strategies. As platforms like Robinhood prepare to offer XRP futures to retail customers and international ETF filings accelerate, XRP's liquidity and market depth should continue expanding through 2025 and beyond.

Sources

- CME Group Press Release - XRP Options Launch

- CME Group Press Release - XRP Futures Launch

- CME Group XRP Futures Overview

- CoinDesk - SEC Ripple Case Officially Over

- The Block - SEC and Ripple Dismiss Appeals

- CoinDesk - Institutional Adoption of XRP Futures

- CNBC - Ripple SEC Settlement Details

- Cointelegraph - Ripple vs SEC Analysis

- Brave New Coin - XRP Legal Clarity

- SEC Official Settlement Statement

DISCLAIMER: This newsletter is for informational purposes only and does not constitute investment advice, advertising, or a recommendation to buy, sell, or hold any securities. This content is not sponsored by or affiliated with any of the mentioned entities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.