Beyond Payments: XRPL's Hidden Capabilities That Could Transform Crypto

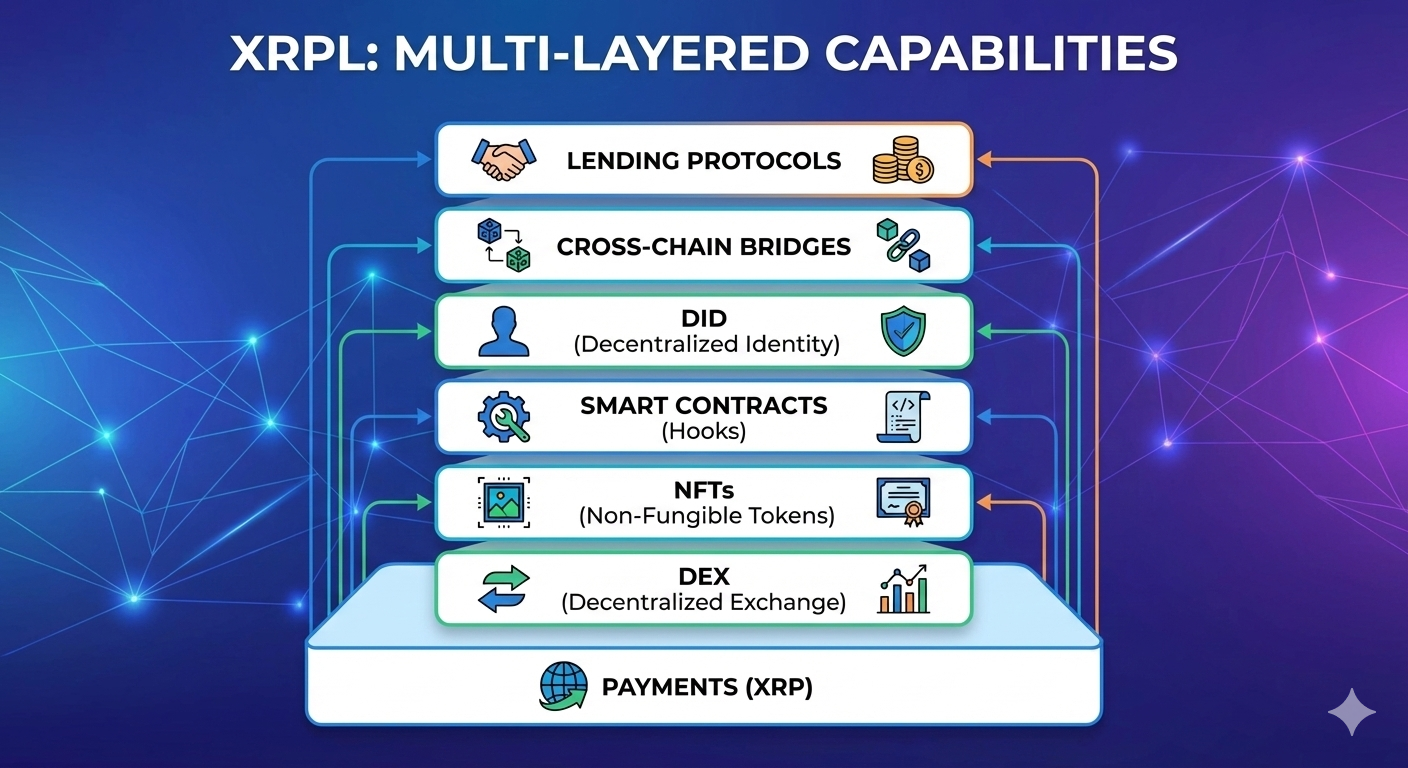

Most think XRPL is just for fast payments. Ripple CTO David Schwartz reveals the hidden capabilities: native smart contracts, DeFi lending, dynamic NFTs, decentralized identity, and cross-chain bridges. Discover how XRPL is quietly building Ethereum-level functionality with superior speed

Ripple CTO David Schwartz recently revealed what the XRP Ledger can really do beyond tokenization and payments, challenging the common misconception that XRPL is merely about moving money fast. While most people associate the XRP Ledger exclusively with cross-border payments and tokenization, that's just scratching the surface of a blockchain platform that's quietly building advanced functionality comparable to Ethereum's capabilities—but with faster speeds and lower costs.

