Bitcoin vs XRP: The Great Decentralization Debate Explodes on Social Media

XRP advocates challenge Bitcoin's decentralization claims as data reveals 6 mining pools control 95% of blocks. While Bitcoin has 18,500 nodes, XRP's 186 validators avoid single points of failure that once crashed Bitcoin's hash rate 35%. Which network is truly more decentralized?

The Bigger Picture: Redefining Decentralization

The Bitcoin versus XRP debate reveals fundamental disagreements about decentralization metrics. While Bitcoin emphasizes censorship resistance and permissionless participation, XRP prioritizes transaction efficiency and institutional adoption.

Proponents argue that XRP's consensus mechanism prevents centralization through democratic processes, noting that the network can withstand up to 20% malicious actors while maintaining functionality. Bitcoin supporters counter that proof-of-work's energy requirements, despite creating barriers to entry, provide unmatched security guarantees.

Both networks face centralization pressures, but through different mechanisms. Bitcoin's mining consolidation occurs despite its decentralized design, while XRP's validator structure is intentionally curated for efficiency. The question becomes whether measured decentralization with institutional oversight offers better real-world utility than maximalist decentralization with practical limitations.

As the cryptocurrency landscape matures, investors and users must evaluate these trade-offs based on their specific needs: store of value versus payment utility, security maximalism versus transaction efficiency, and ideological purity versus regulatory compliance.

Bottom Line Up Front: Recent social media discourse reveals growing tensions between Bitcoin and XRP communities over decentralization claims, with both networks facing unique centralization challenges despite vastly different architectural approaches.

A heated debate erupted on social media this week when prominent crypto commentator Vincent Van Code challenged mainstream narratives about Bitcoin versus XRP decentralization. The discussion, sparked by ongoing tensions between the two communities, highlights fundamental questions about what truly constitutes decentralization in modern cryptocurrency networks.

The Controversy: Numbers Don't Tell the Whole Story

The debate centers on a seemingly simple question: does having more nodes automatically mean better decentralization? Bitcoin supporters frequently cite the network's approximately 18,500 full nodes compared to XRP Ledger's 186 validators. However, critics argue this comparison misses crucial nuances about how these networks actually operate.

Vincent Van Code's analysis points to a critical distinction often overlooked in decentralization discussions: network resilience versus raw node count. While Bitcoin boasts significantly more nodes, the commentator argues that "XRPL has around 900 nodes that hold the key token data on it. So by comparison, XRPL is a far more secure and superior ledger that traditional banks use."

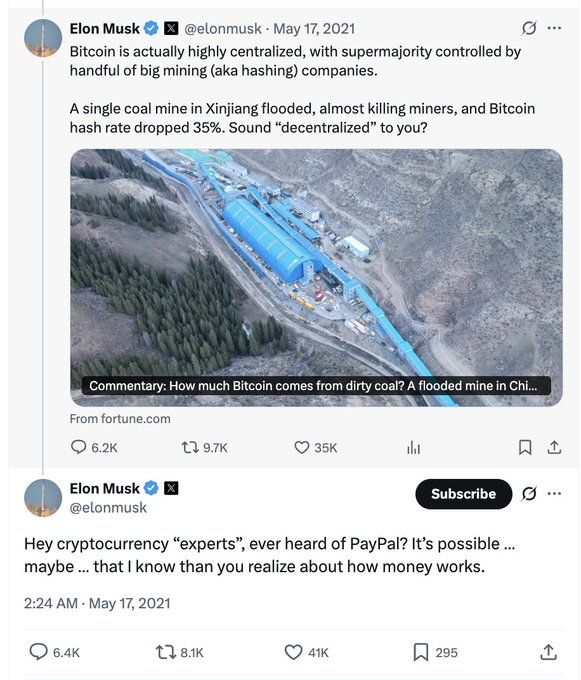

This perspective gained unexpected validation from an unlikely source. In May 2021, Elon Musk publicly criticized Bitcoin's mining concentration, stating "Bitcoin is actually highly centralized, with supermajority controlled by handful of big mining (aka hashing) companies." His observation that a single coal mine flood in Xinjiang caused Bitcoin's hash rate to drop 35% highlighted the type of systemic vulnerabilities that XRP proponents argue their network avoids.

Vincent Van Code's analysis points to a critical distinction often overlooked in decentralization discussions: network resilience versus raw node count. While Bitcoin boasts significantly more nodes, the commentator argues that "XRPL has around 900 nodes that hold the key token data on it. So by comparison, XRPL is a far more secure and superior ledger that traditional banks use."

The analysis becomes more complex when examining Bitcoin's mining infrastructure. Recent data shows that six mining pools control over 95% of Bitcoin block production in 2025, with the top two pools (AntPool & friends and Foundry) controlling 60-70% of the network hashrate. This represents a significant centralization of block template production, even as thousands of nodes participate in validation.

XRP's Architectural Approach: Speed vs Decentralization Trade-offs

XRP employs a Federated Byzantine Agreement (FBA) consensus mechanism that enables 3-5 second transaction settlements and can handle up to 1,500 transactions per second. The network currently operates with 186 validators, with Ripple controlling only one validator (less than 1% of the total).

