$3.31B in ETH Trapped: How Ethereum's Exit Queue Crisis Reveals XRP's Superior Design

With $3.31B in ETH trapped in exit queues for 12-15 days, Ethereum's congestion crisis exposes fundamental design flaws that XRP's 3-5 second settlement elegantly solves. Discover why architecture determines destiny in digital finance.

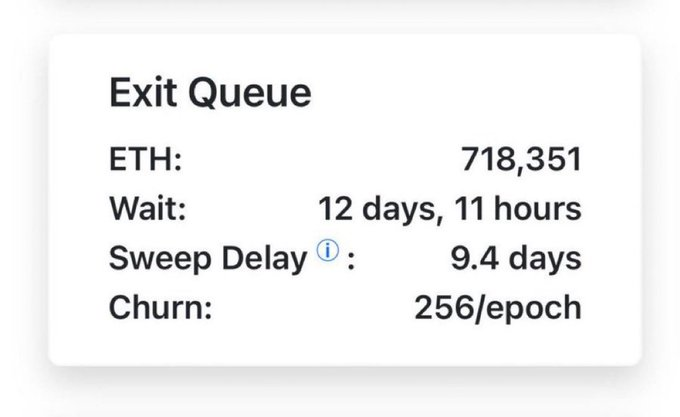

As of August 15, 2025, approximately 768,400 ETH worth $3.5 billion is currently stuck in Ethereum's validator exit queue, with withdrawal delays extending to 12-15 days. This unprecedented congestion highlights fundamental design limitations in Ethereum's proof-of-stake mechanism that XRP and the XRP Ledger (XRPL) solve elegantly.

Understanding Ethereum's Exit Queue Bottleneck

Ethereum's proof-of-stake consensus implements a "churn limit" that restricts how many validators can exit the network per epoch (approximately 6.4 minutes). Currently set at 8-10 validators per epoch, this throttling mechanism was designed to maintain network stability but creates severe liquidity constraints during high-demand periods.

The current crisis stems from multiple factors driving mass validator exits. Beginning mid-July 2025, ETH borrowing rates on Aave surged from 2-3% to as high as 18%, making popular leveraged staking strategies unprofitable overnight. Additionally, profit-taking as ETH approached its all-time high and institutional repositioning ahead of potential Ethereum staking ETF launches have contributed to the unprecedented exit demand.

The Technical Mechanics Behind the Congestion

Ethereum's churn limit protects network stability by preventing rapid validator set changes that could compromise consensus finality. However, this same mechanism creates a "big door in, small door out" dynamic where entering the network is easier than exiting.

During periods of high demand, validator exits can extend from a few hours to days or even weeks, processed on a first-come, first-served basis. The protocol's design inherently prioritizes network security over user liquidity, creating friction that can trap billions in staked assets.

Market Impact and Systemic Risks

The extended exit queue creates significant market implications beyond individual inconvenience. The pressure on liquid staking tokens (LSTs) has led to depeg events, with stETH trading below its ETH value when redemption constraints tighten. This exposes participants to basis risk and liquidity premiums that compound during volatile market conditions.

Professional traders and institutions relying on ETH as collateral face operational challenges when they cannot quickly access their staked assets. Organizations depending on ETH for payroll operations encounter potential liquidity issues due to delays in accessing staked funds, prompting many to adopt stablecoin payment systems instead.

XRP's Revolutionary Approach: Instant Settlement Without Compromise

While Ethereum struggles with validator exit delays, XRP offers a fundamentally different paradigm that eliminates these constraints entirely. Created specifically for payments in 2012, XRP can settle transactions on the ledger in 3-5 seconds without requiring validator queues or extended withdrawal periods.

The XRPL Advantage: No Exit Queues, No Delays

The XRP Ledger's architecture solves Ethereum's liquidity crisis through several key innovations:

Instant Liquidity: Direct XRP payments execute in one transaction with no intermediaries and typically complete in 8 seconds or less. There are no exit queues, churn limits, or withdrawal delays that trap user funds.

Consensus Without Congestion: XRPL uses the Ripple Consensus Protocol Algorithm (RCPA) where transactions need verification by at least 80% of network nodes. This consensus mechanism eliminates the need for staking locks and validator queues entirely.

Scalable Performance: Recent internal benchmark testing shows XRPL can sustain nearly 1,000 transactions per second across 16 geographically distributed validators, with the potential for even higher throughput through payment channels.

