BlackRock Files for Revolutionary iShares Systematic Alternatives ETF: A New Era for Crypto-Adjacent Institutional Investing

BlackRock files for groundbreaking iShares Systematic Alternatives Active ETF (IALT), leveraging success from becoming most profitable with Bitcoin ETFs. The systematic approach could reshape alternative investing while active ETFs see explosive 42% growth in 2025.

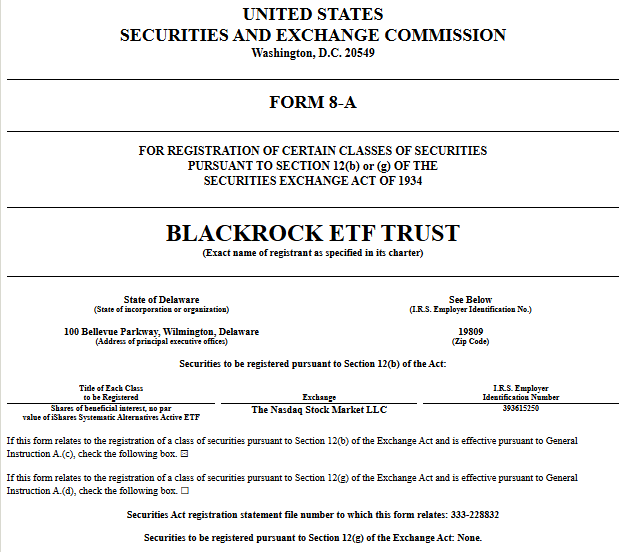

BlackRock has officially registered its groundbreaking iShares Systematic Alternatives Active ETF (ticker: IALT) with the Securities and Exchange Commission, marking the latest expansion in the world's largest asset manager's rapidly growing active ETF platform. The December 1, 2025 Form 8-A filing signals BlackRock's continued push into the red-hot systematic alternatives space as institutional demand for sophisticated, actively managed strategies reaches new heights—potentially including exposure to digital assets and crypto-adjacent investments.

Revolutionary Approach to Alternative Investing

According to the SEC filing, the iShares Systematic Alternatives Active ETF will trade on NASDAQ under the ticker IALT as part of the BlackRock ETF Trust. The fund represents BlackRock's effort to democratize access to systematic alternative strategies that have traditionally been available only to institutional investors.

According to the SEC filing, the iShares Systematic Alternatives Active ETF aims to deliver total return through a "diversified set of alternative or non-traditional strategies." These include exposure to equities, fixed income, commodities, and derivatives. The investment process integrates multiple risk premiums, such as value, momentum, and carry, designed to capture alpha while mitigating downside risk.

The fund will be managed by BlackRock Advisors, LLC, leveraging the firm's systematic and quantitative models to navigate both bull and bear market conditions. This approach seeks to balance performance during strong market rallies and sustained periods of stress.

BlackRock's Digital Asset Success Story

The timing of IALT's filing is particularly significant given BlackRock's phenomenal success in the digital asset space. BlackRock's Bitcoin ETF has proven that cryptocurrency products can become highly profitable for traditional asset managers willing to embrace new technologies. In fact, BlackRock Inc. now earns more from its Bitcoin exchange-traded funds than from any other product line.

The numbers are staggering: While the company's S&P 500 ETF manages about $624 billion in assets, it charges only 0.03% in fees. IBIT's higher 0.25% fee rate on its growing asset base generates more total revenue.

The iShares Bitcoin Trust ETF (IBIT) from BlackRock is no longer just another option in the vast investment universe; it has rapidly ascended to become a dominant player, controlling over $70 billion in assets and managing more than 3% of all circulating Bitcoin.

This success demonstrates BlackRock's ability to identify and capitalize on alternative asset trends before they become mainstream—a capability that could extend to IALT's systematic approach to alternatives.

Riding the Active ETF Boom

BlackRock's IALT launch comes at an opportune time, as the active ETF sector experiences unprecedented growth. Active ETFs accounted for 88% of all U.S.-listed ETF launches through June 2025, and 51% of global ETF launches. Even more striking, active ETFs comprised 29% of global ETF net asset inflows and organic asset growth through June 2025, up from 20% the prior year.

