21Shares Registers XRP ETF in Delaware Despite SEC Delays: Bold Move Signals Market Confidence

21Shares registered its XRP ETF in Delaware despite SEC delays—a bold strategic move showing institutional confidence. While competitors wait, 21Shares positions itself as first-to-market for October 2025 approval.

While the SEC extends review deadlines for XRP ETF applications until October 2025, 21Shares has made a decisive move by registering its XRP ETF in Delaware. This strategic decision demonstrates unwavering confidence in eventual approval and positions the firm significantly ahead of competitors in the race to launch the first spot XRP ETF.

21Shares Takes Initiative Amid Regulatory Uncertainty

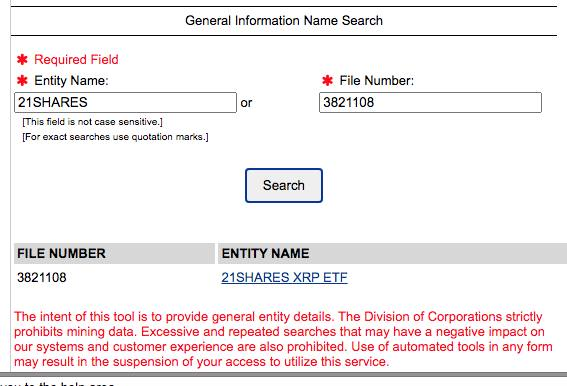

21Shares has completed the registration of its Core XRP Trust in Delaware, marking the most advanced preparatory step any XRP ETF applicant has achieved. This move comes despite the SEC's decision to delay final rulings on multiple XRP ETF applications from major issuers including 21Shares, CoinShares, Bitwise, Grayscale, and Canary Capital until October 2025.

The Delaware registration represents a bold strategic bet that demonstrates 21Shares' commitment to launching an XRP ETF regardless of regulatory timelines. While the SEC extended the 21Shares Core XRP Trust decision deadline from August 20 to October 19, 2025, the firm proactively advanced its operational readiness rather than waiting passively for regulatory clarity.

This administrative milestone indicates that 21Shares has successfully navigated complex legal requirements including trust structuring, custodial arrangements, and operational frameworks. The Delaware incorporation provides several strategic advantages: access to the state's specialized Court of Chancery, predictable corporate law precedents, and streamlined regulatory processes that institutional investors recognize and trust.

Strategic Significance of Moving Forward Despite Delays

The decision to register in Delaware while facing SEC delays signals several important factors about 21Shares' market outlook and competitive strategy. First, it demonstrates exceptional confidence in eventual regulatory approval, as companies typically don't complete expensive legal structuring processes without strong conviction about market viability.

Second, the move creates a significant first-mover advantage. While competitors may still be working through administrative requirements or waiting for clearer regulatory signals, 21Shares has positioned itself as essentially "ready to launch" pending SEC approval. This operational readiness could enable rapid market entry once regulatory clearance is obtained, potentially capturing early market share in what could become a multi-billion-dollar market.

The timing also reveals sophisticated regulatory strategy. Rather than allowing SEC delays to halt progress, 21Shares chose to advance all controllable aspects of ETF preparation. This approach minimizes time-to-market once approval arrives and demonstrates to regulators that the firm has thoroughly addressed operational and compliance considerations.

For the broader cryptocurrency market, 21Shares' decisive action amid uncertainty provides a powerful signal of institutional confidence in XRP's long-term investment viability. Major financial institutions don't typically invest in complex legal and operational infrastructure unless they anticipate significant market demand and regulatory success.

XRP/Ripple Analysis: Institutional Confidence Meets Regulatory Convergence

21Shares' Delaware registration creates multiple positive implications for XRP's institutional adoption trajectory, particularly as it coincides with other significant regulatory developments affecting Ripple Labs.

Competitive Positioning and Market Leadership

The Delaware registration establishes 21Shares as the clear frontrunner in the XRP ETF space. While competitors including CoinShares (October 23 deadline), Bitwise (October 20), and Grayscale (October 18) await SEC decisions, 21Shares has completed the administrative groundwork necessary for immediate launch upon approval.

This preparation advantage could prove decisive in capturing early institutional flows, as ETF launches often see significant first-mover benefits. Bitcoin and Ethereum ETF approvals demonstrated that early entrants can establish dominant market positions, making 21Shares' proactive approach strategically valuable.

Timing with Ripple's Banking Charter

The ETF registration coincides remarkably with Ripple's pursuit of federal banking legitimacy. Ripple applied for a national banking license from the Office of the Comptroller of the Currency on July 2, 2025, with the OCC's 120-day review period placing decisions in late October 2025 – virtually identical to XRP ETF ruling timelines.

If both regulatory processes succeed simultaneously, October 2025 could witness unprecedented institutional validation for XRP through dual pathways: regulated investment products via ETFs and federal banking oversight for Ripple's operations. This convergence would address two primary institutional concerns – investment vehicle availability and regulatory clarity.

Market Impact and Price Implications

21Shares' registration demonstrates that sophisticated institutional players are betting on XRP's regulatory success despite ongoing uncertainties. This institutional confidence could influence broader market sentiment, particularly as October deadlines approach.

Crypto lawyer Bill Morgan noted that "the overlap of ETF rulings and banking charter reviews makes October a defining period for Ripple," with outcomes potentially catalyzing significant institutional adoption. 21Shares' preparedness ensures they're positioned to capitalize immediately on positive regulatory developments.

The firm's willingness to complete complex legal structuring despite delays suggests internal conviction about approval odds that may exceed public market expectations, potentially creating information asymmetry that benefits XRP holders as institutional confidence becomes more apparent.

Conclusion

21Shares' decision to register its XRP ETF in Delaware while facing SEC delays represents a masterclass in proactive regulatory strategy. Rather than allowing uncertainty to halt progress, the firm advanced all controllable preparation aspects, creating significant competitive advantages and signaling strong institutional confidence in XRP's future.

This bold move positions 21Shares as the clear frontrunner for first-to-market advantage when SEC approvals arrive in October 2025. Combined with Ripple's concurrent banking charter pursuit, the convergence of regulatory events could catalyze unprecedented institutional adoption for XRP.

For investors and market participants, 21Shares' decisive action amid uncertainty provides valuable insight into sophisticated institutional sentiment toward XRP's regulatory and market prospects. The October 2025 deadline period now represents not just regulatory decisions, but the potential launch of the crypto industry's most prepared XRP investment vehicle.

DISCLAIMER: This newsletter is for informational purposes only and does not constitute investment advice or a recommendation to buy, sell, or hold any securities. Investments in cryptocurrencies or other financial assets carry significant risks, including the potential for total loss, extreme volatility, and regulatory uncertainty. Past performance is not indicative of future results. Always consult a qualified financial professional and conduct thorough research before making any investment decisions.

Sources

- 21SHARES XRP ETF is now registered in Delaware, USA - ODaily News

- SEC pushes back decisions on XRP ETFs from 21Shares, CoinShares - Crypto Briefing

- XRP News Today: Delayed SEC Ruling on XRP ETF Sparks Debate Over Ripple Price Trajectory - Brave New Coin

- SEC Postpones Multiple XRP ETF Decisions to October 2025 - Bitcoin Ethereum News

- Ripple, XRP News: Ripple Applies for Federal Bank Charter, XRP Jumps 3% - CoinDesk

- Ripple's Federal Bank Charter Application: A Regulatory Milestone for Institutional Crypto Adoption? - AInvest

- XRP News Today: SEC Prolongs XRP ETF Deliberations Amid Regulatory Caution - AInvest