Real-World Performance Comparison

The contrast between Ethereum and XRP becomes stark when examining real-world performance:

- Ethereum Exit Queue: 12-15 days for withdrawal processing during congestion

- XRP Transaction Settlement: 3-5 seconds for standard transfers, with exchange withdrawals completing within 2 hours maximum

While traditional banking systems using SWIFT require 1-5 business days for international transfers, XRP enables near-instant cross-border settlements without the intermediary delays that plague both legacy finance and current Ethereum staking mechanisms.

XRP's Design Philosophy: Finance-First Architecture

Unlike Ethereum's general-purpose blockchain that retrofit financial applications, XRP was purpose-built for financial use cases. XRP serves as a bridge currency to facilitate faster, more affordable cross-border payments, representing the only major L-1 blockchain built specifically for business and designed to power finance applications at scale.

This finance-first approach eliminates architectural bottlenecks that create exit queue problems:

- No Staking Requirements: XRP doesn't require users to lock tokens in staking contracts, eliminating withdrawal delays entirely

- Fixed Supply Model: All 100 billion XRP tokens already exist, with no mining or validation rewards that complicate exit mechanisms

- Institutional-Grade Infrastructure: The network was designed from inception to handle enterprise-level transaction volumes without congestion

Implications for XRP Adoption and Price Potential

Ethereum's exit queue crisis demonstrates the practical limitations of proof-of-stake designs that prioritize decentralization over liquidity. As institutions and professional traders experience these constraints firsthand, XRP's instant settlement advantage becomes increasingly valuable.

Ripple's Strategic Position: The ongoing Ethereum congestion validates Ripple's original thesis that financial networks require different architectural trade-offs than general computing platforms. Ripple has locked 55 billion XRP in escrows to provide supply predictability, ensuring network stability without relying on validator mechanisms that create exit bottlenecks.

Market Opportunity: With billions of dollars periodically trapped in Ethereum's exit queues, financial institutions have clear incentives to explore alternatives offering guaranteed liquidity. XRP's consistent 3-5 second settlement times provide the reliability required for professional trading and treasury management.

Partnership Implications: The liquidity constraints exposed by Ethereum's exit queue crisis strengthen XRP's value proposition for payment partnerships and institutional adoption, particularly in scenarios requiring predictable access to digital assets.

Regulatory Considerations and Legal Clarity

While Ethereum grapples with technical scaling challenges, XRP benefits from increasing regulatory clarity. The resolution of Ripple's SEC case has provided institutional comfort around XRP's legal status, making it a more viable alternative for organizations seeking reliable digital asset infrastructure without regulatory uncertainty.

Architecture Determines Destiny

Ethereum's current exit queue crisis represents more than a temporary congestion issue—it reveals fundamental architectural limitations in proof-of-stake designs that prioritize network security over user liquidity. With $3.31 billion trapped in exit queues and delays extending beyond two weeks, the practical limitations of Ethereum's validator system become undeniable.

XRP's purpose-built financial architecture offers a compelling alternative, delivering instant settlement without compromising network integrity. As the crypto industry matures and institutional adoption accelerates, the operational reliability provided by XRPL's design may prove more valuable than the theoretical decentralization benefits that come with extended exit delays.

The current crisis serves as a stark reminder that in finance, liquidity is paramount—and architectural choices made years ago continue to determine which networks can deliver the instant, reliable settlement that modern digital finance demands.

Key Takeaways:

- Ethereum's exit queue currently traps $3.31 billion in ETH with 12-15 day delays

- XRPL's consensus mechanism eliminates exit queues entirely, providing 3-5 second settlement

- XRP's finance-first architecture offers institutional-grade liquidity without compromise

- Current congestion validates XRP's design philosophy and strengthens adoption prospects

SOURCES

- Blockchain News - ETH Unstaking Warning: 768,400 ETH in Exit Queue ($3.5B)

- AInvest - Ethereum Exit Queue Hits Record 808,880 ETH as Unstaking Surges

- CoinDesk - Ethereum Validator Exit Queue Tops $2B as Stakers Rush to Quit

- CryptoPotato - Ethereum Exit Queue Surge Exposes Fragility in Liquid Staking Markets

- The Crypto Basic - 718,351 Ethereum Worth $3.31B Trapped in Exit Queue

- XRPL.org - Official XRP Ledger Documentation

- Hedge with Crypto - XRP Transaction Speed Analysis

- XRP Authority - Cross-Border Payment Speed Comparisons

- ValidatorQueue.com - Real-time Ethereum Queue Data

- Ethereum Research - Exit Queue Mechanism Papers

DISCLAIMER: This newsletter is for informational purposes only and does not constitute investment advice or a recommendation to buy, sell, or hold any securities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.