The numbers tell a compelling story of investor appetite for active management within the ETF structure. The organic growth rate for active ETFs tops 42% in 2025—over 5x the growth rate of passive ETFs. Despite holding only 10% of market share, active ETFs accounted for approximately 35% of new net flows in 2025.

BlackRock projects that global active ETF assets under management will triple to $4.2 trillion by 2030, from $1.4 trillion as of June 2025.

Digital Assets and the New Portfolio Paradigm

BlackRock's strategic vision extends beyond traditional alternatives. We favor liquid alternatives that have a proven record of generating alpha relative to cash with low correlations to stocks and bonds. Similarly, investors have allocated rapidly to digital currencies since the launch of physically backed ETPs in the space.

The firm's research indicates a fundamental shift in investor behavior: Client polling data shows that about half of our clients are looking to find diversification through alternatives such as liquid alternatives, commodities, and digital assets. This trend supports the potential for systematic alternatives strategies that could include digital asset exposure or crypto-adjacent investments.

However, most of the risk and potential return drivers bitcoin faces are fundamentally different from traditional risky assets, underscoring bitcoin's intriguing potential as a unique contributor to portfolio diversification.

What Makes $IALT Different

The systematic alternatives approach sets IALT apart from traditional active ETFs. BlackRock's systematic alternative strategies seek differentiated risk and return profiles with a low correlation to broad asset classes to help diversify portfolios. The fund will employ cutting-edge technology to process vast data sets and implement sophisticated quantitative models.

The ETF is designed to operate with daily liquidity and portfolio transparency while retaining discretion over short-term rebalancing. This structure could attract both institutional allocators and sophisticated retail investors seeking smoother returns across market cycles.

The systematic approach leverages BlackRock's 40+ years of experience in quantitative investing. The systematic process leverages vast sets of data, both traditional and alternative, to provide investment insights faster, at greater scale and with more granularity.

Potential Crypto and Digital Asset Implications

While IALT's SEC filing doesn't explicitly mention cryptocurrency exposure, the fund's mandate for "commodities and derivatives" exposure could theoretically include digital asset-related instruments. BlackRock's systematic capabilities extend across multiple asset classes, and the firm has demonstrated leadership in crypto innovation.

Important Disclaimer: BlackRock has made no official statement about cryptocurrency exposure within IALT. The following represents informed speculation based on the fund's flexible mandate and BlackRock's broader digital asset strategy.

The fund's systematic approach could theoretically include:

- Commodities exposure that might encompass digital assets

- Derivatives strategies that could include crypto-related instruments

- Momentum and carry factors that have shown effectiveness in digital asset markets

- Alternative data analysis that could incorporate blockchain and crypto metrics

However, significant barriers exist to direct crypto exposure in traditional systematic alternatives funds, including regulatory constraints, volatility management challenges, and institutional comfort levels. Any crypto-related exposure would likely be indirect or through derivatives rather than direct holdings.

Market Context and Implications

The launch reflects broader trends reshaping the ETF landscape. Active ETFs make up 8% of ETF AUM in the US and accounted for almost half of net inflows during 2024. The momentum shows no signs of slowing, with issuers launching over 800 new ETFs in 2025 with 86% being actively managed.

For investors, IALT represents access to institutional-quality systematic strategies that would typically require significant minimum investments and complex fee structures. The ETF wrapper provides the benefits of daily liquidity, transparency, and tax efficiency that have made ETFs increasingly popular.

Market observers note that BlackRock's expansion into alternative ETFs mirrors its ongoing efforts to diversify product offerings beyond traditional equity and bond exposures. The firm has already launched successful active strategies including the iShares Managed Futures Active ETF (ISMF) and various AI-focused offerings.

The Digital Asset Connection

BlackRock's success with Bitcoin ETFs provides important context for IALT's potential impact. BlackRock's decision to offer an ETF in the bitcoin income space will only serve to further confirm there is interest in the market in finding new ways to invest in these alternatives.

