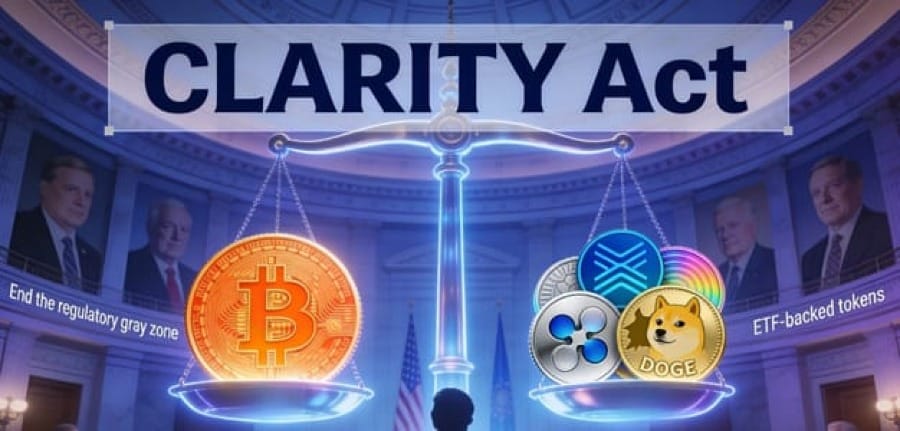

CLARITY Act Provision Could Give XRP, Solana, and Other ETF-Backed Tokens Same Status as Bitcoin

CLARITY Act provision could give XRP, Solana, DOGE & other ETF-backed tokens same regulatory status as Bitcoin. SEC Chair prioritizes ending 'regulatory gray zone' as Senate debates landmark crypto bill.

A newly revealed provision in the Digital Asset Market Clarity Act could fundamentally change the regulatory treatment of several major cryptocurrencies, potentially placing XRP, Solana, Dogecoin, and others on equal footing with Bitcoin and Ethereum under U.S. securities law.

According to reporting by Fox Business journalist Eleanor Terrett, the bill includes language that exempts network tokens from ancillary asset classification if they serve as the primary underlying asset of an exchange-traded product listed on a national securities exchange by January 1, 2026. This date has already passed, meaning several tokens now meet this qualification.

Wow, this is significant

— Zach Rynes | CLG (@ChainLinkGod) January 13, 2026

If this version of the Clarity Act is passed as written, any crypto asset that had an ETF live as of Jan 1, 2026 will be deemed not a security

The Grayscale $LINK ETF launched on Dec 2, 2025… https://t.co/9ekSP72JST

The ETF Exemption: What It Actually Says

The CLARITY Act establishes that tokens backing exchange-traded products registered under the Securities Exchange Act of 1934 and listed on national exchanges by January 1, 2026, would not be subject to the same disclosure requirements as other digital assets classified as "ancillary assets" under the proposed framework.

This matters because the SEC traditionally regulates tokens that derive value from the work of originators or affiliates as securities, requiring extensive disclosures. Under this provision, ETF-backed tokens would bypass these requirements and receive treatment similar to Bitcoin and Ethereum, which have long been recognized as commodities rather than securities.

Which Tokens Qualify?

Based on confirmed ETF launches prior to January 1, 2026, the following tokens would potentially benefit from this provision:

Confirmed ETF Launches:

- XRP: Grayscale XRP Trust ETF (GXRP) began trading in December 2025 on NYSE Arca, along with competing products from Bitwise and 21Shares

- Solana (SOL): Multiple spot ETFs from Grayscale, Bitwise, and other issuers launched in late 2025

- Dogecoin (DOGE): Grayscale Dogecoin Trust ETF and REX-Osprey DOGE product began trading in September and November 2025

- Litecoin (LTC): ETF products approved under new SEC listing standards

- Hedera (HBAR): Exchange-traded products secured listings in late 2025

- Chainlink (LINK): Grayscale Chainlink Trust ETF launched among the wave of altcoin ETF approvals

According to Coinpedia's analysis, this provision means these tokens "could be treated the same way as Bitcoin and Ethereum from day one" if the CLARITY Act becomes law.

🇺🇸 UPDATE: The Digital Asset Market Clarity Act would treat $XRP, $SOL, $LTC, $HBAR, $DOGE, and $LINK the same as $BTC and $ETH.

