BREAKING: SEC Drops Ripple Case: Historic $50M Settlement Ends 4-Year Legal War

Historic victory: SEC drops 4-year Ripple lawsuit with $50M settlement—75% reduction from original penalty. XRP gains regulatory clarity, trading near $3. ETF approvals likely as crypto industry celebrates landmark precedent for digital asset regulation.

Bottom Line Up Front: The SEC and Ripple have reached a final $50 million settlement, ending the most significant crypto lawsuit in U.S. history and providing crucial regulatory clarity for XRP and the broader digital asset industry.

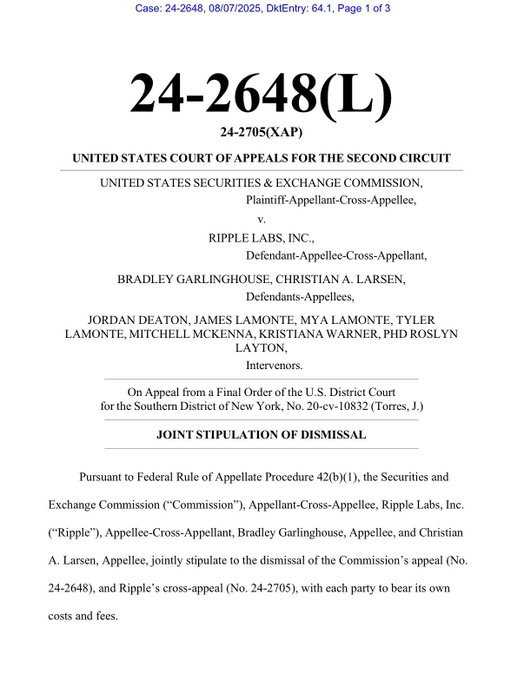

The long-awaited conclusion to the Ripple vs. SEC lawsuit has finally arrived. After more than four years of intense litigation that began in December 2020, both parties have agreed to end their appeals and settle for $50 million—a fraction of the nearly $2 billion the SEC originally sought. This landmark resolution marks a decisive victory for Ripple and establishes important precedents for cryptocurrency regulation in the United States.

The Path to Settlement: Key Timeline

The settlement process unfolded rapidly in 2025. In March, Ripple CEO Brad Garlinghouse announced that the SEC would drop its appeal, calling it "a resounding victory for Ripple, for crypto, every way you look at it." The announcement came after the agency had already begun scaling back its crypto enforcement under the Trump administration, having dropped cases against Coinbase and Kraken earlier in the year.

By April 2025, both parties filed joint motions to pause their appeals while negotiating final terms. The SEC formally authorized the settlement framework on May 8, 2025, following internal deliberations and commission approval. Ripple agreed to withdraw its cross-appeal challenging the court's finding that institutional XRP sales violated securities laws.

Settlement Terms: A Win for Ripple

Under the final agreement, Ripple will pay only $50 million of the original $125 million penalty, with the remaining $75 million being returned from escrow. The settlement also requests that the court lift the permanent injunction that restricted Ripple's ability to engage in future institutional sales—a critical component for the company's business operations.

As Ripple Chief Legal Officer Stuart Alderoty emphasized, this represents his "last update on the lawsuit ever," signaling the complete resolution of all claims against the company and its executives Brad Garlinghouse and Chris Larsen.

Regulatory Implications: Clarity for the Crypto Industry

The settlement builds on Judge Analisa Torres' pivotal July 2023 ruling that distinguished between different types of XRP sales. The court determined that XRP sales on public exchanges to retail investors did not constitute securities offerings, while institutional sales did violate securities laws. This distinction has become a cornerstone for how digital assets may be regulated going forward.

The resolution comes as part of a broader shift in the SEC's approach under the Trump administration. Acting Chair Mark Uyeda has signaled a move away from enforcement-heavy tactics toward establishing clearer regulatory frameworks through the newly formed Crypto Task Force.

However, not all SEC commissioners supported the settlement. Commissioner Caroline Crenshaw issued a dissenting statement, arguing that the agreement "does a tremendous disservice to the investing public and undermines the court's role in interpreting our securities laws."

XRP/Ripple Analysis: Unlocking Future Growth

Price Impact and Market Response

XRP has responded positively to the legal clarity, with the token trading near $3 in August 2025—its highest level since 2018. The price represents significant gains from the uncertainty that plagued the asset during the lawsuit years.

Market analysts project continued strength, with some forecasting XRP could reach $3.50 to $5.00 by the end of 2025, assuming sustained institutional adoption and favorable regulatory conditions.

Business Operations Liberation

The settlement removes the regulatory cloud that has limited Ripple's growth in the U.S. market for years. With the permanent injunction potentially lifted, Ripple can now:

- Resume institutional XRP sales under appropriate regulatory frameworks

- Expand U.S. partnerships without legal uncertainty

- Pursue new business opportunities including potential IPO plans

- Accelerate cross-border payment solutions with major financial institutions

XRP ETF Prospects

The legal clarity significantly improves prospects for XRP exchange-traded funds. Multiple firms including Grayscale, Bitwise, and Franklin Templeton have filed applications for XRP ETFs. Prediction markets show 80% odds of XRP ETF approval in 2025, with Ripple CEO Brad Garlinghouse expressing confidence about approval in the second half of the year.

Strategic Positioning

Ripple has used the settlement period to strengthen its position globally. The company recently acquired prime brokerage firm Hidden Road for $1.25 billion and has been actively expanding in regulated markets like Dubai. CEO Garlinghouse emphasized the company's focus on "building the Internet of Value" now that legal distractions are resolved.

Broader Market Context

The Ripple settlement arrives amid a dramatically different regulatory landscape than when the case began. The crypto industry has matured significantly, with Bitcoin and Ethereum ETFs already approved and institutional adoption accelerating across digital assets.

The resolution also comes as the U.S. seeks to maintain its competitive position in the global crypto economy, with President Trump signing executive orders on digital assets and establishing a crypto czar position in the White House.

Looking Ahead: Industry Transformation

This settlement sets important precedents for how existing cryptocurrencies may be evaluated under securities laws. The distinction between programmatic sales and institutional offerings could provide a framework for other projects facing regulatory uncertainty.

For Ripple specifically, the company is now positioned to capitalize on the growing institutional demand for cross-border payment solutions. With regulatory clarity achieved and business restrictions lifted, Ripple can focus entirely on expanding its network and competing for the multi-trillion-dollar global payments market.

Key Takeaway: The SEC-Ripple settlement represents more than just the end of a lawsuit—it's the beginning of a new chapter for cryptocurrency regulation in America. With XRP's legal status clarified and Ripple's business operations unshackled, both the company and the broader crypto industry can move forward with greater certainty and institutional confidence.

Sources:

- SEC Official Statement on Ripple Settlement (May 8, 2025)

- CoinDesk reporting on settlement terms

- Ripple CEO Brad Garlinghouse official statements

- Court filings from Southern District of New York

- Crypto Briefing legal analysis

DISCLAIMER: This newsletter is for informational purposes only and does not constitute investment advice or a recommendation to buy, sell, or hold any securities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.