The firm's approach to innovation in alternative investments has proven successful: IBIT options, introduced in November 2024, now rank among the most actively traded ETF-based derivatives, averaging $1.7 billion in daily notional volume.

This demonstrates BlackRock's ability to create liquid, institutional-quality products around alternative assets—an approach that could extend to systematic alternatives strategies.

What This Means for Portfolios

The systematic alternatives approach could provide valuable diversification benefits for modern portfolios. Traditional stock-bond correlation has increased during periods of market stress, reducing the effectiveness of classic 60/40 allocations. Alternative strategies that can generate returns uncorrelated to traditional assets become increasingly valuable.

Market dispersion can unlock performance: Increased market volatility and uncertainty are leading to greater dispersion, meaning a greater difference in performance across companies, sectors, geographies, and asset classes. This environment potentially favors those who can capitalize on these inefficiencies.

The systematic approach offers several advantages over traditional alternative investments. It provides institutional-quality strategy implementation while maintaining the liquidity and transparency benefits of the ETF structure.

Looking Ahead

While BlackRock hasn't disclosed the expense ratio or official launch date for IALT, the filing represents another milestone in the active ETF revolution. Analysts suggest the product aligns with a broader industry pivot toward active ETFs that blend systematic investing with traditional diversification

The success of IALT will likely depend on its ability to deliver on its promise of diversified returns with low correlation to traditional assets. As institutional and retail investors continue seeking alternatives to traditional portfolio construction, systematic strategies wrapped in the ETF structure could become increasingly attractive.

BlackRock's timing appears strategic, launching IALT as the active ETF sector reaches an inflection point. With active ETFs accounting for 36% of ETF inflows so far in 2025, the firm is positioning itself to capture significant market share in this rapidly growing segment.

Crypto/XRP Analysis: Indirect Benefits

XRP and Crypto Market Implications:

While IALT won't directly impact XRP or cryptocurrency prices, the fund represents broader trends that could benefit the crypto ecosystem:

- Institutional Legitimization: BlackRock's continued innovation in alternative investments validates non-traditional asset classes, potentially increasing institutional comfort with crypto allocations.

- Systematic Approach Adoption: The success of systematic, quantitative approaches in alternatives could encourage similar methodologies in crypto portfolio management.

- Portfolio Diversification Demand: As traditional 60/40 portfolios face challenges, increased allocation to alternatives could eventually extend to digital assets.

- ETF Innovation: BlackRock's ETF innovation leadership could accelerate the development of more sophisticated crypto investment products.

However, any direct crypto benefits remain highly speculative, as IALT's actual portfolio composition and strategy implementation have not been disclosed.

The iShares Systematic Alternatives Active ETF represents more than just another product launch—it signals the continued evolution of how institutional-quality investment strategies reach mainstream investors through innovative ETF structures, potentially paving the way for broader alternative asset adoption.

Sources & References

Regulatory Documents

- BlackRock ETF Trust Form 8-A Filing - U.S. Securities and Exchange Commission

Financial News & Analysis

- BlackRock Expands ETF Lineup With New Systematic Alternatives Fund - Blockonomi

- BlackRock's Bitcoin ETF Becomes Company's Most Profitable Product - Brave New Coin

- BlackRock Bitcoin ETFs Now Lead Firm Revenue as Investor Demand Climbs - TipRanks

- How gold, bitcoin are moving beyond market hedge and boosting investment income - CNBC

Industry Research & Data

- Active ETFs: Unlocking innovation for investors - iShares by BlackRock

- ETFs Defying Gravity: 2025 Flows Surpass $1T So Far - American Century Investments

- 2025 ETF Trends: Shaping market growth and innovation - Ernst & Young Global

- Morningstar’s Guide to Active ETFs - Morningstar

BlackRock Official Resources

- 2025 Fall Investment Directions - BlackRock

- Systematic Investing - BlackRock

- iShares Bitcoin Trust (IBIT) - BlackRock

- Active ETFs - BlackRock

- iShares Exchange-Traded Funds - BlackRock

Press Releases