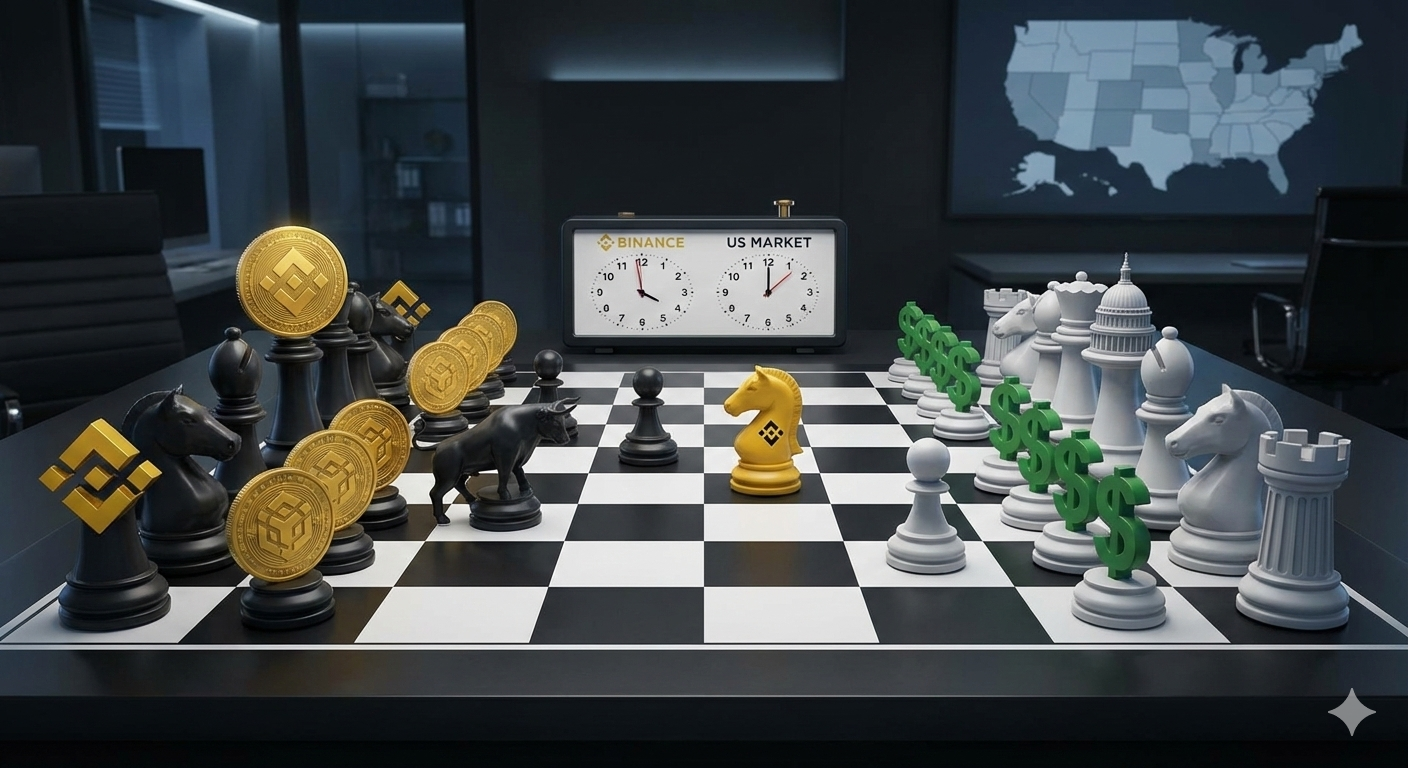

Binance Eyes US Return: CZ's Stake Reduction and Strategic Partnerships Could Reshape American Crypto Landscape

The world's largest crypto exchange is plotting its American comeback. Binance explores reducing CZ's stake while forging partnerships with BlackRock and Trump-linked ventures—moves that could reshape US crypto trading forever

The world's largest cryptocurrency exchange is quietly positioning itself for a comeback in the United States, with Binance exploring strategic moves that could fundamentally alter the competitive dynamics of American crypto trading. According to recent reports from Bloomberg, Binance is considering reducing founder Changpeng "CZ" Zhao's controlling stake while pursuing partnerships with financial heavyweights BlackRock and Trump-linked World Liberty Financial.

REPORT: Binance mulls strategic moves to expand US presence, potentially reducing co-founder CZ's controlling stake that has blocked expansion into key US states, while exploring partnerships with BlackRock and World Liberty Financial.

— Max Avery (@realMaxAvery) December 17, 2025

The Strategic Recalibration

Binance's US ambitions center on a complex restructuring that addresses what has been described as the company's "major hurdle" to expansion: CZ's controlling ownership. Sources familiar with the discussions indicate that Binance is exploring a potential recapitalization of Binance.US that would dilute Zhao's majority stake, potentially opening doors to key state licenses that have remained closed due to regulatory concerns about his leadership.

