CBOE Certifies Amplify XRP ETF for Listing: What This Means for XRP Investors

Cboe certifies Amplify's XRP options-income ETF for listing, joining 15+ pending XRP funds. What this means for investors, launch timelines, and XRP's $8B institutional opportunity—plus the key risks traders must understand.

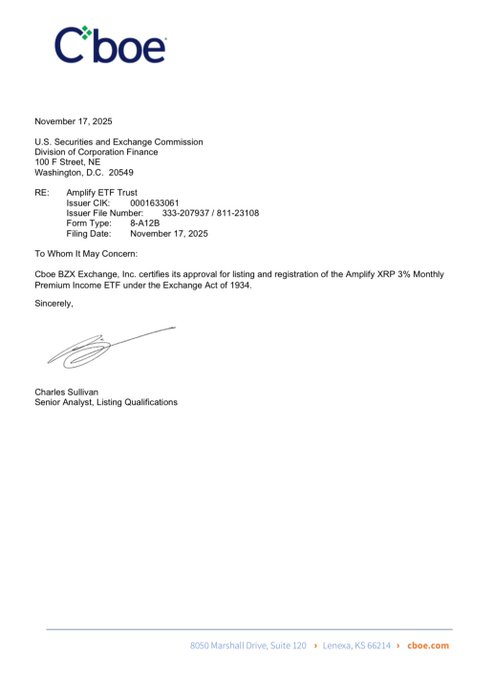

Cboe BZX Exchange has officially certified the Amplify XRP 3% Monthly Premium Income ETF for listing and registration under the Exchange Act of 1934, marking another significant step in the expansion of XRP investment products available to U.S. investors.

The November 17, 2025 certification letter confirms that the Amplify XRP ETF (ticker: XRPM) has cleared a crucial regulatory hurdle on its path to market. However, it's important to note that exchange listing certification is not the same as final SEC approval—the fund still requires an effective registration statement before trading can begin.

What is the Amplify XRP 3% Monthly Premium Income ETF?

Unlike traditional spot ETFs that simply hold the underlying asset, the Amplify XRP ETF employs an income-focused options strategy. According to the fund's prospectus, the ETF aims to invest at least 80% of its assets in XRP-related financial instruments while generating monthly income through covered call options.

The fund's strategy involves selling call options that are approximately 5-10% out of the money with maturities of one week or less, targeting 36% annualized option premium income. This income-first approach differentiates it from pure price-tracking crypto funds, potentially appealing to investors seeking yield rather than pure speculation.

Amplify will achieve XRP exposure through investments in XRP Futures ETFs and, when available, XRP Spot ETFs. The fund operates through a Cayman Islands-based subsidiary structure, allowing flexibility in managing crypto exposure while adhering to U.S. regulatory standards.

The Broader XRP ETF Wave

The Amplify certification arrives amid a historic surge in XRP ETF filings. As of mid-November 2025, there are now 16 XRP ETF applications in the United States, with multiple products already trading:

Currently Trading:

- Canary Capital's XRPC (launched November 13, 2025) - The first pure spot XRP ETF

- REX-Osprey's XRPR (launched September 2025) - Futures-based with partial spot exposure

Listed on DTCC, Pending Launch: According to recent reports, nine additional XRP ETFs are listed on the Depository Trust & Clearing Corporation system, including products from:

- Bitwise (XRP)

- Franklin Templeton (XRPZ) - Managing $450 billion in assets

- 21Shares (TOXR)

- CoinShares (XRPL)

- Amplify (XRPM)

What DTCC and Exchange Listings Actually Mean

Critical Context: Appearances on DTCC's system and exchange listing certifications do not constitute SEC approval. As CryptoSlate clarifies, these are operational preparations—essentially the clearing and settlement plumbing getting ready in case a fund launches.

For an ETF to actually begin trading, the following must occur:

- The SEC must declare the S-1 registration statement effective

- The exchange must issue a public listing notice with ticker and date

- Operational confirmations (DTC eligibility, CUSIP assignment) must be completed

- Form 8-A must be filed to register shares under the Exchange Act

The CBOE certification for Amplify's XRPM represents progress through step one of this process, but trading authorization remains pending.

XRP/Ripple Market Impact Analysis

Current Market Context: XRP has experienced notable volatility surrounding ETF developments. Following Canary's XRPC launch on November 13, XRP rallied 3.28% to $2.48 with trading volume increasing 31%. However, the token remains below key resistance levels at $2.52-$2.59.

Historical Precedents:

- REX-Osprey's XRPR saw $24 million in volume in its first 90 minutes, reaching over $100 million in AUM by October 2025

- XRP rallied 18% ahead of XRPR's launch, then corrected as traders took profits

- Teucrium's leveraged XRP ETF (XXRP) has grown to nearly $400 million in net assets

Institutional Inflow Projections: JPMorgan estimates that spot XRP ETFs could trigger $3-8 billion in inflows during their first year of trading, potentially mirroring the success of Bitcoin and Ethereum ETF launches.