🧠 David Schwartz reveals what the XRPL can really do beyond tokenization & payments

— Xaif Crypto🇮🇳|🇺🇸 (@Xaif_Crypto) December 19, 2025

Most people think the XRPL Ledger is only about moving money fast.

That’s just the surface 👇

🔹 On-chain smart logic (Hooks & amendments)

🔹 Decentralized identity & credentials

🔹 NFTs with… https://t.co/KEPP2rP8BO pic.twitter.com/iaIM7OY54W

The XRPL Most People Don't Know About

According to Schwartz's recent discussion, the XRP Ledger already handles native decentralized exchange functionality, issued assets, and escrows, which together can address approximately 80% of financial sector use cases. But beneath these well-known features lies a sophisticated toolkit that includes:

On-Chain Smart Logic: The XRPL supports hooks and amendments, enabling custom logic to execute before or after transactions. This allows developers to create conditional transactions without the complexity of full smart contracts.

Decentralized Identity & Credentials: The proposed XLS-40 amendment introduces decentralized identity (DID) capabilities to the XRP Ledger, representing a significant leap forward in privacy, security, and financial innovation. This feature could enable institutional volume on decentralized exchanges powered by DIDs, driving growth in decentralized finance.

Native NFT Functionality: Beyond basic token creation, the NFTokenMintOffer amendment enables the combination of minting and offer creation in one step, allowing creators to set sell offers simultaneously with minting. The DynamicNFT amendment adds functionality to make mutable NFTs, where the URI field can be updated after minting.

Built-In DEX with Auto-Bridging: The XRPL features a central limit order book that processes all exchanges for fungible tokens, providing the benefit of fewer trust assumptions and consolidated liquidity rather than the inherent vulnerabilities of smart contracts. Recent upgrades include the PermissionedDEX amendment, which lets DEX operators control participation for regulatory compliance.

Escrow and Multi-Sign Capabilities: The platform supports TokenEscrow for IOU and multi-purpose tokens, and Batch functionality allowing atomic execution of grouped transactions. The ExpandedSignerList amendment increased maximum signer list size from 8 to 32 entries, with each entry able to contain an optional WalletLocator field for additional metadata.

Tokenized Real-World Assets: Tokenized real-world assets on the XRP Ledger are expected to enhance collateralized loans, improve interoperability, and attract institutional adoption, particularly focusing on real estate and commodities.

Cross-Chain Interoperability: The XRPL EVM Sidechain brings Ethereum Virtual Machine compatibility to the XRP ecosystem, connecting with over 55 other blockchains through the Axelar bridge, enabling seamless cross-chain transactions.

The Next Evolution: Smart Contracts and Light Programmability

Schwartz has acknowledged that Ripple should have prioritized native smart contract capabilities on the XRP Ledger much earlier, as the company's early skepticism toward smart contracts delayed development at the Layer-1 level. However, the ecosystem is now catching up rapidly.

Schwartz emphasized that the next major feature would be smart escrows and light programmability, integrated natively into the ledger, addressing broader financial use cases and further cementing XRPL's position in decentralized finance. Unlike fully Turing-complete platforms, the XRP Ledger would avoid unnecessary complexity while allowing for specific use cases that need smart contract functionality.

One primary area for improvement is interoperability, as current smart transactors lack the flexibility needed to support trust-minimized bridging. By integrating light programmability, the XRPL can support trust-minimized bridging solutions crucial for cross-chain interoperability while maintaining its core strengths of speed, security, and low fees.

Native Lending Protocol Expands DeFi Capabilities

Developers Aanchal Malhotra and Vito Tumas have proposed the Native Lending Protocol, which introduces a sophisticated framework for borrowing and lending digital assets directly on the XRPL. Schwartz expressed enthusiasm, noting that "together with the native DEX, this lending protocol forms a critical pillar in enabling more accessible, efficient, and transparent financial services."