The timing is significant. CZ received a presidential pardon from Donald Trump in October 2025 after serving a four-month prison sentence for failing to maintain an effective anti-money-laundering program at Binance. Following the pardon, Zhao has been publicly vocal about his commitment to making America "the capital of crypto," stating at Binance Blockchain Week: "It is my full intention to help make America the capital of crypto."

However, the situation remains fluid. Bloomberg reports that while discussions are ongoing, no concrete plans have been finalized, and the company's strategy continues to evolve as it navigates the complex regulatory landscape.

Powerhouse Partnerships Taking Shape

Binance is simultaneously deepening ties with two significant US entities that could accelerate its American expansion:

BlackRock Integration The crypto exchange has been strengthening its relationship with the world's largest asset manager. BlackRock's BUIDL token—a tokenized money market fund backed by Treasury bills—is now accepted as collateral on Binance, with the BNB Chain becoming the largest platform for deploying the fund, surpassing even Ethereum. The partnership includes discussions about launching new products and establishing revenue-sharing agreements, according to recent reports.

BlackRock's BUIDL fund has grown to over $2.5 billion in market capitalization, and its integration with Binance represents a significant bridge between traditional finance and crypto infrastructure. This institutional validation could prove crucial as Binance attempts to rebuild trust with US regulators and financial institutions.

World Liberty Financial Connection Binance's relationship with World Liberty Financial, the Trump family's crypto venture, has drawn intense scrutiny but represents another strategic avenue for US market access. The exchange recently expanded its use of World Liberty's USD1 stablecoin, adding new trading pairs (BNB/USD1, ETH/USD1, SOL/USD1) and converting some BUSD reserves to USD1.

The political dimensions of this partnership have sparked controversy, with Democratic lawmakers including Senator Elizabeth Warren and Congresswoman Maxine Waters criticizing the relationship as potential "pay-to-play" politics. Warren connected what she characterized as a timeline of CZ pleading guilty to money laundering charges, boosting Trump's crypto ventures, and subsequently receiving a presidential pardon.

Despite the political headwinds, Binance CEO Richard Teng has defended the company's actions, stating that USD1 had already been listed on other exchanges before Binance and that the company simply responded to market demand as "the largest crypto ecosystem in the world."

The Binance.US Collapse and Comeback Challenge

The stakes for Binance's US return are substantial. Before regulatory actions forced a retreat in 2023, Binance.US once commanded approximately 35% of the US crypto exchange market, according to CZ himself. That figure has since fallen to essentially zero.

The collapse was dramatic. Several states have revoked Binance.US licenses, and key markets like New York have refused to issue them. The US Securities and Exchange Commission has alleged that Binance Holdings Ltd. operated both Binance.com and Binance.US, complicating efforts to establish a clear separation between the global and American operations.

Binance now faces a patchwork regulatory landscape where state-by-state licensing remains a major barrier. A pending market-structure bill in Congress could create a federal licensing framework that would simplify operations, but the legislation has stalled amid political disagreements, with uncertain prospects for passage.

Who Benefits from a Binance US Return?

The potential implications of a successful Binance comeback extend across multiple stakeholders:

Retail Traders: Binance has historically offered significantly lower fees than US competitors like Coinbase—as low as 0.1% compared to Coinbase's 0.6% or higher. A return could spark a price war that benefits everyday crypto traders through reduced costs.

Institutional Investors: The BlackRock partnership and potential for regulated operations could attract institutions seeking deep liquidity and sophisticated trading tools while maintaining regulatory compliance.

Competing Exchanges: Coinbase, Kraken, and Gemini would face renewed competitive pressure. Coinbase particularly could see its dominant position challenged, as the company has already acknowledged that increasing competition from both crypto-native and traditional financial firms poses risks to its market share.

The Broader Crypto Market: Binance's return with enhanced regulatory compliance could legitimize the US crypto market further, potentially accelerating mainstream adoption. The US represents the second-largest market for crypto adoption globally, according to Chainalysis, making expanded access significant for the industry.

XRP and Ripple: Potential Winners in Market Shake-Up

Binance's US expansion could have specific implications for Ripple and XRP holders:

Exchange Liquidity Dynamics: On-chain data shows Binance's XRP reserves have fallen to multi-month lows, with approximately 2.71 billion XRP held as of late November 2025—down from higher levels earlier in the year. This declining exchange supply, combined with growing institutional demand from newly launched XRP ETFs, has created what some analysts call a "perfect storm" for potential price appreciation.

JPMorgan analysts have projected that $4-8 billion could flow into XRP ETFs in their first year, representing demand that would vastly exceed typical XRP trading volumes. If Binance.US successfully relaunches with significant market share, it could provide crucial liquidity infrastructure to absorb this institutional demand.

Regulatory Alignment: Ripple recently received conditional approval from the OCC to operate a national trust bank in the US, marking a major regulatory milestone. Binance's potential return under a more compliant structure could create a more favorable environment for regulated crypto operations broadly, potentially benefiting Ripple's institutional partnerships and XRP adoption.