— Cointelegraph (@Cointelegraph) January 13, 2026

This applies if they back exchange-traded products as of Jan. 1, 2026, per Eleanor Terrett. pic.twitter.com/UJJSdmdBp1

SEC Chair: Ending the "Regulatory Gray Zone"

SEC Chairman Paul Atkins has made bringing crypto markets "out of the regulatory gray zone" his top priority for 2026, according to a January 12 interview with Fox Business.

Atkins stated that lawmakers are working on bipartisan legislation to "bring clarity and certainty to the crypto world, and as to the division of responsibility between the SEC and the Commodity Futures Trading Commission." He expressed optimism that the market structure bill could help end years of regulatory uncertainty.

The SEC chief specifically praised the GENIUS Act, passed in late 2025, as "the first statute that the United States government has adopted to recognize crypto assets," and described the upcoming CLARITY Act as building on that foundation.

What This Means for XRP and Ripple

For XRP specifically, this provision could resolve years of regulatory uncertainty. Ripple has fought a high-profile legal battle with the SEC since 2020, when the agency alleged that XRP was an unregistered security. While Ripple secured partial court victories in July 2025, the token's regulatory status remained contested.

According to U.Today, "This single clause may do what Ripple's legal team, two partial court wins and over $200 million in legal defense could not fully achieve: give XRP an explicit legal carve-out from securities status."

The CLARITY Act also includes a provision stating that if a U.S. court has already ruled that a digital asset transaction was not a securities sale, that asset cannot later be treated as a security under the law—further protecting XRP's status.

Current Legislative Status

The CLARITY Act passed the House of Representatives in July 2025 with bipartisan support by a vote of 294-134. However, its path through the Senate has proven more complex.

Recent Developments:

- Originally scheduled for January 15, 2026, the Senate Agriculture Committee delayed its markup to the last week of January

- Senate Banking Committee Chairman Tim Scott and Agriculture Committee Chairman John Boozman are working to reconcile differences between committee versions

- Bipartisan negotiations continue on stablecoin yield provisions and DeFi regulation

Senator Cynthia Lummis urged Democrats not to "retreat from our progress," stating the bill "will provide the clarity needed to keep innovation in the U.S. & protect consumers."

CNBC reported that crypto proponents want the bill passed before the 2026 midterm elections to avoid losing momentum, with industry groups like the Blockchain Association noting that "we've seen this massive movement of companies and activity back on shore because there is a friendly administration to crypto."

Broader Market Structure Framework

Beyond the ETF provision, the CLARITY Act establishes a comprehensive framework for digital asset regulation:

SEC Jurisdiction:

- Regulates "ancillary assets" whose value depends on the work of originators

- Maintains authority over investment contract assets

- Oversees token offerings and disclosures

CFTC Jurisdiction:

- Gains exclusive oversight of "digital commodity" spot markets

- Regulates decentralized tokens deriving value from adoption

- Oversees digital commodity exchanges, brokers, and dealers

Key Provisions:

- Creates registration regimes for crypto intermediaries

- Establishes "mature blockchain system" criteria for commodity classification

- Provides safe harbor for non-fungible tokens (NFTs)

- Requires anti-money laundering compliance for exchanges and brokers

Expert Analysis: What Could Change

While the ETF exemption provision appears straightforward, several factors could affect its implementation:

Legislative Uncertainty: The provision's fate depends on successful passage of the CLARITY Act. Paul Hastings LLP notes that the Senate Banking Committee's alternative "Responsible Financial Innovation Act" takes a different approach, focusing on "ancillary assets" rather than "digital commodities" and giving the SEC more discretion.

Timing Considerations: Legal experts emphasize that "this treatment depends on real conditions being met by 2026, including ETF status." Since January 1, 2026 has passed, the qualifying tokens are now established, but the law must still be enacted.

Regulatory Authority: The bill preserves the SEC's authority to grant exemptions and write detailed rules, meaning the agency would retain some discretion even for ETF-backed tokens.