Potential Benefits for XRP

Increased Institutional Access: ETFs provide a regulated, familiar vehicle for gaining XRP exposure without directly interacting with crypto exchanges. This could open doors for pension funds, mutual funds, and traditional investors to allocate capital through mainstream brokerage accounts.

Enhanced Liquidity: Multiple competing ETF products could improve overall XRP market liquidity and price discovery, as fund creations and redemptions create consistent market activity.

Regulatory Clarity: The wave of XRP ETF approvals signals growing regulatory acceptance following Ripple's legal resolution with the SEC, removing a major uncertainty that had hung over XRP for years.

Important Caveats and Challenges

Not All ETFs Are Created Equal: The Amplify XRPM's options strategy introduces complexity and risks distinct from spot exposure:

- Options Decay: Selling covered calls caps upside potential if XRP rallies sharply

- Premium Volatility: Income targets may not be achieved in low-volatility environments

- Futures Basis Risk: Initial exposure through futures contracts rather than spot XRP introduces basis risk

Market Saturation Concerns: With 16 XRP ETF applications and multiple products potentially launching simultaneously, some analysts question whether sufficient demand exists to support all offerings. Market share fragmentation could result in some funds failing to achieve viable asset bases.

XRP Price Volatility: Despite ETF optimism, XRP faces technical challenges. The token remains in a long-term downward trend with strong resistance at $2.30-$2.40, according to technical analysis. Each attempted breakout has been rejected, keeping XRP trapped in a narrow range.

Launch Timing Uncertainty: While exchange certifications and DTCC listings indicate progress, final approval timelines remain unclear. Historical precedents show that operational preparations can appear well before actual trading authorization.

Regulatory Framework Evolution

The surge in crypto ETF approvals follows significant regulatory developments:

Generic Listing Standards: In September 2025, the SEC approved generic listing standards for commodity-based trust shares on NYSE Arca, Nasdaq, and Cboe BZX. This allows exchanges to list qualifying spot commodity ETPs without product-by-product approvals, streamlining the process.

Post-Trump Administration Shift: The regulatory environment has shifted noticeably since July 2025, when the SEC voted to allow in-kind creations and redemptions for crypto ETFs—a structure previously restricted. This change has encouraged firms to pursue altcoin ETF filings beyond Bitcoin and Ethereum.

Cboe Fast-Track Proposal: Cboe has filed a proposal that would allow certain crypto-backed funds to be listed automatically if their underlying assets have traded as regulated futures for at least six months. This could further accelerate the approval pipeline.

What Comes Next?

For Amplify's XRPM: The fund must still obtain SEC effectiveness for its registration statement and complete final operational approvals before trading can commence. No specific launch date has been announced.

For XRP Markets: Traders are watching whether XRP can break above $2.52 resistance. A sustained move higher could target $2.59-$2.70, though failure to hold $2.40 support could trigger declines toward $2.31-$2.06.

For the ETF Landscape: Bloomberg analyst Eric Balchunas suggests final approvals for the broader suite of crypto ETFs are "likely September to October for all," indicating a comprehensive wave of launches rather than one-off approvals.

Bottom Line

The CBOE certification for Amplify's XRP 3% Monthly Premium Income ETF represents meaningful progress in expanding regulated XRP investment products. However, investors should understand that:

- Listing certification ≠ final approval - Trading authorization still pending

- Options strategies differ from spot exposure - XRPM's covered call approach caps upside

- Market timing remains uncertain - No confirmed launch date despite operational preparations

- Competition is intense - 16 ETF applications competing for market share

- XRP technicals remain challenging - Resistance levels continue to hold despite ETF optimism

For investors seeking XRP exposure, the expanding ETF options provide new regulated pathways—but due diligence on each product's specific strategy, fee structure, and risks remains essential.

Sources

- SEC - Amplify XRP 3% Monthly Premium Income ETF Prospectus

- DL News - CBOE Bids to Fast-Track $8bn XRP ETF Investment Boom

- CoinDesk - First U.S. Spot XRP ETF Could Go Live on Thursday

- CoinDesk - XRP Beats Bitcoin as Ripple-Linked Token's ETF to Go Live

- BeInCrypto - XRP Goes Mainstream: First-Ever US Spot XRP ETF Approved

- CryptoSlate - Here's the Real XRP ETF Launch Timeline as DTCC is Misread Again

- CCN - XRP ETFs Tracker: Complete List of Issuers and Products

- CoinPedia - XRP ETF News: Multiple ETFs Listed on DTCC

- CoinPedia - XRP ETF News: Amplify Files with SEC

DISCLAIMER: This newsletter is for informational purposes only and does not constitute investment advice, advertising, or a recommendation to buy, sell, or hold any securities. This content is not sponsored by or affiliated with any of the mentioned entities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.