Ripple CTO David Schwartz recently emphasized that "we have no interest or desire to control or manage the network," noting that all major protocol changes require 80% agreement from network participants. The network uses Unique Node Lists (UNLs), where validators work together through a democratic consensus process rather than competing for mining rewards.

However, critics remain skeptical of XRP's centralization claims. Some argue that "Ripple holds more than 50% of the supply of XRP in escrow and publishes a 'Unique Node List' of trusted validators," questioning whether this constitutes true decentralization.

Bitcoin's Mining Reality: Centralization Under Pressure

Bitcoin's proof-of-work consensus mechanism faces mounting centralization challenges that validate earlier concerns raised by critics. Between 2019 and 2022, the top two mining pools held approximately 35% of hashrate, but by 2023-2025, this figure jumped to 60-70%. The mining landscape shows "AntPool & friends" controlling about 40% of network hashrate, while Foundry maintains roughly 35%.

The geographic concentration that Musk highlighted in 2021 remains a persistent vulnerability. His reference to a single Xinjiang coal mine flood causing a 35% hash rate drop demonstrated precisely the kind of systemic risk that XRP advocates argue their distributed validator system avoids through design rather than chance.

This concentration occurs despite Bitcoin's energy-intensive proof-of-work system, which requires specialized ASIC hardware and creates barriers to widespread participation. Mining pools operate as centralized coordinators, deciding which transactions to include in blocks while miners simply provide computational power.

The environmental and economic barriers to Bitcoin mining have inadvertently created what some analysts call "evolution into a near-centralized system because of economic forces" despite the network's decentralized design philosophy.

XRP/Ripple Analysis: Regulatory Clarity and Market Position

From an XRP investment perspective, recent developments present both opportunities and challenges:

Positive Developments:

- Regulatory clarity emerged after the SEC's partial victory in 2023, with expectations that the agency won't pursue further legal action under crypto-friendly leadership

- President Trump's pick for SEC chair, Paul Atkins, is widely considered crypto-friendly, potentially benefiting XRP

- XRP has outperformed Bitcoin in 2025, up 47% compared to Bitcoin's 25% year-to-date gain

Ongoing Challenges:

- Unlike other cryptocurrencies that offer mining or staking rewards, XRP Ledger provides no direct economic incentive for running validators

- XRP's supply structure differs significantly from Bitcoin's scarcity model, with 100 billion pre-mined tokens compared to Bitcoin's 21 million cap

- Critics note that XRP remains "a highly speculative cryptocurrency" with price movements difficult to predict

Partnership and Adoption Prospects: XRP's primary utility lies in cross-border payments for financial institutions, with the network designed specifically for faster, cheaper international transactions. Recent validator expansion to 55 nodes includes major organizations like Microsoft, MIT, and CGI, suggesting growing institutional confidence.

The Bigger Picture: Redefining Decentralization

The Bitcoin versus XRP debate reveals fundamental disagreements about decentralization metrics, with high-profile figures like Elon Musk adding credibility to centralization concerns. While Bitcoin emphasizes censorship resistance and permissionless participation, XRP prioritizes transaction efficiency and institutional adoption.

Musk's 2021 critique highlighted a critical vulnerability: Bitcoin's mining infrastructure concentration creates single points of failure that contradict decentralization principles. His dismissive follow-up to "cryptocurrency experts" suggesting he didn't understand "how money works" underscored the tension between Bitcoin maximalists and critics who question the network's practical decentralization.

Proponents argue that XRP's consensus mechanism prevents centralization through democratic processes, noting that the network can withstand up to 20% malicious actors while maintaining functionality. Bitcoin supporters counter that proof-of-work's energy requirements, despite creating barriers to entry, provide unmatched security guarantees.

Both networks face centralization pressures, but through different mechanisms. Bitcoin's mining consolidation occurs despite its decentralized design, while XRP's validator structure is intentionally curated for efficiency. The question becomes whether measured decentralization with institutional oversight offers better real-world utility than maximalist decentralization with practical limitations.

As the cryptocurrency landscape matures, investors and users must evaluate these trade-offs based on their specific needs: store of value versus payment utility, security maximalism versus transaction efficiency, and ideological purity versus regulatory compliance.

The ongoing debate between Bitcoin and XRP communities ultimately reflects broader questions about the future of decentralized finance and which architectural approaches will best serve global financial infrastructure in the coming decades.

DISCLAIMER: This newsletter is for informational purposes only and does not constitute investment advice or a recommendation to buy, sell, or hold any securities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.

Sources

- XRP vs. Bitcoin: Unpacking the Centralization Debate in Cryptocurrency - OneSafe Blog

- Bitcoin (BTC) vs XRP (XRP): Opposing Visions of Scarcity and Decentralisation - Crypto.com

- Bitcoin vs. XRP: The Key Differences Explained - CoinGecko

- Bitcoin Mining Centralization in 2025 - b10c.me

- Who Mines Bitcoin in 2025? The Silent Rise of Centralization - The Coinomist

- XRP Ledger Is Fully Decentralized, No Secret Access - Bitcoin Ethereum News

- Bitcoin Node Overview: Understand Bitnodes & Network Security

- Elon Musk Twitter Thread on Bitcoin Centralization - May 17, 2021