Market Impact and Institutional Adoption

The prospect of regulatory clarity has already influenced market dynamics:

ETF Performance:

- XRP ETFs attracted $1.3 billion in inflows within 50 days, rivaling Bitcoin's ETF debut

- Bitwise's XRP ETF saw $107.6 million in first-day inflows

- Multiple issuers including Franklin Templeton, Canary Capital, and 21Shares launched competing products

Institutional Interest: Summer Mersinger, CEO of the Blockchain Association, told CNBC that regulatory clarity "could help the U.S. court more digital assets companies to set up shop stateside, stimulating the economy and boosting the crypto market."

Eleanor Terrett noted that institutional players are positioning for 2026: "If they had one foot in the space in 2025, they're expected to have two this year."

What Happens Next

Immediate Timeline:

- Senate Banking Committee markup expected late January 2026

- Senate Agriculture Committee markup to follow

- Full Senate vote anticipated in Q1 2026

- If passed, reconciliation with House version and presidential signature could occur by March 2026

Outstanding Issues: According to BeInCrypto, lawmakers are still negotiating:

- Stablecoin yield and reward programs

- Decentralized finance (DeFi) oversight

- Division of regulatory responsibility between SEC and CFTC

- Investor protection requirements

Critical Context: This Is Not Yet Law

Important Limitations:

- The CLARITY Act has not been enacted into law

- The ETF exemption provision is part of draft legislation still under negotiation

- Senate passage is not guaranteed, with some Democrats expressing concerns about investor protections

- Charles Hoskinson expressed skepticism about the timeline, doubting the bill will pass in Q1 2026

- Even if passed, implementation would require additional SEC rulemaking

The provision creates a pathway for certain tokens to receive favorable treatment, but it does not guarantee this outcome. Legal experts caution that the bill's language provides "clear criteria and definitions," but interpretation and enforcement would still require coordination between regulators.

Bottom Line

The CLARITY Act's ETF exemption provision represents a potentially significant shift in how major cryptocurrencies could be regulated in the United States. By establishing that tokens backing exchange-traded products launched before January 1, 2026, would receive more favorable treatment, Congress appears to be moving toward regulatory parity for XRP, Solana, Dogecoin, Litecoin, Hedera, and Chainlink with Bitcoin and Ethereum.

However, this outcome depends entirely on:

- The CLARITY Act passing both chambers of Congress

- Presidential signature

- Implementation by regulatory agencies

- Resolution of ongoing negotiations over controversial provisions

SEC Chairman Paul Atkins' stated commitment to ending crypto's "regulatory gray zone" and the bipartisan support the bill has received suggest momentum toward passage, but legislative delays and political disagreements mean the timeline and final form of any crypto market structure law remain uncertain.

For investors, this provision highlights the growing acceptance of cryptocurrency exchange-traded products as legitimate investment vehicles and the potential for clearer regulatory frameworks in 2026—but does not guarantee that these specific provisions will become law as written.

Sources

- Congress.gov - H.R.3633 Digital Asset Market Clarity Act of 2025

- The Market Periodical - Digital Asset Market Clarity Act Sets New U.S. Crypto Rule

- Coinpedia - Will XRP Be Treated Like Bitcoin and Ethereum Under the Clarity Act?

- U.Today - XRP May Soon Be Legally Untouchable by SEC

- Economy Watch - SEC Chair Signals 2026 Breakthrough for U.S. Crypto Regulation

- U.Today - SEC Chair Confirms Bipartisan Bill to Crown U.S. 'Crypto Capital' in 2026

- CNBC - Lawmakers Are Preparing to Try Again on Major Crypto Bill

- Cryptonews - NYSE Approves Listings for Grayscale's XRP and Dogecoin ETFs

- Grayscale - XRP Trust ETF

- BeInCrypto - CLARITY Act Delayed Again

- Cryptonews - Lummis Introduces Blockchain Bill Ahead of Crypto Legislation

- Paul Hastings LLP - Update on Crypto Market Structure Legislation

- Latham & Watkins - US Crypto Policy Tracker: Legislative Developments

- ainvest - XRP, Solana, Dogecoin: High-Momentum Altcoins to Watch

DISCLAIMER: This newsletter is for informational purposes only and does not constitute investment advice, advertising, or a recommendation to buy, sell, or hold any securities. This content is not sponsored by or affiliated with any of the mentioned entities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.