Market Competition Benefits: Currently, XRP is available on Binance.US but trading volumes remain limited due to the platform's restricted operations. A revitalized Binance.US with competitive fees and broader state access could increase XRP trading accessibility for American investors, particularly if the exchange replicates its global platform's deep liquidity and trading pairs.

However, it's important to note that Ripple's recent transfers of $152 million in XRP to Binance and other large movements have raised questions about potential selling pressure, though these appear to be routine treasury management operations rather than market-dumping strategies.

Political Headwinds and Timing Pressures

Despite the optimism, significant challenges remain. Democratic lawmakers have been vocal in their opposition, with the potential for regulatory backlash that could complicate Binance's return. Senator Warren has characterized the CZ pardon and Binance's Trump-adjacent partnerships as evidence of "corruption."

The timing pressure is real. As sources note, if Democrats gain power in future elections, "the warm climate the company enjoys right now could shift fast." Binance appears to be moving quickly to capitalize on the current pro-crypto political environment.

Leadership changes add another layer of complexity. Binance recently promoted Yi He to co-CEO alongside Richard Teng, though her close relationship with CZ has raised questions about how effectively the company can demonstrate separation from its founder—a separation that may be necessary to satisfy US regulators.

The Competitive Landscape Evolves

Coinbase, which went public in 2021 and has served as America's premier crypto on-ramp, faces arguably the most direct threat. The company has already seen its market position challenged by emerging competitors as crypto goes mainstream, with traditional finance firms like Charles Schwab planning to launch crypto trading in 2026.

Binance's potential return would intensify this competitive pressure significantly. The exchange has a history of aggressively gaining market share through zero-fee or low-fee trading strategies that have rattled rivals. However, actually executing on a US comeback faces substantial practical barriers beyond just regulatory approval—including rebuilding trust, reestablishing banking relationships, and navigating the complex web of state licensing requirements.

What's Next?

Binance's path forward remains uncertain but potentially transformative for the US crypto market. The company's multi-pronged strategy—restructuring ownership, partnering with traditional finance giants, and cultivating political relationships—represents a comprehensive approach to overcoming the regulatory obstacles that led to its 2023 retreat.

Whether these efforts succeed depends on multiple factors: congressional action on federal crypto legislation, state-level regulatory decisions, the durability of current political alignments, and Binance's ability to demonstrate genuine compliance culture beyond its founder's shadow.

For now, the crypto market is watching closely. If Binance succeeds in returning to the US with significant scale, it could trigger a new era of competition that reshapes pricing, innovation, and accessibility in American crypto trading. For XRP and other digital assets, increased liquidity and trading venues could prove beneficial, though the ultimate impact will depend on execution details that remain to be finalized.

The next few months will be critical as Binance navigates this complex strategic landscape, with the balance between opportunity and obstacles remaining precarious.

Sources

- Cointelegraph: Binance mulls new US strategy, CZ potentially reducing stake

- Crypto Breaking: Binance Explores Multiple Paths to Reenter the U.S. Market

- Bitcoin Ethereum News: How Binance's CZ is planning to enter the US market

- The Coin Republic: Binance Deepens BlackRock Ties as CZ Seeks to Revive its US Subsidiary

- Bloomberg/Yahoo Finance: Binance Denied It Helped Trump's Crypto Venture—But A $2B Deal And A Presidential Pardon Have Lawmakers Asking Questions

- CNBC: Binance CEO dismisses claims the firm boosted a Trump crypto venture ahead of CZ pardon

- CoinDesk: Binance Expands Trading With Trump-Linked World Liberty Financial's Stablecoin

- Fortune: BlackRock's $2.5 billion tokenized money market fund gets boost with Binance tie-up

- FXStreet: Binance weighs US subsidiary relaunch as CZ considers stake reduction

- Benzinga: Trump-Pardoned Changpeng Zhao May Be 'Retired' But Binance's US Strategy Says Otherwise

- ZyCrypto: Perfect Storm Brewing — Binance's Shrinking XRP Supply Could Trigger Massive Ripple's XRP Rocket

- CoinGape: Ripple Transfers Over $152 Million in XRP to Binance After 600M Coins Shuffle

- BeInCrypto: Rising ETF Demand Sparks XRP Supply Crunch on Binance

- CCN: US Just Approved Ripple and Other Major Firms Into Banking System — Here's Where XRP Fits In

- CNBC: Coinbase to soon unveil prediction markets powered by Kalshi

- PYMNTS: Coinbase Faces New Competition as Crypto Goes Mainstream

- WunderTrading: Top Coinbase Competitors in 2025

DISCLAIMER: This newsletter is for informational purposes only and does not constitute investment advice, advertising, or a recommendation to buy, sell, or hold any securities. This content is not sponsored by or affiliated with any of the mentioned entities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.