Future Vision: Staking and Advanced Consensus

While XRPL's current Proof of Association model has remained stable for over a decade, Schwartz noted that his thoughts on governance and consensus models have evolved, and the ecosystem has reached a moment where it makes sense to discuss potential new designs.

Schwartz outlined two technically compelling ideas currently being discussed: a two-layer consensus model with an inner validator set selected based on stake advancing the ledger while the outer layer governs fees and amendments, and using transaction fees to fund zero-knowledge proofs that verify smart contract execution. However, he cautioned that both ideas are "awesome technically but probably not realistically likely to be good, at least not any time soon."

Transparency Through XRPL Hub

In a recent move toward greater transparency, Schwartz opened his long-running XRPL Hub to the public, making critical network information available including real-time performance metrics such as uptime, peer data, and traffic charts. The hub has been running on version 2.6.2 for over a month without encountering any issues, providing developers with a reference point for comparing their own setups.

Market Implications: Strong Demand Despite Volatility

The expanded capabilities of XRPL come at a time when XRP has experienced significant institutional demand, with newly launched spot XRP ETFs approaching $1 billion in inflows less than a month after going live. This demonstrates that institutional investors recognize the platform's potential beyond simple payments.

Standard Chartered has issued a blockbuster prediction that XRP could hit $12.50 by 2028, representing a potential 500%+ increase from current levels, based on growing adoption of RippleNet's On-Demand Liquidity service by banks in Japan, Latin America, and the Middle East, as well as Ripple's push into tokenized assets.

XRP/Ripple Analysis: Strategic Positioning for DeFi Dominance

Price Potential: While XRP currently faces technical pressure trading below major moving averages, models point to a potential move toward $2.50–$2.55 by December 2025 if the $2.00 support area continues to hold. Long-term forecasts remain optimistic, with analysts predicting XRP could reach minimum prices around $4.65 in 2027 and potentially exceed $10 by 2030.

Ripple's Business Operations: The expanded XRPL functionality directly benefits Ripple's core business model. Schwartz explained that XRP is essential for maintaining XRPL's security, as spam attacks pose a serious risk to public ledgers and XRP imposes a cost on every transaction to ensure network stability. This means all new features—from NFTs to smart contracts—will drive XRP utility and demand.

Legal Standing: The court's August 2024 ruling that programmatic sales and sales on secondary markets of XRP are not securities has lifted significant uncertainty, though the SEC filed an appeal in January 2025 challenging the July 2023 ruling. The potential for full legal clarity under a more crypto-friendly regulatory environment could accelerate institutional adoption.

Partnership Opportunities: Ripple has made significant strides expanding partnerships across Asia, Africa, and Latin America, with these regions' demand for efficient payment solutions aligning well with Ripple's offerings. The addition of smart contract capabilities opens doors to partnerships beyond payments, including DeFi protocols, NFT marketplaces, and tokenization platforms.

Adoption Prospects: The introduction of native smart contracts expected to be permissionless and customizable will enhance XRPL's existing features including escrows, NFTs, authorized trustlines, payment channels, the DEX, and the AMM. This positions XRPL to compete directly with Ethereum for developer mindshare while offering superior speed and cost efficiency.

What This Means for Crypto

The narrative that XRPL is "just for payments" is outdated. With comprehensive DeFi capabilities, native NFT functionality, emerging smart contract support, and institutional-grade features like permissioned DEXs and decentralized identity, the XRP Ledger is positioning itself as a full-featured blockchain platform.

For developers, this means access to a fast, low-cost platform with proven institutional adoption. For investors, it suggests that XRP's utility—and therefore its value proposition—extends far beyond its role in Ripple's payment network. As Schwartz noted, XRPL can already handle the most important 80% of financial use cases with native features, and upcoming enhancements will close the remaining gap.

The question isn't whether XRPL can compete with other smart contract platforms—it's whether the market fully understands what it's already capable of doing.